false

0001173489

0001173489

2024-08-07

2024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 7, 2024

CEVA, INC.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

000-49842

|

|

77-0556376

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

15245 Shady Grove Road, Suite 400, Rockville, MD 20850

(Address of Principal Executive Offices, and Zip Code)

(240) 308-8328

Registrant’s Telephone Number, Including Area Code

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common Stock, $0.001 par value

|

|

CEVA

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 7, 2024, Ceva, Inc. (the “Company”) announced its financial results for the quarter ended June 30, 2024. A copy of the press release, dated August 7, 2024, is attached and filed herewith as Exhibit 99.1. On the same day, the Company will hold a conference call to discuss its financial results for the second quarter of 2024. A copy of the script of the conference call is attached hereto as Exhibit 99.2. This information, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference to such filing.

In addition to the disclosure of financial results for the quarter and year ended June 30, 2024 and 2023 in accordance with generally accepted accounting principles in the United States (“GAAP”), the press release and script also included non-GAAP gross margin, operating income, operating loss, net loss and diluted loss per share for the referenced periods.

Non-GAAP gross margin for the second quarter of 2024 and 2023 each excluded (a) equity-based compensation expenses and (b) amortization of acquired intangibles.

Non-GAAP operating income for the second quarter of 2024 and non-GAAP operating loss for the second quarter of 2023 each excluded (a) equity-based compensation expenses, (b) the impact of the amortization of acquired intangibles and (c) costs associated with business acquisitions.

Non-GAAP net loss and diluted loss per share for the second quarter of 2024 and 2023 each excluded (a) equity-based compensation expenses, (b) the impact of the amortization of acquired intangibles, (c) costs associated with business acquisitions and (d) loss associated with the remeasurement of marketable equity securities.

Non-GAAP net loss and diluted loss per share including the discontinued operations for the second quarter of 2023 excluded (a) equity-based compensation expenses, (b) the impact of the amortization of acquired intangibles, (c) costs associated with business acquisitions, (d) loss associated with the remeasurement of marketable equity securities and (e) loss associated with discontinued operations.

The Company believes that the reconciliation of financial measures in the press release and script is useful to investors in analyzing the results for the quarters ended June 30, 2024 and 2023 because the exclusion of the applicable expenses may provide a more meaningful analysis of the Company’s core operating results and comparison of quarterly results. Further, the Company believes it is useful for investors to understand how the expenses associated with the application of FASB ASC No. 718 are reflected on its statements of income. The reconciliation of financial measures should be reviewed in addition to and in conjunction with results presented in accordance with GAAP, and are intended to provide additional insight into the Company’s operations that, when viewed with its GAAP results and the accompanying reconciliation, offer a more complete understanding of factors and trends affecting the Company’s business. The reconciliation of financial measures should not be viewed as a substitute for the Company’s reported GAAP results.

The script also included reference to the universal shelf registration statement on Form S-3 filed by the Company with the U.S. Securities and Exchange Commission on August 7, 2024. The registration statement on Form S-3 is not yet effective, and the securities covered by the registration statement may not be sold, nor may offers to buy be accepted under the Form S-3 registration statement, prior to the time the Form S-3 registration statement becomes effective. This discussion and the discussion in the script do not constitute an offer to sell nor the solicitation of an offer to buy the securities that are proposed to be registered on the Form S-3.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

|

Exhibit

Number

|

|

Description

|

| |

|

|

|

99.1

|

|

|

|

|

99.2

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CEVA, INC.

|

| |

|

|

Date: August 7, 2024

|

By:

|

/s/ Yaniv Arieli

|

| |

Name:

|

Yaniv Arieli

|

| |

Title:

|

Chief Financial Officer

|

Exhibit 99.1

Ceva, Inc. Announces Second Quarter 2024 Financial Results

| |

●

|

Licensing and related revenues $17.3 million, up 28% year-over-year

|

| |

●

|

Royalty revenue $11.2 million, up 19% year-over-year, generated from 461 million shipped units, up 24% year-over-year

|

| |

●

|

Long-term roadmap deals signed with 2 infrastructure OEMs developing custom silicon driven by rise in AI-related traffic on wireless networks

|

| |

●

|

Strategic deal signed with leading U.S. analog semiconductor company for Ceva-Waves Bluetooth portfolio

|

ROCKVILLE, MD., August 7, 2024 – Ceva, Inc. (NASDAQ: CEVA), the leading licensor of silicon and software IP that enables Smart Edge devices to connect, sense and infer data more reliably and efficiently, today announced its financial results for the second quarter ended June 30, 2024. Financial results for the second quarter ended June 30, 2023, reflect Ceva’s continuing operations only, with the Intrinsix business reflected as a discontinued operation, unless otherwise noted.

Operational Highlights:

|

●

|

Launched Ceva-Waves-Links, a Multi-Protocol wireless platform IP family to accelerate enhanced connectivity in MCUs and SOCs for IoT and Smart Edge AI applications

|

|

●

|

Extended its Smart Edge IP leadership with Ceva-NeuPro-Nano, a TinyML Optimized family of NPUs for AIoT devices

|

|

●

|

Achieved an important milestone of surpassing 18 billion Ceva-powered devices shipped

|

Total revenue for the second quarter of 2024 was $28.4 million, up 24%, compared to $22.9 million reported for the second quarter of 2023. Licensing and related revenue for the second quarter of 2024 was $17.3 million, up 28%, compared to $13.6 million reported for the same quarter a year ago. Royalty revenue for the second quarter of 2024 was $11.2 million, up 19%, compared to $9.4 million reported for the same quarter a year ago.

Amir Panush, Chief Executive Officer of Ceva, commented: “We are pleased to report strong execution and results for the second quarter that exceeded our estimates, with licensing revenue and royalty revenue growing 28% and 19%, respectively, year over-year. In licensing, customer demand for our IP portfolio is being driven by the growing adoption of AI across every industry and every device. We signed a number of strategic deals in the quarter, including one with a leading U.S. analog semiconductor company for our Bluetooth portfolio and two with our large OEM customers in wireless infrastructure for their development of next-generation ASICs to address the incredible growth in network traffic and performance improvements required to support Generative AI and Hybrid AI systems. Our royalty business grew on the back of broad market strength and market share gains in IoT, and strong growth in the smartphone market.”

During the quarter, eleven IP licensing agreements were concluded, targeting a wide range of end markets and applications, including AI solutions for industrial and consumer edge AI devices, next-generation wireless infrastructure to enable ubiquitous AI, 5G satellite, 5G RedCap and Bluetooth connectivity for wearables and hearables. Five of the deals signed in the quarter were with OEMs and one deal signed was with a first-time customer.

GAAP gross margin for the second quarter of 2024 was 90%, as compared to 85% in the second quarter of 2023. GAAP operating loss for the second quarter of 2024 was $0.04 million, as compared to a GAAP operating loss of $5.3 million for the same period in 2023. GAAP net loss for the second quarter of 2024 was $0.3 million, as compared to a GAAP net loss of $4.9 million reported for the same period in 2023. GAAP diluted loss per share for the second quarter of 2024 was $0.01, as compared to GAAP diluted loss per share of $0.21 for the same period in 2023.

GAAP net loss with the discontinued operation for the second quarter of 2023 was $5.8 million. GAAP diluted loss per share with the discontinued operation for the second quarter of 2023 was $0.25.

Non-GAAP gross margin for the second quarter of 2024 was 91%, as compared to 86% for the same period in 2023. Non-GAAP operating income for the second quarter of 2024 was $4.4 million, as compared to non-GAAP operating loss of $1.1 million reported for the second quarter of 2023. Non-GAAP net income and diluted income per share for the second quarter of 2024 were $4.2 million and $0.17, respectively, compared with non-GAAP net loss and diluted loss per share of $0.5 million and $0.02, respectively, reported for the second quarter of 2023.

Non-GAAP net loss including the discontinued operation for the second quarter of 2023 was $0.5 million. Non-GAAP diluted loss per share including the discontinued operation for the second quarter of 2023 was $0.02.

Yaniv Arieli, Chief Financial Officer of Ceva, stated: “Our excellent second quarter performance generated top line growth of 24% year-over-year and coupled with disciplined expense control, enabled us to expand our adjusted operating margin to 15%. We are encouraged by the strength of our licensing pipeline and royalty growth potential from our broad and diversified customer base and reflecting this, we continued to buy back the company’s stock during the quarter, repurchasing approximately 100,000 shares for approximately $2 million under our stock repurchase program. At the end of the quarter, our cash and cash equivalent balances, marketable securities and bank deposits were approximately $158 million, which we can leverage to grow our share in edge AI and other high-growth markets.”

Ceva Conference Call

On August 7, 2024, Ceva management will conduct a conference call at 8:30 a.m. Eastern Time to discuss the operating performance for the quarter.

The conference call will be available via the following dial in numbers:

| |

●

|

U.S. Participants : Dial 1-844-435-0316 (Access Code : Ceva)

|

| |

●

|

International Participants: Dial +1-412-317-6365 (Access Code: Ceva)

|

The conference call will also be available live via webcast at the following link: https://app.webinar.net/8mGNyBxXMLR. Please go to the web site at least fifteen minutes prior to the call to register.

For those who cannot access the live broadcast, a replay will be available by dialing +1-877-344-7529 or +1-412-317-0088 (access code: 2162644) from one hour after the end of the call until 9:00 a.m. (Eastern Time) on Aug 14, 2024. The replay will also be available at Ceva's web site www.ceva-ip.com.

Forward Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties, as well as assumptions that if they materialize or prove incorrect, could cause the results of Ceva to differ materially from those expressed or implied by such forward-looking statements and assumptions. Forward-looking statements include statements regarding the customer demand for Ceva’s IP portfolio being driven by the growing adoption of AI across every industry and every device, the strength of Ceva’s licensing pipeline and royalty growth potential, and Ceva’s ability to leverage its capital resources to grow its share in edge AI and other high-growth markets. The risks, uncertainties and assumptions that could cause differing Ceva results include: the effect of intense industry competition; the ability of Ceva's technologies and products incorporating Ceva's technologies to achieve market acceptance; Ceva's ability to meet changing needs of end-users and evolving market demands; the cyclical nature of and general economic conditions in the semiconductor industry; Ceva's ability to diversify its royalty streams and license revenues; Ceva's ability to continue to generate significant revenues from the handset baseband market and to penetrate new markets; instability and disruptions related to the ongoing Israel-Gaza conflict; and general market conditions and other risks relating to Ceva's business, including, but not limited to, those that are described from time to time in our SEC filings. Ceva assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

Non-GAAP Financial Measures

Non-GAAP gross margin for both the second quarters of 2024 and 2023 excluded: (a) equity-based compensation expenses of $0.2 million and (b) amortization of acquired intangibles of $0.1 million.

Non-GAAP operating income for the second quarter of 2024 excluded: (a) equity-based compensation expenses of $3.9 million, (b) the impact of the amortization of acquired intangibles of $0.3 million, and (c) $0.3 million of costs associated with business acquisitions. Non-GAAP operating loss for the second quarter of 2023 excluded: (a) equity-based compensation expenses of $3.9 million, (b) the impact of the amortization of acquired intangibles of $0.3 million, and (c) $0.1 million of costs associated with business acquisitions.

Non-GAAP net loss and diluted loss per share for the second quarter of 2024 excluded: (a) equity-based compensation expenses of $3.9 million, (b) the impact of the amortization of acquired intangibles of $0.3 million, (c) $0.3 million of costs associated with business acquisitions and (d) $0.1 million loss associated with the remeasurement of marketable equity securities. Non-GAAP net loss and diluted loss per share for the second quarter of 2023 excluded: (a) equity-based compensation expenses of $3.9 million, (b) the impact of the amortization of acquired intangibles of $0.3 million, (c) $0.1 million of costs associated with business acquisitions and (d) $0.1 million loss associated with the remeasurement of marketable equity securities.

Non-GAAP net loss including the discontinued operation and diluted loss per share including the discontinued operation for the second quarter of 2023 excluded: (a) equity-based compensation expenses of $3.9 million, (b) the impact of the amortization of acquired intangibles of $0.3 million, (c) $0.1 million of costs associated with business acquisitions, (d) $0.1 million loss associated with the remeasurement of marketable equity securities and (e) $1.0 million loss associated with discontinued operations.

About Ceva, Inc.

At Ceva, we are passionate about bringing new levels of innovation to the smart edge. Our wireless communications, sensing and Edge AI technologies are at the heart of some of today’s most advanced smart edge products. From Bluetooth connectivity, Wi-Fi, UWB and 5G platform IP for ubiquitous, robust communications, to scalable Edge AI NPU IPs, sensor fusion processors and embedded application software that make devices smarter, we have the broadest portfolio of IP to connect, sense and infer data more reliably and efficiently. We deliver differentiated solutions that combine outstanding performance at ultra-low power within a very small silicon footprint. Our goal is simple – to deliver the silicon and software IP to enable a smarter, safer, and more interconnected world. This philosophy is in practice today, with Ceva powering more than 18 billion of the world’s most innovative smart edge products from AI-infused smartwatches, IoT devices and wearables to autonomous vehicles and 5G mobile networks.

Our headquarters are in Rockville, Maryland with a global customer base supported by operations worldwide. Our employees are among the leading experts in their areas of specialty, consistently solving the most complex design challenges, enabling our customers to bring innovative smart edge products to market.

Ceva is a sustainability- and environmentally-conscious company, adhering to our Code of Business Conduct and Ethics. As such, we emphasize and focus on environmental preservation, recycling, the welfare of our employees and privacy – which we promote on a corporate level. At Ceva, we are committed to social responsibility, values of preservation and consciousness towards these purposes.

Ceva: Powering the Smart Edge™

Visit us at www.ceva-ip.com and follow us on LinkedIn, X, YouTube, Facebook, and Instagram.

For more information, contact:

|

Yaniv Arieli

Ceva, Inc.

CFO

+1.650.417.7941

yaniv.arieli@ceva-ip.com

|

Richard Kingston

Ceva, Inc.

VP Market Intelligence, Investor & Public Relations

+1.650.417.7976

richard.kingston@ceva-ip.com

|

Ceva, Inc. AND ITS SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF LOSS – U.S. GAAP

U.S. dollars in thousands, except per share data

| |

|

Three months ended

|

|

|

Six months ended

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Licensing and related revenues

|

|

$ |

17,278 |

|

|

$ |

13,551 |

|

|

$ |

28,692 |

|

|

$ |

31,799 |

|

|

Royalties

|

|

|

11,159 |

|

|

|

9,371 |

|

|

|

21,817 |

|

|

|

17,385 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

|

28,437 |

|

|

|

22,922 |

|

|

|

50,509 |

|

|

|

49,184 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues

|

|

|

2,933 |

|

|

|

3,524 |

|

|

|

5,436 |

|

|

|

7,032 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

25,504 |

|

|

|

19,398 |

|

|

|

45,073 |

|

|

|

42,152 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development, net

|

|

|

18,758 |

|

|

|

18,056 |

|

|

|

36,749 |

|

|

|

36,730 |

|

|

Sales and marketing

|

|

|

3,095 |

|

|

|

2,632 |

|

|

|

5,911 |

|

|

|

5,351 |

|

|

General and administrative

|

|

|

3,537 |

|

|

|

3,911 |

|

|

|

7,109 |

|

|

|

7,738 |

|

|

Amortization of intangible assets

|

|

|

149 |

|

|

|

142 |

|

|

|

299 |

|

|

|

296 |

|

|

Total operating expenses

|

|

|

25,539 |

|

|

|

24,741 |

|

|

|

50,068 |

|

|

|

50,115 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

|

(35 |

) |

|

|

(5,343 |

) |

|

|

(4,995 |

) |

|

|

(7,963 |

) |

|

Financial income, net

|

|

|

1,406 |

|

|

|

1,118 |

|

|

|

2,663 |

|

|

|

2,573 |

|

|

Reevaluation of marketable equity securities

|

|

|

(58 |

) |

|

|

(119 |

) |

|

|

(118 |

) |

|

|

(236 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before taxes on income

|

|

|

1,313 |

|

|

|

(4,344 |

) |

|

|

(2,450 |

) |

|

|

(5,626 |

) |

|

Income tax expense

|

|

|

1,604 |

|

|

|

546 |

|

|

|

3,289 |

|

|

|

1,963 |

|

|

Net loss from continuing operation

|

|

|

(291 |

) |

|

|

(4,890 |

) |

|

|

(5,739 |

) |

|

|

(7,589 |

) |

|

Discontinued operation

|

|

|

— |

|

|

|

(928 |

) |

|

|

— |

|

|

|

(3,101 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(291 |

) |

|

$ |

(5,818 |

) |

|

$ |

(5,739 |

) |

|

$ |

(10,690 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operation

|

|

$ |

(0.01 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.32 |

) |

|

Discontinued operation

|

|

|

— |

|

|

|

(0.04 |

) |

|

|

— |

|

|

|

(0.13 |

) |

|

Basic and diluted net loss per share

|

|

$ |

(0.01 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.46 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used to compute net loss per share (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

23,628 |

|

|

|

23,476 |

|

|

|

23,568 |

|

|

|

23,405 |

|

Unaudited Reconciliation of GAAP to Non-GAAP Financial Measures

U.S. Dollars in thousands, except per share amounts

| |

|

Three months ended

|

|

|

Six months ended

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

GAAP net loss

|

|

$ |

(291 |

) |

|

$ |

(5,818 |

) |

|

$ |

(5,739 |

) |

|

$ |

(10,690 |

) |

|

Equity-based compensation expense included in cost of revenues

|

|

|

191 |

|

|

|

214 |

|

|

|

394 |

|

|

|

420 |

|

|

Equity-based compensation expense included in research and development expenses

|

|

|

2,438 |

|

|

|

2,344 |

|

|

|

4,445 |

|

|

|

4,446 |

|

|

Equity-based compensation expense included in sales and marketing expenses

|

|

|

451 |

|

|

|

449 |

|

|

|

816 |

|

|

|

827 |

|

|

Equity-based compensation expense included in general and administrative expenses

|

|

|

820 |

|

|

|

903 |

|

|

|

1,816 |

|

|

|

1,769 |

|

|

Amortization of intangible assets related to acquisition of businesses

|

|

|

278 |

|

|

|

251 |

|

|

|

556 |

|

|

|

475 |

|

|

Costs associated with business and asset acquisitions

|

|

|

252 |

|

|

|

95 |

|

|

|

532 |

|

|

|

95 |

|

|

Loss associated with the remeasurement of marketable equity securities

|

|

|

58 |

|

|

|

119 |

|

|

|

118 |

|

|

|

236 |

|

|

Non-GAAP from discontinued operations

|

|

|

0 |

|

|

|

963 |

|

|

|

0 |

|

|

|

2,049 |

|

|

Non-GAAP net income (loss)

|

|

$ |

4,197 |

|

|

$ |

(480 |

) |

|

$ |

2,938 |

|

|

$ |

(373 |

) |

|

GAAP weighted-average number of Common Stock used in computation of diluted net loss and loss per share (in thousands)

|

|

|

23,628 |

|

|

|

23,476 |

|

|

|

23,568 |

|

|

|

23,405 |

|

|

Weighted-average number of shares related to outstanding stock-based awards (in thousands)

|

|

|

1,482 |

|

|

|

— |

|

|

|

1,421 |

|

|

|

— |

|

|

Weighted-average number of Common Stock used in computation of diluted earnings per share, excluding the above (in thousands)

|

|

|

25,110 |

|

|

|

23,476 |

|

|

|

24,989 |

|

|

|

23,405 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP diluted loss per share

|

|

$ |

(0.01 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.46 |

) |

|

Equity-based compensation expense

|

|

$ |

0.16 |

|

|

$ |

0.17 |

|

|

$ |

0.32 |

|

|

$ |

0.32 |

|

|

Amortization of intangible assets related to acquisition of businesses

|

|

$ |

0.01 |

|

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

Costs associated with business and asset acquisitions

|

|

$ |

0.01 |

|

|

$ |

0.00 |

|

|

$ |

0.02 |

|

|

$ |

0.00 |

|

|

Loss associated with the remeasurement of marketable equity securities

|

|

$ |

0.00 |

|

|

$ |

0.01 |

|

|

$ |

0.00 |

|

|

$ |

0.01 |

|

|

Non-GAAP from discontinued operation

|

|

|

— |

|

|

$ |

0.04 |

|

|

|

— |

|

|

$ |

0.09 |

|

|

Non-GAAP diluted earnings (loss) per share

|

|

$ |

0.17 |

|

|

$ |

(0.02 |

) |

|

$ |

0.12 |

|

|

$ |

(0.02 |

) |

| |

|

Three months ended

|

|

|

Six months ended

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

GAAP Operating loss

|

|

$ |

(35 |

) |

|

$ |

(5,343 |

) |

|

$ |

(4,995 |

) |

|

$ |

(7,963 |

) |

|

Equity-based compensation expense included in cost of revenues

|

|

|

191 |

|

|

|

214 |

|

|

|

394 |

|

|

|

420 |

|

|

Equity-based compensation expense included in research and development expenses

|

|

|

2,438 |

|

|

|

2,344 |

|

|

|

4,445 |

|

|

|

4,446 |

|

|

Equity-based compensation expense included in sales and marketing expenses

|

|

|

451 |

|

|

|

449 |

|

|

|

816 |

|

|

|

827 |

|

|

Equity-based compensation expense included in general and administrative expenses

|

|

|

820 |

|

|

|

903 |

|

|

|

1,816 |

|

|

|

1,769 |

|

|

Amortization of intangible assets related to acquisition of businesses

|

|

|

278 |

|

|

|

251 |

|

|

|

556 |

|

|

|

475 |

|

|

Costs associated with business and asset acquisitions

|

|

|

252 |

|

|

|

95 |

|

|

|

532 |

|

|

|

95 |

|

|

Total non-GAAP Operating Income (Loss)

|

|

$ |

4,395 |

|

|

$ |

(1,087 |

) |

|

$ |

3,564 |

|

|

$ |

69 |

|

| |

|

Three months ended

|

|

|

Six months ended

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Gross Profit

|

|

$ |

25,504 |

|

|

$ |

19,398 |

|

|

$ |

45,073 |

|

|

$ |

42,152 |

|

|

GAAP Gross Margin

|

|

|

90 |

% |

|

|

85 |

% |

|

|

89 |

% |

|

|

86 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity-based compensation expense included in cost of revenues

|

|

|

191 |

|

|

|

214 |

|

|

|

394 |

|

|

|

420 |

|

|

Amortization of intangible assets related to acquisition of businesses

|

|

|

129 |

|

|

|

109 |

|

|

|

257 |

|

|

|

179 |

|

|

Total Non-GAAP Gross profit

|

|

|

25,824 |

|

|

|

19,721 |

|

|

|

45,724 |

|

|

|

42,751 |

|

|

Non-GAAP Gross Margin

|

|

|

91 |

% |

|

|

86 |

% |

|

|

91 |

% |

|

|

87 |

% |

Ceva, Inc. AND ITS SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

(U.S. Dollars in thousands)

| |

|

June 30,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023 (*)

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

24,702 |

|

|

$ |

23,287 |

|

|

Marketable securities and short-term bank deposits

|

|

|

133,709 |

|

|

|

143,251 |

|

|

Trade receivables, net

|

|

|

18,298 |

|

|

|

8,433 |

|

|

Unbilled receivables

|

|

|

17,357 |

|

|

|

21,874 |

|

|

Prepaid expenses and other current assets

|

|

|

13,201 |

|

|

|

12,526 |

|

|

Total current assets

|

|

|

207,267 |

|

|

|

209,371 |

|

|

Long-term assets:

|

|

|

|

|

|

|

|

|

|

Severance pay fund

|

|

|

6,762 |

|

|

|

7,070 |

|

|

Deferred tax assets, net

|

|

|

1,317 |

|

|

|

1,609 |

|

|

Property and equipment, net

|

|

|

6,843 |

|

|

|

6,732 |

|

|

Operating lease right-of-use assets

|

|

|

6,137 |

|

|

|

6,978 |

|

|

Investment in marketable equity securities

|

|

|

288 |

|

|

|

406 |

|

|

Goodwill

|

|

|

58,308 |

|

|

|

58,308 |

|

|

Intangible assets, net

|

|

|

2,411 |

|

|

|

2,967 |

|

|

Other long-term assets

|

|

|

11,069 |

|

|

|

10,644 |

|

|

Total assets

|

|

$ |

300,402 |

|

|

$ |

304,085 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Trade payables

|

|

$ |

1,092 |

|

|

$ |

1,154 |

|

|

Deferred revenues

|

|

|

2,830 |

|

|

|

3,018 |

|

|

Accrued expenses and other payables

|

|

|

18,445 |

|

|

|

20,202 |

|

|

Operating lease liabilities

|

|

|

2,615 |

|

|

|

2,513 |

|

|

Total current liabilities

|

|

|

24,982 |

|

|

|

26,887 |

|

|

Long-term liabilities:

|

|

|

|

|

|

|

|

|

|

Accrued severance pay

|

|

|

7,210 |

|

|

|

7,524 |

|

|

Operating lease liabilities

|

|

|

2,964 |

|

|

|

3,943 |

|

|

Other accrued liabilities

|

|

|

1,460 |

|

|

|

1,390 |

|

|

Total liabilities

|

|

|

36,616 |

|

|

|

39,744 |

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

24 |

|

|

|

23 |

|

|

Additional paid in-capital

|

|

|

254,302 |

|

|

|

252,100 |

|

|

Treasury stock

|

|

|

(1,917 |

) |

|

|

(5,620 |

) |

|

Accumulated other comprehensive loss

|

|

|

(2,894 |

) |

|

|

(2,329 |

) |

|

Retained earnings

|

|

|

14,271 |

|

|

|

20,167 |

|

|

Total stockholders’ equity

|

|

|

263,786 |

|

|

|

264,341 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

300,402 |

|

|

$ |

304,085 |

|

(*) Derived from audited financial statements.

Exhibit 99.2

| Ceva, Inc. Q2 2024 Financial Results Conference Call - Prepared Remarks :: August 7, 2024 |

|

Ceva, Inc.

Second Quarter 2024 Financial Results Conference Call

Prepared Remarks of Amir Panush, Chief Executive Officer and

Yaniv Arieli, Chief Financial Officer

August 7, 2024

8:30 A.M. Eastern

Richard

Good morning everyone and welcome to Ceva’s second quarter 2024 earnings conference call. Joining me today on the call are Amir Panush, Chief Executive Officer, and Yaniv Arieli, Chief Financial Officer of Ceva.

Forward Looking Statements and Non-GAAP Financial Measures

Before handing over to Amir, I would like to remind everyone that today’s discussion contains forward-looking statements that involve risks and uncertainties, as well as assumptions that if they materialize or prove incorrect, could cause the results of Ceva to differ materially from those expressed or implied by such forward-looking statements and assumptions. Forward-looking statements include statements regarding our market positioning, strategy and growth opportunities, market trends and dynamics, expectations regarding demand for and benefits of our technologies, our expectations and financial goals and guidance regarding future performance, and our plans and expectations regarding our recently filed registration statement on Form S-3 and any potential future offering or capital raises and the use of proceeds therefrom. Ceva assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

In addition, following the divestment of the Intrinsix business, financial results from Intrinsix were transitioned to a discontinued operation beginning in the third quarter of 2023, and all prior period financial results have been recast accordingly. We will also be discussing certain non-GAAP financial measures which we believe provide a more meaningful analysis of our core operating results and comparison of quarterly results. A reconciliation of non-GAAP financial measures is included in the earnings release we issued this morning and in the SEC filings section of our investors relations website at investors.ceva-ip.com.

| Ceva, Inc. Q2 2024 Financial Results Conference Call - Prepared Remarks :: August 7, 2024 |

|

With that said, I’d like to turn the call over to Amir who will review our business performance for the quarter, review the year and provide some insight into our ongoing business. Amir;

Amir

Thank you, Richard. Good morning everyone and thank you for joining us today. We are pleased to report an excellent second quarter that exceeded our estimates with strong licensing execution from our team worldwide, coupled with royalty growth driven by broad market strength in IoT and robust smartphone shipments. We also surpassed the milestone of 18 billion Ceva-powered smart edge devices shipped to date, as our shipment volumes continue to accelerate rapidly in our IoT end markets.

Our strategy to be focused on developing and licensing leading IPs that enable smart edge devices to connect, sense and infer data is effective and highly synergistic with the growing adoption of AI across every industry. We are seeing more and more licensing deals that are driven by customer needs to incorporate more processing power, more sensing capabilities, more wireless connectivity options, and highly efficient NPUs to run AI workloads on-device. No other IP company has the technology portfolio capable of addressing these three pillars required by every edge AI-enabled device and we are fully focused on maximizing our leadership position and extracting better economics per deal as a result.

Licensing revenue was up 28% year-over-year, and our backlog heading into the third quarter is healthy, on the back of signing some very significant deals in the quarter. In particular, we signed new strategic agreements with 2 infrastructure OEM customers for their development of custom silicon that will enable the infrastructure that is essential for the successful deployment of hybrid AI. The future path of AI inference needs to be hybrid, with AI processing distributed between the cloud and edge devices with more and more inferencing being performed on the end device for cost, security, privacy and user experience reasons. Generative AI has accelerated this requirement, where GenAI developers and providers utilize multiple GenAI models using a mix of compute in the cloud data center and on-device, depending on latency, connectivity, availability, security and privacy requirements. The communications infrastructure that enables hybrid AI is constantly evolving to improve performance and ensure the experience is seamless. Our customers have repeatedly chosen us for their long-term roadmaps due to our DSP leadership in compute efficiency and the value we created together in past platforms.

| Ceva, Inc. Q2 2024 Financial Results Conference Call - Prepared Remarks :: August 7, 2024 |

|

The step up in performance we have delivered to these customers with our latest processor architecture has enabled us to extract more value per deal and will drive higher royalties per chip from their next generation products.

Another notable licensing achievement in the quarter, we signed a strategic Bluetooth portfolio licensing deal with a top 3 U.S. semiconductor analog company that is expanding from sensing to connectivity and AI. This customer is adding connectivity capabilities across its product offering and consolidating their Bluetooth product roadmap around Ceva’s IP going forward. We believe this customer has the potential to become a very high-volume shipper of our IP in future years, with a significant royalty opportunity. This deal follows on from a deal with another U.S. leading MCU player late last year, where we licensed our Wi-Fi 6 IP for their MCUs. We continue to uncover new opportunities within the U.S. semiconductor industry, across our entire portfolio of IPs. As we have stated previously, the U.S. market forms an important part of our growth strategy, and these deals are clear indicators that our strategy for growth in the U.S. is achieving success.

Overall, we signed 11 deals in the quarter, addressing AI solutions for industrial and consumer edge AI devices, next-generation wireless infrastructure to enable ubiquitous AI, 5G satellite, 5G RedCap and Bluetooth connectivity for wearables and hearables. Five of the deals were with OEMs and one deal was with a first-time customer.

Turning to royalties, broad market strength across our smart edge customer base, including strong global smartphone shipments, resulted in royalty revenues growing 5% sequentially and 19% year-over-year. Shipment volumes grew 24% year-over-year, driven predominantly by our customers taking more market share in Bluetooth, Wi-Fi and cellular IoT in the growing industrial, healthcare and consumer IoT end markets. Smartphones recovered well from Q1, and our large customer addressing the low to mid-range market segment is expanding its customer base with new design wins at Vivo and Xiaomi amongst others. Also, of note, we received the first royalties from our spatial audio collaboration with boAt, India’s #1 hearables and wearables OEM. And one of our largest Bluetooth customers reported the first shipments of their new Wi-Fi 6 / Bluetooth 5 combo chip aimed at high volume smart edge devices including TWS earphones, smart watches, smart glasses, and smart hearing aids. Overall, the royalty momentum we are experiencing is underpinned by our strong licensing activities in the past 3 years. These customers are now starting to come to market with their latest chips powered by our IP, expanding our customer base across end markets. This will continue to be a strong tailwind for our royalty business for years to come, and we continue to partner closely with our customers to ensure they successfully reach the market with their increasingly intelligent and connected products.

| Ceva, Inc. Q2 2024 Financial Results Conference Call - Prepared Remarks :: August 7, 2024 |

|

Taking a step back, it has becoming abundantly clear that AI is a key factor in driving our business both directly and indirectly. As we have stated previously, there is no AI without sensing or connectivity. Every smart edge device requires sensing to take data from its surroundings, to which AI is then applied in order to inform decisions. And each of these devices needs to be connected to transfer this data to other devices, to the cloud or to the network. These three use cases are inextricably linked and provide incredible opportunities for Ceva to grow and flourish.

During the second quarter, we launched two new IP products that continue our AI and connectivity momentum. The first of these relates to AI for IoT devices. AI is increasingly finding its way into every device, no matter how small or power constrained. TinyML is the field of machine learning that will bring AI inferencing to billions of devices in the coming years and represents a huge opportunity in AI beyond the cloud which most of us are familiar with today. In fact, ABI Research forecasts that TinyML shipments in IoT devices are set to grow at a CAGR of 48% throughout the rest of the decade to reach almost 3.65 billion by 2030, all running on the device. In order for this market to reach its potential, specialized Neural Processor Units or NPUs are required to run the TinyML networks in many of these devices, in a power and cost-efficient manner. Leveraging our vast experience in AI, low power processing and the ability to handle sensing workloads in parallel, we introduced a new NPU called NeuPro-Nano during the quarter. This NPU, which is the first fully programmable NPU to efficiently execute any complete, end-to-end TinyML application with an optimal balance of power, performance and area thanks to innovative features like Ceva NetSqueeze which significantly reduces the memory footprint required for AI in these IoT devices. This ensures NeuPro-Nano fits the market requirements for TinyML based AI workloads, from factory maintenance to consumer audio enhancements and appeals to our broad customer base as they begin to plan to incorporate AI in their next generation products. NeuPro-Nano is currently in evaluation with customers and we expect the first licensing deals to close this year and first product in the market as soon as 2026. This is a significant opportunity for us to cross-sell this NPU into our existing customer base, where we already command leadership and are a trusted partner to more than 100 customers today. We believe that this area of AI is an untapped market and that we have the right solution to fully exploit this opportunity.

| Ceva, Inc. Q2 2024 Financial Results Conference Call - Prepared Remarks :: August 7, 2024 |

|

The second significant product launch in the quarter is Ceva-Waves Links, a new multi-protocol solution for wireless connectivity. The Ceva-Waves-Links110 (the first of Links series) is already in development/integration with a lead OEM customer. Increasingly, devices require more than one wireless connectivity standard to get the best performance and enable all the features required. Our broad customer base of Bluetooth, Wi-Fi and UWB customers increasingly are looking to license additional IPs from us and integrate them together in a single chip. Be it Bluetooth and Wi-Fi combo for smart home connectivity, or Bluetooth and UWB for digital car keys, in our opinion there is no other IP company capable of delivering these multi-standard wireless solutions. Waves makes this even easier for our customers and allows us to provide more IP per deal, leading to higher value per deal through license fees and royalties.

In closing, I would like to take this opportunity to thank our teams for strong execution this quarter, and to our customers and partners for putting their trust with us, together bringing more and more Ceva-powered devices to market. My belief in our people and technology grows every day, and the potential of our company is unlimited in the AI era. We have the right strategy to capitalize on our unique capabilities, and we are laser focused on our execution. We fully expect to deliver on our stated financial and business targets for the year and are committed to ensuring everyone sees and understands the value that Ceva brings as an AI-focused company through our Smart Edge “connect, sense and infer” value proposition. All of this in turn will unlock and create more shareholder value.

Now I will turn the call over to Yaniv for the financials.

| Ceva, Inc. Q2 2024 Financial Results Conference Call - Prepared Remarks :: August 7, 2024 |

|

Yaniv

Thank you, Amir. I’ll now start by reviewing the results of our operations for the second quarter of 2024.

Revenue for the second quarter was $28.4 million, up 24% compared to $22.9 million for the same quarter last year. The revenue breakdown is as follows:

Licensing and related revenue was $17.3 million, reflecting 61% of total revenues, significantly increased 28% year-over-year and 51% sequentially.

Royalty revenue was $11.2 million, reflecting 39% of total revenues, increased 19% year-over-year and 5% sequentially.

Gross margin came better than our guidance, 90% on a GAAP and 91% on non-GAAP basis compared to 85% and 86% on GAAP and non-GAAP, respectively, a year ago.

Total GAAP operating expenses for the second quarter were $25.5 million, at the higher end of our guidance, due mainly to higher sales commissions and employee related benefits.

Total non-GAAP operating expenses for the second quarter, excluding equity-based compensation expenses, amortization of intangibles and related acquisition costs, were $21.4 million, just above the higher end of our guidance, for the same reasons I just mentioned.

Non-GAAP operating margins and income were 15% of revenue and $4.4 million, higher than negative operating margins of (4%) and operating losses of $0.8 million recorded in the first quarter of 2024 and negative operating margins of (5%) and operating losses of $1.1 million recorded in the second quarter of 2023, respectively.

GAAP operating loss for the second quarter of 2024 was $35,000, as compared to a GAAP operating loss of $5.3 million for the same period in 2023.

GAAP and non-GAAP taxes were $1.6 million, in line with our guidance and effected by geographies of deals signed.

| Ceva, Inc. Q2 2024 Financial Results Conference Call - Prepared Remarks :: August 7, 2024 |

|

GAAP net loss for the second of 2024 quarter was $0.3 million and diluted loss per share was 0.01 cents, as compared to net loss of $4.9 million and diluted loss per share of 21 cents for the same period last year.

Non-GAAP net income and diluted income per share for the second quarter of 2024 increased significantly to $4.2 million and 17 cents, respectively, as compared to net loss of $0.5 million and diluted loss per share of 2 cents reported for the same period last year.

With respect to other related data

Shipped units by Ceva licensees during the second quarter of 2024 were 461 million units, up 24% from the second quarter 2023 reported shipments.

Of the 461 million units reported, 79 million units, or 17%, were for mobile handset modems.

| |

●

|

353 million units were for consumer IoT markets, up 28% from 276 million units in the second quarter of 2023.

|

| |

●

|

28 million units were for Industrial IoT markets, doubled from 14 million in the second quarter of 2023.

|

| |

●

|

Bluetooth shipments were 266 million units in the quarter, up 26% year-over-year.

|

| |

●

|

Cellular IoT shipments were 40 million units, up 92% year-over-year.

|

| |

●

|

Wi-Fi shipments were 35 million units, up 21% year-over-year.

|

Overall, a strong quarter across all our end markets and the third consecutive quarter of year-over-year royalty revenue growth.

As for the balance sheet items

As of June 30, 2024, Ceva’s cash and cash equivalent balances, marketable securities and bank deposits were approximately $158 million. In the second quarter of 2024 we repurchased approximately 100,000 shares for approximately $2.0 million. As of today, around 543,000 shares are available for repurchase under the repurchase program as expanded in November 2023.

| Ceva, Inc. Q2 2024 Financial Results Conference Call - Prepared Remarks :: August 7, 2024 |

|

Our DSO for the second quarter of 2024 is 59 days, same as first quarter.

During the second quarter, we generated $2.4 million cash from operating activities, on-going depreciation and amortization was $1.0 million, and purchase of fixed assets was $0.6 million.

At the end of the second quarter, our headcount was 434 people, of whom 359 are engineers.

Also, this morning we filed a universal shelf registration statement on Form S-3 with the SEC, which if and when declared effective will permit Ceva to offer and sell, from time to time in one or more offerings, up to $150 million of common stock, preferred stock, debt securities, warrants, or any combination of these securities. We believe that having an S-3 on file is good corporate housekeeping and will provide us with a tool to further enhance our financial flexibility and opportunistically access additional capital to fund acquisitions or other business opportunities or strategic initiatives should they arise. At present, we do not have any impending transaction that would require us to draw down the shelf. If we decide to raise capital in a future offering using the shelf registration statement, Ceva will describe the specific details of that future offering in a prospectus supplement that is filed with the SEC.

Now for the guidance for the third quarter of 2024 and the year

| |

●

|

Our annual growth plans progress well, and we are working hard to achieve even better results than originally forecasted. As Amir stated earlier, we have a healthy pipeline of potential deal flow for our wide range of technologies and markets, and as such we expect overall revenues for the year to be at the mid to high-end of our 4%-8% guidance.

|

Coupled with our cost control measures and focus, we are within reach to more than double our non-GAAP operating margins and operating profit for 2024 over 2023, and close to double non-GAAP fully diluted EPS, which is higher than originally forecasted.

As for the third quarter:

| |

●

|

Total revenue is expected to be $26.0 to $28.0 million.

|

| Ceva, Inc. Q2 2024 Financial Results Conference Call - Prepared Remarks :: August 7, 2024 |

|

| |

●

|

Gross margin is expected to be similar to the second quarter, approximately 90% on a GAAP basis and 91% on a non-GAAP basis, excluding an aggregate of $0.2 million of equity-based compensation expenses and $0.1 million amortization of acquired intangibles.

|

| |

●

|

GAAP OPEX is expected to be in the range of $24.8 million to $25.8 million, in-line with our annual plans. Of our anticipated total operating expenses for the third quarter, $3.9 million is expected to be attributable to equity-based compensation expenses, $0.3 million for amortization of acquired intangibles and $0.2 million for expenses related to business acquisition.

|

| |

●

|

Non-GAAP OPEX is expected to be similar to the second quarter, in the range of $20.7 million to $21.7 million.

|

| |

●

|

Net interest income is expected to be approximately $1.2 million.

|

| |

●

|

Taxes are expected to be approximately $1.9 million.

|

| |

●

|

Share count is expected to be 25.3 million shares.

|

Operator: You can now open the Q&A session

Wrap Up: Richard

Thank you for joining us today and for your continued interest in Ceva. As a reminder, the prepared remarks for this conference call are filed as an exhibit to the Current Report on Form 8-K and accessible through the investor section of our website at https://investors.ceva-ip.com.

With regards to upcoming events, we will be participating in the following conferences:

|

●

|

Oppenheimer 27th Annual Technology, Internet & Communications Conference, August 12-14, virtually

|

|

●

|

5th Annual Needham Semiconductor and Semicap Virtual Conference, August 21-22, virtually

|

|

●

|

Jefferies Semiconductor, IT Hardware & Communications Technology Summit, August 28th in Chicago

|

|

●

|

Jefferies Israel Tech Trek 2024 Conference, September 10-12 in Tel Aviv, Israel

|

Further information on these events and all events we will be participating in can be found on the investors section of our website.

Thank you and goodbye

v3.24.2.u1

Document And Entity Information

|

Aug. 07, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CEVA, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 07, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-49842

|

| Entity, Tax Identification Number |

77-0556376

|

| Entity, Address, Address Line One |

15245 Shady Grove Road

|

| Entity, Address, Address Line Two |

Suite 400

|

| Entity, Address, City or Town |

Rockville

|

| Entity, Address, State or Province |

MD

|

| Entity, Address, Postal Zip Code |

20850

|

| City Area Code |

240

|

| Local Phone Number |

308-8328

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CEVA

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001173489

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

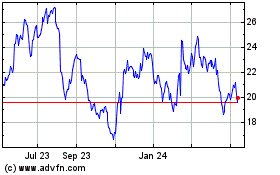

CEVA (NASDAQ:CEVA)

Historical Stock Chart

From Aug 2024 to Sep 2024

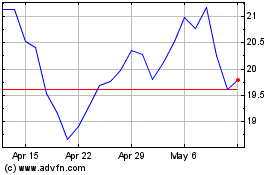

CEVA (NASDAQ:CEVA)

Historical Stock Chart

From Sep 2023 to Sep 2024