false

0001455365

0001455365

2024-08-08

2024-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August

8, 2024

Cognition

Therapeutics, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-40886 |

|

13-4365359 |

(State

or other jurisdiction of

incorporation or organization) |

|

( Commission File Number) |

|

(I.R.S.

Employer

Identification No.) |

2500

Westchester Avenue

Purchase,

NY |

|

10577 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code: (412)

481-2210

Not

Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ¨ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Exchange on Which

Registered |

| Common

Stock, par value $0.001 per share |

|

CGTX |

|

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 2.02 |

Results of Operations

and Financial Condition. |

On August 8, 2024, Cognition Therapeutics, Inc. (the “Company”)

issued a press release announcing its financial results for the quarter ended June 30, 2024. A copy of the Company’s press

release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information disclosed under Item 2.02, including Exhibit 99.1,

is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific

reference in such filing.

| Item 9.01 |

Financial Statements

and Exhibits. |

(d) Exhibits

The following exhibits are being furnished herewith:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| COGNITION THERAPEUTICS, INC. |

|

| |

|

| By: |

/s/

Lisa Ricciardi |

|

| Name: |

Lisa Ricciardi |

|

| Title: |

President and Chief Executive Officer |

|

Date: August 8, 2024

Exhibit 99.1

Cognition

Therapeutics Reports Financial Results for the Second Quarter 2024 and Provides Business

and Clinical Update

- Proof-of-Concept

Phase 2 SHINE Trial Demonstrates ~40% Mean Improvement in ADAS-Cog 11 vs Placebo and Consistent Positive Changes Across Multiple Cognitive

and Functional Measures -

- On Track to

Report Topline Results from SHIMMER Study in Mild-to-Moderate DLB by YE 2024 -

- Company to

Host Investor Conference Call at 8:30 a.m. -

Purchase,

NY – August 8, 2024 – Cognition Therapeutics, Inc. (Nasdaq: CGTX), a clinical

stage company developing product candidates that treat neurodegenerative disorders, (the “Company” or “Cognition”),

today reported financial results for the second quarter ended June 30, 2024, and provided a business update.

“We

announced favorable results from the Phase 2 ‘SHINE’ Study that provided proof-of-concept that CT1812 has potential to slow

the progression of mild-to-moderate Alzheimer’s disease after just six months of treatment,” said Lisa

Ricciardi, Cognition’s president and CEO. “In terms of next steps, we are looking forward to reading out results from our

‘SHIMMER’ study in mild-to-moderate dementia with Lewy bodies by year-end 2024 and are now planning the next phase of development

in our Alzheimer's disease program.”

Business and Corporate Highlights

| · | Phase

2 proof-of-concept SHINE study (NCT03507790) of CT1812 in 153 participants with mild-to-moderate

Alzheimer’s disease demonstrated consistent positive changes slowing cognitive decline,

a biomarker signal of neuroprotection, and a favorable safety and tolerability profile |

| o | Participants

treated with once daily oral CT1812 (pooled 100 and 300mg) experienced a 39% slowing of decline

compared to placebo-treated as measured with ADAS-Cog 11* |

| o | Consistent

trends favoring CT1812 were observed in other cognitive measures: ADAS-Cog 13, cognitive

composite, MMSE; and in functional measures: ADCS-ADL and ADCS-CGIC |

| o | A

significant reduction in neurofilament light chain (NfL), a biomarker of neurodegeneration,

in participants treated with 300mg CT1812 compared to placebo |

| o | No

discontinuations due to AEs in the 100mg CT1812 group; all elevated liver enzymes occurring

in the 300 mg dose group; serious adverse events (SAE) similar in placebo and treated arms |

| o | Results

presented at the 2024 Alzheimer’s Association International Conference (AAIC) |

| · | Investor

webcast held to discuss SHINE results, an archive of which is available here. |

| · | Published

three manuscripts that demonstrate CT1812 impact on pathways related to amyloid biology,

synapse and neuroinflammation, hallmarks of Alzheimer’s disease pathology: |

| o | Proteomic

analyses from the first cohort of the Phase 2 COG0201 ‘SHINE’ study (SHINE-A)

in the journal, Neurobiology of Disease |

| o | Clinical

findings from the Phase 1b COG0105 ‘SPARC’ study in Alzheimer's Research &

Therapy and the Phase 2 COG0202 ‘SEQUEL’ study in The Journal of Prevention

of Alzheimer's Disease |

Cognition

Therapeutics, Inc.

www.cogrx.com

| · | Continued

progress in Phase 2 START study (NCT05531656) of CT1812 in early Alzheimer’s disease |

| · | Continued

enrollment in Phase 2 MAGNIFY study (NCT05893537) of CT1812 in geographic atrophy secondary

to dry age-related macular degeneration |

Second Quarter 2024 Financial Results

Cash

and cash equivalents as of June 30, 2024 were approximately $28.5 million and total grant funds remaining from the NIA were $57.3

million. The Company estimates that it has sufficient cash to fund operations and capital expenditures

into the second quarter of 2025.

Research and development expenses were

$11.6 million for the second quarter ended June 30, 2024, compared to $8.5 million for the comparable period in 2023. The increase

was primarily related to higher costs associated with advancing our clinical programs, including Phase 2 trial activities with contract

research organizations and personnel cost.

General and administrative expenses

were $3.1 million for the second quarter ended June 30, 2024, compared to $3.3 million for the comparable period in 2023. The decrease

was primarily related to lower professional services.

The Company reported a net loss of $7.0

million, or $(0.18) per basic and diluted share for the second quarter ended June 30, 2024, compared to a net loss of $4.7 million,

or $(0.16) per basic and diluted share for the same period in 2023.

Conference Call

| Date

/ Time |

August 8,

2024 at 8:30am ET / 5:30am PT |

| |

|

| Telephone

Access: |

US/Canada Participant Toll-Free

Dial-in Number: (800) 715-9871

US/Canada Participant International

Dial-In Number: (646) 307-1963

Conference ID Number: 3702003 |

| |

|

| Webcast

Access: |

The

audio webcast with live Q&A will be accessible at https://edge.media-server.com/mmc/p/3napeebe

or via the Investor Relations section of Cognition’s website. An archive of the webcast and presentation will be available

for 90 days beginning at approximately 10:30 a.m. ET on August 8, 2024. |

* CT1812 did not achieve statistical

significance on ADAS-Cog 11, the first of the ordered secondary efficacy endpoints, in the pooled 100mg and 300mg dose group compared

to placebo

About Cognition Therapeutics:

Cognition

Therapeutics, Inc. is a clinical-stage biopharmaceutical company engaged in the discovery and development of innovative, small molecule

therapeutics targeting age-related degenerative disorders of the central nervous system and retina. We are currently investigating our

lead candidate CT1812 in clinical programs in Alzheimer’s

disease, dementia with Lewy bodies (DLB) and dry age-related macular degeneration (dry AMD). We believe CT1812 and our pipeline of σ-2

receptor modulators can regulate pathways that are impaired in these diseases. We believe that targeting the σ-2 receptor with

CT1812 represents a mechanism functionally distinct from other current approaches in clinical development for the treatment of degenerative

diseases. More about Cognition Therapeutics and its pipeline can be found at https://cogrx.com/.

Cognition

Therapeutics, Inc.

www.cogrx.com

Forward-Looking Statements

This press release

contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. All statements contained

in this press release, other than statements of historical facts or statements that relate to present facts or current conditions, are

forward-looking statements. These statements, including statements relating to our product candidates, including CT1812, and any expected

or implied benefits or results, including that initial clinical results observed with respect to CT1812 will be replicated in late trials

and our clinical development plans, including statements regarding our clinical studies of CT1812 and any analyses of the results therefrom,

the timing and expected results of our clinical trials, upcoming presentations on our clinical trials, and cash runway, involve known

and unknown risks, uncertainties and other important factors that may cause our actual results, performance, or achievements to be materially

different from any future results, performance, or achievements expressed or implied by the forward-looking statements. In some cases,

you can identify forward-looking statements by terms such as “may,” might,” “will,” “should,”

“expect,” “plan,” “aim,” “seek,” “anticipate,” “could,” “intend,”

“target,” “project,” “contemplate,” “believe,” “estimate,” “predict,”

“forecast,” “potential” or “continue” or the negative of these terms or other similar expressions.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial

trends that we believe may affect our business, financial condition, and results of operations. These forward-looking statements speak

only as of the date of this press release and are subject to a number of risks, uncertainties and assumptions, some of which cannot be

predicted or quantified and some of which are beyond our control. Factors that may cause actual results to differ materially from current

expectations include, but are not limited to: our ability to successfully advance our current and future product candidates through development

activities, preclinical studies and clinical trials and costs related thereto; uncertainties inherent in the results of preliminary data

and pre-clinical studies being predictive of the results of clinical trials; the timing, scope and likelihood of regulatory filings and

approvals, including regulatory approval of our product candidates; competition; our ability to secure new (and retain existing) grant

funding; our ability to grow and manage growth, maintain relationships with suppliers and retain our management and key employees; changes

in applicable laws or regulations; the possibility that the we may be adversely affected by other economic, business or competitive factors,

including ongoing economic uncertainty; our estimates of expenses and profitability; the evolution of the markets in which we compete;

our ability to implement our strategic initiatives and continue to innovate our existing products; our ability to defend our intellectual

property; the impacts of ongoing global and regional conflicts; the impact of the COVID-19 pandemic on our business, supply chain and

labor force; and the risks and uncertainties described in the “Risk Factors” section of our annual and quarterly reports

filed the Securities & Exchange Commission. These risks are not exhaustive and we face both known and unknown risks. You

should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking

statements may not be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements.

Moreover, we operate in a dynamic industry and economy. New risk factors and uncertainties may emerge from time to time, and it is not

possible for management to predict all risk factors and uncertainties that we may face. Except as required by applicable law, we do not

plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future

events, changed circumstances or otherwise.

Cognition

Therapeutics, Inc.

www.cogrx.com

Cognition

Therapeutics, Inc.

Unaudited Selected

Financial Data

| (in thousands, except share and per share data amounts) | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| Consolidated Statements of Operations Data: | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Operating Expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

$ | 11,577 | | |

$ | 8,497 | | |

$ | 22,130 | | |

$ | 13,927 | |

| General and administrative | |

| 3,101 | | |

| 3,320 | | |

| 6,650 | | |

| 6,863 | |

| Total operating expenses | |

| 14,678 | | |

| 11,817 | | |

| 28,780 | | |

| 20,790 | |

| Loss from operations | |

| (14,678 | ) | |

| (11,817 | ) | |

| (28,780 | ) | |

| (20,790 | ) |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Grant income | |

| 7,311 | | |

| 6,925 | | |

| 12,223 | | |

| 10,351 | |

| Other income (expense), net | |

| 333 | | |

| 172 | | |

| 577 | | |

| (443 | ) |

| Interest expense | |

| (7 | ) | |

| (6 | ) | |

| (17 | ) | |

| (16 | ) |

| Loss on currency translation from liquidation of subsidiary | |

| — | | |

| — | | |

| (195 | ) | |

| — | |

| Total other income, net | |

| 7,637 | | |

| 7,091 | | |

| 12,588 | | |

| 9,892 | |

| Net loss | |

$ | (7,041 | ) | |

$ | (4,726 | ) | |

$ | (16,192 | ) | |

$ | (10,898 | ) |

| Foreign currency translation adjustment, including reclassifications | |

| — | | |

| (1 | ) | |

| 195 | | |

| 3 | |

| Total comprehensive loss | |

$ | (7,041 | ) | |

$ | (4,727 | ) | |

$ | (15,997 | ) | |

$ | (10,895 | ) |

| Net loss per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.18 | ) | |

$ | (0.16 | ) | |

$ | (0.44 | ) | |

$ | (0.37 | ) |

| Diluted | |

$ | (0.18 | ) | |

$ | (0.16 | ) | |

$ | (0.44 | ) | |

$ | (0.37 | ) |

| Weighted-average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 40,062,954 | | |

| 29,614,822 | | |

| 36,899,112 | | |

| 29,356,144 | |

| Diluted | |

| 40,062,954 | | |

| 29,614,822 | | |

| 36,899,112 | | |

| 29,356,144 | |

| | |

As of | |

| (in thousands) | |

June 30, 2024 | | |

December 31, 2023 | |

| Consolidated Balance Sheet Data: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 28,533 | | |

$ | 29,922 | |

| Total assets | |

| 34,369 | | |

| 35,163 | |

| Total liabilities | |

| 11,360 | | |

| 10,689 | |

| Accumulated deficit | |

| (157,381 | ) | |

| (141,189 | ) |

| Total stockholders’ equity | |

| 23,009 | | |

| 24,474 | |

Contact Information:

Cognition

Therapeutics, Inc.

info@cogrx.com |

Casey

McDonald (media)

Tiberend Strategic Advisors, Inc.

cmcdonald@tiberend.com |

Mike Moyer (investors)

LifeSci Advisors

mmoyer@lifesciadvisors.com |

Cognition

Therapeutics, Inc.

www.cogrx.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

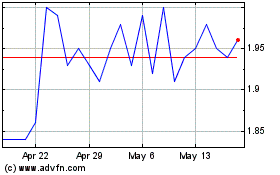

Cognition Therapeutics (NASDAQ:CGTX)

Historical Stock Chart

From Oct 2024 to Nov 2024

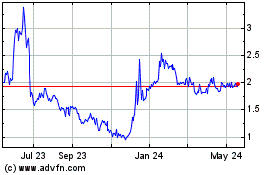

Cognition Therapeutics (NASDAQ:CGTX)

Historical Stock Chart

From Nov 2023 to Nov 2024