Clearfield, Inc.

(NASDAQ: CLFD), a leader in fiber connectivity,

reported results for the fourth quarter and fiscal year

2024.

|

Fiscal Q4 2024 Financial Summary |

|

|

|

(in millions except per share data and percentages) |

Q4 2024 |

vs. Q4 2023 |

Change |

Change (%) |

|

|

Net Sales |

$ |

46.8 |

|

$ |

49.7 |

|

$ |

(2.9 |

) |

-6 |

% |

|

|

|

|

|

|

|

|

|

Gross Profit ($) |

$ |

10.7 |

|

$ |

12.0 |

|

$ |

(1.3 |

) |

-11 |

% |

|

|

Gross Profit (%) |

|

22.8 |

% |

|

24.1 |

% |

|

-1.3 |

% |

-5 |

% |

|

|

|

|

|

|

|

|

|

(Loss) Income from Operations |

$ |

(3.0 |

) |

$ |

1.7 |

|

$ |

(4.7 |

) |

-276 |

% |

|

|

Income Tax (Benefit) Expense |

$ |

(0.5 |

) |

$ |

0.6 |

|

$ |

(1.1 |

) |

-187 |

% |

|

|

|

|

|

|

|

|

|

Net (Loss) Income |

$ |

(0.8 |

) |

$ |

2.7 |

|

$ |

(3.5 |

) |

-131 |

% |

|

|

Net (Loss) Income per Diluted Share |

$ |

(0.06 |

) |

$ |

0.17 |

|

$ |

(0.23 |

) |

-135 |

% |

|

| |

|

|

|

|

|

|

Fiscal YTD 2024 Financial Summary |

|

|

|

(in millions except per share data and percentages) |

2024 YTD |

vs. 2023 YTD |

Change |

Change (%) |

|

|

Net Sales |

$ |

166.7 |

|

$ |

268.7 |

|

$ |

(102.0 |

) |

-38 |

% |

|

|

|

|

|

|

|

|

|

Gross Profit ($) |

$ |

28.9 |

|

$ |

85.3 |

|

$ |

(56.4 |

) |

-66 |

% |

|

|

Gross Profit (%) |

|

17.3 |

% |

|

31.7 |

% |

|

-14.4 |

% |

-45 |

% |

|

|

|

|

|

|

|

|

|

(Loss) Income from Operations |

$ |

(23.2 |

) |

$ |

37.3 |

|

$ |

(60.5 |

) |

-162 |

% |

|

|

Income Tax (Benefit) Expense |

$ |

(3.8 |

) |

$ |

9.1 |

|

$ |

(12.9 |

) |

-142 |

% |

|

|

|

|

|

|

|

|

|

Net (Loss) Income |

$ |

(12.5 |

) |

$ |

32.5 |

|

$ |

(45.0 |

) |

-138 |

% |

|

|

Net (Loss) Income per Diluted Share |

$ |

(0.85 |

) |

$ |

2.17 |

|

$ |

(3.02 |

) |

-139 |

% |

|

| |

|

|

|

|

|

Management Commentary

"As we close out the fiscal year, we are proud of how

well-positioned Clearfield is to capitalize on the significant

opportunities ahead. Our quarterly outperformance was driven by

stronger-than-expected sales in the MSO and Large Regional service

provider markets," said Company President and Chief Executive

Officer, Cheri Beranek. "Our revenue from products for homes

connected continues to grow and we are encouraged by the positive

response to our active cabinet solutions. Looking forward, we are

excited about the opportunities from both public and private

funding for rural broadband expansion. Our recent NTIA recognition

for self-certification to the Build America Buy America (“BABA”)

requirements further prepares us for the significant Broadband

Equity, Access, and Deployment (“BEAD”) Program opportunity ahead,

with initial revenue expected in late 2025," said Beranek.

“We are pleased to report positive cash flow from operations of

approximately $22.2 million for the full year, reflecting our

commitment to strategically investing in the organization, while

maintaining a prudent and disciplined approach to our cost

controls. We’ve made significant progress in reducing our inventory

levels, and we will continue to prioritize this effort to further

enhance cash flow from operations,” said Chief Financial Officer

Dan Herzog. “Pockets of inventory remain at some customer sites,

however, the successful transition of Clearfield becoming a full

portfolio supplier of products for both passing and connecting

homes has positioned the company for growth consistent with the

general industry outlook. As a result, we are guiding to revenues

of $170 million to $185 million in fiscal year 2025, with revenue

growth expected to be primarily driven by the U.S. market as we

concentrate on gross profit improvements in our international

markets.

Financial Results for the Three Months Ended September

30, 2024

Net sales for the fourth quarter of fiscal 2024 decreased 5.9%

to $46.8 million from $49.7 million in the same year-ago

quarter.

As of September 30, 2024, order backlog (defined as purchase

orders received but not yet fulfilled) was $25.1 million, a

decrease of $7.5 million, or 23%, compared to $32.6 million as of

June 30, 2024, and a decrease of $32.2 million, or 56.1%, from

September 30, 2023.

Gross margin for the fourth quarter of fiscal 2024 was 22.8%,

compared to 24.1% in the fourth quarter of fiscal 2023. While gross

margin was down from the year ago quarter, it was slightly improved

from the previous quarter gross margin of 21.9% due to lower excess

inventory charges as a result of better utilization in the

quarter.

Operating expenses for the fourth quarter of fiscal 2024

increased 33.1% to $13.7 million, or 29.3% of net sales, from $10.3

million, or 20.7% of net sales, mainly due to higher variable

compensation and professional fees than in the same year-ago

quarter.

Net loss for the fourth quarter of fiscal 2024 totaled $0.8

million, or ($0.06) per diluted share, compared to net income of

$2.7 million, or $0.17 per diluted share, in the same year-ago

quarter.

OutlookAt this time and after considering the

expected impacts of seasonality and the current state of the

industry, the Company expects net sales for the first quarter of

fiscal 2025 to be in the range of $33 million to $38 million and

net loss per share to be in the range of $0.28 to $0.35. This loss

per share range is based on the number of shares outstanding at the

end of the fourth quarter and does not reflect potential share

repurchases completed in the first quarter of fiscal 2025.

Additionally, the Company expects net sales in fiscal year 2025 to

be in the range of $170 million to $185 million.

Conference CallManagement will hold a

conference call today, November 7, 2024, at 5:00 p.m. Eastern Time

(4:00 p.m. Central Time) to discuss these results and provide an

update on business conditions.

U.S. dial-in: 1-833-816-1424International dial-in:

1-412-317-0517Conference ID: 10192600

The live webcast of the call can be accessed at the Clearfield

Investor Relations website along with the company's earnings press

release and presentation.

A replay of the call will be available after 8:00 p.m. Eastern

Time on the same day through November 21, 2024, while an archived

version of the webcast will be available on the Investor Relations

website for 90 days.

U.S. replay dial-in: 1-844-512-2921International replay dial-in:

1-412-317-6671Replay ID: 10192600

About Clearfield, Inc. Clearfield, Inc.

(NASDAQ: CLFD) designs, manufactures, and distributes fiber optic

management, protection, and delivery products for communications

networks. Our “fiber to anywhere” platform serves the unique

requirements of leading incumbent local exchange carriers

(traditional carriers), competitive local exchange carriers

(alternative carriers), and MSO/cable TV companies, while also

catering to the broadband needs of the utility/municipality,

enterprise, and data center markets. Headquartered in Minneapolis,

MN, Clearfield deploys more than a million fiber ports each year.

For more information, visit www.SeeClearfield.com.

Cautionary Statement Regarding Forward-Looking

InformationForward-looking statements contained herein and

in any related presentation or in the related Earnings Presentation

are made pursuant to the safe harbor provisions of the Private

Litigation Reform Act of 1995. Words such as “may,” “plan,”

“expect,” “aim,” “believe,” “project,” “target,” “anticipate,”

“intend,” “estimate,” “will,” “should,” “could,” “outlook,” or

“continue” or comparable terminology are intended to identify

forward-looking statements. Such forward looking statements

include, for example, statements about the Company’s future revenue

and operating performance, expected customer ordering patterns and

future supply agreements with customers, anticipated shipping on

backlog and future lead times, future availability of components

and materials from the Company’s supply chain, compliance with

Build America Buy America (“BABA”) Act requirements, future

availability of labor impacting our customers’ network builds, the

impact of the Broadband Equity, Access, and Deployment (BEAD)

Program, Rural Digital Opportunity Fund (RDOF) or other government

programs on the demand for the Company’s products or timing of

customer orders, the Company’s ability to match capacity to meet

demand, expansion into new markets and trends in and growth of the

FTTx markets, market segments or customer purchases and other

statements that are not historical facts. These statements are

based upon the Company's current expectations and judgments about

future developments in the Company's business. Certain important

factors could have a material impact on the Company's performance,

including, without limitation: inflationary price pressures and

uncertain availability of components, raw materials, labor and

logistics used by us and our suppliers could negatively impact our

profitability; we rely on single-source suppliers, which could

cause delays, increase costs or prevent us from completing customer

orders; we depend on the availability of sufficient supply of

certain materials and global disruptions in the supply chain for

these materials could prevent us from meeting customer demand for

our products; a significant percentage of our sales in the last

three fiscal years have been made to a small number of customers,

and the loss of these major customers could adversely affect us;

further consolidation among our customers may result in the loss of

some customers and may reduce sales during the pendency of business

combinations and related integration activities; we may be subject

to risks associated with acquisitions, and the risks could

adversely affect future operating results; we have exposure to

movements in foreign currency exchange rates; adverse global

economic conditions and geopolitical issues could have a negative

effect on our business, and results of operations and financial

condition; growth may strain our business infrastructure, which

could adversely affect our operations and financial condition;

product defects or the failure of our products to meet

specifications could cause us to lose customers and sales or to

incur unexpected expenses; we are dependent on key personnel;

cyber-security incidents, including ransomware, data breaches or

computer viruses, could disrupt our business operations, damage our

reputation, result in increased expense, and potentially lead to

legal proceedings; our business is dependent on interdependent

management information systems; natural disasters, extreme weather

conditions or other catastrophic events could negatively affect our

business, financial condition, and operating results; pandemics and

other health crises, including COVID-19, could have a material

adverse effect on our business, financial condition, and operating

results; to compete effectively, we must continually improve

existing products and introduce new products that achieve market

acceptance; if the telecommunications market does not continue to

expand, our business may not grow as fast as we expect, which could

adversely impact our business, financial condition and operating

results; changes in U.S. government funding programs may cause our

customers and prospective customers to delay, reduce, or accelerate

purchases, leading to unpredictable and irregular purchase cycles;

intense competition in our industry may result in price reductions,

lower gross profits and loss of market share; our success depends

upon adequate protection of our patent and intellectual property

rights; we face risks associated with expanding our sales outside

of the United States; expectations relating to environmental,

social and governance matters may increase our cost of doing

business and expose us to reputational harm and potential

liability; our operating results may fluctuate significantly from

quarter to quarter, which may make budgeting for expenses difficult

and may negatively affect the market price of our common stock; our

stock price has been volatile historically and may continue to be

volatile - the price of our common stock may fluctuate

significantly; anti-takeover provisions in our organizational

documents, Minnesota law and other agreements could prevent or

delay a change in control of our Company; and other factors set

forth in Part I, Item IA. Risk Factors of Clearfield's Annual

Report on Form 10-K for the year ended September 30, 2023 as well

as other filings with the Securities and Exchange Commission. The

Company undertakes no obligation to update these statements to

reflect actual events unless required by law.

Investor Relations Contact:Greg McNiff The

Blueshirt Group773-485-7191clearfield@blueshirtgroup.com

| |

CLEARFIELD, INC. |

|

|

|

|

|

|

| |

CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

| |

(IN

THOUSANDS, EXCEPT SHARE DATA) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

September 30, |

|

|

| |

|

|

2024 |

|

|

2023 |

|

|

| |

Assets |

|

|

|

|

|

|

| |

Current Assets |

|

|

|

|

|

|

| |

Cash and

cash equivalents |

$ |

16,167 |

|

$ |

37,827 |

|

|

| |

Short-term

investments |

|

114,825 |

|

|

130,286 |

|

|

| |

Accounts

receivable, net |

|

21,309 |

|

|

28,392 |

|

|

| |

Inventories,

net |

|

66,766 |

|

|

98,055 |

|

|

| |

Other

current assets |

|

10,528 |

|

|

1,695 |

|

|

| |

Total

current assets |

|

229,595 |

|

|

296,255 |

|

|

| |

|

|

|

|

|

|

|

| |

Property, plant and equipment, net |

|

23,953 |

|

|

21,527 |

|

|

| |

|

|

|

|

|

|

|

| |

Other Assets |

|

|

|

|

|

|

| |

Long-term

investments |

|

24,505 |

|

|

6,343 |

|

|

| |

Goodwill |

|

6,627 |

|

|

6,528 |

|

|

| |

Intangible

assets, net |

|

6,343 |

|

|

6,092 |

|

|

| |

Right of use

lease assets |

|

15,797 |

|

|

13,861 |

|

|

| |

Deferred tax

asset |

|

6,135 |

|

|

3,039 |

|

|

| |

Other |

|

2,320 |

|

|

1,872 |

|

|

| |

Total other

assets |

|

61,727 |

|

|

37,735 |

|

|

| |

Total

Assets |

$ |

315,275 |

|

$ |

355,517 |

|

|

| |

|

|

|

|

|

|

|

| |

Liabilities and Shareholders' Equity |

|

|

|

|

|

|

| |

Current Liabilities |

|

|

|

|

|

|

| |

Current

portion of lease liability |

$ |

3,357 |

|

$ |

3,737 |

|

|

| |

Current

maturities of long-term debt |

|

- |

|

|

2,112 |

|

|

| |

Accounts

payable |

|

6,720 |

|

|

8,891 |

|

|

| |

Accrued

compensation |

|

6,977 |

|

|

5,571 |

|

|

| |

Accrued

expenses |

|

4,378 |

|

|

2,404 |

|

|

| |

Factoring

liability |

|

2,920 |

|

|

6,289 |

|

|

| |

Total

current liabilities |

|

24,352 |

|

|

29,004 |

|

|

| |

|

|

|

|

|

|

|

| |

Other Liabilities |

|

|

|

|

|

|

| |

Long-term

debt, net of current maturities |

|

2,228 |

|

|

- |

|

|

| |

Long-term

portion of lease liability |

|

12,771 |

|

|

10,629 |

|

|

| |

Deferred tax

liability |

|

161 |

|

|

721 |

|

|

| |

Total

Liabilities |

|

39,512 |

|

|

40,354 |

|

|

| |

|

|

|

|

|

|

|

| |

Shareholders' Equity |

|

|

|

|

|

|

| |

Common

stock |

|

140 |

|

|

153 |

|

|

| |

Additional

paid-in capital |

|

159,582 |

|

|

188,218 |

|

|

| |

Accumulated

other comprehensive income (loss) |

|

1,079 |

|

|

(544 |

) |

|

| |

Retained

earnings |

|

114,962 |

|

|

127,336 |

|

|

| |

Total

Shareholders' Equity |

|

275,763 |

|

|

315,163 |

|

|

| |

Total

Liabilities and Shareholders' Equity |

$ |

315,275 |

|

$ |

355,517 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CLEARFIELD, INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

|

|

|

|

|

|

|

|

|

|

(IN THOUSANDS, EXCEPT SHARE DATA) |

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Year Ended |

|

|

|

September 30, |

|

September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

$ |

46,772 |

|

|

$ |

49,685 |

|

|

$ |

166,705 |

|

|

$ |

268,720 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

36,104 |

|

|

|

37,692 |

|

|

|

137,816 |

|

|

|

183,441 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

10,668 |

|

|

|

11,993 |

|

|

|

28,889 |

|

|

|

85,279 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and |

|

|

|

|

|

|

|

|

|

|

|

|

|

administrative |

|

13,681 |

|

|

|

10,277 |

|

|

|

52,111 |

|

|

|

47,992 |

|

|

|

(Loss) Income from operations |

|

(3,013 |

) |

|

|

1,716 |

|

|

|

(23,222 |

) |

|

|

37,287 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income |

|

1,819 |

|

|

|

1,878 |

|

|

|

7,472 |

|

|

|

5,206 |

|

|

|

Interest expense |

|

(124 |

) |

|

|

(330 |

) |

|

|

(506 |

) |

|

|

(881 |

) |

|

|

(Loss) Income before income taxes |

|

(1,318 |

) |

|

|

3,264 |

|

|

|

(16,256 |

) |

|

|

41,612 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax (benefit) expense |

|

(492 |

) |

|

|

568 |

|

|

|

(3,803 |

) |

|

|

9,079 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

$ |

(827 |

) |

|

$ |

2,696 |

|

|

$ |

(12,453 |

) |

|

$ |

32,533 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.06 |

) |

|

$ |

0.16 |

|

|

$ |

(0.85 |

) |

|

$ |

2.17 |

|

|

|

Diluted |

$ |

(0.06 |

) |

|

$ |

0.17 |

|

|

$ |

(0.85 |

) |

|

$ |

2.17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

14,234,506 |

|

|

|

15,258,782 |

|

|

|

14,582,450 |

|

|

|

14,975,972 |

|

|

|

Diluted |

|

14,234,506 |

|

|

|

15,258,782 |

|

|

|

14,582,450 |

|

|

|

15,012,527 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clearfield, Inc. |

|

|

|

|

|

|

|

|

Consolidated Statement of Cashflows |

|

|

|

|

|

|

|

|

(In Thousands) |

|

|

|

|

|

|

|

| |

|

|

|

|

Year Ended |

|

|

Year Ended |

| |

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

| |

Cash flows from operating activities |

|

|

|

|

|

|

|

| |

Net (loss) income |

|

|

$ |

(12,453 |

) |

|

$ |

32,533 |

|

| |

Adjustments to reconcile net income to cash provided by operating

activities: |

|

|

|

|

|

|

|

| |

Depreciation and amortization |

|

|

|

7,411 |

|

|

|

6,054 |

|

| |

Amortization of discount on investments |

|

|

|

(4,406 |

) |

|

|

(3,512 |

) |

| |

Deferred income taxes |

|

|

|

(4,078 |

) |

|

|

(2,114 |

) |

| |

Stock-based compensation expense |

|

|

|

4,641 |

|

|

|

3,578 |

|

| |

Changes in operating assets and liabilities |

|

|

|

|

|

|

|

| |

Accounts receivable |

|

|

|

7,799 |

|

|

|

26,277 |

|

| |

Inventories, net |

|

|

|

31,990 |

|

|

|

(15,083 |

) |

| |

Other assets |

|

|

|

(9,225 |

) |

|

|

(1,466 |

) |

| |

Accounts payable and accrued expenses |

|

|

|

544 |

|

|

|

(27,843 |

) |

| |

Net cash provided by operating activities |

|

|

|

22,223 |

|

|

|

18,424 |

|

| |

|

|

|

|

|

|

|

|

| |

Cash flows from investing activities: |

|

|

|

|

|

|

|

| |

Purchases of property, plant and equipment and intangible

assets |

|

|

|

(9,567 |

) |

|

|

(8,384 |

) |

| |

Purchase of investments |

|

|

|

(159,393 |

) |

|

|

(210,923 |

) |

| |

Proceeds from sales and maturities of investments |

|

|

|

162,064 |

|

|

|

107,060 |

|

| |

Net cash used in investing activities |

|

|

|

(6,896 |

) |

|

|

(112,247 |

) |

| |

|

|

|

|

|

|

|

|

| |

Cash flows from financing activities: |

|

|

|

|

|

|

|

| |

Issuance of long-term debt |

|

|

|

2,171 |

|

|

|

- |

|

| |

Repayment of long-term debt |

|

|

|

(2,171 |

) |

|

|

(16,700 |

) |

| |

Proceeds from issuance of common stock under employee stock

purchase plan |

|

|

|

586 |

|

|

|

611 |

|

| |

Repurchase of shares for payment of withholding taxes for vested

restricted stock grants |

|

|

|

(493 |

) |

|

|

(1,220 |

) |

| |

Tax withholding and proceeds related to exercise of stock

options |

|

|

|

(9 |

) |

|

|

(491 |

) |

| |

Issuance of stock under equity compensation plans |

|

|

|

1 |

|

|

|

954 |

|

| |

Net borrowings and repayments of factoring liability |

|

|

|

(3,617 |

) |

|

|

1,586 |

|

| |

Net proceeds from issuance of common stock |

|

|

|

- |

|

|

|

130,262 |

|

| |

Repurchase of common stock |

|

|

|

(33,374 |

) |

|

|

- |

|

| |

Net cash (used in) provided by financing activities |

|

|

|

(36,906 |

) |

|

|

115,002 |

|

| |

|

|

|

|

|

|

|

|

| |

Effect of exchange rates on cash |

|

|

|

(81 |

) |

|

|

(2 |

) |

| |

(Decrease) Increase in cash and cash equivalents |

|

|

|

(21,660 |

) |

|

|

21,177 |

|

| |

Cash and cash equivalents, beginning of period |

|

|

|

37,827 |

|

|

|

16,650 |

|

| |

Cash and cash equivalents, end of period |

|

|

$ |

16,167 |

|

|

$ |

37,827 |

|

| |

|

|

|

|

|

|

|

|

| |

Supplemental disclosures for cash flow information |

|

|

|

|

|

|

|

| |

Cash paid during the year for income taxes |

|

|

$ |

159 |

|

|

$ |

12,967 |

|

| |

Cash paid for interest |

|

|

$ |

394 |

|

|

$ |

463 |

|

| |

Right of use assets obtained through lease liabilities |

|

|

$ |

4,731 |

|

|

$ |

3,776 |

|

| |

|

|

|

|

|

|

|

|

| |

Non-cash financing activities |

|

|

|

|

|

|

|

| |

Cashless exercise of stock options |

|

|

$ |

19 |

|

|

$ |

566 |

|

| |

|

|

|

|

|

|

|

|

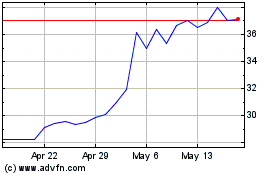

Clearfield (NASDAQ:CLFD)

Historical Stock Chart

From Oct 2024 to Nov 2024

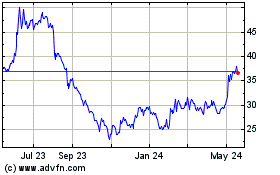

Clearfield (NASDAQ:CLFD)

Historical Stock Chart

From Nov 2023 to Nov 2024