Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

September 23 2024 - 4:08PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement Number 333-266390

September 23, 2024

COMCAST CORPORATION

€900,000,000 3.250% Euro Notes due 2032 (the “2032 Euro Notes”)

€900,000,000 3.550% Euro Notes due 2036 (the “2036 Euro Notes”)

£750,000,000 5.250% Sterling Notes due 2040 (the “Sterling Notes”)

The 2032 Euro Notes and 2036 Euro Notes are herein referred to as the “Euro Notes.” The Euro Notes and Sterling Notes are herein

referred to as the “Notes.”

Final Term Sheet

|

|

|

| Issuer: |

|

Comcast Corporation (the “Company”) |

|

|

| Guarantors: |

|

Comcast Cable Communications, LLC and NBCUniversal Media, LLC |

|

|

| Issue of Securities: |

|

3.250% Euro Notes due 2032 3.550% Euro Notes

due 2036 5.250% Sterling Notes due 2040 |

|

|

| Denominations: |

|

The Euro Notes will be issued in minimum denominations of €100,000 and integral multiples of €1,000 in excess thereof

The Sterling Notes will be issued in minimum denominations of £100,000 and

integral multiples of £1,000 in excess thereof |

|

|

| Use of Proceeds: |

|

We intend to use the net proceeds from this offering, after deducting underwriters’ discount and expenses, for working capital and general corporate purposes, including the redemption in full of our outstanding 5.250% Notes due

November 7, 2025 and the repayment of certain of our other debt with near-term maturities. We have delivered a notice of redemption in respect of the 5.250% Notes due November 7, 2025 on the date hereof. |

|

|

| Indenture: |

|

Indenture dated as of September 18, 2013 by and among the Company, the guarantors named therein and The Bank of New York Mellon, as trustee (the “Trustee”), as amended by the First Supplemental Indenture dated

as of November 17, 2015 by and among the Company, the guarantors named therein and the Trustee and as further amended by the Second Supplemental Indenture dated as of July 29, 2022 by and among the Company, the guarantors named therein and

the Trustee. |

1

|

|

|

|

|

| Optional Tax Redemption: |

|

Each series of Notes may be redeemed, at any time, by the Company, in whole, but not in part, at a redemption price equal to 100% of the aggregate principal amount of such Notes, together with accrued and unpaid interest on such

Notes being redeemed to, but not including, the date fixed for redemption, if as a result of any change in, or amendment to, the laws (or any regulations or rulings promulgated under the laws) of the United States (or any taxing authority in the

United States), or any change in, or amendment to, an official position regarding the application or interpretation of such laws, regulations or rulings, which change or amendment is announced or becomes effective on or after the date hereof, the

Company becomes or, based upon a written opinion of independent counsel selected by the Company, will become obligated to pay additional amounts as described in the Prospectus Supplement |

|

|

| Trustee: |

|

The Bank of New York Mellon |

|

|

| Paying Agent: |

|

The Bank of New York Mellon, London Branch |

|

|

| Expected Ratings:1 |

|

Moody’s: A3; S&P: A-; Fitch: A- |

|

|

| Joint Book-Running Managers: |

|

Barclays Bank PLC BNP Paribas

Goldman Sachs & Co. LLC Morgan Stanley & Co.

International plc |

|

|

| Co-Managers: |

|

Banco Santander, S.A. Deutsche Bank AG, London

Branch J.P. Morgan Securities plc Merrill Lynch

International Mizuho International plc PNC Capital Markets

LLC SMBC Nikko Capital Markets Limited Société

Générale The Toronto-Dominion Bank U.S. Bancorp

Investments, Inc. Wells Fargo Securities International Limited |

| 1 |

A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time. |

2

|

|

|

|

|

ICBC Standard Bank Plc Lloyds Securities

Inc. NatWest Markets Plc Scotiabank (Ireland) Designated

Activity Company Truist Securities, Inc. Academy Securities,

Inc. BNY Mellon Capital Markets, LLC Commerzbank

Aktiengesellschaft ING Bank N.V., Belgian Branch Intesa

Sanpaolo IMI Securities Corp. Loop Capital Markets LLC |

|

|

| Trade Date: |

|

September 23, 2024 |

|

|

| Settlement Date: |

|

September 26, 2024 (T+3) |

|

|

| Listing: |

|

The Company intends to list each series of Notes on the NASDAQ Global Market |

3

|

|

|

| 2032 Euro Notes |

|

|

|

|

| Aggregate Principal Amount: |

|

€900,000,000 |

|

|

| Maturity Date: |

|

September 26, 2032 |

|

|

| Interest Rate: |

|

3.250% per annum, accruing from September 26, 2024 |

|

|

| Interest Payment Dates: |

|

September 26 of each year, commencing September 26, 2025 |

|

|

| Benchmark Bund Rate: |

|

DBR 1.700% due 15 August 2032 |

|

|

| Benchmark Bund Price: |

|

97.560% |

|

|

| Spread to Benchmark Bund: |

|

125.5 bps |

|

|

| Mid-swap Rate: |

|

2.363% |

|

|

| Reoffer Spread to Mid-swap: |

|

+93 bps |

|

|

| Yield to Maturity: |

|

3.293% |

|

|

| Public Offering Price: |

|

99.702% plus accrued interest, if any, from September 26, 2024 |

|

|

| Underwriters’ Discount: |

|

0.350% |

|

|

| Net Proceeds to Comcast, Before Expenses: |

|

99.352% per €900,000,000 principal amount of 2032 Euro Notes; €894,168,000 total |

|

|

| Day Count Convention: |

|

Actual/Actual (ICMA) |

|

|

| Optional Redemption: |

|

Prior to June 26, 2032 (three (3) months prior to the maturity date of the 2032 Euro Notes) (the “2032 Euro Notes Par Call Date”), the Company may redeem the 2032 Euro Notes at its option, in whole or in part, at

any time and from time to time, at a redemption price (expressed as a percentage of the principal amount and rounded to three decimal places) equal to the greater of: (1) (a) the sum of the present values of the remaining scheduled payments of

principal and interest thereon discounted to the redemption date (assuming that the 2032 Euro Notes matured on the 2032 Euro Notes Par Call Date) on an annual basis (ACTUAL/ACTUAL (ICMA)) at

the |

4

|

|

|

|

|

applicable comparable government bond rate plus 20 basis points, less (b) interest accrued to the date of redemption, and (2) 100% of the principal amount of the 2032 Euro Notes to be redeemed, plus, in either case, accrued and

unpaid interest thereon to the redemption date. On or after the 2032 Euro Notes Par Call Date, the Company may redeem the 2032 Euro Notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal

amount of the 2032 Euro Notes being redeemed plus accrued and unpaid interest thereon to the redemption date. |

|

|

| Additional Issuances: |

|

An unlimited amount of additional 2032 Euro Notes may be issued. The 2032 Euro Notes and any additional 2032 Euro Notes that may be issued may be treated as a single series for all purposes under the Indenture |

|

|

| CUSIP / ISIN / Common Code: |

|

20030N EL1 / XS2909746310 / 290974631 |

5

|

|

|

| 2036 Euro Notes |

|

|

|

|

| Aggregate Principal Amount: |

|

€900,000,000 |

|

|

| Maturity Date: |

|

September 26, 2036 |

|

|

| Interest Rate: |

|

3.550% per annum, accruing from September 26, 2024 |

|

|

| Interest Payment Dates: |

|

September 26 of each year, commencing September 26, 2025 |

|

|

| Benchmark Bund Rate: |

|

DBR 0.000% due 15 May 2036 |

|

|

| Benchmark Bund Price: |

|

76.890% |

|

|

| Spread to Benchmark Bund: |

|

131.1 bps |

|

|

| Mid-swap Rate: |

|

2.465% |

|

|

| Reoffer Spread to Mid-swap: |

|

+113 bps |

|

|

| Yield to Maturity: |

|

3.595% |

|

|

| Public Offering Price: |

|

99.568% plus accrued interest, if any, from September 26, 2024 |

|

|

| Underwriters’ Discount: |

|

0.375% |

|

|

| Net Proceeds to Comcast, Before Expenses: |

|

99.193% per €900,000,000 principal amount of 2036 Euro Notes; €892,737,000 total |

|

|

| Day Count Convention: |

|

Actual/Actual (ICMA) |

|

|

| Optional Redemption: |

|

Prior to June 26, 2036 (three (3) months prior to the maturity date of the 2036 Euro Notes) (the “2036 Euro Notes Par Call Date”), the Company may redeem the 2036 Euro Notes at its option, in whole or in part, at

any time and from time to time, at a redemption price (expressed as a percentage of the principal amount and rounded to three decimal places) equal to the greater of: (1) (a) the sum of the present values of the remaining scheduled payments of

principal and interest thereon discounted to the redemption date (assuming that the 2036 Euro Notes matured on the 2036 Euro Notes Par Call Date) on an annual basis (ACTUAL/ACTUAL (ICMA)) at

the |

6

|

|

|

|

|

applicable comparable government bond rate plus 20 basis points, less (b) interest accrued to the date of redemption, and (2) 100% of the principal amount of the 2036 Euro Notes to be redeemed, plus, in either case, accrued and

unpaid interest thereon to the redemption date. On or after the 2036 Euro Notes Par Call Date, the Company may redeem the 2036 Euro Notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal

amount of the 2036 Euro Notes being redeemed plus accrued and unpaid interest thereon to the redemption date. |

|

|

| Additional Issuances: |

|

An unlimited amount of additional 2036 Euro Notes may be issued. The 2036 Euro Notes and any additional 2036 Euro Notes that may be issued may be treated as a single series for all purposes under the Indenture |

|

|

| CUSIP / ISIN / Common Code: |

|

20030N EM9 / XS2909746401 / 290974640 |

7

|

|

|

| Sterling Notes |

|

|

|

|

| Aggregate Principal Amount: |

|

£750,000,000 |

|

|

| Maturity Date: |

|

September 26, 2040 |

|

|

| Interest Rate: |

|

5.250% per annum, accruing from September 26, 2024 |

|

|

| Interest Payment Dates: |

|

September 26 of each year, commencing September 26, 2025 |

|

|

| Benchmark Gilt Rate: |

|

UKT 4.250% due 7 December 2040 |

|

|

| Benchmark Gilt Price: |

|

99.560% |

|

|

| Spread to Benchmark Gilt: |

|

+95 bps |

|

|

| Yield to Maturity: |

|

5.306% |

|

|

| Public Offering Price: |

|

99.411% plus accrued interest, if any, from September 26, 2024 |

|

|

| Underwriters’ Discount: |

|

0.495% |

|

|

| Net Proceeds to Comcast, Before Expenses: |

|

98.916% per £750,000,000 principal amount of Sterling Notes; £741,870,000 total |

|

|

| Day Count Convention: |

|

Actual/Actual (ICMA) |

|

|

| Optional Redemption: |

|

Prior to June 26, 2040 (three (3) months prior to the maturity date of the Sterling Notes) (the “Sterling Notes Par Call Date”), the Company may redeem the Sterling Notes at its option, in whole or in part, at

any time and from time to time, at a redemption price (expressed as a percentage of the principal amount and rounded to three decimal places) equal to the greater of: (1) (a) the sum of the present values of the remaining scheduled payments of

principal and interest thereon discounted to the redemption date (assuming that the Sterling Notes matured on the Sterling Notes Par Call Date) on an annual basis (ACTUAL/ACTUAL (ICMA)) at the applicable comparable government bond rate plus 15 basis

points, less (b) interest accrued to the date of redemption, and (2) 100% of the principal amount of the Sterling Notes to be redeemed, plus, in |

8

|

|

|

|

|

either case, accrued and unpaid interest thereon to the redemption date. On or after the Sterling Notes Par Call Date, the Company may redeem the Sterling Notes, in whole or in part, at any time and from time to time, at a

redemption price equal to 100% of the principal amount of the Sterling Notes being redeemed plus accrued and unpaid interest thereon to the redemption date. |

|

|

| Additional Issuances: |

|

An unlimited amount of additional Sterling Notes may be issued. The Sterling Notes and any additional Sterling Notes that may be issued may be treated as a single series for all purposes under the Indenture |

|

|

| CUSIP / ISIN / Common Code: |

|

20030N EN7 / XS2909746666 / 290974666 |

It is expected that delivery of the Notes will be made against payment therefor on or about September 26,

2024, which is the third business day following the date hereof (such settlement cycle being referred to as “T+3”). Under Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in

the secondary market generally are required to settle in one business day unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes prior to the business day preceding the settlement date

will be required, by virtue of the fact that the notes initially will settle in T+3, to specify an alternative settlement cycle at the time of any such trade to prevent failed settlement and should consult their own advisors.

The Notes will be represented by beneficial interests in fully registered permanent global notes without interest coupons attached, which will

be registered in the name of, and shall be deposited on or about September 26, 2024 with a common depositary for, and in respect of interests held through, Euroclear Bank, S.A./N.V., as operator of the Euroclear System (“Euroclear”),

and Clearstream Banking, société anonyme (“Clearstream”). Any Notes represented by global notes held by a nominee of Euroclear or Clearstream will be subject to the then applicable procedures of Euroclear and Clearstream, as

applicable. Euroclear and Clearstream’s current practice is to make payments in respect of global notes to participants of record that hold an interest in the relevant global notes at the close of business on the date that is the clearing

system business day (for these purposes, Monday to Friday inclusive except December 25th and January 1st) immediately preceding each applicable interest payment date.

This term sheet is not a prospectus for the purposes of Regulation (EU) 2017/1129, including the same as it forms part of domestic law in the

United Kingdom by virtue of the European Union (Withdrawal) Act 2018, as amended by the European Union (Withdrawal Agreement) Act 2020.

9

MiFID II and UK MiFIR – professionals/ECPs-only / No PRIIPs or UK PRIIPs KID –

Manufacturer target market (MiFID II and UK MiFIR product governance) is eligible counterparties and professional clients only (all distribution channels). No PRIIPs or UK PRIIPs key information document (KID) has been prepared as the notes are not

available to retail investors in the EEA or UK.

The communication of this term sheet and any other document or materials relating to the

issue of the notes is not being made, and such documents or materials have not been approved, by an authorized person for the purposes of Section 21 of the United Kingdom’s Financial Services and Markets Act 2000, as amended. Accordingly,

such documents and/or materials are not being distributed to, and must not be passed on to, the general public in the United Kingdom. This document and such other documents and/or materials are for distribution only to persons who (i) have

professional experience in matters relating to investments and who fall within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the

“Financial Promotion Order”)), (ii) fall within Article 49(2)(a) to (d) of the Financial Promotion Order, (iii) are outside the United Kingdom, or (iv) are other persons to whom it may otherwise lawfully be made under the

Financial Promotion Order (all such persons together being referred to as “relevant persons”). This document is directed only at relevant persons and must not be acted on or relied on by persons who are not relevant persons. Any investment

or investment activity to which this term sheet and any other document or materials relates will be engaged in only with relevant persons. Any person in the United Kingdom that is not a relevant person should not act or rely on this term sheet or

any of its contents.

Relevant stabilization regulations including FCA/ICMA will apply.

The issuer has filed a registration statement (including a prospectus and accompanying prospectus supplement) with the SEC for the offering to

which this communication relates. Before you invest, you should read the prospectus in that registration statement, the accompanying prospectus supplement and other documents the issuer has filed with the SEC for more complete information about the

issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and

the prospectus supplement if you request it by calling Barclays Bank PLC at 1-888-603-5847 or BNP Paribas at (800) 854-5674.

10

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Aug 2024 to Sep 2024

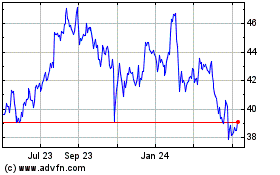

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Sep 2023 to Sep 2024