Fourth Quarter 2024 Highlights

- Incurred net loss of $265.5 million due primarily to a $224.7

million non-cash mark-to-market adjustment to warrants and other

contingent value right liabilities required by the significant

year-over-year increase in our share price

- Reported operating loss of $39.8 million, a decrease of $43.7

million over fourth quarter 2023

- Generated adjusted EBITDA of $13.3 million, a decrease of $43.4

million over fourth quarter 2023

- Secured $625 million through a convertible note offering with

favorable 0% interest terms

- Strengthened the balance sheet, ending the quarter with cash

and cash equivalents of $836.2 million as of December 31, 2024

- Earned 974 self-mined bitcoin with an average cash cost to

self-mine one bitcoin of $51,035

- Operated total hash rate of 20.1 EH/s, consisting of 19.1 EH/s

self-mining and 1.0 EH/s hosting

Core Scientific, Inc. (NASDAQ: CORZ), a leader in

digital infrastructure for bitcoin mining and HPC, today announced

financial results for the fiscal fourth quarter of 2024. Net loss

was $265.5 million, as compared to a net loss of $195.7 million for

the same period in 2023. Total revenue was $94.9 million, as

compared to $141.9 million for the same period last year. Operating

loss was $39.8 million, as compared to Operating income of $3.9

million for the same period in 2023. Adjusted EBITDA was $13.3

million, as compared to $56.7 million for the same period in the

prior year. Fourth quarter net loss of $265.5 million resulted

primarily from a net $224.7 million non-cash mark-to-market

adjustment in the value of our tranche 1 and tranche 2 warrants and

other contingent value rights required as a result of the

significant quarter-over-quarter increase in our share price.

"In the fourth quarter, Core Scientific continued to build on

what was a transformational year for our business," said Adam

Sullivan, Core Scientific’s Chief Executive Officer. "We

successfully executed our growth strategy across multiple fronts,

achieving significant milestones in both our HPC and Bitcoin mining

operations. Our infrastructure expansion efforts were particularly

strong - through strategic site acquisitions and existing site

expansions, we increased our total portfolio capacity to 1,300 MW

of powered infrastructure by year-end. Additionally, we

strengthened our financial foundation through an upsized $625

million senior convertible note offering, demonstrating the

market's confidence in our vision and providing us with the capital

to accelerate our growth initiatives."

"Looking ahead in 2025, we are executing on a clear strategy for

accelerated growth, driven by unprecedented demand for HPC

infrastructure and the continued strength of our Bitcoin mining

operations. With our expanded infrastructure capacity,

industry-leading operational expertise, and commitment to

technological innovation, Core Scientific is uniquely positioned to

capture the growing opportunities in AI computing and digital asset

mining. We remain focused on delivering value to our shareholders

and reinforcing our position as an industry leader in scalable,

high-density computing solutions."

Fiscal Fourth Quarter 2024 Financial Results (Compared to

Fiscal Fourth Quarter 2023)

Total revenue for the fiscal fourth quarter of 2024 was $94.9

million, consisting of $79.9 million in Digital asset self-mining

revenue, $6.5 million in digital asset hosted mining revenue and

$8.5 million in HPC hosting revenue.

Digital asset self-mining gross profit for the fiscal fourth

quarter of 2024 was $1.7 million (2% gross margin), compared to

$32.6 million (29% gross margin) for the same period in the prior

year, a decrease of $30.9 million. The decrease in Digital asset

self-mining gross profit was primarily driven by a $32.3 million

decrease in self-mining revenue, the result of a 68% decrease in

bitcoin mined due to the halving and the operational shift to HPC

hosting, partially offset by a 130% increase in the average price

of bitcoin.

Digital asset hosted mining gross profit for the fiscal fourth

quarter of 2024 was $2.3 million (36% gross margin), as compared to

$6.7 million (23% gross margin) for the same period in the prior

year. The decrease in Digital asset hosted mining gross profit was

primarily due to a $23.3 million decrease in hosted mining revenue

driven by the termination of contracts with several customers since

2023 in support of our shift to HPC hosting, partially offset by a

82% decrease in power costs due to lower rates and usage.

HPC hosting gross profit for the fiscal fourth quarter of 2024

was $0.7 million (9% gross margin). HPC hosting revenue includes a

base license fee as well as the direct pass-through of power costs

to our client, with no margin added. HPC hosting costs at our

Austin, Texas data center consist primarily of lease expense, the

direct pass-through of power costs, and direct and indirect

facilities operations expenses, including personnel and benefit

costs and stock-based compensation. The non-GAAP gross margin for

the fiscal fourth quarter of 2024, which excludes the direct

pass-through of power costs, was 13%.

Operating expenses for the fiscal fourth quarter of 2024 totaled

$43.6 million, as compared to $30.0 million for the same period in

the prior year. The increase of $13.6 million was primarily

attributable to a $5.7 million increase in stock-based

compensation, a $5.0 million increase in personnel and related

expenses due to increased employee headcount to support our

transition to HPC operations, and $2.7 million in post-emergence

bankruptcy advisor fees. During fiscal 2023, pre-emergence

bankruptcy advisor fees were included in Reorganization items,

net.

Net loss for the fiscal fourth quarter of 2024 was $265.5

million, as compared to a net loss of $195.7 million for the same

period in the prior year. Net loss for the fiscal fourth quarter of

2024 increased by $69.8 million driven primarily by a net $224.7

million mark-to-market adjustment on our warrants and other

contingent value rights comprising a $227.4 million increase in the

fair value of warrant liabilities, partially offset by a $2.7

million decrease in fair value of contingent value rights. These

mark-to-market adjustments were driven by the increase in our stock

price during the period. Also contributing to the increase in net

loss was a $47.0 million decrease in total revenue. These increases

to net loss were partially offset by a decrease of $112.9 million

in Reorganization items, net with no comparable activity for the

same period in fiscal 2024 due the Company’s emergence from

bankruptcy during the first quarter 2024 and a $82.8 million

decrease in Interest expense, net due primarily to the one-time

recognition of interest expense in the fourth quarter of 2023 for

amounts not previously recorded due to our bankruptcy proceedings,

in anticipation of our emergence from bankruptcy and our improved

capital structure throughout 2024.

Non-GAAP Adjusted EBITDA for the fiscal fourth quarter 2024 was

$13.3 million, as compared to Non-GAAP Adjusted EBITDA of $56.7

million for the same period in the prior year. This $43.4 million

decrease was driven by a $47.0 million decrease in total revenue, a

$2.4 million increase in HPC site startup costs, a $2.7 million

increase in cash operating expenses, a $1.5 million decrease in

gain from sales of digital assets, and a $0.8 million decrease in

the change in fair value of digital assets, partially offset by a

$7.9 million decrease in cash cost of revenue, a $1.7 million

decrease in realized losses on energy derivatives and a $1.5

million decrease in impairment of digital assets.

Full Fiscal Year Financial and Operational

Achievements

- Total revenue of $510.7 million, a increase of $8.3 million

compared to 2023

- Operating loss of $19.2 million, a decrease of $28.2 million

over 2023

- Net loss of $1.3 billion, a decrease of $1.1 billion over 2023,

due primarily to a $1.4 billion non-cash mark-to-market adjustment

to warrants and other contingent value right liabilities required

by the significant year-over-year increase in our share price

- Adjusted EBITDA of $157.4 million, a decrease of $12.1 million

over 2023

- Average actual self-mining fleet energy efficiency of 25.1

joules per terahash

Fiscal Year 2024 Financial Results (Compared to Fiscal Year

2023)

Total revenue for the year ended December 31, 2024 was $510.7

million, consisting of $408.7 million in digital asset self-mining

revenue, $77.6 million in digital asset hosted mining revenue and

$24.4 million in HPC hosting revenue.

Digital asset self-mining gross profit for the year ended

December 31, 2024 was $94.4 million (23% gross margin), as compared

to $98.6 million (25% gross margin) for the same period in the

prior year, a decrease of $4.2 million. The decrease in Digital

asset self-mining gross profit was primarily driven by an 8%

increase in cost of revenue due primarily to a $19.9 million

increase in depreciation expense which was driven primarily by new

generation miners placed in service during the current year, and a

$9.3 million increase in employee compensation due to increases in

bonuses and salaries driven primarily by an increase in employee

headcount. The negative impact of the increase in Digital asset

self-mining cost of revenue was partially offset by a 5% increase

in mining revenue driven by a 128% increase in the average price of

bitcoin, a 13% increase in our self-mining hash rate, driven by our

fleet mix and efficiency, and an increase in the number of mining

units deployed, partially offset by a 52% decrease in bitcoin mined

due to the halving and the conversion to HPC hosting.

Digital asset hosted mining gross profit for the year ended

December 31, 2024 was $24.0 million (31% gross margin), as compared

to $24.8 million (22% gross margin) for the same period in the

prior year, a decrease of $0.8 million. The decrease in Digital

asset hosted mining gross profit was primarily due to a $34.5

million decrease in Digital asset hosted mining revenue due to the

termination of contracts with several customers since 2023, as we

convert to HPC hosting. The decrease in Digital asset hosted mining

revenue was partially offset by a $33.7 million decrease in Digital

asset hosted mining cost of revenue primarily driven by lower power

costs from lower rates and usage.

HPC hosting gross profit for the year ended December 31, 2024

was $2.7 million (11% gross margin). The non-GAAP gross margin for

the year ended December 31, 2024, was 15%, which excludes the

direct pass-through of power costs.

Operating expenses for the year ended December 31, 2024 totaled

$132.2 million, compared to $108.1 million for the same period in

the prior year. The increase of $24.1 million was primarily

attributable to a $21.9 million increase in personnel and related

expenses due to increased employee headcount to support our

transition to HPC operations, a $5.1 million increase in

professional services, $4.8 million of post-emergence bankruptcy

advisory fees and a $2.0 million increase in advertising and

marketing, partially offset by lower stock-based compensation of

$9.9 million due to cancellations and forfeitures of equity-based

awards. During fiscal 2023, pre-emergence bankruptcy advisor fees

were included in Reorganization items, net.

Net loss for the year ended December 31, 2024 was $1.3 billion,

as compared to a net loss of $246.5 million for the same period in

the prior year. Net loss for the year ended December 31, 2024

increased by $1.1 billion driven primarily by a net $1.4 billion

mark-to-market adjustment on our warrants and other contingent

value rights comprising a $1.5 billion increase in the fair value

of warrant liabilities, partially offset by a $82.1 million

decrease in fair value of contingent value rights. These non-cash

mark-to-market adjustments were driven by the increase in our stock

price during the period. Also contributing to the increase in net

loss was a $20.6 million decrease in gain on extinguishment of debt

compared to the same period in the prior year, partially offset by

a decrease of $302.6 million in Reorganization items, net, which

included gains on extinguishment of pre-emergence obligations of

$238.4 million, and a $49.2 million decrease in Interest expense,

due to lower average debt balances during the year.

Non-GAAP Adjusted EBITDA for the year ended December 31, 2024

was $157.4 million, as compared to Non-GAAP Adjusted EBITDA of

$169.5 million for the same period in the prior year. This $12.1

million decrease was driven by a $20.0 million increase in cash

operating expenses, a $4.1 million increase in HPC site startup

costs, a $3.9 million decrease in gain from sales of digital

assets, a $3.4 million increase in realized losses on energy

derivatives, and a $1.1 million decrease in change in fair value of

digital assets, partially offset by a $8.3 million increase in

total revenue, a $7.6 million decrease in cash cost of revenue, and

a $4.4 million decrease in impairment of digital assets.

CONFERENCE CALL AND LIVE WEBCAST

In conjunction with this release, Core Scientific, Inc. will

host a conference call today, Wednesday, February 26, 2025, at 4:30

pm Eastern Time that will be webcast live. Adam Sullivan, Chief

Executive Officer, Denise Sterling, Chief Financial Officer and Jon

Charbonneau, Vice President Investor Relations, will host the

call.

Investors may dial into the call by using the following

telephone numbers: +1 (877) 407-1875 (U.S. toll free) or +1 (215)

268-9909 (U.S. local) five to ten minutes prior to the start time

to allow for registration.

Investors with Internet access may listen to the live audio

webcast via the Investor Relations page of the Core Scientific,

Inc. website, http://investors.corescientific.com or by using the

following link

https://event.choruscall.com/mediaframe/webcast.html?webcastid=ymDjLEm1.

Please allow 10 minutes prior to the call to download and install

any necessary audio software. A replay of the audio webcast will be

available for one year.

A supplementary investor presentation for the fiscal fourth

quarter 2024 may be accessed at

https://investors.corescientific.com/investors/events-and-presentations/default.aspx.

AUDIO REPLAY

An audio replay of the event will be archived on the Investor

Relations section of the Company's website at

http://investors.corescientific.com and via telephone by dialing +1

(877) 660-6853 (U.S. toll free) or +1 (201) 612-7415 (U.S. local)

and entering Access Code 13749193.

ABOUT CORE SCIENTIFIC

Core Scientific, Inc. (“Core Scientific” or the “Company”) is a

leader in digital infrastructure for bitcoin mining and

high-performance computing. We operate dedicated, purpose-built

facilities for digital asset mining and are a premier provider of

digital infrastructure, software solutions and services to our

third-party customers. We employ our own large fleet of computers

(“miners”) to earn digital assets for our own account and to

provide hosting services for large bitcoin mining customers and we

are in the process of allocating and converting a significant

portion of our ten facilities in Alabama (1), Georgia (2), Kentucky

(1), North Carolina (1), North Dakota (1), Oklahoma (1) and Texas

(3) to support artificial intelligence-related workloads under a

series of contracts that entail the modification of certain of our

data centers to deliver hosting services for high-performance

computing (“HPC”). We derive the majority of our revenue from

earning bitcoin for our own account (“self-mining”). To learn more,

visit www.corescientific.com.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including but not limited

to, statements regarding projections, estimates and forecasts of

revenue and other financial and performance metrics, projections of

market opportunity and expectations, the Company’s ability to

scale, grow its business and execute on its growth plans and

hosting contracts, source energy at reasonable rates, the

advantages, expected growth, and anticipated future revenue of the

Company, and the Company’s ability to source and retain talent. You

can identify forward-looking statements by the fact that they do

not relate strictly to historical or current facts. These

statements may include words such as “aim,” “estimate,” “plan,”

“project,” “forecast,” “goal,” “intend,” “will,” “expect,”

“anticipate,” “believe,” “seek,” “target” or other similar

expressions that predict or indicate future events or trends or

that are not statements of historical matters. All forward-looking

statements are subject to risks and uncertainties that may cause

actual results to differ materially, including: our ability to earn

digital assets profitably and to attract customers for our digital

asset and high performance compute hosting capabilities; our

ability to perform under our existing colocation agreements, our

ability to maintain our competitive position in our existing

operating segments, the impact of increases in total network hash

rate; our ability to raise additional capital to continue our

expansion efforts or other operations; our need for significant

electric power and the limited availability of power resources; the

potential failure in our critical systems, facilities or services

we provide; the physical risks and regulatory changes relating to

climate change; potential significant changes to the method of

validating blockchain transactions; our vulnerability to physical

security breaches, which could disrupt our operations; a potential

slowdown in market and economic conditions, particularly those

impacting high performance computing, the blockchain industry and

the blockchain hosting market; the identification of material

weaknesses in our internal control over financial reporting; price

volatility of digital assets and bitcoin in particular; potential

changes in the interpretive positions of the SEC or its staff with

respect to digital asset mining firms; the increasing likelihood

that U.S. federal and state legislatures and regulatory agencies

will enact laws and regulations to regulate digital assets and

digital asset intermediaries; increasing scrutiny and changing

expectations with respect to ESG policies; the effectiveness of our

compliance and risk management methods; the adequacy of our sources

of recovery if the digital assets held by us are lost, stolen or

destroyed due to third-party digital asset services; the effects of

our emergence from bankruptcy and our substantial level of

indebtedness and our current liquidity constraints affecting our

financial condition and ability to service our indebtedness. Any

such forward-looking statements represent management’s estimates

and beliefs as of the date of this press release. While we may

elect to update such forward-looking statements at some point in

the future, we disclaim any obligation to do so, even if subsequent

events cause our views to change.

Although the Company believes that in making such

forward-looking statements its expectations are based upon

reasonable assumptions, such statements may be influenced by

factors that could cause actual outcomes and results to be

materially different from those projected. The Company cannot

assure you that the assumptions upon which these statements are

based will prove to have been correct. Additional important factors

that may affect the Company’s business, results of operations and

financial position are described from time to time in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2024,

Quarterly Reports on Form 10-Q and the Company’s other filings with

the Securities and Exchange Commission. The Company does not

undertake any obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise, except as may be required by applicable law.

Core Scientific, Inc.

Consolidated Balance

Sheets

(in thousands, except par

value)

(Unaudited)

December 31,

2024

December 31,

2023

Assets

Current Assets:

Cash and cash equivalents

$

836,197

$

50,409

Restricted cash

783

19,300

Accounts receivable

1,025

1,001

Digital assets

23,893

2,284

Prepaid expenses and other current

assets

42,064

24,022

Total Current Assets

903,962

97,016

Property, plant and equipment, net

556,342

585,431

Operating lease right-of-use assets

114,472

7,844

Other noncurrent assets

24,039

21,865

Total Assets

$

1,598,815

$

712,156

Liabilities and Stockholders’

Deficit

Current Liabilities:

Accounts payable

$

19,265

$

154,751

Accrued expenses and other current

liabilities

69,230

179,636

Deferred revenue

18,134

9,830

Operating lease liabilities, current

portion

9,974

77

Finance lease liabilities, current

portion

1,669

19,771

Notes payable, current portion

16,290

124,358

Total Current Liabilities

134,562

488,423

Operating lease liabilities, net of

current portion

97,843

1,512

Finance lease liabilities, net of current

portion

3

35,745

Convertible and other notes payable, net

of current portion

1,073,990

684,082

Contingent value rights, net of current

portion

4,272

—

Warrant liabilities

1,097,285

—

Other noncurrent liabilities

11,040

—

Total liabilities not subject to

compromise

2,418,995

1,209,762

Liabilities subject to compromise

—

99,335

Total Liabilities

2,418,995

1,309,097

Commitments and contingencies

Stockholders’ Deficit:

Preferred stock; $0.00001 par value;

2,000,000 and nil shares authorized at December 31, 2024 and

December 31, 2023, respectively; none issued and outstanding at

December 31, 2024 and December 31, 2023

—

—

Common stock; $0.00001 and $0.0001 par

value at December 31, 2024 and December 31, 2023, respectively;

10,000,000 shares authorized at December 31, 2024 and December 31,

2023; 292,606 and 386,883 shares issued and outstanding at December

31, 2024 and December 31, 2023, respectively

3

36

Additional paid-in capital

2,915,035

1,823,260

Accumulated deficit

(3,735,218

)

(2,420,237

)

Total Stockholders’ Deficit

(820,180

)

(596,941

)

Total Liabilities and Stockholders’

Deficit

$

1,598,815

$

712,156

Core Scientific, Inc.

Consolidated Statements of

Operations

(in thousands, except per

share amounts)

(Unaudited)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Revenue:

Digital asset self-mining revenue

$

79,900

$

112,169

$

408,740

$

390,333

Digital asset hosted mining revenue from

customers

6,504

29,760

77,554

102,005

Digital asset hosted mining revenue from

related parties

—

—

—

10,062

HPC hosting revenue

8,521

—

24,378

—

Total revenue

94,925

141,929

510,672

502,400

Cost of revenue:

Cost of digital asset self-mining

78,215

79,571

314,335

291,696

Cost of digital asset hosted mining

services

4,170

23,058

53,558

87,245

Cost of HPC hosting services

7,777

—

21,709

—

Total cost of revenue

90,162

102,629

389,602

378,941

Gross profit

4,763

39,300

121,070

123,459

Change in fair value of digital assets

(805

)

—

(1,052

)

—

Gain from sale of digital assets

—

1,535

—

3,893

Impairment of digital assets

—

(1,542

)

—

(4,406

)

Change in fair value of energy

derivatives

—

(3,918

)

(2,757

)

(3,918

)

Losses on exchange or disposal of

property, plant and equipment

(149

)

(1,442

)

(4,210

)

(1,956

)

Operating expenses:

Research and development

5,016

1,876

11,830

7,184

Sales and marketing

2,870

3,886

9,969

7,019

General and administrative

35,706

24,237

110,448

93,908

Total operating expenses

43,592

29,999

132,247

108,111

Operating (loss) income

(39,783

)

3,934

(19,196

)

8,961

Non-operating expenses (income), net:

Loss (gain) on debt extinguishment

—

1,070

487

(20,065

)

Interest expense, net

1,136

83,921

37,070

86,238

Reorganization items, net

—

112,852

(111,439

)

191,122

Change in fair value of warrants and

contingent value rights

224,716

—

1,369,157

—

Other non-operating (income) expense,

net

(469

)

1,448

(325

)

(2,530

)

Total non-operating expenses, net

225,383

199,291

1,294,950

254,765

Loss before income taxes

(265,166

)

(195,357

)

(1,314,146

)

(245,804

)

Income tax expense

375

336

859

683

Net loss

$

(265,541

)

$

(195,693

)

$

(1,315,005

)

$

(246,487

)

Net loss per share, basic and diluted

$

(0.60

)

$

(0.51

)

$

(4.39

)

$

(0.65

)

Weighted average shares outstanding, basic

and diluted

306,146

385,074

255,832

379,863

Core Scientific, Inc.

Segment Results

(in thousands, except

percentages)

(Unaudited)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Digital Asset Self-Mining

Segment

(in thousands, except

percentages)

Digital asset self-mining revenue

$

79,900

$

112,169

$

408,740

$

390,333

Cost of digital asset self-mining:

Power fees

37,249

42,810

160,833

165,848

Depreciation expense

25,432

27,746

108,499

88,628

Employee compensation

10,417

4,419

26,129

16,853

Facility operations expense

3,580

3,359

13,274

14,055

Other segment items

1,537

1,237

5,600

6,312

Total cost of digital asset

self-mining

78,215

79,571

314,335

291,696

Digital Asset Self-Mining gross profit

$

1,685

$

32,598

$

94,405

$

98,637

Digital Asset Self-Mining gross margin

2

%

29

%

23

%

25

%

Digital Asset Hosted Mining

Segment

Digital asset hosted mining revenue from

customers

$

6,504

$

29,760

$

77,554

$

112,067

Cost of digital asset hosted mining

services:

Power fees

2,738

14,834

35,408

62,366

Depreciation expense

359

3,195

3,604

6,806

Employee compensation

689

1,531

4,933

6,337

Facility operations expense

266

1,164

2,765

5,285

Other segment items

118

2,334

6,848

6,451

Total cost of digital asset hosted mining

services

4,170

23,058

53,558

87,245

Digital Asset Hosted Mining gross

profit

$

2,334

$

6,702

$

23,996

$

24,822

Digital Asset Hosted Mining gross

margin

36

%

23

%

31

%

22

%

HPC Hosting Segment

HPC hosting revenue:

License fees

$

5,873

$

—

$

17,498

$

—

Maintenance and other

(9

)

—

73

—

Licensing revenue

5,864

—

17,571

—

Power fees passed through to customer

2,657

—

6,807

—

Total HPC hosting revenue

8,521

—

24,378

—

Cost of HPC hosting services:

Depreciation expense

3

—

3

—

Employee compensation

1,037

—

2,514

—

Facility operations expense

3,943

—

11,907

—

Other segment items

137

—

478

—

Cost of licensing revenue

5,120

—

14,902

—

Power fees passed through to customer

2,657

—

6,807

—

Total cost of HPC hosting services

7,777

—

21,709

—

HPC Hosting gross profit

$

744

$

—

$

2,669

$

—

HPC Hosting licensing gross margin

13

%

—

%

15

%

—

%

HPC Hosting gross margin

9

%

—

%

11

%

—

%

Consolidated

Consolidated total revenue

$

94,925

$

141,929

$

510,672

$

502,400

Consolidated cost of revenue

$

90,162

$

102,629

$

389,602

$

378,941

Consolidated gross profit

$

4,763

$

39,300

$

121,070

$

123,459

Consolidated gross margin

5

%

28

%

24

%

25

%

Core Scientific, Inc. Non-GAAP

Financial Measures (Unaudited)

Adjusted EBITDA is a non-GAAP financial measure defined as our

net loss, adjusted to eliminate the effect of (i) interest income,

interest expense, and other income (expense), net; (ii) provision

for income taxes; (iii) depreciation and amortization; (iv)

stock-based compensation expense; (v) Reorganization items, net;

(vi) unrealized fair value adjustment on energy derivatives; (vii)

change in the fair value of warrant and contingent value rights,

(viii) HPC organizational startup costs which are not reflective of

the ongoing costs incurred after startup, (ix) post-emergence

bankruptcy advisory costs incurred related to reorganization which

are not reflective of the ongoing costs incurred in post-emergence

operations, and (x) certain additional non-cash items that do not

reflect the performance of our ongoing business operations. For

additional information, including the reconciliation of net income

(loss) to Adjusted EBITDA, please refer to the table below. We

believe Adjusted EBITDA is an important measure because it allows

management, investors, and our Board of Directors to evaluate and

compare our operating results, including our return on capital and

operating efficiencies, from period-to-period by making the

adjustments described above. In addition, it provides useful

information to investors and others in understanding and evaluating

our results of operations, as well as provides a useful measure for

period-to-period comparisons of our business, as it removes the

effect of net interest expense, taxes, certain non-cash items,

variable charges and timing differences. Moreover, we have included

Adjusted EBITDA in this earnings release because it is a key

measurement used by our management internally to make operating

decisions, including those related to operating expenses, evaluate

performance, and perform strategic and financial planning.

The above items are excluded from our Adjusted EBITDA measure

because these items are non-cash in nature or because the amount

and timing of these items are not related to the current results of

our core business operations which renders evaluation of our

current performance, comparisons of performance between periods and

comparisons of our current performance with our competitors less

meaningful. However, you should be aware that when evaluating

Adjusted EBITDA, we may incur future expenses similar to those

excluded when calculating this measure. Our presentation of this

measure should not be construed as an inference that its future

results will be unaffected by unusual items. Further, this non-GAAP

financial measure should not be considered in isolation from, or as

a substitute for, financial information prepared in accordance with

accounting principles generally accepted in the United States

(“GAAP”). We compensate for these limitations by relying primarily

on GAAP results and using Adjusted EBITDA on a supplemental basis.

Our computation of Adjusted EBITDA may not be comparable to other

similarly titled measures computed by other companies because not

all companies calculate this measure in the same fashion. You

should review the reconciliation of net loss to Adjusted EBITDA

below and not rely on any single financial measure to evaluate our

business.

The following table reconciles the non-GAAP financial measure to

the most directly comparable U.S. GAAP financial performance

measure, which is net loss, for the periods presented (in

thousands):

Three Months Ended December

31,

Year Ended December

31,

2024

20231

2024

20231

Adjusted EBITDA

Net loss

$

(265,541

)

$

(195,693

)

$

(1,315,005

)

$

(246,487

)

Adjustments:

Interest expense, net

1,136

83,921

37,070

86,238

Income tax expense

375

336

859

683

Depreciation and amortization

26,041

31,203

113,205

96,003

Stock-based compensation expense

24,202

17,478

51,924

58,892

Unrealized fair value adjustment on energy

derivatives

—

2,262

(2,262

)

2,262

Losses on exchange or disposal of

property, plant and equipment

149

1,442

4,210

1,956

HPC organizational startup costs

—

—

4,611

—

Post-emergence bankruptcy advisory

costs

2,662

—

4,822

—

Loss (gain) on debt extinguishment

—

1,070

487

(20,065

)

Reorganization items, net

—

112,852

(111,439

)

191,122

Change in fair value of warrants and

contingent value rights

224,716

—

1,369,157

—

Other non-operating expenses (income),

net

(469

)

1,448

(325

)

(2,530

)

Other

2

369

123

1,474

Adjusted EBITDA

$

13,273

$

56,688

$

157,437

$

169,548

1 Certain prior year amounts have

been omitted for consistency with the current year

presentation.

Please follow us on:

https://www.linkedin.com/company/corescientific/

https://twitter.com/core_scientific

https://www.youtube.com/@Core_Scientific

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226238202/en/

Investors: ir@corescientific.com

Media: press@corescientific.com

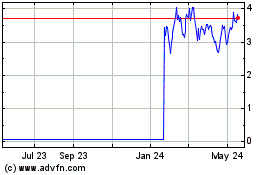

Core Scientific (NASDAQ:CORZ)

Historical Stock Chart

From Jan 2025 to Feb 2025

Core Scientific (NASDAQ:CORZ)

Historical Stock Chart

From Feb 2024 to Feb 2025