false

0000889609

0000889609

2025-02-25

2025-02-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

February 25, 2025

| |

CONSUMER PORTFOLIO SERVICES, INC. |

|

| |

(Exact Name of Registrant as Specified in Charter) |

|

| california |

|

1-11416 |

|

33-0459135 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

3800 Howard Hughes Pkwy, Suite 1400, Las Vegas, NV 89169 |

|

| |

(Address of Principal Executive Offices) (Zip Code) |

|

Registrant's telephone number, including area code

(949) 753-6800

| |

Not Applicable |

|

| |

(Former name or former address, if changed since last report) |

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, no par value |

CPSS |

The Nasdaq Stock Market LLC (Global Market) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 25, 2025, the registrant announced its earnings for the

three-month and twelve-month periods ended December 31, 2024. A copy of the announcement is attached as an exhibit to this report. As noted

in the announcement, the registrant will hold a conference call on Wednesday, February 26, 2025 at 01:00 p.m. ET to discuss its fourth

quarter 2024 operating results. Those wishing to participate can pre-register for the conference call at the following link https://register.vevent.com/register/BI34e818cf84a24e118241657af74dd2d4.

Registered participants will receive an email containing conference call details for dial-in options.

Item 9.01. Financial Statements and Exhibits.

Neither financial statements nor pro forma

financial information are filed with this report.

(d) Exhibits

One exhibit is included with this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CONSUMER PORTFOLIO SERVICES, INC. |

| |

|

| |

|

| Dated: February 26, 2025 |

By: /s/ Denesh Bharwani |

| |

Denesh Bharwani

Executive Vice President and Chief Financial Officer

Signing on behalf of the registrant |

Exhibit 99.1

|

NEWS RELEASE |

CPS ANNOUNCES

FOURTH QUARTER AND FULL YEAR 2024 EARNINGS

| § | Revenues of $105.3 million for the fourth quarter and $393.5 million for 2024 |

| § | Net income of $19.2 million, or $0.79 per diluted share for 2024 |

| § | Total portfolio balance of $3.491 billion, highest in company history |

| § | New contract purchases of $1.682 billion for the full year 2024 |

LAS VEGAS, NV, February 25, 2025 (GlobeNewswire)

-- Consumer Portfolio Services, Inc. (Nasdaq: CPSS) (“CPS” or the “Company”) today announced earnings of $5.1

million, or $0.21 per diluted share, for its fourth quarter ended December 31, 2024.

Revenues for the fourth quarter of 2024 were $105.3

million, an increase of $13.3 million, or 14.5%, compared to $92.0 million for the fourth quarter of 2023. Total operating expenses for

the fourth quarter of 2024 were $98.0 million compared to $82.1 million for the 2023 period. Pretax income for the fourth quarter of 2024

was $7.4 million compared to pretax income of $9.8 million in the fourth quarter of 2023.

For the twelve months ended December 31, 2024

total revenues were $393.5 million compared to $352.0 million for the twelve months ended December 31, 2023, an increase of approximately

$41.5 million, or 11.8%. Total operating expenses for the twelve months ended December 31, 2024 were $366.1 million, compared to $290.9

million for the twelve months ended December 30, 2023. Pretax income for the twelve months ended December 31, 2024 was $27.4 million,

compared to $61.1 million for the twelve months ended December 31, 2023. Net income for the twelve months ended December 31, 2024 was

$19.2 million compared to $45.3 million for the twelve months ended December 31, 2023.

During the fourth quarter of 2024, CPS purchased

$457.8 million of new contracts compared to $445.9 million during the third quarter of 2024 and $301.8 million during the fourth quarter

of 2023. The total number of contracts purchased for 2024 totaled $1.682 billion compared to $1.358 billion in 2023. The Company's receivables

totaled $3.491 billion as of December 31, 2024, an increase from $3.329 billion as of September 31, 2024 and an increase from $2.970 billion

as of December 31, 2023.

Annualized net charge-offs for the fourth quarter

of 2024 were 8.02% of the average portfolio as compared to 7.74% for the fourth quarter of 2023. Delinquencies greater than 30 days (including

repossession inventory) were 14.85% of the total portfolio as of December 31, 2024, compared to 14.55% as of December 31, 2023.

“New loan originations grew by 24% in 2024

over the prior year, leading to solid top line revenue growth” said Charles E. Bradley, Chief Executive Officer. “With positive

trends in loan originations and operating efficiencies, we remain optimistic in all aspects of our business going into 2025.”

Conference Call

CPS announced that it will hold a conference call

on February 26, 2025 at 1:00 p.m. ET to discuss its fourth quarter 2024 operating results.

Those wishing to participate can pre-register

for the conference call at the following link https://register.vevent.com/register/BI34e818cf84a24e118241657af74dd2d4.

Registered participants will receive an email containing conference call details for dial-in options. To avoid delays, we encourage participants

to dial into the conference call fifteen minutes ahead of the schedule start time. A replay will be available beginning two hours after

conclusion of the call for 12 months via the Company’s website at https://ir.consumerportfolio.com/investor-relations.

About Consumer Portfolio Services, Inc.

Consumer Portfolio Services, Inc. is an independent

specialty finance company that provides indirect

automobile financing to individuals with past credit problems or limited credit histories. We purchase retail installment sales contracts

primarily from franchised automobile dealerships secured by late model used vehicles and, to a lesser extent, new vehicles. We fund these

contract purchases on a long-term basis primarily through the securitization markets and service the contracts over their lives.

Forward-looking statements in this news release

include the Company's recorded figures representing allowances for remaining expected lifetime credit losses, its estimates of fair value

(most significantly for its receivables accounted for at fair value), its provision for credit losses, its entries offsetting the preceding,

and figures derived from any of the preceding. In each case, such figures are forward-looking statements because they are dependent on

the Company’s estimates of losses to be incurred in the future. The accuracy of such estimates may be adversely affected by various

factors, which include the following: possible increased delinquencies; repossessions and losses on retail installment contracts; incorrect

prepayment speed and/or discount rate assumptions; possible unavailability of qualified personnel, which could adversely affect the Company’s

ability to service its portfolio; possible increases in the rate of consumer bankruptcy filings, which could adversely affect the Company’s

rights to collect payments from its portfolio; other changes in government regulations affecting consumer credit; possible declines in

the market price for used vehicles, which could adversely affect the Company’s realization upon repossessed vehicles; and economic

conditions in geographic areas in which the Company's business is concentrated. Any or all of such factors also may affect the Company’s

future financial results, as to which there can be no assurance. Any implication that the results of the most recently completed quarter

are indicative of future results is disclaimed, and the reader should draw no such inference. Factors such as those identified above in

relation to losses to be incurred in the future may affect future performance.

Investor Relations Contact

Danny Bharwani, Chief Financial Officer

949-753-6811

Consumer Portfolio Services, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited)

| | |

Three months ended | | |

Twelve months ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

$ | 98,150 | | |

$ | 83,260 | | |

$ | 363,962 | | |

$ | 329,219 | |

| Mark to finance receivables measured at fair value | |

| 5,000 | | |

| 6,000 | | |

| 21,000 | | |

| 12,000 | |

| Other income | |

| 2,153 | | |

| 2,718 | | |

| 8,544 | | |

| 10,795 | |

| | |

| 105,303 | | |

| 91,978 | | |

| 393,506 | | |

| 352,014 | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Employee costs | |

| 23,889 | | |

| 23,157 | | |

| 96,192 | | |

| 88,148 | |

| General and administrative | |

| 14,422 | | |

| 13,777 | | |

| 54,710 | | |

| 50,001 | |

| Interest | |

| 52,522 | | |

| 40,277 | | |

| 191,257 | | |

| 146,631 | |

| Provision for credit losses | |

| (728 | ) | |

| (1,600 | ) | |

| (5,307 | ) | |

| (22,300 | ) |

| Other expenses | |

| 7,847 | | |

| 6,523 | | |

| 29,223 | | |

| 28,437 | |

| | |

| 97,952 | | |

| 82,134 | | |

| 366,075 | | |

| 290,917 | |

| Income before income taxes | |

| 7,351 | | |

| 9,844 | | |

| 27,431 | | |

| 61,097 | |

| Income tax expense | |

| 2,206 | | |

| 2,657 | | |

| 8,228 | | |

| 15,754 | |

| Net income | |

$ | 5,145 | | |

$ | 7,187 | | |

$ | 19,203 | | |

$ | 45,343 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.24 | | |

$ | 0.34 | | |

$ | 0.90 | | |

$ | 2.17 | |

| Diluted | |

$ | 0.21 | | |

$ | 0.29 | | |

$ | 0.79 | | |

$ | 1.80 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Number of shares used in computing earnings per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 21,412 | | |

| 21,136 | | |

| 21,292 | | |

| 20,896 | |

| Diluted | |

| 24,274 | | |

| 24,879 | | |

| 24,325 | | |

| 25,218 | |

Condensed Consolidated Balance Sheets

(In thousands)

(Unaudited)

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 11,713 | | |

$ | 6,174 | |

| Restricted cash and equivalents | |

| 125,684 | | |

| 119,257 | |

| Finance receivables measured at fair value | |

| 3,313,767 | | |

| 2,722,662 | |

| | |

| | | |

| | |

| Finance receivables | |

| 5,420 | | |

| 27,553 | |

| Allowance for finance credit losses | |

| (433 | ) | |

| (2,869 | ) |

| Finance receivables, net | |

| 4,987 | | |

| 24,684 | |

| | |

| | | |

| | |

| Deferred tax assets, net | |

| 1,010 | | |

| 3,736 | |

| Other assets | |

| 36,707 | | |

| 27,233 | |

| | |

$ | 3,493,868 | | |

$ | 2,903,746 | |

| | |

| | | |

| | |

| Liabilities and Shareholders' Equity: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 70,151 | | |

$ | 62,544 | |

| Warehouse lines of credit | |

| 410,898 | | |

| 234,025 | |

| Residual interest financing | |

| 99,176 | | |

| 49,875 | |

| Securitization trust debt | |

| 2,594,384 | | |

| 2,265,446 | |

| Subordinated renewable notes | |

| 26,489 | | |

| 17,188 | |

| | |

| 3,201,098 | | |

| 2,629,078 | |

| | |

| | | |

| | |

| Shareholders' equity | |

| 292,770 | | |

| 274,668 | |

| | |

$ | 3,493,868 | | |

$ | 2,903,746 | |

Operating and Performance Data ($ in millions)

| | |

At and for the | | |

At and for the | |

| | |

Three months ended | | |

Twelve months ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Contracts purchased | |

$ | 457.81 | | |

$ | 301.80 | | |

$ | 1,681.94 | | |

$ | 1,357.75 | |

| Contracts securitized | |

$ | 298.42 | | |

$ | 306.70 | | |

$ | 1,256.13 | | |

$ | 1,352.11 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total portfolio balance (1) | |

$ | 3,490.96 | | |

$ | 2,970.07 | | |

$ | 3,490.96 | | |

$ | 2,970.07 | |

| Average portfolio balance (1) | |

$ | 3,445.52 | | |

$ | 2,958.95 | | |

$ | 3,209.99 | | |

$ | 2,913.57 | |

| | |

| | | |

| | | |

| | | |

| | |

| Delinquencies (1) | |

| | | |

| | | |

| | | |

| | |

| 31+ Days | |

| 12.11% | | |

| 12.29% | | |

| | | |

| | |

| Repossession Inventory | |

| 2.74% | | |

| 2.26% | | |

| | | |

| | |

| Total Delinquencies and Repo. Inventory | |

| 14.85% | | |

| 14.55% | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Annualized Net Charge-offs as % of Average Portfolio (1) | |

| 8.02% | | |

| 7.74% | | |

| 7.62% | | |

| 6.53% | |

| | |

| | | |

| | | |

| | | |

| | |

| Recovery rates (1), (2) | |

| 27.2% | | |

| 34.3% | | |

| 30.1% | | |

| 39.2% | |

| | |

For the | | |

For the | |

| | |

Three months ended | | |

Twelve months ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

$(3) | | |

%(4) | | |

$(3) | | |

%(4) | | |

$(3) | | |

%(4) | | |

$(3) | | |

%(4) | |

| Interest income | |

$ | 98.15 | | |

| 11.4% | | |

$ | 83.26 | | |

| 11.3% | | |

$ | 363.96 | | |

| 11.3% | | |

$ | 329.22 | | |

| 11.3% | |

| Mark to finance receivables measured at fair value | |

| 5.00 | | |

| 0.6% | | |

| 6.00 | | |

| 0.8% | | |

| 21.00 | | |

| 0.7% | | |

| 12.00 | | |

| 0.4% | |

| Other income | |

| 2.15 | | |

| 0.2% | | |

| 2.72 | | |

| 0.4% | | |

| 8.54 | | |

| 0.3% | | |

| 10.80 | | |

| 0.4% | |

| Interest expense | |

| (52.52 | ) | |

| -6.1% | | |

| (40.28 | ) | |

| -5.4% | | |

| (191.26 | ) | |

| -6.0% | | |

| (146.63 | ) | |

| -5.0% | |

| Net interest margin | |

| 52.78 | | |

| 6.1% | | |

| 51.70 | | |

| 7.0% | | |

| 202.25 | | |

| 6.3% | | |

| 205.38 | | |

| 7.0% | |

| Provision for credit losses | |

| 0.73 | | |

| 0.1% | | |

| 1.60 | | |

| 0.2% | | |

| 5.31 | | |

| 0.2% | | |

| 22.30 | | |

| 0.8% | |

| Risk adjusted margin | |

| 53.51 | | |

| 6.2% | | |

| 53.30 | | |

| 7.2% | | |

| 207.56 | | |

| 6.5% | | |

| 227.68 | | |

| 7.8% | |

| Other operating expenses (5) | |

| (46.16 | ) | |

| -5.4% | | |

| (43.46 | ) | |

| -5.9% | | |

| (180.13 | ) | |

| -5.6% | | |

| (166.59 | ) | |

| -5.7% | |

| Pre-tax income | |

$ | 7.35 | | |

| 0.9% | | |

$ | 9.84 | | |

| 1.3% | | |

$ | 27.43 | | |

| 0.9% | | |

$ | 61.10 | | |

| 2.1% | |

________________

| (1) |

Excludes third party portfolios. |

| (2) |

Wholesale auction liquidation amounts (net of expenses) as a percentage of the account balance at the time of sale. |

| (3) |

Numbers may not add due to rounding. |

| (4) |

Annualized percentage of the average portfolio balance. Percentages may not add due to rounding. |

| (5) |

Total pre-tax expenses less provision for credit losses and interest expense. |

v3.25.0.1

Cover

|

Feb. 25, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 25, 2025

|

| Entity File Number |

1-11416

|

| Entity Registrant Name |

CONSUMER PORTFOLIO SERVICES, INC.

|

| Entity Central Index Key |

0000889609

|

| Entity Tax Identification Number |

33-0459135

|

| Entity Incorporation, State or Country Code |

CA

|

| Entity Address, Address Line One |

3800 Howard Hughes Pkwy

|

| Entity Address, Address Line Two |

Suite 1400

|

| Entity Address, City or Town |

Las Vegas

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89169

|

| City Area Code |

949

|

| Local Phone Number |

753-6800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

CPSS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

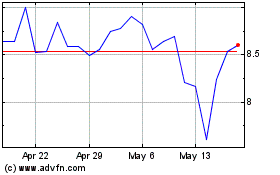

Consumer Portfolio Servi... (NASDAQ:CPSS)

Historical Stock Chart

From Jan 2025 to Feb 2025

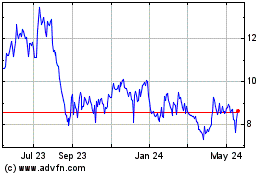

Consumer Portfolio Servi... (NASDAQ:CPSS)

Historical Stock Chart

From Feb 2024 to Feb 2025