Current Report Filing (8-k)

May 20 2022 - 7:16AM

Edgar (US Regulatory)

false 0001662774 0001662774 2022-05-19 2022-05-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 19, 2022

CORTEXYME, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-38890 |

|

90-1024039 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 269 East Grand Ave. South San Francisco, California |

|

94080 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (415) 910-5717

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

|

CRTX |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.01. |

Completion of Acquisition or Disposition of Assets. |

Merger Agreement

On May 19, 2022, Cortexyme, Inc., a Delaware corporation (the “Company”), completed its previously announced acquisition (the “Merger”) of Novosteo Inc., a Delaware corporation (“Novosteo”), pursuant to that certain Agreement and Plan of Merger and Reorganization, dated as of May 9, 2022, (the “Merger Agreement”), by and among the Company, Quince Merger Sub I, Inc., a Delaware corporation and a wholly owned subsidiary of the Company, Quince Merger Sub II, LLC, a Delaware limited liability company and a wholly owned subsidiary of Company, Novosteo, and Fortis Advisors LLC, a Delaware limited liability company, solely in its capacity as the securityholders’ representative.

Pursuant to the terms of the Merger Agreement, at the closing of the Merger (the “Effective Time”), each share of capital stock of Novosteo (the “Novosteo Capital Stock”) that was issued and outstanding immediately prior to the Effective Time was automatically cancelled and converted into the right to receive 0.0911 shares of common stock, par value $0.001 per share, of the Company (the “Company Common Stock”). The total number of shares of the Company Common Stock issued as consideration for the Merger was approximately 6 million shares (the “Merger Shares”), including options to purchase an aggregate of 507,108 shares of the Company Common Stock upon conversion of the outstanding Novosteo options based on the Company Option Exchange Ratio (as defined in the Merger Agreement), with the awards retaining the same vesting and other terms and conditions as in effect immediately prior to consummation of the Merger.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, a copy of which was filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K (File No. 001-38890), filed with the Securities and Exchange Commission on May 12, 2022, and is incorporated herein by reference.

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Departure of Executive Officer

On May 20, 2022, the Company announced the departure of Caryn McDowell, the Company’s Chief Legal and Administrative Officer and Corporate Secretary, effective as of July 8, 2022 (the “Departure Date”). In connection with the departure of Ms. McDowell from the Company, the Company entered into a transition agreement (the “Separation Agreement”) with Ms. McDowell on May 19, 2022, providing for (i) a release of claims against the Company; (ii) cash severance payments of $339,000, which equals to nine months of Ms. McDowell’s 2022 base salary, to be paid in a lump sum; and (iii) certain health care continuation benefits. The Separation Agreement also provides for an accelerated vesting of the restricted stock award issued to Ms. McDowell on March 3, 2022 and an extension of the post-termination exercise period for all vested stock options or other equity awards held by Ms. McDowell through the twelve-month period following the Departure Date, provided that the specified severance preconditions are met. In addition, in the event the Company consummates a change in control within three months after the Departure Date, subject to satisfaction of specified conditions, Ms. McDowell would also be entitled to additional cash severance and COBRA coverage, payment of target annual bonus and accelerated vesting with respect to her equity awards.

The foregoing description of the terms of the Separation Agreement is not complete and is qualified in its entirety by reference to the complete texts of the Separation Agreement, a copy of which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2022.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 20, 2022

|

|

|

| Cortexyme, Inc. |

|

|

| By: |

|

/s/ Christopher Lowe |

|

|

Christopher Lowe |

|

|

Chief Financial Officer and Chief Operating Officer |

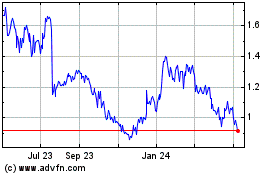

Quince Therapeutics (NASDAQ:QNCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

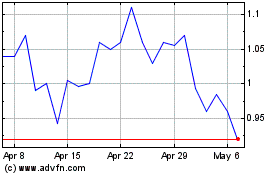

Quince Therapeutics (NASDAQ:QNCX)

Historical Stock Chart

From Apr 2023 to Apr 2024