Cutera, Inc. (NASDAQ: CUTR) (“Cutera” or the “Company”), a

leading provider of laser and other energy-based aesthetic systems

for practitioners worldwide, today reported financial results for

the first quarter ended March 31, 2020.

First Quarter 2020 Financial and Operational

Highlights

- Revenue was $32.2 million, an 11% decrease from prior-year

period on reduced capital equipment sales due to COVID-19

disruption, partially offset by

- truSculpt portfolio revenue growth of 11%

- Recurring revenue growth of 28% and

- International revenue growth of 18%

- Gross Margin was 44% compared to 48% in the prior-year period,

on reduced capital sales volume

- Net loss was $12.4 million, or $0.86 per fully diluted share,

as compared to a net loss of $8.2 million, or $0.59 per fully

diluted share, in the prior-year period.

- Closed public stock offering on April 21, 2020 resulting in

approximately $27 million net proceeds

“Our first quarter results reflected strength and momentum

exiting 2019, offset by the significant impacts of the COVID-19

pandemic that flowed through the global economy during the

quarter,” commented Dave Mowry, Chief Executive Officer of Cutera,

Inc. “We have taken a number of steps to adapt our business to the

current environment, and I am extremely proud of our team’s

response. With a strong balance sheet and a culture of innovation,

we are well-positioned to strengthen our competitive advantage as

we move through this crisis. During this time, we have dedicated

ourselves to providing critical support to our customers as they

navigate the reopening of their practices and prepare to

accommodate pent-up demand for procedures. Our recent capital raise

will ensure that we are able to continue investing in our strong

pipeline of new products and build upon our technology leadership

position in the body sculpting market.”

2020 Financial Outlook

As previously announced on April 3, 2020, Cutera has withdrawn

its previously announced full-year 2020 guidance due to uncertainty

over the magnitude and duration of the impacts from the COVID-19

pandemic on its financial results.

Conference Call

The Company’s management will host a conference call to discuss

these results and related matters today at 1:30 p.m. PT / 4:30 p.m.

ET. Participating on the call will be Dave Mowry, Chief Executive

Officer, Jason Richey, President, and Fuad Ahmad, Interim Chief

Financial Officer.

To participate in the conference call, dial 1-833-423-0434

(domestic) or +1 918-922-6619 (international) and refer to the

Conference Code: 2339504

The call will also be webcast and can be accessed from the

Investor Relations section of Cutera’s website at

http://www.cutera.com/. The webcast replay of the call will be

available at the same site approximately one hour after the end of

the call.

About Cutera, Inc.

Brisbane, California-based Cutera is a leading provider of laser

and other energy-based aesthetic systems for practitioners

worldwide. Since 1998, Cutera has developed innovative, easy-to-use

products that enable physicians and other qualified practitioners

to offer safe and effective aesthetic treatments to their patients.

For more information, call 1-888-4CUTERA or visit

www.cutera.com.

*Use of Non-GAAP Financial

Measures

In this press release, in order to supplement the Company’s

condensed consolidated financial statements presented in accordance

with Generally Accepted Accounting Principles, or GAAP, management

has disclosed certain non-GAAP financial measures for the statement

of operations and net income (loss) per diluted share. Non-GAAP

adjustments include stock-based compensation, depreciation,

amortization, executive separation costs, customer relationship

management (“CRM”) and enterprise resource planning (“ERP”) system

implementation costs, as well as the net tax impact of excluding

these items. From time to time in the future, there may be other

items that we may exclude if the Company believes that doing so is

consistent with the goal of providing useful information to

investors and management. The Company has provided a reconciliation

of each non-GAAP financial measure used in this earnings release to

the most directly comparable GAAP financial measure. The Company

has not provided a reconciliation of non-GAAP guidance measures to

the corresponding GAAP measures on a forward-looking basis due to

the potential significant variability, limited visibility,

unpredictability, or unique non-recurring nature of the items.

Forward-looking non-GAAP measures include adjusted EBITDA. The

Company defines adjusted EBITDA as earnings before interest, taxes,

depreciation and amortization, stock-based compensation, executive

separation costs, and charges related to CRM and ERP software

implementation costs.

Company management uses these measurements as aids in monitoring

the Company’s ongoing financial performance from quarter to

quarter, and year to year, on a regular basis and for benchmarking

against other similar companies. Non-GAAP financial measures used

by the Company may be calculated differently from, and therefore

may not be comparable to, similarly titled measures used by other

companies. These non-GAAP financial measures should be considered

along with, but not as alternatives to, the operating performance

measure as prescribed by GAAP. Non-GAAP financial measures for the

statement of operations and net income per diluted share exclude

the following:

Non-cash expenses for stock-based compensation. The

Company has excluded the effect of stock-based compensation

expenses in calculating its non-GAAP operating expenses and net

income measures. Although stock-based compensation is a key

incentive offered to its employees, the Company continues to

evaluate its business performance excluding stock-based

compensation expenses. The Company records stock-based compensation

expense related to grants of options, employee stock purchase plan,

and performance and restricted stock. Depending upon the size,

timing and the terms of the grants, this expense may vary

significantly but will recur in future periods. The Company

believes that excluding stock-based compensation better allows for

comparisons to its peer companies;

Depreciation and amortization. The Company has excluded

depreciation and amortization expense in calculating its non-GAAP

operating expenses and net income measures. Depreciation and

amortization are non-cash charges to current operations;

Executive separation. We have excluded costs associated

with the resignation of our former Chief Executive Officer in

calculating our non-GAAP operating expenses and net income

measures. We exclude these non-recurring separation costs because

we believe that these items do not reflect future operating

expenses;

Customer Relationship Management. We have excluded CRM

system costs related to direct and incremental costs incurred in

connection with our multi-phase implementation of a new CRM

solution and the related technology infrastructure costs. We

exclude these costs because we believe that these items do not

reflect future operating expenses and will be inconsistent in

amounts and frequency making it difficult to contribute to a

meaningful evaluation of our operating performance; and

Enterprise Resource Planning. We have excluded ERP system

costs related to direct and incremental costs incurred in

connection with our multi-phase implementation of a new ERP

solution and the related technology infrastructure costs. We

exclude these costs because we believe that these items do not

reflect future operating expenses and will be inconsistent in

amounts and frequency making it difficult to contribute to a

meaningful evaluation of our operating performance; and

Non-Recurring Legal Expenses. We have excluded legal

expenses related to our pending litigation with Lutronic. We

believe these expenses are non-recurring and do not reflect future

operating expenses.

The Company believes that excluding all of the items above

allows users of its financial statements to better review and

assess both current and historical results of operations.

Safe Harbor Statement

Certain statements in this press release, other than purely

historical information, are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act, and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”).

These statements include, but are not limited to, Cutera’s plans,

objectives, strategies, financial performance and outlook, CFO and

other senior leadership searches, product launches and performance,

trends, prospects or future events and involve known and unknown

risks that are difficult to predict. As a result, the Company’s

actual financial results, performance, achievements or prospects

may differ materially from those expressed or implied by these

forward-looking statements. In some cases, you can identify

forward-looking statements by the use of words such as “may,”

“could,” “seek,” “guidance,” “predict,” “potential,” “likely,”

“believe,” “will,” “should,” “expect,” “anticipate,” “estimate,”

“plan,” “intend,” “forecast,” “foresee” or variations of these

terms and similar expressions, or the negative of these terms or

similar expressions. Forward-looking statements are based on

management's current, preliminary expectations and are subject to

risks and uncertainties, which may cause Cutera's actual results to

differ materially from the statements contained herein. These

statements are not guarantees of future performance, and

stockholders should not place undue reliance on forward-looking

statements. There are a number of risks, uncertainties and other

important factors, many of which are beyond the Company’s control,

that could cause its actual results to differ materially from the

forward-looking statements contained in this press release,

including those described in the “Risk Factors” section of Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current

Reports on Form 8-K, the Registration Statement on Form S-8 and

other documents filed from time to time with the United States

Securities and Exchange Commission by Cutera.

All information in this press release is as of the date of its

release. Accordingly, undue reliance should not be placed on

forward-looking statements. Cutera undertakes no obligation to

update publicly any forward-looking statements to reflect new

information, events or circumstances after the date they were made,

or to reflect the occurrence of unanticipated events. If the

Company updates one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking statements. Cutera's

financial performance for the fourth quarter and full year ended

December 31, 2019, as discussed in this release, is preliminary and

unaudited, and subject to adjustment.

CUTERA, INC. CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands) (unaudited)

March 31,

December 31,

2020

2019

Assets Current assets: Cash and cash equivalents

$

14,774

$

26,316

Marketable investments

4,746

7,605

Accounts receivable, net

15,660

21,556

Inventories

36,941

33,921

Other current assets and prepaid expenses

4,831

5,648

Total current assets

76,952

95,046

Property and equipment, net

2,687

2,817

Deferred tax asset

408

423

Goodwill

1,339

1,339

Operating lease right-of-use assets

7,143

7,702

Other long-term assets

5,901

6,411

Total assets

$

94,430

$

113,738

Liabilities and Stockholders' Equity Current

liabilities: Accounts payable

$

14,604

$

12,685

Accrued liabilities

23,663

30,307

Operating leases liabilities

2,204

2,800

Extended warranty liabilities

1,765

1,999

Deferred revenue

10,180

10,831

Total current liabilities

52,416

58,622

Deferred revenue, net of current portion

2,789

3,391

Income tax liability

93

93

Operating lease liabilities, net of current portion

5,149

5,112

Other long-term liabilities

447

578

Total liabilities

60,894

67,796

Stockholders’ equity: Common stock

15

14

Additional paid-in capital

82,292

82,346

Accumulated deficit

(48,772)

(36,358)

Accumulated other comprehensive income (loss)

1

(60)

Total stockholders' equity

33,536

45,942

Total liabilities and stockholders' equity

$

94,430

$

113,738

CUTERA, INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (in thousands, except per share data)

(unaudited)

Three Months Ended

March 31,

March 31,

2020

2019

Products

$

26,391

$

30,762

Service

5,848

5,264

Total net revenue

32,239

36,026

Products

14,103

15,541

Service

3,800

3,176

Total cost of revenue

17,903

18,717

Gross profit

14,336

17,309

Gross margin %

44%

48%

Operating expenses: Sales and marketing

14,789

16,104

Research and development

3,870

3,706

General and administrative

7,806

5,525

Total operating expenses

26,465

25,335

Loss from operations

(12,129

)

(8,026

)

Interest and other expense, net

(207

)

(79

)

Loss before income taxes

(12,336

)

(8,105

)

Income tax expense

78

115

Net loss

(12,414

)

(8,220

)

Net loss per share: Basic

(0.86

)

(0.59

)

Diluted

(0.86

)

(0.59

)

Weighted-average number of shares used in per share

calculations: Basic

14,433

14,017

Diluted

14,433

14,017

CUTERA, INC. CONSOLIDATED FINANCIAL HIGHLIGHTS (in

thousands, except percentage data) (unaudited)

Three Months Ended

% Change

March 31,

March 31,

2020 Vs

2020

2019

2019

Revenue By Geography: United States

$

13,784

$

20,400

-32%

International

18,455

$

15,626

+18%

Total Net Revenue

$

32,239

$

36,026

-11%

International as a percentage of total revenue

57%

43%

Revenue By Product Category: Systems - North America

$

10,382

$

17,580

-41%

- Rest of World

10,576

$

9,629

+10%

Total Systems

20,958

27,209

-23%

Consumables

2,533

$

1,945

+30%

Skincare

2,900

$

1,608

+80%

Total Products

26,391

30,762

-14%

Service

5,848

$

5,264

+11%

Total Net Revenue

$

32,239

$

36,026

-11%

Three Months Ended

March 31,

March 31,

2020

2019

Pre-tax Stock-Based Compensation Expense: Cost of revenue

$

290

$

269

Sales and marketing

718

718

Research and development

321

263

General and administrative

650

57

$

1,980

$

1,307

CUTERA, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (in thousands) (unaudited)

Three Months Ended

March 31,

March 31,

2020

2019

Cash flows from operating activities: Net loss

$

(12,414)

$

(8,220)

Adjustments to reconcile net loss to net cash used in operating

activities: Stock-based compensation

1,980

1,307

Depreciation of tangible assets

360

411

Amortization of contract acquisition costs

717

690

Change in deferred tax asset

15

6

Provision for doubtful accounts receivable

590

98

Other

35

103

Changes in assets and liabilities: Accounts receivable

5,306

403

Inventories

(3,020)

1,355

Other current assets and prepaid expenses

807

(916)

Other long-term assets

(207)

(679)

Accounts payable

1,919

(942)

Accrued liabilities

(6,567)

(1,467)

Extended warranty liabilities

(234)

(492)

Other long-term liabilities

-

(140)

Deferred revenue

(1,253)

525

Income tax liability

-

5

Net cash used in operating activities

(11,966)

(7,953)

Cash flows from investing activities: Acquisition of

property, equipment and software

(230)

(65)

Disposal of property and equipment

-

-

Proceeds from sales of marketable investments

-

-

Proceeds from maturities of marketable investments

6,800

3,200

Purchase of marketable investments

(3,930)

(1,586)

Net cash provided by investing activities

2,640

1,549

Cash flows from financing activities: Proceeds from

exercise of stock options and employee stock purchase plan

201

131

Taxes paid related to net share settlement of equity awards

(2,234)

(490)

Payments on finance lease obligations

(183)

(131)

Net cash used in financing activities

(2,216)

(490)

Net decrease in cash and cash equivalents

(11,542)

(6,894)

Cash and cash equivalents at beginning of period

26,316

26,052

Cash and cash equivalents at end of period

$

14,774

$

19,158

CUTERA, INC. RECONCILIATION OF GAAP

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS TO NON-GAAP

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in

thousands, except per share data) (unaudited)

Three Months Ended March 31, 2020 Three Months

Ended March 31, 2019 GAAP

DepreciationandAmortization Stock-BasedCompensation

CRM and ERPImplementation Taxes andOtherAdjustments

Non-GAAP GAAP DepreciationandAmortization

Stock-BasedCompensation CRM and ERPImplementation

Taxes andOtherAdjustments Non-GAAP Net revenue

$

32,239

-

-

-

-

$

32,239

$

36,026

-

-

-

-

$

36,026

Cost of revenue

17,903

(140

)

(290

)

-

-

17,473

18,717

(129

)

(269

)

-

-

18,319

Gross profit

14,336

140

290

-

-

14,766

17,309

129

269

-

-

17,707

Gross margin %

44

%

46

%

48

%

49

%

Operating expenses: Sales and marketing

14,789

(871

)

(718

)

(165

)

-

13,035

16,104

(868

)

(718

)

(85

)

-

14,433

Research and development

3,870

(38

)

(321

)

-

-

3,511

3,706

(21

)

(263

)

-

-

3,422

General and administrative

7,806

(28

)

(650

)

(245

)

(324

)

(a)

6,559

5,525

(83

)

(57

)

(239

)

(614

)

(b)

4,531

Total operating expenses

26,465

(937

)

(1,690

)

(409

)

(324

)

23,105

25,335

(972

)

(1,038

)

(324

)

(614

)

22,387

Loss from operations

(12,129

)

1,077

1,980

409

324

(8,339

)

(8,026

)

1,101

1,307

324

614

(4,680

)

Interest and other expense, net

(207

)

-

-

-

-

(207

)

(79

)

-

-

-

-

(79

)

Loss before income taxes

(12,336

)

1,077

1,980

409

324

(8,546

)

(8,105

)

1,101

1,307

324

614

(4,759

)

Provision for income taxes

78

-

-

-

5

83

115

-

-

-

3

118

Net loss

$

(12,414

)

1,077

1,980

409

319

$

(8,629

)

$

(8,220

)

1,101

1,307

324

611

$

(4,877

)

Net loss per share: Basic

$

(0.86

)

$

(0.60

)

$

(0.59

)

$

(0.35

)

Diluted

$

(0.86

)

$

(0.60

)

$

(0.59

)

$

(0.35

)

Weighted-average number of shares used in per share

calculations: Basic

14,433

14,433

14,017

14,017

Diluted

14,433

14,433

14,017

14,017

a) Other adjustment of $324

related to certain non-recurring legal expenses.

b) Other adjustment of $614

related to Executive separation costs.

Operating expenses as a % of net revenue

GAAP Non-GAAP GAAP Non-GAAP

Sales and marketing

45.9

%

40.4

%

44.7

%

40.1

%

Research and development

12.0

%

10.9

%

10.3

%

9.5

%

General and administrative

24.2

%

20.3

%

15.3

%

12.6

%

82.1

%

71.7

%

70.3

%

62.1

%

CUTERA, INC. RECONCILIATION OF LOSS TO ADJUSTED

EBITDA (in thousands) (unaudited)

Three Months

Ended

March 31, 2020

Net loss

$

(12,414

)

Adjustments: Stock-based compensation

1,980

Depreciation and amortization

1,077

CRM and ERP implementation costs

409

Other adjustments

324

Interest and other expense, net

207

Provision for income taxes

78

Total adjustments

$

4,075

Adjusted EBITDA

$

(8,339

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200507005285/en/

Cutera, Inc. Anne Werdan Director, Investor Relations

415-657-5500 awerdan@cutera.com

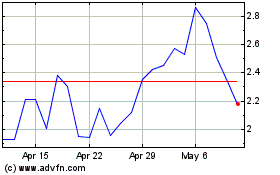

Cutera (NASDAQ:CUTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cutera (NASDAQ:CUTR)

Historical Stock Chart

From Apr 2023 to Apr 2024