false

0000766792

0000766792

2024-05-13

2024-05-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT PURSUANT

TO

SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported):

May

13, 2024

CVD

EQUIPMENT CORPORATION

(Exact

Name of Registrant as Specified in Its Charter)

| New

York |

|

1-16525 |

|

11-2621692 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

355

South Technology Drive

Central

Islip, New York |

|

11722 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

Telephone Number, Including Area Code: (631) 981-7081

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

Registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

CVV |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition

On

May 13, 2024, the Company issued a press release announcing its results of operations for the first quarter March 31, 2024.

A

copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The

information in this report (including Exhibit 99.1) is being furnished pursuant to Item 2.02 and shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

Item

9.01. Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

Date:

May 13, 2024

| |

CVD

EQUIPMENT CORPORATION |

| |

|

|

| |

By:

|

/s/

Richard Catalano |

| |

Name: |

Richard

Catalano |

| |

Title:

|

Executive

Vice President, Chief Financial Officer,

Secretary

and Treasurer |

Exhibit

99.1

|

enabling

tomorrow’s technologies™ |

| 355

South Technology Drive, Central Islip, New York 11722 | T 631.981.7081 | info@cvdequipment.com |

CVD

Equipment Corporation Reports

First

Quarter Fiscal Year 2024 Financial Results

CENTRAL

ISLIP, N.Y., (Business Wire) – May 13, 2024 - CVD Equipment Corporation (NASDAQ: CVV), today announced its financial results for

the first quarter ended March 31, 2024.

Manny

Lakios, President and CEO of CVD Equipment Corporation, commented, “First quarter 2024 revenue was $4.9 million, down significantly

versus the prior year period, as our business continues to experience fluctuations in revenue given the nature of the emerging growth

end markets we serve. While we are disappointed with our first quarter performance, we’ll stay the course on strategic efforts

to achieve profitability, carefully managing our costs and cash flow while simultaneously focusing on growth and return on investment.”

Mr.

Lakios added, “As we mentioned in our year-end press release, we started off the year with several key order wins during the first

quarter. These included a strategic order for our PVT200 system from a new customer, marking an important milestone as we seek to gain

traction for SiC crystal boule growth, as well as a multi-system order for our SiC CVD coating reactors. The PVT200 customer plans to

evaluate our equipment for potential additional orders. This improved order performance resulted in an increase in backlog from $18.4

million at year-end to $27.1 million at March 31, 2024. We are encouraged by these orders, as we continue to fund both research and development

and sales and marketing activities, including direct engagement with multiple potential customers, highly focused on penetrating key

market opportunities.”

First

Quarter 2024 Financial Performance

| ● | Revenue

of $4.9 million, down $3.8 million or 43.4% year over year primarily due to lower system

revenues. |

| ● | Gross

profit margin percentage was 17.5% due to lower gross profit margins on certain contracts

in progress at our CVD Equipment segment partially offset by higher gross profit margins

by our SDC segment. |

| ● | Operating

loss of $1.6 million. |

| ● | Net

loss of $1.5 million or $0.22 basic and diluted share, compared to a net loss of $40,000

or $0.01 per basic and diluted share for the prior year first quarter. |

| ● | Cash

and cash equivalents of $11.9 million as of March 31, 2024 as compared to $14.0 million as

of December 31, 2023. |

First

Quarter 2024 Operational Performance

| ● | Orders

for the first quarter were $13.5 million primarily driven by demand in the aerospace sector

and in our SDC segment for gas delivery equipment. |

| www.cvdequipment.com | www.firstnano.com | www.stainlessdesign.com |

| Page 1 of 3 |

|

enabling

tomorrow’s technologies™ |

| |

● |

As

mentioned above we received these important orders in the quarter: |

| |

|

● |

An

order for our new PVT200 system used to grow silicon carbide crystals for the manufacture of 200 mm wafers. This represents our second

customer for our PVT equipment that the customer will evaluate for potential additional orders. |

| |

|

● |

A

multisystem order from an industrial customer for approximately $10 million that will be used for depositing a silicon carbide protective

coating on OEM components, with systems scheduled to ship in 2025. |

| |

● |

During

the first quarter, we implemented a plan to reduce our operating costs to be consistent with current customer demand. This resulted

in a reduction in our work force in early January 2024. We continue to evaluate the demand for our products and opportunities to

reduce our operating costs. |

The

success of our PVT150 and PVT200 marketing efforts is dependent on the performance of our equipment in the field, overall market conditions,

our customers’ ability to qualify their end product with their customers and our customers’ ability to obtain the funding

necessary to purchase our equipment.

Management

Conference Call and Webcast

The

Company will hold a conference call to discuss its results today at 5:00 pm (Eastern Time). To participate in the live conference call,

please dial toll free (877) 407-2991 or international (201) 389-0925. A telephone replay will be available for 7 days. To access the

replay, dial (877) 660-6853 or international (201) 612-7415. The replay passcode is 13746228.

A

live and archived webcast of the call will also be available on the company’s website at www.cvdequipment.com/events. The

archived webcast will be available at the same location approximately two hours following the end of the live event.

About

CVD Equipment Corporation

CVD

Equipment Corporation (NASDAQ: CVV) designs, develops, and manufactures a broad range of chemical vapor deposition, thermal processing,

physical vapor transport, gas and chemical delivery control systems, and other equipment and process solutions used to develop and manufacture

materials and coatings for industrial applications and research. Our products are used in production environments as well as research

and development centers, both academic and corporate. Major target markets include high power electronics (silicon carbide), EV battery

materials / energy storage (carbon nanotubes, graphene and silicon nanowires), aerospace & defense (ceramic matrix composites) and

industrial applications. Through its application laboratory, the Company allows customers the option to bring their process tools to

our laboratory and to work collaboratively with our scientists and engineers to optimize process performance.

The

Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements. Certain information

included in this press release (as well as information included in oral statements or other written statements made or to be made by

CVD Equipment Corporation) contains statements that are forward-looking. All statements other than statements of historical fact are

hereby identified as “forward-looking statements, “as such term is defined in Section 27A of the Securities Exchange Act

of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward looking information involves a

number of known and unknown risks and uncertainties that could cause actual results to differ materially from those discussed or anticipated

by management. Potential risks and uncertainties include, among other factors, market and business conditions, the success of CVD Equipment

Corporation’s growth and sales strategies, the possibility of customer changes in delivery schedules, cancellation of, or failure

to receive orders, potential delays in product shipments, delays in obtaining inventory parts from suppliers and failure to satisfy customer

acceptance requirements, competition in our existing and potential future product lines of business, including our PVT systems; our ability

to obtain financing on acceptable terms if and when needed; uncertainty as to our ability to develop new products for the high power

electronics market; uncertainty as to our future profitability; uncertainty as to any future expansion of the Company; uncertainty as

to our ability to adequately obtain raw materials and components from foreign markets in light of geopolitical developments; and other

risks and uncertainties that are described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and

the Company’s other filings with the Securities and Exchange Commission. For forward-looking statements in this release, the Company

claims the protection of the safe harbor of the Private Securities Litigation Reform Act of 1995. The Company assumes no obligations

to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. Past performance

is not a guarantee of future results.

For

further information about this topic please contact:

Richard

Catalano, Executive Vice President & CFO

Phone:

(631) 981-7081

Email:

investorrelations@cvdequipment.com

| www.cvdequipment.com | www.firstnano.com | www.stainlessdesign.com |

| Page 2 of 3 |

|

enabling

tomorrow’s technologies™ |

CVD

EQUIPMENT CORPORATION AND SUBSIDIARIES

Condensed

Consolidated Statements of Operations

(In

thousands, except per share data- Unaudited)

| | |

Three

Months Ended March

31, | |

| | |

2024 | | |

2023 | |

| Revenue | |

$ | 4,922 | | |

$ | 8,695 | |

| Cost of revenue | |

| 4,063 | | |

| 6,261 | |

| Gross profit | |

| 859 | | |

| 2.434 | |

| Operating expenses | |

| | | |

| | |

| Research and development | |

| 746 | | |

| 602 | |

| Selling | |

| 419 | | |

| 419 | |

| General

and administrative | |

| 1,317 | | |

| 1,600 | |

| Total operating expenses | |

| 2,482 | | |

| 2,621 | |

| Operating loss | |

| (1,623 | ) | |

| (187 | ) |

| Net loss | |

$ | (1,472 | ) | |

$ | (40 | ) |

| Basic and diluted loss

per share | |

$ | (0.22 | ) | |

$ | (0.01 | ) |

CVD

EQUIPMENT CORPORATION AND SUBSIDIARIES

Condensed

Consolidated Balance Sheets

(In

thousands -Unaudited)

| | |

March

31, 2024 | | |

December

31, 2023 | |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash

equivalents | |

$ | 11,893 | | |

$ | 14,025 | |

| Accounts receivable, net | |

| 2,971 | | |

| 1,906 | |

| Contract assets | |

| 2,689 | | |

| 1,604 | |

| Inventories, net | |

| 4,925 | | |

| 4,454 | |

| Other

current assets | |

| 858 | | |

| 852 | |

| Total current assets | |

| 23,336 | | |

| 22,841 | |

| Property, plant and equipment, net | |

| 12,089 | | |

| 12,166 | |

| Other assets | |

| 18 | | |

| 18 | |

| Total assets | |

$ | 35,443 | | |

$ | 35,025 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’

Equity | |

| | | |

| | |

| Current liabilities | |

$ | 10,198 | | |

$ | 8,554 | |

| Long-term debt, net of current portion | |

| 247 | | |

| 268 | |

| Total stockholders’

equity | |

| 24,998 | | |

| 26,203 | |

| Total liabilities and

stockholders’ equity | |

$ | 35,443 | | |

$ | 35,025 | |

This

earnings release should be read in conjunction with the Company’s filings with the Securities and Exchange Commission, including

the Annual Report on Form 10-K for fiscal year ended December 31, 2023.

| www.cvdequipment.com | www.firstnano.com | www.stainlessdesign.com |

| Page 3 of 3 |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

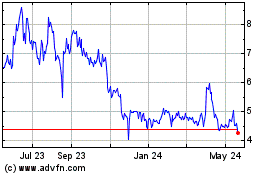

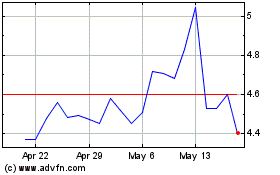

CVD Equipment (NASDAQ:CVV)

Historical Stock Chart

From Oct 2024 to Nov 2024

CVD Equipment (NASDAQ:CVV)

Historical Stock Chart

From Nov 2023 to Nov 2024