false

--12-31

0001282224

0001282224

2024-10-16

2024-10-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current

Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): October 16,

2024

DOLPHIN

ENTERTAINMENT, INC.

(Exact name of registrant as specified in its charter)

| Florida |

001-38331 |

86-0787790 |

| (State

or other jurisdiction |

(Commission

|

(IRS

Employer |

| of

incorporation) |

File

Number) |

Identification

No.) |

150

Alhambra Circle, Suite 1200,

Coral Gables, Florida

33134

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area

code (305) 774

-0407

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.015 par value per share |

|

DLPN |

|

The Nasdaq

Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03. Material Modification to Rights of Security

Holders.

To the extent required by Item 3.03 of

Form 8-K, the information contained in Item 5.03 of this report is incorporated herein by reference.

Item 5.03. Amendment to Articles of Incorporation or Bylaws; Change

in Fiscal Year.

The Board of Directors of Dolphin

Entertainment, Inc., a Florida corporation (the “Company”), has approved a reverse stock split of the Company’s

issued and outstanding shares of common stock, par value $0.015 per share (the “Common Stock”), at a ratio of 1-for-2

(the “Reverse Stock Split”). The Reverse Stock Split went effective on October 16, 2024 (the “Market Effective

Date”).

Effects of the Reverse Stock Split

Effective Date; Symbol; CUSIP

Number. The Common Stock began trading on a split-adjusted basis on the Nasdaq Capital Market exchange on the Market Effective Date.

In connection with the Reverse Stock Split, the CUSIP number for the Common Stock changed to 25686H 308. The trading symbol for the Common

Stock will remain “DLPN.”

Split Adjustment; Treatment

of Fractional Shares. The total number of shares of Common Stock held by each shareholder of the Company was converted automatically

into the number of shares of Common Stock equal to: (i) the number of issued and outstanding shares of Common Stock held by each such

shareholder immediately prior to the Reverse Stock Split divided by (ii) 2. Any fractional share of Common Stock that would otherwise

result from the Reverse Stock Split is being rounded to a whole share and, as such, any shareholder who otherwise would have held a fractional

share after giving effect to the Reverse Stock Split instead holds one whole share of the post-Reverse Stock Split Common Stock after

giving effect to the Reverse Stock Split. As a result, no fractional shares are being issued in connection with the Reverse Stock Split

and no cash or other consideration is being paid in connection with any fractional shares that would otherwise have resulted from the

Reverse Stock Split. The Company is treating shareholders holding shares of Common Stock in “street name” (that is, held through

a bank, broker or other nominee) in the same manner as shareholders of record whose shares of Common Stock are registered in their names.

Banks, brokers or other nominees are instructed to effect the Reverse Stock Split for their beneficial holders holding shares of our Common

Stock in “street name;” however, these banks, brokers or other nominees may apply their own specific procedures for processing

the Reverse Stock Split. The shares of Common Stock underlying the Company’s outstanding awarded options, restricted stock units

and warrants will be similarly adjusted along with corresponding adjustments to their exercise prices. Nevada Agency and Transfer Company,

the Company’s transfer agent, is acting as the exchange agent for the Reverse Stock Split and will provide instructions to shareholders

of record regarding the process for exchanging shares.

Articles of Amendment; Shareholder

Approval. The Company effected the Reverse Stock Split pursuant to the Company’s filing of Articles of Amendment (the “Articles

of Amendment”) to its Amended and Restated Articles of Incorporation with the Secretary of State of the State of Florida on

October 15, 2024, in accordance with Section 607.10025 of the Florida Business Corporation Act (the “Act”). The Articles

of Amendment became effective at 12:01 a.m. on October 16, 2024. A copy of the Articles of Amendment is attached hereto as Exhibit 3.1

and is incorporated herein by reference. The Articles of Amendment were approved by the Company’s shareholders pursuant to 607.10025

of the Act at the Company’s annual meeting of shareholders held on September 25, 2024.

Capitalization. The number

of authorized shares of Common Stock remain unchanged at 200,000,000 shares. As of October 16, 2024, there were 22,224,984 shares

of Common Stock outstanding. As a result of the Reverse Stock Split, there are 11,112,584 million shares of Common Stock outstanding

(subject to adjustment due to the effect of rounding fractional shares into whole shares). The Reverse Stock Split did not have any effect

on the stated par value of the Common Stock.

Item 7.01. Regulation FD Disclosure.

On October 14, 2024, the Company

issued a press release announcing the Reverse Stock Split. A copy of the Company’s press release is furnished as Exhibit 99.1

to this Current Report on Form 8-K and incorporated by reference in this Item 7.01. The information contained in this Item 7.01, including

Exhibit 99.1, shall not be deemed “filed” with the Securities and Exchange Commission nor incorporated by reference in any

registration statement filed by the Company under the Securities Act of 1933, as amended.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

|

|

|

|

|

|

| |

|

|

|

DOLPHIN ENTERTAINMENT, INC. |

| |

|

|

|

| Date: October 16, 2024 |

|

|

|

By: |

|

/s/

Mirta A. Negrini |

| |

|

|

|

|

|

Mirta A. Negrini |

| |

|

|

|

|

|

Chief Financial and Operating Officer |

Exhibit 3.1

ARTICLES OF AMENDMENT TO

AMENDED AND RESTATED ARTICLES OF INCORPORATION OF

DOLPHIN ENTERTAINMENT, INC.,

A FLORIDA CORPORATION

Pursuant to the provisions of Section 607.1006 of

the Florida Business Corporation Act, Dolphin Entertainment, Inc., a Florida corporation, Florida Document Number P14000097818, hereby

adopts the following amendment to its Amended and Restated Articles of Incorporation:

Article III, Capital Stock, is hereby amended by

adding the following paragraph at the end of Section A thereof:

Upon the filing and effectiveness (the “Effective

Time”) of this amendment to the Corporation’s Amended and Restated Articles of Incorporation, as amended, pursuant to the

Business Corporation Act of the State of Florida, each two (2) shares of Common Stock issued and outstanding or held by the Corporation

as treasury stock immediately prior to the Effective Time shall, automatically and without action on the part of the respective holders

thereof or the Corporation, be combined and converted into one (1) share of Common Stock, subject to treatment of fractional share interests

as described below (the “Reverse Stock Split”). No fractional shares of Common Stock shall be issued in connection with the

Reverse Stock Split; rather, the fractional shares of Common Stock created as a result of the Reverse Stock Split shall be rounded up

to the next whole number such that in lieu of fractional shares, each shareholder who would have otherwise been entitled to receive a

fractional share of Common Stock shall instead receive a whole share of Common Stock as a result of the Reverse Stock Split.

The Amendment was adopted by the shareholders of the

Corporation on September 24, 2024. The number of votes cast in favor of the Amendment by the shareholders was sufficient for its approval.

The Effective Time of the Amendment shall be 12:01 am EST on October 16, 2024.

| Dated: October 15, 2024 |

/s/ Mirta A Negrini

Name: Mirta A. Negrini

Title: Chief Financial Officer

|

| |

|

| |

|

Exhibit 99.1

Dolphin Entertainment, Inc. Announces 1-for-2

Reverse Stock Split

MIAMI, FL, October 14, 2024 / Dolphin Entertainment,

Inc. (NASDAQ:DLPN), a leading entertainment marketing and premium content production company, today announced that the company will effect

a 1-for-2 reverse split of its issued and outstanding shares of common stock. The reverse stock split will become effective October 16,

2024 at 12:01 a.m. EDT. Shares of the company's common stock will trade on a split-adjusted basis on The NASDAQ Capital Market, as of

the opening of trading on Wednesday, October 16, 2024. The new CUSIP number for the Company’s common stock will be 25686H 308.

The reverse stock split is being effected as part

of the company's plan to regain compliance with the $1.00 minimum bid price continued listing requirement of The NASDAQ Capital Market

and to have the additional authorized shares of common stock available to provide additional flexibility regarding the potential use of

shares of common stock for business and financial purposes in the future.

When the reverse stock split becomes effective, every

two shares of Dolphin Entertainment, Inc.’s common stock will be automatically combined into one new share of common stock. No fractional

shares will be issued, and no cash or other consideration will be paid. Instead, the company will issue one whole share of the post-split

common stock to any shareholder of record who otherwise would have received a fractional share as a result of the reverse stock split.

The reverse stock split will reduce the number of shares of outstanding common stock from approximately 22.2 million shares to approximately

11.1 million shares.

Dolphin Entertainment, Inc.’s transfer agent,

Nevada Agency and Transfer Company, will provide instructions to shareholders of record regarding the process for exchanging shares. Shareholders

who are holding their shares in electronic form at their brokerage firms do not have to take any action as the effects of the reverse

stock split will automatically be reflected in their brokerage accounts.

About Dolphin Entertainment, Inc.

Dolphin Entertainment, Inc. (NASDAQ:DLPN), founded in 1996 by Bill O'Dowd, has evolved from its origins as an Emmy-nominated television,

digital, and feature film content producer to a company with three dynamic divisions: Dolphin Entertainment, Dolphin Marketing, and Dolphin

Ventures.

Dolphin Entertainment:

This legacy division, where it all began, has a rich history of producing acclaimed television shows, digital content, and feature films.

With high-profile partnerships like IMAX and notable projects including "The Blue Angels," Dolphin Entertainment continues to

set the standard in quality storytelling and innovative content creation.

Dolphin Marketing:

Established in 2017, this division has become a powerhouse in public relations, influencer marketing, branding strategy, talent booking,

and special events. Comprising top-tier companies such as 42West, The Door, Shore Fire, Special Projects, and The Digital Dept., Dolphin

Marketing serves a wide range of industries, from entertainment, music and sports to hospitality, fashion and consumer products.

Dolphin Ventures:

This division leverages Dolphin's best-in-class cross-marketing acumen and business development relationships to create, launch and/or

accelerate innovative ideas and promising products, events and content in our areas of expertise. Key ventures include collaborations

with Rachael Ray for Staple Gin and Mastercard Midnight Theatre. The company is actively exploring new projects in AI, beauty, and sports.

Contact:

James Carbonara/Hayden IR

(646)-755-7412

james@haydenir.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

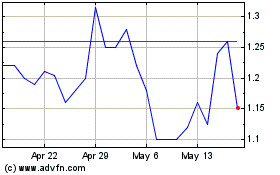

Dolphin Entertainment (NASDAQ:DLPN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dolphin Entertainment (NASDAQ:DLPN)

Historical Stock Chart

From Nov 2023 to Nov 2024