Dorman Products, Inc. (the “Company” or “Dorman”) (NASDAQ: DORM), a

leading supplier in the motor vehicle aftermarket industry, today

announced its financial results for the third quarter ended

September 28, 2024.

Kevin Olsen, Dorman’s President and Chief

Executive Officer, stated, “We delivered strong performance in the

third quarter with earnings growth exceeding our expectations.

Light Duty drove mid-single digit net sales growth, as our

innovation strategy continues to bolster Dorman’s leading portfolio

of aftermarket solutions. While net sales were down in our Heavy

Duty segment and flat in our Specialty Vehicle segment, both

delivered solid topline results when considering the headwinds that

persisted in each sector throughout the quarter. Each of our

businesses continues to execute exceptionally well against our

operational excellence initiatives. These efforts are enabling

streamlined workflows, quicker speeds to market, and increased

profitability across the enterprise.

“With three quarters of strong financial

results, coupled with our positive outlook and visibility through

the balance of the year, we are updating our full-year net sales

and EPS growth guidance. For 2024, we now anticipate net sales

growth to be in the range of 3.5% to 4.5%. We are also increasing

and narrowing our EPS guidance and now expect diluted EPS to be in

the range of $6.15 to $6.25 and adjusted diluted EPS* to be in the

range of $6.85 to $6.95.

“We are pleased with our results through the

third quarter and look forward to delivering solid sales and

earnings growth for the year. Our performance is a testament to the

hard work and dedication of our Contributors, the strength of our

customer relationships, and our unwavering commitment to driving

innovation for our end users.”

Third Quarter Financial

ResultsThe Company reported third-quarter 2024 net sales

of $503.8 million, up 3.2% compared to net sales of $488.2 million

in the third quarter of 2023.

Gross profit was $203.8 million in the third

quarter of 2024, or 40.5% of net sales, compared to $183.2 million,

or 37.5% of net sales, for the same quarter last year.

Selling, general and administrative (“SG&A”)

expenses were $124.5 million, or 24.7% of net sales, in the third

quarter of 2024 compared to $119.0 million, or 24.4% of net sales,

for the same quarter last year. Adjusted SG&A expenses* were

$117.9 million, or 23.4% of net sales, in the third quarter of

2024, compared to $114.1 million, or 23.4% of net sales, in the

same quarter last year.

Diluted EPS was $1.80 in the third quarter of

2024, up 41% compared to diluted EPS of $1.28 in the same quarter

last year. Adjusted diluted EPS* was $1.96 in the third quarter of

2024, up 40% compared to adjusted diluted EPS* of $1.40 in the same

quarter last year.

During the quarter, the Company generated $44

million in cash from operating activities, invested $9 million in

capital expenditures, repaid $11 million of debt and returned $27

million to shareholders through stock repurchases.

Segment results were as follows:

| |

Net Sales |

|

Segment Profit Margin |

| ($ in millions) |

Q3 2024 |

|

Q3 2023 |

|

Change |

|

Q3 2024 |

|

Q3 2023 |

|

Change |

|

Light Duty |

$ |

393.6 |

|

$ |

374.7 |

|

5 |

% |

|

19.0 |

% |

|

16.1 |

% |

|

290 bps |

| Heavy

Duty |

|

59.6 |

|

|

62.8 |

|

-5 |

% |

|

4.5 |

% |

|

3.0 |

% |

|

150 bps |

| Specialty

Vehicle |

|

50.6 |

|

|

50.6 |

|

0 |

% |

|

17.0 |

% |

|

13.5 |

% |

|

350 bps |

2024 GuidanceThe Company

updated its full-year 2024 guidance, detailed in the table below,

which excludes any potential impacts from future acquisitions and

divestitures, supply chain disruptions, significant inflation,

interest rate changes and additional share repurchases.

|

|

Updated 2024 Guidance |

Prior 2024 Guidance |

| Net Sales

Growth vs. 2023 |

3.5% – 4.5% |

3% – 5% |

| Diluted

EPS |

$6.15 – $6.25 |

$5.32 – $5.52 |

|

Growth vs. 2023 |

50% – 52% |

30% – 35% |

| Adjusted

Diluted EPS* |

$6.85 – $6.95 |

$6.00 – $6.20 |

|

Growth vs. 2023 |

51% – 53% |

32% – 37% |

|

Tax Rate Estimate |

24% |

24% |

Share Repurchase ProgramDorman

repurchased 273,653 shares of its common stock for $26.7 million at

an average share price of $97.70 during the quarter ended September

28, 2024. The Company had $134.6 million remaining under its prior

share repurchase authorization.

In October, the Company’s Board of Directors

authorized a new share repurchase program, effective January 1,

2025, authorizing the Company to repurchase up to $500 million of

its outstanding common stock by the end of 2027. Under this

program, share repurchases may be made from time to time depending

on market conditions, share price, share availability and other

factors at the Company’s discretion. The prior share repurchase

plan and any amounts that remain available for purchases under that

plan will expire on December 31, 2024.

Conference Call and WebcastThe

Company will hold a conference call and webcast for investors on

Friday, November 1, 2024 beginning at 8:00 a.m. Eastern time. The

conference call can be accessed by telephone at (888) 440-4182

within the U.S. or +1 (646) 960-0653 outside the U.S. When

prompted, enter the conference ID number 1698878. A live audio

webcast along with the accompanying presentation materials can be

accessed on the Company’s website at Dorman Products, Inc. -

Events. A replay of the session will be available on the Investor

section of the Company’s website after the call.

About Dorman ProductsDorman

gives professionals, enthusiasts and owners greater freedom to fix

motor vehicles. For over 100 years, we have been driving new

solutions, releasing tens of thousands of aftermarket replacement

products engineered to save time and money and increase convenience

and reliability.

Founded and headquartered in the United States,

we are a pioneering global organization offering an always-evolving

catalog of products, covering cars, trucks and specialty vehicles,

from chassis to body, from underhood to undercarriage, and from

hardware to complex electronics.

*Non-GAAP MeasuresIn addition

to the financial measures prepared in accordance with generally

accepted accounting principles (GAAP), this earnings release also

contains Non-GAAP financial measures. The reasons why we believe

these measures provide useful information to investors and a

reconciliation of these measures to the most directly comparable

GAAP measures and other information relating to these Non-GAAP

measures are included in the supplemental schedules attached.

Forward-Looking StatementsThis

press release contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Words such as “may,” “will,” “should,” “likely,” “probably,”

“anticipates,” “expects,” “intends,” “plans,” “projects,”

“believes,” “views,” “estimates” and similar expressions are used

to identify these forward-looking statements. Readers are cautioned

not to place undue reliance on those forward-looking statements,

which speak only as of the date such statements were made. Such

forward-looking statements are based on current expectations that

involve known and unknown risks, uncertainties and other factors

(many of which are outside of our control). Such risks,

uncertainties and other factors relate to, among other things:

competition in and the evolution of the motor vehicle aftermarket

industry; changes in our relationships with, or the loss of, any

customers or suppliers; our ability to develop, market and sell new

and existing products; our ability to anticipate and meet customer

demand; our ability to purchase necessary materials from our

suppliers and the impacts of any related logistics constraints;

widespread public health pandemics; political and regulatory

matters, such as changes in trade policy, the imposition of tariffs

and climate regulation; our ability to protect our information

security systems and defend against cyberattacks; our ability to

protect our intellectual property and defend against any claims of

infringement; and financial and economic factors, such as our level

of indebtedness, fluctuations in interest rates and inflation. More

information on these risks and other potential factors that could

affect the Company’s business, reputation, results of operations,

financial condition, and stock price is included in the Company’s

filings with the Securities and Exchange Commission (“SEC”),

including in the “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” sections

of the Company’s most recently filed periodic reports on Form 10-K

and Form 10-Q and subsequent filings. The Company is under no

obligation to, and expressly disclaims any such obligation to,

update any of the information in this document, including but not

limited to any situation where any forward-looking statement later

turns out to be inaccurate whether as a result of new information,

future events or otherwise.

Investor Relations ContactAlex

Whitelam, VP, Investor Relations & Risk

Managementawhitelam@dormanproducts.com (445) 448-9522

Visit our website at www.dormanproducts.com. The

Investor Relations section of the website contains a significant

amount of information about Dorman, including financial and other

information for investors. Dorman encourages investors to visit its

website periodically to view new and updated information.

|

DORMAN PRODUCTS, INC. Consolidated Statements of

Operations(in thousands, except per-share amounts) |

| |

|

|

|

| |

Three Months Ended |

|

Three Months Ended |

|

(unaudited) |

9/28/24 |

|

Pct.* |

|

9/30/23 |

|

Pct. * |

|

Net sales |

$ |

503,773 |

|

100.0 |

|

$ |

488,186 |

|

100.0 |

| Cost of goods sold |

|

299,970 |

|

59.5 |

|

|

304,968 |

|

62.5 |

|

Gross profit |

|

203,803 |

|

40.5 |

|

|

183,218 |

|

37.5 |

| Selling, general and

administrative expenses |

|

124,532 |

|

24.7 |

|

|

119,010 |

|

24.4 |

|

Income from operations |

|

79,271 |

|

15.7 |

|

|

64,208 |

|

13.2 |

| Interest expense, net |

|

9,762 |

|

1.9 |

|

|

12,215 |

|

2.5 |

| Other income, net |

|

1,615 |

|

0.3 |

|

|

605 |

|

0.1 |

|

Income before income taxes |

|

71,124 |

|

14.1 |

|

|

52,598 |

|

10.8 |

| Provision for income

taxes |

|

15,871 |

|

3.2 |

|

|

12,076 |

|

2.5 |

|

Net income |

$ |

55,253 |

|

11.0 |

|

$ |

40,522 |

|

8.3 |

| |

|

|

|

|

|

|

|

| Diluted earnings per

share |

$ |

1.80 |

|

|

|

$ |

1.28 |

|

|

| |

|

|

|

|

|

|

|

| Weighted average diluted

shares outstanding |

|

30,739 |

|

|

|

|

31,555 |

|

|

| |

|

|

|

|

|

|

|

| |

Nine Months Ended |

|

Nine Months Ended |

|

(unaudited) |

9/28/24 |

|

Pct.* |

|

9/30/23 |

|

Pct. * |

| Net

sales |

$ |

1,475,425 |

|

100.0 |

|

$ |

1,435,492 |

|

100.0 |

| Cost of goods sold |

|

890,775 |

|

60.4 |

|

|

944,291 |

|

65.8 |

|

Gross profit |

|

584,650 |

|

39.6 |

|

|

491,201 |

|

34.2 |

| Selling, general and

administrative expenses |

|

378,489 |

|

25.7 |

|

|

353,681 |

|

24.6 |

|

Income from operations |

|

206,161 |

|

14.0 |

|

|

137,520 |

|

9.6 |

| Interest expense, net |

|

30,569 |

|

2.1 |

|

|

36,733 |

|

2.6 |

| Other income, net |

|

1,711 |

|

0.1 |

|

|

1,358 |

|

0.1 |

|

Income before income taxes |

|

177,303 |

|

12.0 |

|

|

102,145 |

|

7.1 |

| Provision for income

taxes |

|

41,812 |

|

2.8 |

|

|

23,170 |

|

1.6 |

|

Net income |

$ |

135,491 |

|

9.2 |

|

$ |

78,975 |

|

5.5 |

| |

|

|

|

|

|

|

|

| Diluted earnings per

share |

$ |

4.37 |

|

|

|

$ |

2.50 |

|

|

| |

|

|

|

|

|

|

|

| Weighted average diluted

shares outstanding |

|

31,019 |

|

|

|

|

31,540 |

|

|

| |

|

|

|

|

|

|

|

|

|

| * Percentage of

sales. Data may not add due to rounding. |

|

DORMAN PRODUCTS, INC. Consolidated Balance Sheets

(in thousands, except share data) |

| |

|

(unaudited) |

9/28/24 |

|

12/31/23 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

45,127 |

|

|

$ |

36,814 |

|

|

Accounts receivable, less allowance for doubtful accounts of $1,647

and $3,518 |

|

571,051 |

|

|

|

526,867 |

|

|

Inventories |

|

665,237 |

|

|

|

637,375 |

|

|

Prepaids and other current assets |

|

34,661 |

|

|

|

32,653 |

|

|

Total current assets |

|

1,316,076 |

|

|

|

1,233,709 |

|

| Property, plant and equipment,

net |

|

165,734 |

|

|

|

160,113 |

|

| Operating lease right-of-use

assets |

|

107,176 |

|

|

|

103,476 |

|

| Goodwill |

|

443,340 |

|

|

|

443,889 |

|

| Intangible assets, net |

|

284,138 |

|

|

|

301,556 |

|

| Other assets |

|

47,633 |

|

|

|

49,664 |

|

|

Total assets |

$ |

2,364,097 |

|

|

$ |

2,292,407 |

|

| Liabilities and

shareholders’ equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

205,905 |

|

|

$ |

176,664 |

|

|

Accrued compensation |

|

27,003 |

|

|

|

23,971 |

|

|

Accrued customer rebates and returns |

|

208,274 |

|

|

|

204,495 |

|

|

Revolving credit facility |

|

61,760 |

|

|

|

92,760 |

|

|

Current portion of long-term debt |

|

18,750 |

|

|

|

15,625 |

|

|

Other accrued liabilities |

|

39,631 |

|

|

|

33,636 |

|

|

Total current liabilities |

|

561,323 |

|

|

|

547,151 |

|

| Long-term debt |

|

455,038 |

|

|

|

467,239 |

|

| Long-term operating lease

liabilities |

|

94,294 |

|

|

|

91,262 |

|

| Other long-term

liabilities |

|

9,203 |

|

|

|

9,627 |

|

| Deferred tax liabilities,

net |

|

9,637 |

|

|

|

8,925 |

|

| Commitments and

contingencies |

|

|

|

| Shareholders’

equity: |

|

|

|

|

Common stock, $0.01 par value; 50,000,000 shares authorized;

30,516,759 and 31,299,770 shares issued and outstanding in 2024 and

2023, respectively |

|

305 |

|

|

|

313 |

|

|

Additional paid-in capital |

|

110,595 |

|

|

|

101,045 |

|

|

Retained earnings |

|

1,127,259 |

|

|

|

1,069,435 |

|

|

Accumulated other comprehensive loss |

|

(3,557 |

) |

|

|

(2,590 |

) |

|

Total shareholders’ equity |

|

1,234,602 |

|

|

|

1,168,203 |

|

|

Total liabilities and shareholders' equity |

$ |

2,364,097 |

|

|

$ |

2,292,407 |

|

| Selected

Cash Flow Information (unaudited): |

| |

| |

Three Months Ended |

|

Nine Months Ended |

| (in thousands) |

9/28/24 |

|

9/30/23 |

|

9/28/24 |

|

9/30/23 |

|

Cash provided by operating activities |

$ |

44,293 |

|

$ |

56,224 |

|

$ |

159,622 |

|

$ |

149,110 |

|

Depreciation, amortization and accretion |

$ |

14,812 |

|

$ |

13,817 |

|

$ |

43,015 |

|

$ |

40,786 |

| Capital

expenditures |

$ |

8,555 |

|

$ |

9,667 |

|

$ |

31,245 |

|

$ |

32,936 |

|

DORMAN PRODUCTS, INC. Non-GAAP Financial

Measures(in thousands, except per-share amounts) |

|

|

|

Our financial results include certain financial measures not

derived in accordance with generally accepted accounting principles

(GAAP). Non-GAAP financial measures should not be used as a

substitute for GAAP measures, or considered in isolation, for the

purpose of analyzing our operating performance, financial position

or cash flows. Additionally, these non-GAAP measures may not be

comparable to similarly titled measures reported by other

companies. However, we have presented these non-GAAP financial

measures because we believe this presentation, when reconciled to

the corresponding GAAP measure, provides useful information to

investors by offering additional ways of viewing our results,

profitability trends, and underlying growth relative to prior and

future periods and to our peers. Management uses these non-GAAP

financial measures in making financial, operating, and planning

decisions and in evaluating our performance. Non-GAAP financial

measures may reflect adjustments for charges such as fair value

adjustments, amortization, transaction costs, severance,

accelerated depreciation, and other similar expenses related to

acquisitions as well as other items that we believe are not related

to our ongoing performance. |

| |

| Adjusted

Net Income: |

| |

Three Months Ended |

|

Nine Months Ended |

|

(unaudited) |

9/28/24* |

|

9/30/23* |

|

9/28/24* |

|

9/30/23* |

|

Net income (GAAP) |

$ |

55,253 |

|

|

$ |

40,522 |

|

|

$ |

135,491 |

|

|

$ |

78,975 |

|

| Pretax

acquisition-related intangible assets amortization [1] |

|

6,173 |

|

|

|

5,485 |

|

|

|

17,138 |

|

|

|

16,336 |

|

| Pretax

acquisition-related transaction and other costs [2] |

|

396 |

|

|

|

465 |

|

|

|

1,327 |

|

|

|

14,880 |

|

| Pretax

executive transition services expense [3] |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,801 |

|

| Pretax

fair value adjustment to contingent consideration [4] |

|

— |

|

|

|

(1,000 |

) |

|

|

— |

|

|

|

(13,400 |

) |

| Pretax

reduction in workforce costs [5] |

|

76 |

|

|

|

— |

|

|

|

4,926 |

|

|

|

— |

|

| Tax

adjustment (related to above items) [6] |

|

(1,654 |

) |

|

|

(1,214 |

) |

|

|

(5,815 |

) |

|

|

(4,891 |

) |

| Adjusted

net income (Non-GAAP) |

$ |

60,244 |

|

|

$ |

44,258 |

|

|

$ |

153,067 |

|

|

$ |

93,701 |

|

| |

|

|

|

|

|

|

|

| Diluted

earnings per share (GAAP) |

$ |

1.80 |

|

|

$ |

1.28 |

|

|

$ |

4.37 |

|

|

$ |

2.50 |

|

| Pretax

acquisition-related intangible assets amortization [1] |

|

0.20 |

|

|

|

0.17 |

|

|

|

0.55 |

|

|

|

0.52 |

|

| Pretax

acquisition-related transaction and other costs [2] |

|

0.01 |

|

|

|

0.01 |

|

|

|

0.04 |

|

|

|

0.47 |

|

| Pretax

executive transition services expense [3] |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.06 |

|

| Pretax

fair value adjustment to contingent consideration [4] |

|

— |

|

|

|

(0.03 |

) |

|

|

— |

|

|

|

(0.42 |

) |

| Pretax

reduction in workforce costs [5] |

|

0.00 |

|

|

|

— |

|

|

|

0.16 |

|

|

|

— |

|

| Tax

adjustment (related to above items) [6] |

|

(0.05 |

) |

|

|

(0.04 |

) |

|

|

(0.19 |

) |

|

|

(0.16 |

) |

| Adjusted

diluted earnings per share (Non-GAAP) |

$ |

1.96 |

|

|

$ |

1.40 |

|

|

$ |

4.93 |

|

|

$ |

2.97 |

|

| |

|

|

|

|

|

|

|

| Weighted

average diluted shares outstanding |

|

30,739 |

|

|

|

31,555 |

|

|

|

31,019 |

|

|

|

31,540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * Amounts may not

add due to rounding.See accompanying notes at the end of this

supplemental schedule. |

| Adjusted

Gross Profit: |

| |

Three Months Ended |

|

Three Months Ended |

|

(unaudited) |

9/28/24 |

|

Pct.** |

|

9/30/23 |

|

Pct.** |

|

Gross profit (GAAP) |

$ |

203,803 |

|

40.5 |

|

$ |

183,218 |

|

37.5 |

| Pretax

acquisition-related transaction and other costs [2] |

|

1 |

|

0.0 |

|

|

6 |

|

0.0 |

| Adjusted

gross profit (Non-GAAP) |

$ |

203,804 |

|

40.5 |

|

$ |

183,224 |

|

37.5 |

| |

|

|

|

|

|

|

|

| Net

sales |

$ |

503,773 |

|

|

|

$ |

488,186 |

|

|

| |

|

|

|

|

|

|

|

| |

Nine Months Ended |

|

Nine Months Ended |

|

(unaudited) |

9/28/24 |

|

Pct.** |

|

9/30/23 |

|

Pct.** |

| Gross

profit (GAAP) |

$ |

584,650 |

|

39.6 |

|

$ |

491,201 |

|

34.2 |

| Pretax

acquisition-related transaction and other costs [2] |

|

11 |

|

0.0 |

|

|

11,806 |

|

0.8 |

| Adjusted

gross profit (Non-GAAP) |

$ |

584,661 |

|

39.6 |

|

$ |

503,007 |

|

35.0 |

| |

|

|

|

|

|

|

|

| Net

sales |

$ |

1,475,425 |

|

|

|

$ |

1,435,492 |

|

|

| Adjusted

SG&A Expenses: |

| |

Three Months Ended |

|

Three Months Ended |

|

(unaudited) |

9/28/24 |

|

Pct.** |

|

9/30/23 |

|

Pct.** |

|

SG&A expenses (GAAP) |

$ |

124,532 |

|

|

24.7 |

|

|

$ |

119,010 |

|

|

24.4 |

|

| Pretax acquisition-related

intangible assets amortization [1] |

|

(6,173 |

) |

|

(1.2 |

) |

|

|

(5,485 |

) |

|

(1.1 |

) |

| Pretax acquisition-related

transaction and other costs [2] |

|

(395 |

) |

|

(0.1 |

) |

|

|

(459 |

) |

|

(0.1 |

) |

| Pretax fair value adjustment to

contingent consideration [4] |

|

— |

|

|

— |

|

|

|

1,000 |

|

|

0.2 |

|

| Pretax reduction in workforce

costs [5] |

|

(76 |

) |

|

(0.0 |

) |

|

|

— |

|

|

— |

|

| Adjusted SG&A expenses

(Non-GAAP) |

$ |

117,888 |

|

|

23.4 |

|

|

$ |

114,066 |

|

|

23.4 |

|

| |

|

|

|

|

|

|

|

| Net sales |

$ |

503,773 |

|

|

|

|

$ |

488,186 |

|

|

|

| |

|

|

|

|

|

|

|

| |

Nine Months Ended |

|

Nine Months Ended |

|

(unaudited) |

9/28/24 |

|

Pct.** |

|

9/30/23 |

|

Pct.** |

| SG&A expenses (GAAP) |

$ |

378,489 |

|

|

25.7 |

|

|

$ |

353,681 |

|

|

24.6 |

|

| Pretax acquisition-related

intangible assets amortization [1] |

|

(17,138 |

) |

|

(1.2 |

) |

|

|

(16,336 |

) |

|

(1.1 |

) |

| Pretax acquisition-related

transaction and other costs [2] |

|

(1,316 |

) |

|

(0.1 |

) |

|

|

(3,074 |

) |

|

(0.2 |

) |

| Executive transition services

expense [3] |

|

— |

|

|

— |

|

|

|

(1,801 |

) |

|

(0.1 |

) |

| Pretax fair value adjustment to

contingent consideration [4] |

|

— |

|

|

— |

|

|

|

13,400 |

|

|

0.9 |

|

| Pretax reduction in workforce

costs [5] |

|

(4,926 |

) |

|

(0.3 |

) |

|

|

— |

|

|

— |

|

| Adjusted SG&A expenses

(Non-GAAP) |

$ |

355,109 |

|

|

24.1 |

|

|

$ |

345,870 |

|

|

24.1 |

|

| |

|

|

|

|

|

|

|

| Net sales |

$ |

1,475,425 |

|

|

|

|

$ |

1,435,492 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| * *Percentage of

sales. Data may not add due to rounding. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

[1] – Pretax acquisition-related intangible asset amortization

results from allocating the purchase price of acquisitions to the

acquired tangible and intangible assets of the acquired business

and recognizing the cost of the intangible asset over the period of

benefit. Such costs were $6.2 million pretax (or $4.6 million after

tax) during the three months ended September 28, 2024 and

$17.1 million pretax (or $12.9 million after tax) during the nine

months ended September 28, 2024. Such costs were $5.5 million

pretax (or $4.2 million after tax) during the three months ended

September 30, 2023 and $16.3 million pretax (or $12.3 million

after tax) during the nine months ended September 30, 2023.[2]

– Pretax acquisition-related transaction and other costs include

costs incurred to complete and integrate acquisitions, accretion on

contingent consideration obligations, inventory fair value

adjustments and facility consolidation and start-up expenses.

During both the three and nine months ended September 28,

2024, we incurred charges included in cost of goods sold for

integration costs of $0.0 million pretax (or $0.0 million after

tax). During the three and nine months ended September 28,

2024, we incurred charges included in selling, general and

administrative expenses to complete and integrate acquisitions of

$0.4 million pretax (or $0.3 million after tax) and $1.3 million

pretax (or $1.0 million after tax), respectively.During the three

and nine months ended September 30, 2023, we incurred charges

included in cost of goods sold for integration costs, other

facility consolidation expenses and inventory fair value

adjustments of $0.0 million pretax (or $0.0 million after tax) and

$11.8 million pretax (or $8.9 million after tax), respectively.

During the three and nine months ended September 30, 2023, we

incurred charges included in selling, general and administrative

expenses to complete and integrate acquisitions, accretion on

contingent consideration obligations and facility consolidation and

start-up expenses of $0.5 million pretax (or $0.4 million after

tax) and $3.1 million pretax (or $2.4 million after tax),

respectively.[3] – Pretax executive transition service expenses

represents an accrual for costs required to be paid under an

agreement in connection with the planned transition of our

Executive Chairman to Non-Executive Chairman, and other

professional services rendered in connection with the execution of

the agreement. The expense was $1.8 million pretax (or $1.4 million

after tax) during the nine months ended September 30, 2023.[4]

– Fair value adjustments to contingent consideration represents the

change to our estimates of ultimate earnout payment amounts for a

previously completed acquisition based on projections of financial

performance compared to the target amounts defined in the purchase

agreement and totaled $1.0 million pretax (or $0.8 million after

tax) and $13.4 million pretax (or $10.2 million after tax) during

the three and nine months ended September 30, 2023,

respectively.[5] – Pretax reduction in workforce costs represents

costs incurred in connection with our planned workforce reduction

including severance and other payroll-related costs insurance

continuation costs, modifications of share-based compensation

awards, and other costs directly attributable to the action. During

the three and nine months ended September 28, 2024, the

expense was $0.1 million pretax (or $0.1 million after tax) and

$4.9 million pretax (or $3.7 million after tax), respectively.[6] –

Tax adjustments represent the aggregate tax effect of all non-GAAP

adjustments reflected in the table above and totaled $(1.7) million

and $(5.8) million during the three and nine months ended

September 28, 2024, respectively, and $(1.2) million and

$(4.9) million during the three and nine months ended

September 30, 2023, respectively. Such items are estimated by

applying our statutory tax rate to the pretax amount, or an actual

tax amount for discrete items. |

2024 Guidance:

The Company provides the following updated guidance ranges

related to their fiscal 2024 outlook:

| |

Year Ending 12/31/2024 |

|

(unaudited) |

Low End* |

|

High End* |

|

Diluted earnings per share (GAAP) |

$ |

6.15 |

|

|

$ |

6.25 |

|

| Pretax

acquisition-related intangible assets amortization |

|

0.73 |

|

|

|

0.73 |

|

| Pretax

acquisition transaction and other costs |

|

0.05 |

|

|

|

0.05 |

|

| Pretax

reduction in workforce costs |

|

0.15 |

|

|

|

0.15 |

|

| Tax

adjustment (related to above items) |

|

(0.23 |

) |

|

|

(0.23 |

) |

| Adjusted

diluted earnings per share (Non-GAAP) |

$ |

6.85 |

|

|

$ |

6.95 |

|

| |

|

|

|

| Weighted

average diluted shares outstanding |

|

31,000 |

|

|

|

31,000 |

|

|

|

|

|

|

|

|

|

|

| *Data

may not add due to rounding. |

|

|

|

|

|

|

|

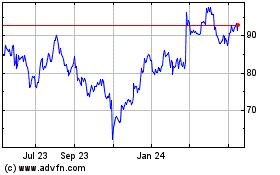

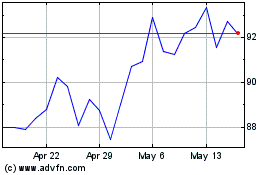

Dorman Products (NASDAQ:DORM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dorman Products (NASDAQ:DORM)

Historical Stock Chart

From Nov 2023 to Nov 2024