false

2023-09-28

0000720875

Dynatronics Corp.

0000720875

2023-09-28

2023-09-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 28, 2023

DYNATRONICS CORP.

(Exact name of registrant as specified in its charter)

|

Utah

|

000-12697

|

87-0398434

|

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

1200 Trapp Rd, Eagan

Minnesota, Utah, United States

55121

(Address of principal executive offices) (ZIP Code)

Registrant’s telephone number, including area code: (801) 568-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

|

Common Stock

|

|

DYNT

|

|

NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On September 28, 2023, Dynatronics Corporation ("Company") issued a press release reporting, among other things, financial results relating to the quarter and fiscal year ended June 30, 2023. Also, as previously announced by a press release issued on September 14, 2023, on September 28, 2023, the Company held a conference call in which executives of the Company reviewed the fourth quarter and fiscal year 2023 results. An audio replay of the call will be available until Midnight on October 5, 2023, by dialing 855-669-9658 (U.S./Canada callers) or 604-674-8052 (international callers), using replay access code 3039. The full text of the press release is furnished herewith as Exhibit 99.1.

The information under this Item 2.02 and in Exhibit 99.1, is being "furnished" and is not being "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 and is not to be incorporated by reference into any filing of the registrant under the Securities Act of 1933, whether made before or after the date hereof, regardless of any general incorporation language in any such filing, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: September 28, 2023 |

DYNATRONICS CORPORATION |

| |

|

|

| |

By: |

/s/John Krier |

| |

Name: |

John Krier |

| |

Title: |

Chief Executive Officer |

Dynatronics Corporation Reports Fourth Quarter and Fiscal Year 2023 Financial Results and Update on CEO Succession Plan

EAGAN, MN / ACCESSWIRE / September 28, 2023 / Dynatronics Corporation (NASDAQ:DYNT) ("Dynatronics" or the "Company"), a leading manufacturer of athletic training, physical therapy, and rehabilitation products, today reported financial results for its fourth quarter and fiscal year ended June 30, 2023, and provided additional details on the previously announced CEO succession plan.

CEO Succession Plan

Effective October 1, 2023, Brian Baker will assume the roles of Chief Executive Officer and Board Member as part of the Company's executive transition plan announced in May 2023. John Krier, the Company's current Chief Executive Officer and Chief Financial Officer will remain as an executive consultant and Interim Chief Financial Officer while the Company continues the search for a permanent Chief Financial Officer.

Key Financial Highlights

Q4 FY '23 Financial Highlights

Note: All financials referenced in this release are in conformity with U.S. Generally Accepted Accounting Principles ("GAAP") and comparisons in this release are to the same period in the prior year unless otherwise noted.

- Total net sales of $8.4 million.

- Gross profit margin of 14.7%.

- Net loss of $2.4 million.

FY '23 Financial Highlights

- Total net sales of $40.6 million.

- Gross profit margin of 25.0%.

- Net loss of $5.0 million.

Notable Balance Sheet Highlights

- Net cash of $0.6 million.

- As of September 15, 2023, $1.8 million drawn, with $2.6 million available on previously announced working capital asset-based line of credit established on August 1, 2023.

- Proceeds from line of credit used for $2.0 million reduction in accounts payable as of September 15, 2023, compared to June 30, 2023.

Guidance for FY '24

Dynatronics reiterates its previous net sales guidance for FY '24 of $34 million to $37 million. The Company expects the distribution of net sales across the quarters in FY '24 to align with historical trends, highest in the first quarter, lower in the second and third quarters, with a bounce back in the fourth quarter.

The Company is continuing its recent practice of not providing gross margin guidance given the recent reductions in revenue and operating costs.

Selling, general, and administrative expenses are anticipated to be 29% to 33% of net sales in FY '24.

The Company's financial guidance for FY '24 is subject to the risks identified in its safe harbor notification below. The Company continues to expect volatility due to the challenges related to the broader economic environment, including competitive pressures, inflationary pressures, supply chain disruptions, extended handling times and delays or disruption in procedure volume. Dynatronics also expects some ongoing volatility from the Company's business optimization.

Fiscal Year 2024 Priorities

The Company also reiterates its goals to strengthen customer relationships, while improving operating profitability and financial flexibility.

Conference Call FY '23 Q4 and Year End Results

The Company will hold a conference call, consisting of prepared remarks by management, and a question-and-answer session with analysts, at 8:00 AM ET on Thursday, September 28, 2023, to review its fourth quarter and fiscal year 2023 results.

Interested persons may access the live conference call by dialing 800-319-4610 (U.S./Canada callers) or 604-638-5340 (international callers). It is recommended that participants call or login 10 minutes ahead of the scheduled start time to ensure proper connection. An audio replay will be available one hour after the live call until Midnight on October 5, 2023, by dialing 855-669-9658 (U.S./Canada callers) or 604-674-8052 (international callers), using replay access code 3039.

About Dynatronics Corporation

Dynatronics is a leading medical device company committed to providing high-quality restorative products designed to accelerate achieving optimal health. The Company designs, manufactures, and sells a broad range of products for clinical use in physical therapy, rehabilitation, pain management, and athletic training. Through its distribution channels, Dynatronics markets and sells to orthopedists, physical therapists, chiropractors, athletic trainers, sports medicine practitioners, clinics, and hospitals. The Company's products are marketed under a portfolio of high-quality, well-known industry brands including Bird & Cronin®, Solaris™, Hausmann®, Physician's Choice®, and PROTEAM™, among others. More information is available at www.dynatronics.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Those statements include references to the Company's expectations and similar statements. Such forward-looking statements reflect the views of management at the time such statements are made. These statements include our statements regarding the Company's planned management transition, expected overall performance, expectations regarding net sales, distribution of net sales, and selling general and administrative costs in fiscal year 2024, and uncertainties related to the broader economic environment, including higher raw material, delivery and shipment costs, supply chain disruptions, extended handling times and delays or disruption in procedure volume and volatility resulting from continued execution of the Company's business optimization strategy.. These forward-looking statements are subject to a number of risks, uncertainties, estimates, and assumptions that may cause actual results to differ materially from current expectations. The contents of this release should be considered in conjunction with the risk factors, warnings, and cautionary statements that are contained in the Company's annual, quarterly, and other reports filed with the Securities and Exchange Commission. Dynatronics does not undertake to update its forward-looking statements, whether as a result of new information, future events, or otherwise.

Summary Financial Results

The following is a summary of operating results for the periods ended June 30, 2023 and 2022, the balance sheet highlights at June 30, 2023 and June 30, 2022 and cash flow for periods ended June 30, 2023 and 2022.

Summary Selected Financial Data

Statements of Operations Highlights

In thousands, except share and per share amounts

| |

|

Quarter Ended |

|

|

|

Year Ended |

|

| |

|

June 30 |

|

|

|

June 30 |

|

| |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net sales |

$ |

8,438 |

|

|

$ |

11,191 |

|

|

$ |

40,609 |

|

|

$ |

44,338 |

|

| Cost of sales |

|

7,201 |

|

|

|

8,574 |

|

|

|

30,459 |

|

|

|

33,665 |

|

| Gross Profit |

|

1,237 |

|

|

|

2,617 |

|

|

|

10,150 |

|

|

|

10,673 |

|

| |

|

14.7% |

|

|

|

23.4% |

|

|

|

25.0% |

|

|

|

24.1% |

|

| Selling, general and administrative expenses |

|

3,593 |

|

|

|

4,102 |

|

|

|

15,002 |

|

|

|

15,430 |

|

| Other (expense) income, net |

|

(25 |

) |

|

|

(78 |

) |

|

|

(121 |

) |

|

|

764 |

|

| Net income (loss) |

$ |

(2,381 |

) |

|

$ |

(1,563 |

) |

|

$ |

(4,973 |

) |

|

$ |

(3,993 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock dividend, in common stock, issued or to be issued |

|

(172 |

) |

|

|

(182 |

) |

|

|

(691 |

) |

|

|

(733 |

) |

| Net income (loss) attributable to common stockholders |

$ |

(2,553 |

) |

|

$ |

(1,745 |

) |

|

$ |

(5,664 |

) |

|

$ |

(4,726 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to common stockholders per common share - basic and diluted |

$ |

(0.63 |

) |

|

$ |

(0.48 |

) |

|

$ |

(1.46 |

) |

|

$ |

(1.32 |

) |

| Weighted-average common shares outstanding - basic and diluted |

|

4,039,618 |

|

|

|

3,637,449 |

|

|

|

3,870,670 |

|

|

|

3,570,655 |

|

Balance Sheet Highlights

In thousands

| |

|

June 30, 2023 |

|

|

|

June 30, 2022 |

|

| Cash and cash equivalents and restricted cash |

$ |

553 |

|

|

$ |

701 |

|

| Trade accounts receivable, net |

|

3,722 |

|

|

|

5,416 |

|

| Inventories, net |

|

7,403 |

|

|

|

12,071 |

|

| Prepaids & other |

|

741 |

|

|

|

1,038 |

|

| Total current assets |

|

12,419 |

|

|

|

19,226 |

|

| |

|

|

|

|

|

|

|

| Non-current assets |

|

17,644 |

|

|

|

16,208 |

|

| Total assets |

$ |

30,063 |

|

|

$ |

35,434 |

|

| |

|

|

|

|

|

|

|

| Accounts payable |

$ |

4,530 |

|

|

$ |

6,169 |

|

| Accrued payroll and benefits expense |

|

878 |

|

|

|

1,360 |

|

| Accrued expenses |

|

891 |

|

|

|

862 |

|

| Other current liabilities |

|

1,642 |

|

|

|

1,544 |

|

| Line of credit |

|

- |

|

|

|

- |

|

| Total current liabilities |

|

7,941 |

|

|

|

9,935 |

|

| |

|

|

|

|

|

|

|

| Non-current liabilities |

|

5,265 |

|

|

|

3,800 |

|

| Total liabilities |

|

13,206 |

|

|

|

13,735 |

|

| |

|

|

|

|

|

|

|

| Stockholders' equity |

|

16,857 |

|

|

|

21,699 |

|

| Total liabilities and stockholders' equity |

$ |

30,063 |

|

|

$ |

35,434 |

|

Cash Flow Highlights

In thousands

| |

|

Quarter Ended |

|

|

|

Twelve Months Ended |

|

| |

|

June 30 |

|

|

|

June 30 |

|

| |

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net loss |

$ |

(2,381 |

) |

|

$ |

(1,563 |

) |

|

$ |

(4,973 |

) |

|

$ |

(3,993 |

) |

| Depreciation and amortization |

|

341 |

|

|

|

313 |

|

|

|

1,349 |

|

|

|

1,435 |

|

| Stock-based compensation |

|

22 |

|

|

|

29 |

|

|

|

131 |

|

|

|

178 |

|

| (Gain) loss on sale of property and equipment |

|

- |

|

|

|

23 |

|

|

|

- |

|

|

|

24 |

|

| Receivables |

|

645 |

|

|

|

(290 |

) |

|

|

1,695 |

|

|

|

227 |

|

| Inventory |

|

2,300 |

|

|

|

(468 |

) |

|

|

4,668 |

|

|

|

(5,573 |

) |

| Prepaid and other assets |

|

(226 |

) |

|

|

512 |

|

|

|

(159 |

) |

|

|

1,463 |

|

| Accounts payable, accrued expenses, and other liabilities |

|

(734 |

) |

|

|

(181 |

) |

|

|

(2,339 |

) |

|

|

1,355 |

|

| Net cash provided by (used in) operating activities |

|

(33 |

) |

|

|

(1,625 |

) |

|

|

372 |

|

|

|

(4,884 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

(10 |

) |

|

|

(57 |

) |

|

|

(187 |

) |

|

|

(318 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Payments on non-current liabilities |

|

(74 |

) |

|

|

(90 |

) |

|

|

(333 |

) |

|

|

(350 |

) |

| Proceeds from issuance of common stock, net |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Net cash used in financing activities |

|

(74 |

) |

|

|

(90 |

) |

|

|

(333 |

) |

|

|

(350 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net change in cash and cash equivalents |

|

(117 |

) |

|

|

(1,772 |

) |

|

|

(148 |

) |

|

|

(5,552 |

) |

| Cash and cash equivalents at beginning of the period |

|

670 |

|

|

|

2,473 |

|

|

|

701 |

|

|

|

6,253 |

|

| Cash and cash equivalents at end of the period |

$ |

553 |

|

|

$ |

701 |

|

|

$ |

553 |

|

|

$ |

701 |

|

Contact:

Dynatronics Corporation

Investor Relations

ir@dynatronics.com

For additional information, please visit: www.dynatronics.com

Connect with Dynatronics on LinkedIn

SOURCE: Dynatronics Corporation

v3.23.3

Document and Entity Information Document

|

Sep. 28, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Creation Date |

Sep. 28, 2023

|

| Document Period End Date |

Sep. 28, 2023

|

| Amendment Flag |

false

|

| Entity Registrant Name |

Dynatronics Corp.

|

| Entity Address, Address Line One |

1200 Trapp Rd, Eagan

|

| Entity Address, City or Town |

Minnesota

|

| Entity Address, State or Province |

UT

|

| Entity Address, Country |

US

|

| Entity Address, Postal Zip Code |

55121

|

| Entity Incorporation, State Country Name |

UT

|

| City Area Code |

801

|

| Local Phone Number |

568-7000

|

| Entity File Number |

000-12697

|

| Entity Central Index Key |

0000720875

|

| Entity Emerging Growth Company |

false

|

| Entity Tax Identification Number |

87-0398434

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

DYNT

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date the document was made available and submitted, in YYYY-MM-DD format. The date of submission, date of acceptance by the recipient, and the document effective date are all potentially different.

| Name: |

dei_DocumentCreationDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

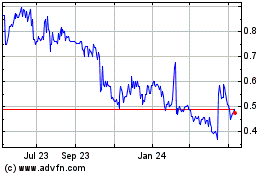

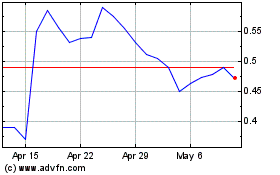

Dynatronics (NASDAQ:DYNT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dynatronics (NASDAQ:DYNT)

Historical Stock Chart

From Nov 2023 to Nov 2024