electroCore, Inc. (Nasdaq: ECOR), a commercial-stage bioelectronic

medicine company and wellness company, today announced third

quarter 2024 financial results.

Recent Highlights

- Eighth consecutive record quarterly revenue of $6.6 million, an

increase of 45% over third quarter 2023

- Year to date, revenue of $18.1 million; an increase of

67% over the first nine months of 2023

- Sales of Rx gammaCore™ and Truvaga™ before variable

TAC-STIM™ sales increased 63% over the third quarter 2023

- Net loss of $2.5 million, a reduction of 38% over third quarter

2023

- Net cash used in operating activities through the nine months

ended September 30, 2024 of $5.7 million, a decrease of

51% over the nine months ended September 30, 2023

“Demand for our Rx gammaCore™ and Truvaga™

solutions continue to drive robust growth,” commented Dan

Goldberger, Chief Executive Officer of electroCore. “Outside of

TAC-STIM sales which are inherently variable and incremental to our

operations, our business continues showing consistent growth on a

quarterly and year to date basis. As we continue to scale, we

will generate incremental revenues that will benefit from operating

leverage helping us to reach positive cash flow and ultimately

drive earnings.”

Third Quarter 2024 Financial

Results

For the quarter ended September 30,

2024, electroCore reported net sales of $6.6 million

compared to $4.5 million during the same period of 2023,

which represents an approximate 45% increase over the

prior year. The increase of $2.0 million is primarily due

to an increase in net sales across Rx gammaCore and

Truvaga channels.

| (in thousands) |

|

Three months ended September 30, |

|

|

% Change |

|

|

Nine months ended September 30, |

|

|

% Change |

|

|

Channel |

|

2024 |

|

2023 |

|

|

|

|

|

2024 |

|

2023 |

|

|

|

|

|

Rx gammaCore™ – VA/DoD |

|

$ |

4,777 |

|

$ |

2,737 |

|

|

75 |

% |

|

|

$ |

13,224 |

|

$ |

6,523 |

|

|

103 |

% |

|

| Rx gammaCore – U.S.

Commercial |

|

|

441 |

|

|

439 |

|

|

— |

|

|

|

|

1,350 |

|

|

1,314 |

|

|

3 |

% |

|

| Outside the United States |

|

|

485 |

|

|

465 |

|

|

4 |

% |

|

|

|

1,398 |

|

|

1,299 |

|

|

8 |

% |

|

| Truvaga™ |

|

|

657 |

|

|

266 |

|

|

147 |

% |

|

|

|

1,614 |

|

|

703 |

|

|

130 |

% |

|

| Total Before

TAC-STIM™ |

|

|

6,360 |

|

|

3,907 |

|

|

63 |

% |

|

|

|

17,586 |

|

|

9,839 |

|

|

79 |

% |

|

| TAC-STIM |

|

|

194 |

|

|

601 |

|

|

-68 |

% |

|

|

|

550 |

|

|

1,000 |

|

|

-45 |

% |

|

| Total

Revenue |

|

$ |

6,554 |

|

$ |

4,508 |

|

|

45 |

% |

|

|

$ |

18,136 |

|

$ |

10,839 |

|

|

67 |

% |

|

Gross profit for the third quarter of 2024 was

$5.5 million as compared to $3.8 million for the third quarter of

2023. Gross margin was 84% for the third quarter of 2024 as

compared to 85% in the third quarter of 2023.

Total operating expenses in the third quarter of

2024 were approximately $8.1 million as compared to $8.0 million in

the third quarter of 2023.

Research and development expense in the third

quarter of 2024 was $0.5 million as compared to $1.2 million in the

third quarter of 2023. This decrease was primarily due to a

significant reduction in investments associated with the

development of Truvaga Plus.

Selling, general and administrative expense in

the third quarter of 2024 was $7.6 million as compared to $6.7

million in the third quarter of 2023. This increase was primarily

due to greater variable selling and marketing costs consistent with

an increase in sales and recognition of lease expense associated

with the expansion of the Company's facility in Rockaway, New

Jersey.

GAAP net loss in the third quarter of 2024 was

$2.5 million compared to $4.0 million in the third quarter of 2023.

This significant improvement was primarily due to the increase in

net sales to $6.6 million for the third quarter of 2024 as compared

to $4.5 million during the same period in 2023. Net loss per share

in the third quarter of 2024 was $0.31 as compared to a $0.68 net

loss per share in the third quarter of 2023.

Adjusted EBITDA net loss in the third quarter of

2024 was $2.1 million as compared to adjusted EBITDA net loss of

$3.0 million in the third quarter of 2023. These improved results

are also primarily due to the increase in third quarter of 2024 net

sales as compared to the same period in 2023.

The Company defines adjusted EBITDA net loss as

GAAP net loss, adjusted to exclude non-operating gains/losses,

depreciation and amortization, stock-compensation expense,

inventory reserve charges, severance and other related charges,

legal fees associated with stockholders’ litigation, and benefit

from income taxes. A reconciliation of GAAP net loss to Non-GAAP

adjusted EBITDA net loss has been provided in the financial

statement tables included in this press release.

Cash, cash equivalents, marketable securities

and restricted cash at September 30, 2024 totaled approximately

$13.2 million, as compared to approximately $10.6 million as of

December 31, 2023.

Webcast and Conference Call

Information electroCore’s management team

will host a conference call today, November 13, 2024,

beginning at 4:30 PM EST. Investors interested in listening to

the conference call, or webcast may dial 877-407-8835 for

domestic callers or 201-689-8779 for international callers,

using Conference ID: 13744121, or click through the following

link:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=qH6ud5sW

An archived webcast of the event will be

available on the “Investors” section of the company’s website

at: www.electrocore.com.

About electroCore, Inc.

electroCore, Inc. is a commercial stage

bioelectronic medicine and wellness company dedicated to improving

health through its non-invasive vagus nerve stimulation (“nVNS”)

technology platform. Our focus is the commercialization of medical

devices for the management and treatment of certain medical

conditions and consumer product offerings utilizing nVNS to promote

general wellbeing and human performance in the United States and

select overseas markets.

For more information, visit

www.electrocore.com.

Forward-Looking Statements

This press release and other written and oral

statements made by representatives of electroCore may contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements include, but are not limited to, statements about,

electroCore’s business prospects and clinical and product

development plans; its pipeline or potential markets for its

technologies; the timing, outcome and impact of regulatory,

clinical and commercial developments; business prospects around its

prescription gammaCore product, general

wellness Truvaga and TAC-STIM products, and other

potential new products and markets, and other statements that are

not historical in nature, particularly those that utilize

terminology such as “anticipates,” “will,”

“expects,” “believes,” “intends,” and other words of

similar meaning, derivations of such words and the use of future

dates. Actual results could differ from those projected in any

forward-looking statements due to numerous factors. Such factors

include, among others, the ability to raise the additional funding

needed to continue to pursue electroCore’s business and product

development plans, the inherent uncertainties associated with

developing new products or technologies, the ability to

commercialize gammaCore, TAC-STIM, and Truvaga, electroCore’s

results of operations and financial performance, inflation and

currency fluctuations, and any expectations electroCore may have

with respect thereto, competition in the industry in which

electroCore operates and overall economic and market conditions.

Any forward-looking statements are made as of the date of this

press release, and electroCore assumes no obligation to update the

forward-looking statements or to update the reasons why actual

results could differ from those projected in the forward-looking

statements, except as required by law. Investors should consult all

of the information set forth herein and should also refer to the

risk factor disclosure set forth in the reports and other documents

electroCore files with the SEC available at www.sec.gov.

Contact:

ECOR Investor Relations(973)

302-9253investors@electrocore.com

|

electroCore, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(unaudited) |

|

(in thousands, except per share data) |

|

|

| |

|

Three months ended |

|

Nine months ended |

| |

|

September 30, |

|

September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net sales |

|

$ |

6,554 |

|

|

$ |

4,508 |

|

|

$ |

18,136 |

|

|

$ |

10,839 |

|

| Cost of goods sold |

|

|

1,065 |

|

|

|

661 |

|

|

|

2,791 |

|

|

|

1,704 |

|

| Gross profit |

|

|

5,489 |

|

|

|

3,847 |

|

|

|

15,345 |

|

|

|

9,135 |

|

| Gross profit

margin |

|

|

84 |

% |

|

|

85 |

% |

|

|

85 |

% |

|

|

84 |

% |

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

521 |

|

|

|

1,249 |

|

|

|

1,555 |

|

|

|

4,213 |

|

| Selling, general and

administrative |

|

|

7,619 |

|

|

|

6,724 |

|

|

|

22,881 |

|

|

|

20,233 |

|

|

Total operating expenses |

|

|

8,140 |

|

|

|

7,973 |

|

|

|

24,436 |

|

|

|

24,446 |

|

|

Loss from operations |

|

|

(2,651 |

) |

|

|

(4,126 |

) |

|

|

(9,091 |

) |

|

|

(15,311 |

) |

| Other (income) expense |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and other income |

|

|

(159 |

) |

|

|

(94 |

) |

|

|

(439 |

) |

|

|

(298 |

) |

| Other expense |

|

|

5 |

|

|

|

— |

|

|

|

128 |

|

|

|

— |

|

| Total Other expense

(income) |

|

|

(154 |

) |

|

|

(94 |

) |

|

|

(311 |

) |

|

|

(298 |

) |

| Loss before income taxes |

|

|

(2,497 |

) |

|

|

(4,032 |

) |

|

|

(8,780 |

) |

|

|

(15,013 |

) |

|

Benefit from income taxes |

|

|

— |

|

|

|

— |

|

|

|

122 |

|

|

|

211 |

|

| Net loss |

|

$ |

(2,497 |

) |

|

$ |

(4,032 |

) |

|

$ |

(8,658 |

) |

|

$ |

(14,802 |

) |

| Net loss per share of common

stock - Basic and Diluted |

|

$ |

(0.31 |

) |

|

$ |

(0.68 |

) |

|

$ |

(1.19 |

) |

|

$ |

(2.87 |

) |

| Weighted average common shares

outstanding - Basic and Diluted |

|

|

8,093 |

|

|

|

5,945 |

|

|

|

7,255 |

|

|

|

5,149 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

electroCore, Inc. |

|

Condensed Consolidated Balance Sheet

Information |

|

(unaudited) |

|

(in thousands) |

|

|

| |

|

September 30, 2024 |

|

|

December 31, 2023 |

|

|

Cash and cash equivalents |

|

$ |

4,929 |

|

|

$ |

10,331 |

|

| Restricted cash |

|

$ |

250 |

|

|

$ |

250 |

|

| Marketable securities |

|

$ |

8,018 |

|

|

$ |

— |

|

| Total assets |

|

$ |

21,045 |

|

|

$ |

16,102 |

|

| Current liabilities |

|

$ |

7,912 |

|

|

$ |

8,123 |

|

| Total liabilities |

|

$ |

11,590 |

|

|

$ |

8,660 |

|

| Total stockholders'

equity |

|

$ |

9,455 |

|

|

$ |

7,442 |

|

(Unaudited) Use of Non-GAAP Financial

Measure

The Company is presenting adjusted EBITDA net

loss because it believes this measure is a useful indicator of its

operating performance. Management uses this non-GAAP measure

principally as a measure of the Company’s core operating

performance and believes that this measure is useful to investors

because it is frequently used by the financial community,

investors, and other interested parties to evaluate companies in

the Company’s industry. The Company also believes that this measure

is useful to its management and investors as a measure of

comparative operating performance from period to period.

Additionally, the Company believes its use of non-GAAP adjusted

EBITDA net loss from operations facilitates management’s internal

comparisons to historical operating results by factoring out

potential differences caused by gains and charges not related to

its regular, ongoing business, including, without limitation,

non-cash charges and certain large and unpredictable charges such

as restructuring expenses.

The Company defines adjusted EBITDA net loss as

GAAP net loss, adjusting to exclude

non-operating gains/losses, depreciation and amortization,

stock-compensation expense, inventory reserve charges, severance

and other related charges, legal fees associated with stockholders’

litigation, and benefit from income taxes. A reconciliation of GAAP

net loss to Non-GAAP adjusted EBITDA net loss is provided in the

financial statement table below.

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| (in thousands) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

GAAP net loss |

$ |

(2,497 |

) |

|

$ |

(4,032 |

) |

|

$ |

(8,658 |

) |

|

$ |

(14,802 |

) |

| Depreciation and

amortization |

|

185 |

|

|

|

291 |

|

|

|

592 |

|

|

|

735 |

|

| Stock-based compensation |

|

400 |

|

|

|

543 |

|

|

|

1,356 |

|

|

|

1,298 |

|

| Inventory reserve charge |

|

— |

|

|

|

193 |

|

|

|

— |

|

|

|

258 |

|

| Severance and other related

charges |

|

— |

|

|

|

113 |

|

|

|

— |

|

|

|

445 |

|

| Legal fees associated with

stockholders' litigation |

|

2 |

|

|

|

7 |

|

|

|

73 |

|

|

|

42 |

|

|

Interest and other (income) expense |

|

(154 |

) |

|

|

(94 |

) |

|

|

(311 |

) |

|

|

(298 |

) |

| Benefit

from income taxes |

|

— |

|

|

|

— |

|

|

|

(122 |

) |

|

|

(211 |

) |

| Adjusted EBITDA net

loss |

$ |

(2,064 |

) |

|

$ |

(2,979 |

) |

|

$ |

(7,070 |

) |

|

$ |

(12,533 |

) |

The Company’s use of a non-GAAP measure has

limitations as an analytical tool, and you should not consider it

in isolation or as a substitute for analysis of its results as

reported under GAAP. Some of these limitations are: (i) the

non-GAAP measure does not reflect interest or tax payments that may

represent a reduction in cash available; (ii) although depreciation

and amortization are non-cash charges, the assets being depreciated

and amortized may have to be replaced in the future, and the

non-GAAP measure does not reflect cash capital expenditure

requirements for such replacements or for new capital expenditure

requirements; (iii) the non-GAAP measure does not reflect the

potentially dilutive impact of equity-based compensation; and (iv)

the non-GAAP measure does not reflect changes in, or cash

requirements for working capital needs; other companies, including

companies in electroCore’s industry, may calculate adjusted EBITDA

net loss differently, effectively reducing its usefulness as a

comparative measure.

Because of these and other limitations, you

should consider the non-GAAP measure together with other GAAP-based

financial performance measures, including various cash flow

metrics, net loss, and other GAAP results. A reconciliation of GAAP

net loss to non-GAAP adjusted EBITDA net loss has been provided in

the preceding financial statements table of this press release.

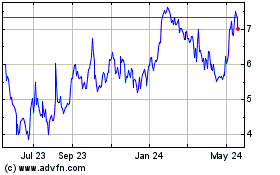

electroCore (NASDAQ:ECOR)

Historical Stock Chart

From Oct 2024 to Nov 2024

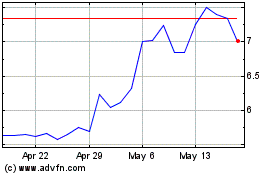

electroCore (NASDAQ:ECOR)

Historical Stock Chart

From Nov 2023 to Nov 2024