Filed Pursuant to Rule 424(b)(5)

Registration No. 333-262223

PROSPECTUS SUPPLEMENT

(To Prospectus dated January 25, 2022)

Up to $20,000,000

Common Stock

electroCore, Inc. (the “Company”

or “we”) entered into an At The Market Offering Agreement (the “Agreement”), dated November 29, 2024, with H.C.

Wainwright & Co., LLC (“Wainwright”), relating to shares of our common stock, $0.001 par value per share, offered by this

prospectus supplement and the accompanying prospectus. In accordance with the terms of the Agreement, we may offer and sell shares of

our common stock having an aggregate offering price of not more than $20,000,000.

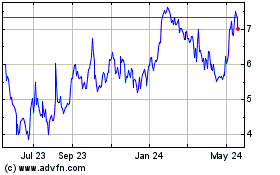

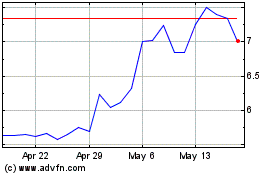

Our common stock is listed

on The Nasdaq Capital Market under the symbol “ECOR.” The last reported sale price of our common stock on November 27, 2024

was $12.25 per share.

Upon our delivery of a placement

notice and subject to the terms and conditions of the Agreement, Wainwright may sell shares of our common stock by methods deemed to be

an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or the

Securities Act. Wainwright will act as sales agent using its commercially reasonable efforts consistent with its normal trading and sales

practices on mutually agreed terms between Wainwright and us. There is no arrangement for funds to be received in any escrow, trust or

similar arrangement.

Wainwright will be entitled

to compensation at a fixed commission rate of 3.0% of the gross proceeds of each sale of shares of our common stock. In connection with

the sale of our shares of common stock on our behalf, Wainwright will be deemed to be an “underwriter” within the meaning

of the Securities Act and the compensation of Wainwright will be deemed to be underwriting commissions or discounts. We have also agreed

to provide indemnification and contribution to Wainwright with respect to certain liabilities, including liabilities under the Securities

Act.

As of the date hereof,

the aggregate market value of our common stock held by our non-affiliates (“public float”), as calculated pursuant to the

rules of the Securities and Exchange Commission (the “SEC”), was approximately $74.37 million, based upon 6,554,591 shares

of our outstanding common stock held by non-affiliates at the per share price of $13.60, the closing sale price of our common stock on

the Nasdaq Capital Market on November 14, 2024. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities

registered on the registration statement of which this prospectus is a part in a public primary offering with a value exceeding more than

one-third of our public float in any 12-month period so long as our public float remains below $75.0 million. As of the date hereof, we

have offered approximately $1.46 million in securities pursuant to General Instruction I.B.6 of Form S-3 during the 12 calendar months

prior to and including the date of this prospectus.

Investing in our securities

involves a high degree of risk. See “Risk Factors,” beginning on page S-6 of this prospectus supplement, as well as the documents

incorporated by reference in this prospectus supplement, for a discussion of the factors you should carefully consider before deciding

to purchase our securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

H.C. Wainwright & Co.

The date of this prospectus supplement is

November 29, 2024

____________________________________________________________________________________________

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

| ABOUT THIS PROSPECTUS SUPPLEMENT |

S-1 |

| |

|

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS |

S-2 |

| |

|

| PROSPECTUS SUPPLEMENT SUMMARY |

S-3 |

| |

|

| THE OFFERING |

S-5 |

| |

|

| RISK FACTORS |

S-6 |

| |

|

| USE OF PROCEEDS |

S-8 |

| |

|

| PLAN OF DISTRIBUTION |

S-8 |

| |

|

| LEGAL MATTERS |

S-9 |

| |

|

| EXPERTS |

S-9 |

| |

|

| INCORPORATION OF CERTAIN INFORMATION BY REFERENCE |

S-11 |

PROSPECTUS

| ABOUT THIS PROSPECTUS |

1 |

| |

|

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS |

1 |

| |

|

| ABOUT THE COMPANY |

2 |

| |

|

| RISK FACTORS |

2 |

| |

|

| USE OF PROCEEDS |

3 |

| |

|

| RATIO OF EARNINGS TO FIXED CHARGES |

4 |

| |

|

| PLAN OF DISTRIBUTION |

4 |

| |

|

| DESCRIPTION OF DEBT SECURITIES |

5 |

| |

|

| DESCRIPTION OF PREFERRED STOCK |

14 |

| |

|

| DESCRIPTION OF CAPITAL STOCK |

16 |

| |

|

| DESCRIPTION OF WARRANTS |

19 |

| |

|

| DESCRIPTION OF RIGHTS |

21 |

| |

|

| DESCRIPTION OF UNITS |

22 |

| |

|

| EXPERTS |

23 |

| |

|

| LEGAL MATTERS |

24 |

| |

|

| WHERE YOU CAN FIND MORE INFORMATION |

24 |

| |

|

| INFORMATION INCORPORATED BY REFERENCE |

24 |

About this Prospectus

Supplement

This document is in two parts.

The first part is the prospectus supplement, including the documents incorporated by reference, which describes the specific terms of

this offering. The second part, the accompanying prospectus dated January 25, 2022, including the documents incorporated by reference,

provides more general information. Before you invest, you should carefully read this prospectus supplement, the accompanying prospectus,

all information incorporated by reference herein and therein. These documents contain information you should consider when making your

investment decision. This prospectus supplement may add, update or change information contained in the accompanying prospectus. To the

extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained

in the accompanying prospectus or any document incorporated by reference therein filed prior to the date of this prospectus supplement,

on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent

with a statement in another document having a later date - for example, a document filed after the date of this prospectus supplement

and incorporated by reference in this prospectus supplement and the accompanying prospectus - the statement in the document having the

later date modifies or supersedes the earlier statement.

You should rely only on the

information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and in any free writing

prospectuses we may provide to you in connection with this offering. We have not, and Wainwright has not, authorized any other person

to provide you with any information that is different. If anyone provides you with different or inconsistent information, you should not

rely on it. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales

are permitted. The distribution of this prospectus supplement and the offering of the common stock in certain jurisdictions may be restricted

by law. Persons outside the United States who come into possession of this prospectus supplement must inform themselves about, and observe

any restrictions relating to, the offering of the common stock and the distribution of this prospectus supplement outside the United States.

This prospectus supplement does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer

to buy, any securities offered by this prospectus supplement by any person in any jurisdiction in which it is unlawful for such person

to make such an offer or solicitation.

We further note that the

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated

by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Special Note Regarding

Forward-Looking Statements

This prospectus supplement

and certain information incorporated herein by reference contains forward-looking statements that involve risks and uncertainties. Our

actual results could differ materially from those discussed in the forward-looking statements. The statements contained in this prospectus

supplement that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). Forward-looking statements are often identified by the use of words such as, but not limited to, “anticipate,”

“believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “plan,” “project,” “seek,” “should,” “strategy,” “target,”

“will,” “would” and similar expressions or variations intended to identify forward-looking statements. These statements

are based on the beliefs and assumptions of our management based on information currently available to management. Such forward-looking

statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events

to differ materially from future results expressed or implied by such forward-looking statements.

Factors that could cause

or contribute to such differences include, but are not limited to, those included in this prospectus supplement, the accompanying prospectus

and the documents incorporated by reference herein and therein, as well as those contained in our Annual Report on Form 10-K for the year

ended December 31, 2023, and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024 and September 30,

2024, including those described under “Risk Factors” herein and therein. Other risks may be described from time to time in

our filings made under the securities laws, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports

on Form 8-K. There may be additional risks, uncertainties and factors that we do not currently view as material or that are not known.

The forward-looking statements contained in this document are made only as of the date of this document. Except as required by law, we

undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise,

as well as those described elsewhere in this prospectus supplement and accompanying prospectus, and other factors that we may publicly

disclose from time to time. Furthermore, such forward-looking statements speak only as of the date made.

Prospectus Supplement

Summary

This summary highlights

selected information about us, this offering and information appearing elsewhere in this prospectus supplement and the accompanying prospectus

and in the documents we incorporate by reference. This summary is not complete and does not contain all the information you should consider

before investing in our common stock pursuant to this prospectus supplement and the accompanying prospectus. Before making an investment

decision, to fully understand this offering and its consequences to you, you should carefully read this entire prospectus supplement

and the accompanying prospectus, including “Risk Factors” beginning on page S-6 of this prospectus supplement and the financial

statements and related notes and the other information that we incorporated by reference herein, including our Annual Reports on Form

10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we file from time to time.

Unless the context otherwise

requires, all references in this prospectus supplement and the accompanying prospectus to “electroCore,” “we,”

“us,” “our,” “the Company” or similar words refer to electroCore, Inc., together with our consolidated

subsidiaries.

Overview

We are a commercial stage bioelectronic medicine

and general wellness company dedicated to improving health and quality of life through our proprietary non-invasive vagus nerve stimulation

(“nVNS”) technology platform.

nVNS modulates neurotransmitters through its effects

on both the peripheral and central nervous systems. Our nVNS treatment is delivered through a proprietary high-frequency burst waveform

that safely and comfortably passes through the skin and stimulates therapeutically relevant fibers in the vagus nerve. Various scientific

publications suggest that nVNS works through a variety of mechanistic pathways including the modulation of neurotransmitters.

Historically, vagus nerve stimulation or VNS, required

an invasive surgical procedure to implant a costly medical device. This generally limited VNS from being used by anyone other than the

most severe patients. Our non-invasive medical devices and general wellness products are self-administered and intended for regular or

intermittent use over many years.

Our capabilities include product development, regulatory

affairs and compliance, sales and marketing, product testing, assembly, fulfillment, and customer support. We derive revenues from the

sale of products in the United States and select overseas markets. We have two principal product categories:

| • | Handheld, personal use medical devices for the management and treatment of certain medical conditions such

as primary headache; and |

| • | Handheld, personal use consumer products utilizing nVNS technology to promote general wellness and human

performance. |

We believe our nVNS products may be used in the future

to effectively treat additional medical conditions.

Our goal is to be a leader in non-invasive neuromodulation

by using our proprietary nVNS platform technology to deliver better health. To achieve this, we offer multiple propositions:

| • | Prescription gammaCore medical devices for the treatment of certain medical conditions such as primary headache; |

| • | Truvaga products for the support of general health and wellbeing; and |

| • | TAC-STIM for human performance. |

Our flagship gammaCore Sapphire is a prescription

medical device that is FDA cleared for a variety of primary headache conditions. gammaCore is available by prescription only and Sapphire

is a portable, reusable, rechargeable and reloadable personal use option for patients to use at home or on the go. Prescriptions are written

by a health care provider and dispensed from a specialty pharmacy, through the patient’s healthcare system, or shipped directly

to certain patients in the United States directly from our facility in Rockaway, NJ. After the initial prescription is filled, access

to additional therapy can be refilled for certain of our gammaCore products through the input of a prescription-only authorization.

We offer two versions of our Truvaga products

for the support of general health and wellbeing. Truvaga 350 is a personal use consumer electronics general wellness product and Truvaga

Plus, which was launched in April 2024, is our next generation, app-enabled general wellness product. Neither product requires a prescription,

and both are available direct-to-consumer from electroCore at www.truvaga.com.

TAC-STIM is a form of nVNS for human performance

and has been developed in collaboration with the United States Department of Defense Biotech Optimized for Operational Solutions and Tactics,

or BOOST, program. TAC-STIM products are available as a Commercial Off the Shelf (COtS) solution to professional organizations and are

the subject of ongoing research and evaluation within the United States Air Force Special Operations Command, the United States Army Special

Operations Command and at the United States Air Force Research Laboratory. We are exploring strategies to make our TAC-STIM product available

to other branches of the active-duty military and certain human performance professionals in the United States and abroad.

Truvaga and TAC-STIM products are intended

for general wellness in compliance with the FDA guidance document entitled “General Wellness: Policy for Low-Risk Devices; Guidance

for Industry and FDA Staff, issued on September 27, 2019.” Truvaga and TAC-STIM products are not medical devices and are not intended

to diagnose, treat, cure, or prevent any disease or medical condition.

Corporate Information

Our principal executive offices

are located at 200 Forge Way, Suite 205, Rockaway, New Jersey 07866. Our telephone number is (973) 290-0097 and our website address is

www.electrocore.com. We have included our website address in this prospectus supplement as an inactive textual reference only. The information

available on or accessible through our website does not constitute a part of this prospectus supplement or the accompanying prospectus

and should not be relied upon. Our common stock is listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “ECOR”.

The Offering

| Issuer |

electroCore,

Inc. |

| Common stock offered by us |

Shares having an aggregate offering price

of not more than $20,000,000. |

| Manner of offering |

“At the market offering” that

may be made from time to time through our sales agent, H.C. Wainwright & Co., LLC. See “Plan of Distribution” on

page S-8. |

| Use of proceeds |

We intend to use the net proceeds for

sales and marketing, working capital and general corporate purposes. Please see “Use of Proceeds” on page S-8. |

| Risk factors |

This investment involves a high degree

of risk. See “Risk Factors” beginning on page S-6 of this prospectus supplement, as well as the other information included

in or incorporated by reference in this prospectus supplement and the accompanying prospectus, for a discussion of risks you should

carefully consider before investing in our securities. |

| Nasdaq

Capital Market symbol |

ECOR |

The number of shares

of our Common Stock to be outstanding immediately after this offering is based on 6,507,011 shares outstanding as of September 30, 2024,

and excludes as of that date: (i) 548,000 shares of our Common Stock reserved for issuance upon the exercise of outstanding options at

a weighted average exercise price of $31.39 per share; (ii) 1,640,000 shares of our Common Stock reserved for issuance upon the exercise

of outstanding warrants at a weighted average exercise price of $5.37 per share; (iii) 454,000 shares of our Common Stock reserved for

issuance upon settlement of restricted and deferred stock units; and (iv) 1,608,000 shares of our Common Stock reserved for issuance upon

the exercise of pre-funded warrants.

Risk Factors

Investing in our securities

involves a high degree of risk and uncertainty. In addition to the other information included or incorporated by reference in this prospectus

supplement and the accompanying prospectus, you should carefully consider the risks described below, before making an investment decision

with respect to the securities. We expect to update these Risk Factors from time to time in the periodic and current reports that we file

with the SEC after the date of this prospectus supplement. These updated Risk Factors will be incorporated by reference in this prospectus

supplement and the accompanying prospectus. Please refer to these subsequent reports for additional information relating to the risks

associated with investing in our common stock. If any of such risks and uncertainties actually occurs, our business, financial condition,

and results of operations could be severely harmed. This could cause the trading price of our common stock to decline, and you could lose

all or part of your investment.

Risks Related to this Offering

Resales of our common stock in the public

market by our stockholders during this offering may cause the market price of our common stock to fall.

We may issue common stock

from time to time in connection with this offering. The issuance from time to time of these new shares of our common stock, or our ability

to issue new shares of common stock in this offering, could result in resales of our common stock by our current stockholders concerned

about the potential ownership dilution of their holdings. In turn, these resales could have the effect of depressing the market price

for our common stock.

There may be future sales or other dilution

of our equity, which may adversely affect the market price of our common stock.

We are generally not restricted

from issuing additional common stock, including any securities that are convertible into or exchangeable for, or that represent the right

to receive, common stock. The market price of our common stock could decline as a result of sales of common stock or securities that are

convertible into or exchangeable for, or that represent the right to receive, common stock after this offering or the perception that

such sales could occur.

Our management will have broad discretion

over the use of the net proceeds from this offering, you may not agree with how we use the proceeds and the proceeds may not be invested

successfully.

We have not designated any

portion of the net proceeds from this offering to be used for any particular purpose. Accordingly, our management will have broad discretion

as to the use of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of commencement

of this offering. Accordingly, you will be relying on the judgment of our management with regard to the use of these net proceeds, and

you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It

is possible that, pending their use, we may invest the net proceeds in a way that does not yield a favorable, or any, return for our company.

The actual number of shares we will issue

under the Agreement, at any one time or in total, is uncertain.

Subject to certain limitations

in the Agreement and compliance with applicable law, we have the discretion to deliver placement notices to Wainwright at any time throughout

the term of the Agreement. The number of shares that are sold through Wainwright after delivering a placement notice will fluctuate based

on the market price of the common stock during the sales period and limits we set with Wainwright.

SEC regulations may limit the number of

shares we may sell under this prospectus supplement.

Under current SEC regulations, because our public

float is currently less than $75 million, and for so long as our public float remains less than $75 million, the amount we can raise through

primary public offerings of securities in any twelve-month period using shelf registration statements, including sales under this prospectus,

is limited to an aggregate of one-third of our public float, which is referred to as the baby shelf rules. As of November 14,

2024, the aggregate market value of our outstanding common stock held by non-affiliates, or public float, was approximately $74.37 million

based on 6,554,591 shares of outstanding common stock held by non-affiliates as of such date, at a price of $13.60 per share on November

14, 2024, which was the highest closing sale price of our common stock on the Nasdaq Capital Market within 60 days of the filing date

of this prospectus supplement. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities registered on the

registration statement, of which this Prospectus Supplement is a part, in a public primary offering with a value exceeding more than one-third

of our public float in any 12-month period so long as our public float remains below $75.0 million.

You may experience immediate and substantial

dilution in the book value per share of the common stock you purchase.

The shares sold in this offering,

if any, will be sold from time to time at various prices. Because the prices per share at which shares of our common stock are sold in

this offering could be substantially higher than the book value per share of our common stock, you may suffer immediate and substantial

dilution in the net tangible book value of the common stock you purchase in this offering.

The common stock offered hereby will be

sold in “at-the-market” offerings, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares

in this offering at different times will likely pay different prices, and so may experience different outcomes in their investment results.

We will have discretion, subject to market demand, to vary the timing, prices and numbers of shares sold, and there is no minimum or maximum

sales price. Investors may experience a decline in the value of their shares as a result of share sales made at prices lower than the

prices they paid.

Because there are no current plans to pay

cash dividends on our common stock for the foreseeable future, you may not receive any return on investment unless you sell shares of

our common stock for a price greater than that which you paid for it.

We may retain future earnings,

if any, for future operations, expansion and debt repayment and have no current plans to pay any cash dividends for the foreseeable future.

Any decision to declare and pay dividends in the future will be made at the discretion of our board of directors and will depend on, among

other things, our results of operations, financial condition, cash requirements, contractual restrictions and other factors that our board

of directors may deem relevant. In addition, our ability to pay dividends may be limited by covenants of any existing and future outstanding

indebtedness we or our subsidiaries incur. As a result, you may not receive any return on an investment in our common stock unless you

sell your shares of our common stock for a price greater than that which you paid for it.

Use of Proceeds

We may issue and sell shares

of our common stock having aggregate sales proceeds of up to $20,000,000 from time to time. Because there is no minimum offering amount

required as a condition of this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable

at this time. There can be no assurance that we will sell any shares under or fully utilize the Agreement with Wainwright as a source

of financing.

We currently intend to use

the net proceeds for sales and marketing, working capital, and general corporate purposes. In addition, we believe opportunities may exist

from time to time to expand our current business through acquisitions or in-licenses of, or investments in, complementary companies, medicines,

intellectual property or technologies. While we have no current agreements or commitments for any specific acquisitions, in-licenses or

investments at this time, we may use a portion of the net proceeds for these purposes.

As of the date of this prospectus

supplement, we cannot specify with certainty all of the particular uses of the net proceeds to be received in connection with this offering.

The amounts and timing of our actual expenditures will depend on numerous factors, including the progress of our development efforts,

any collaborations that we may enter into with third parties for our product candidates, and any unforeseen cash needs. Accordingly, our

management will have broad discretion in the application of the net proceeds from this offering and investors will be relying on the judgment

of our management regarding the application of the net proceeds from this offering.

Pending the use of any net

proceeds, we expect to invest the net proceeds in interest-bearing, marketable securities. We cannot predict whether these investments

will yield a favorable return.

Plan of Distribution

We entered into the Agreement

with H.C. Wainwright & Co., LLC, or Wainwright, under which we may issue and sell from time to time shares of our common stock having

an aggregate offering price of not more than $20,000,000 through Wainwright as our sales agent. Sales of the common stock, if any, will

be made by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under

the Securities Act.

Wainwright will offer our

common stock at prevailing market prices subject to the terms and conditions of the Agreement as agreed upon by us and Wainwright. We

will designate the number of shares which we desire to sell, the time period during which sales are requested to be made, any limitation

on the number of shares that may be sold in one day and any minimum price below which sales may not be made. Subject to the terms and

conditions of the Agreement, Wainwright will use its commercially reasonable efforts consistent with its normal trading and sales practices

to sell on our behalf all of the shares of common stock requested to be sold by us. We or Wainwright may suspend the offering of the common

stock being made through Wainwright under the Agreement upon proper notice to the other party.

Settlement for sales of common

stock will occur on the first business day (or such shorter settlement cycle as may be in effect under Exchange Act Rule 15c6-1 from time

to time) following the date on which any sales are made, or on some other date that is agreed upon by us and Wainwright in connection

with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an

escrow, trust or similar arrangement.

We will pay Wainwright in

cash, upon each sale of our shares of common stock pursuant to the Agreement, a commission equal to 3.0% of the gross proceeds from each

sale of shares of our common stock. Because there is no minimum offering amount required as a condition to this offering, the actual total

public offering amount, commissions and proceeds to us, if any, are not determinable at this time. Pursuant to the terms of the Agreement,

we agreed to reimburse Wainwright for the documented fees and costs of its legal counsel reasonably incurred in connection with entering

into the transactions contemplated by the Agreement in an amount not to exceed $50,000 in the aggregate. Additionally, pursuant to the

terms of the Agreement, we agreed to reimburse Wainwright for the documented fees and costs of its legal counsel reasonably incurred in

connection with Wainwright’s ongoing diligence, drafting and other filing requirements arising from the transactions contemplated

by the Agreement in an amount not to exceed $2,500 in the aggregate per calendar quarter. We estimate that the total expenses of the offering

payable by us, excluding compensation and reimbursements payable to Wainwright under the Agreement, will be approximately $35,000. We

will report at least quarterly the number of shares of common stock sold through Wainwright under the Agreement, the net proceeds to us

and the compensation paid by us to Wainwright in connection with the sales of common stock.

In connection with the sales

of common stock on our behalf, Wainwright will be deemed to be an “underwriter” within the meaning of the Securities Act,

and the compensation paid to Wainwright will be deemed to be underwriting commissions or discounts. We have agreed in the Agreement to

provide indemnification and contribution to Wainwright against certain liabilities, including liabilities under the Securities Act.

The offering of our shares

of common stock pursuant to the Agreement will terminate upon the earlier of the (i) sale of all of our shares of common stock provided

for in this prospectus supplement, or (ii) termination of the Agreement as permitted therein.

Wainwright and its affiliates

may in the future provide various investment banking and other financial services for us and our affiliates, for which services they may

in the future receive customary fees. To the extent required by Regulation M, Wainwright will not engage in any market making activities

involving our shares of common stock while the offering is ongoing under this prospectus supplement. This summary of the material provisions

of the Agreement does not purport to be a complete statement of its terms and conditions and is qualified in its entirety by reference

to the Agreement, a copy of which was filed as Exhibit 10.1 to our Current Report on Form 8-K filed on November 29, 2024 and is incorporated

herein by reference.

Our common stock is listed

on The Nasdaq Capital Market under the symbol “ECOR.”

Legal Matters

The validity of the common

stock offered by this prospectus supplement will be passed upon for us by Dentons US LLP, New York, New York. Ellenoff Grossman &

Schole LLP, New York, New York, is counsel for Wainwright in connection with this offering.

Experts

The consolidated financial statements

of electroCore, Inc. and subsidiaries as of December 31, 2023 and 2022 and for the years ended December 31, 2023 and 2022 have been incorporated

by reference herein and in the registration statement in reliance upon the report of Marcum LLP, independent registered public accounting

firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing. The report on the consolidated

financial statements contains an explanatory paragraph regarding the Company’s ability to continue as a going concern.

We file annual, quarterly and

periodic reports, proxy statements and other information with the SEC. Our SEC filings are available to the public from the SEC’s

website at www.sec.gov. We make available free of charge our annual, quarterly and current reports, proxy statements and other information

upon request. To request such materials, please contact the Corporate Secretary at the following address or telephone number: electroCore,

Inc., 200 Forge Way, Suite 205, Rockaway, New Jersey 07866, Attention: Corporate Secretary; (973) 290-0097. Exhibits to the documents

will not be sent, unless those exhibits have specifically been incorporated by reference in this prospectus supplement.

We maintain our website at www.electrocore.com.

Our website and the information contained therein or connected thereto are not incorporated into this prospectus supplement.

We have filed with the SEC a

registration statement on Form S-3 under the Securities Act relating to the securities we are offering by this prospectus supplement.

This prospectus supplement does not contain all of the information set forth in the registration statement and the exhibits and schedules

to the registration statement. Please refer to the registration statement and its exhibits and schedules for further information with

respect to us and our securities. Statements contained in this prospectus supplement and accompanying prospectus as to the contents of

any contract or other document are not necessarily complete and, in each instance, we refer you to the copy of that contract or document

filed as an exhibit to the registration statement. You may read and obtain a copy of the registration statement and its exhibits and schedules

from the SEC, as described above.

Incorporation of

Certain Information by Reference

The SEC allows us to “incorporate

by reference” the information we file with them, which means that we can disclose important information to you by referring you

to those documents. The information incorporated by reference is considered to be part of this prospectus supplement and the accompanying

prospectus, and information that we file later with the SEC will automatically update and supersede this information. We incorporate by

reference the documents listed below and any future information filed (rather than furnished) with the SEC under Sections 13(a), 13(c),

14, or 15(d) of the Exchange Act between the date of this prospectus supplement and the termination of this offering, provided, however,

that we are not incorporating any information furnished under Item 2.02 or Item 7.01 of any current report on Form 8-K:

| · | Our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 13, 2024. |

| · | Our Definitive Proxy Statement on Schedule 14A, filed with the SEC on July 17, 2024 (other than

the portions thereof which are furnished and not filed); |

| · | the description of our Common Stock which is registered under Section 12 of the Exchange Act, in our

registration statement on Form 8-A filed with the SEC on June 11, 2018, including any amendments or reports filed for the purpose of updating

such description, including Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on

March 13, 2024. |

Any statement in

a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes

of this prospectus supplement to the extent that a statement contained herein or in any other subsequently filed document which also is

incorporated or deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded

shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

$75,000,000

electroCore, Inc.

Debt Securities

Preferred Stock

Common Stock

Warrants

Rights

Units

From time to time, we may offer and sell up to

an aggregate of $75,000,000 of any combination of the securities described in this prospectus, either individually or in combination.

We may also offer common stock or preferred stock upon conversion of debt securities, common stock upon conversion of preferred stock,

or common stock, preferred stock or debt securities upon the exercise of warrants.

When we decide to sell particular securities,

we will provide you with the specific terms and the offering price of the securities we are then offering in one or more prospectus supplements

to this prospectus. The prospectus supplement may add to, change or update information contained in this prospectus. The prospectus supplement

may also contain important information about U.S. federal income tax consequences. You should carefully read this prospectus, together

with any prospectus supplements and information incorporated by reference in this prospectus and any prospectus supplements, before you

decide to invest. This prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

Our common stock is quoted on The NASDAQ Global

Select Market under the trading symbol “ECOR.” Any common stock sold pursuant to this prospectus or any prospectus supplement

will be listed on that exchange, subject to official notice of issuance. Each prospectus supplement to this prospectus will contain information,

where applicable, as to any other listing on any national securities exchange of the securities covered by the prospectus supplement.

We may offer and sell the securities described

in this prospectus to or through one or more underwriters, dealers or agents, or directly to purchasers on an immediate, continuous or

delayed basis. The names of any underwriters, dealers or agents involved in the sale of any securities, the specific manner in which they

may be offered and any applicable commissions or discounts will be set forth in an accompanying prospectus supplement covering the sales

of those securities. As of January 13, 2022, the aggregate market value of our outstanding common stock held by non-affiliates pursuant

to General Instruction I.B.6 of Form S-3 was approximately $57.7 million, which is based on 65,594,696 shares of common stock held by

non-affiliates as of such date and a price of $0.88 per share, the closing price of our common stock on January 12, 2022. Pursuant to

General Instruction I.B.6 of Form S-3, in no event will we sell securities registered on the registration statement of which this prospectus

is a part with a value of more than one-third of the aggregate market value of our common stock held by non-affiliates in any 12-month

period, so long as the aggregate market value of our common stock held by non-affiliates is less than $75 million. We have not sold any

securities pursuant to General Instruction I.B.6 of Form S-3 during the 12 calendar months prior to, and including, the date of this prospectus.

Investing in our securities involves significant

risks. See “Risk Factors” beginning on page 3.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is January 25,

2022.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

that we filed with the U.S. Securities and Exchange Commission (the “SEC”) utilizing a “shelf” registration process

or continuous offering process, which allows the Company to offer and sell any combination of the securities described in this prospectus

in one or more offerings. Using this prospectus, we may offer up to a total dollar amount of $75,000,000 of these securities.

This prospectus provides you with a general description

of the securities we may offer. Each time we sell securities pursuant to this registration statement and the prospectus contained herein,

we will provide a prospectus supplement that will contain specific information about the terms of that offering. That prospectus supplement

may include additional risk factors about us and the terms of that particular offering. Prospectus supplements may also add to, update

or change the information contained in this prospectus. To the extent that any statement that we make in a prospectus supplement is inconsistent

with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in

such prospectus supplement. In addition, as described in the section entitled “Where You Can Find More Information,” we have

filed and plan to continue to file other documents with the SEC that contain information about our business. Before you decide whether

to invest in any of these securities, you should read this prospectus, the prospectus supplement that further describes the offering of

these securities and the information we file with the SEC.

In this prospectus and any prospectus supplement,

unless otherwise stated or the context otherwise indicates, references to “ECOR,” “electroCore,” “the Company,”

“we,” “us,” “our” and similar references refer to electroCore, Inc., a Delaware corporation.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus and certain information incorporated

herein by reference contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially

from those discussed in the forward-looking statements. The statements contained in this prospectus that are not purely historical are

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are often

identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,”

“seek,” “should,” “strategy,” “target,” “will,” “would” and similar

expressions or variations intended to identify forward-looking statements. These statements are based on the beliefs and assumptions of

our management based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties

and other important factors that could cause actual results and the timing of certain events to differ materially from future results

expressed or implied by such forward-looking statements.

Factors that could cause or contribute to such

differences include, but are not limited to, (i) those included in our Annual Report on Form 10-K for the fiscal year ended December 31,

2020, (ii) those contained in our other SEC reports described under “Risk Factors,” (iii) those described elsewhere in this

prospectus, and (iv) other factors that we may publicly disclose from time to time. Furthermore, such forward-looking statements speak

only as of the date made. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events

or circumstances after the date of such statements.

TRADEMARKS

The electroCore logo, gammaCore and other trademarks

of electroCore, Inc. appearing in this prospectus are the property of electroCore, Inc. All other trademarks, service marks and trade

names in this prospectus are the property of their respective owners. We have omitted the ® and ™ designations, as applicable,

for the trademarks used in this prospectus.

ABOUT THE COMPANY

Business Overview

We are a commercial-stage medical device company

with a proprietary non-invasive vagus nerve stimulation, or nVNS, therapy. nVNS is a platform bioelectronic medical therapy that modulates

neurotransmitters and immune function through its effects on both the peripheral and central nervous systems. We are initially focused

on neurology, and our therapy, gammaCore, is cleared by the U.S. Food and Drug Administration, or FDA, for use by adults for the following

neurology indications: the acute treatment of pain associated with each of migraine and episodic cluster headache, or eCH, the preventive

treatment of migraine headache and adjunctive use for the preventive treatment of cluster headaches, or CH. In February 2021, the FDA

cleared the use of gammaCore for acute and preventive treatment of migraine in adolescents. In September 2021, the FDA cleared the use

of gammaCore for the treatment of Paroxysmal Hemicrania (PH) and Hemicrania Continua (HC) in adults. PH and HC are rare forms of trigeminal

autonomic cephalalgias that are typically debilitating and difficult to treat.

Our strategy has been to focus on selling gammaCore

to treat different forms of primary headache upon regulatory approval. Following our initial FDA clearance in early 2017, our commercial

strategy was to establish gammaCore as a first-line treatment option for the acute treatment of eCH in adult patients, who have few alternative

treatment options available to them. This strategy was supported by a product registry conducted from July 2017 through June 2018 to build

advocacy among key opinion leaders in leading headache centers in the United States, and to generate patient demand in the form of prescriptions

submitted to payers. We leveraged this advocacy during the registry period as we expanded into migraine and prepared for a full commercial

launch of gammaCore and gammaCore Sapphire for the acute treatment of pain associated with eCH and migraine in adult patients, which was

accomplished in the third quarter of 2018. With the clearance of adjunctive use for the prevention of CH in December 2018, we continued

to build upon our existing base of advocacy and patient support. In March 2020, the FDA cleared gammaCore for the preventive treatment

of migraine headache in adult patients. In February 2021, gammaCore was cleared by the FDA for the acute and preventive treatment of migraine

in adolescents between 12 and 17 years of age. In September 2021, gammaCore was cleared in adults by the FDA for two rare forms of trigeminal

autonomic cephalalgias, Paroxysmal Hemicrania and Hemicrania Continua.

Since May 2019, we have focused our sales efforts

in three channels, (i) the U.S. Department of Veterans Affairs and U.S. Department of Defense, with (ii) commercial payers, and (iii)

the United Kingdom. We continue to evaluate strategies to expand commercial adoption of gammaCore, including the potential use of telemedicine

and cash pay direct to consumer and physician dispense approaches.

Litigation Update

As an update to our prior disclosure of the ongoing

securities class action case in the Superior Court of New Jersey for Somerset County, captioned Paul Kuehl vs. electroCore, Inc., et

al., Docket No. SOM-L 000876-19, on November 11, 2021, we and the other defendants filed a supplemental motion to dismiss based on

our certificate of incorporation’s forum selection clause. On December 10, 2021, the Superior Court heard argument of the original

motion to dismiss and the supplemental motion to dismiss based on the federal forum selection clause. On December 14, 2021, the Superior

Court granted both motions in their entirety and dismissed the action without leave to re-plead.

In the ongoing securities class action case in

the United States District Court for the District of New Jersey captioned Allyn Turnofsky vs. electroCore, Inc., et al., Case 3:19-cv-18400,

on November 17, 2021, we and the other defendants moved to dismiss the new complaint. Briefing on the motion is now complete. Argument

of the motion has not yet been scheduled.

RISK FACTORS

Before you invest in any of the Company’s

securities, in addition to the other information in this prospectus and the applicable prospectus supplement, you should carefully consider

(i) the risk factors contained in the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, which

are incorporated by reference into this prospectus, (ii) all of the other information included or incorporated by reference in this prospectus,

and (iii) the applicable prospectus supplement, as the same may be updated from time to time by the Company’s future filings under

the Exchange Act.

The risks and uncertainties described herein are

not the only ones facing the Company. Additional risks and uncertainties not presently known to the Company or that the Company currently

deems immaterial may also impair its business or operations. Any adverse effect on the Company’s business, financial condition or

operating results could result in a decline in the value of the securities and the loss of all or part of your investment. The prospectus

supplement applicable to each series of securities the Company offers may contain a discussion of additional risks applicable to an investment

in the Company and the securities the Company is offering under that prospectus supplement.

Our failure to meet the continued listing

requirements of Nasdaq could result in a delisting of our common stock, which could negatively impact the market price and liquidity of

our common stock and our ability to access the capital markets.

On December 20, 2021, we received a letter from

the Listing Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”) indicating that, based upon the closing bid

price of our common stock for the last 30 consecutive business days, we did not meet the minimum bid price of $1.00 per share required

for continued listing on The Nasdaq Global Select Market pursuant to Nasdaq Listing Rule 5450(a)(1). Pursuant to the initial Nasdaq notice

and Rule 5810(c)(3)(A) of the Nasdaq Listing Rules, we have 180 calendar days from the date of the notice, or until June 20, 2022, to

regain compliance with the minimum bid price requirement in Rule 5450(a)(1) by achieving a closing bid price for our common stock of at

least $1.00 per share over a minimum of 10 consecutive business days.

Such a delisting would have a negative effect

on the price of our common stock, impair the ability to sell or purchase our common stock when persons wish to do so, and any delisting

could materially adversely affect our ability to raise capital or pursue strategic, financing or other transactions on acceptable terms,

or at all. Delisting from the Nasdaq Global Select Market could also have other negative results, including the potential loss of institutional

investor interest.

USE OF PROCEEDS

Unless otherwise indicated in the prospectus supplement,

the Company will use the net proceeds from the sale of securities offered by this prospectus for sales and marketing, working capital,

and general corporate purposes. In addition, we believe opportunities may exist from time to time to expand our current business through

acquisitions or in-licenses of, or investments in, complementary companies, medicines, intellectual property or technologies. While we

have no current agreements or commitments for any specific acquisitions, in-licenses or investments at this time, we may use a portion

of the net proceeds for these purposes. As of the date of this prospectus, the Company has not identified any specific and material proposed

uses of the anticipated proceeds.

Our expected use of net proceeds from the sale

of any securities offered pursuant to the applicable prospectus supplement for such offering will vary depending on our then current intentions

based upon our plans and business condition. As of the date of this prospectus, we cannot predict with certainty all of the particular

uses for the net proceeds to be received upon the completion of any offering or the amounts that we will actually spend on any specific

uses set forth above. The amounts and timing of our actual use of the net proceeds will vary depending on numerous factors, including

the factors described under the heading “Risk Factors” in this prospectus. As a result, unless otherwise specified in the

prospectus supplement, our management will have broad discretion in its application of the net proceeds, and investors will be relying

on our judgment in such application.

Pending use of net proceeds from the sale of securities

offered by this prospectus, we may invest in short- and intermediate-term interest-bearing obligations, investment-grade instruments,

certificates of deposit or direct or guaranteed obligations of the U.S. government.

RATIO OF EARNINGS TO FIXED

CHARGES

If the Company offers debt securities and/or preference

equity securities under this prospectus, then the Company will, if required at that time, provide a ratio of earnings to fixed charges

and/or ratio of combined fixed charges and preference dividends to earnings, respectively, in the applicable prospectus supplement for

such offering.

PLAN OF DISTRIBUTION

The Company may sell the securities being offered

by it in this prospectus pursuant to underwritten public offerings, negotiated transactions, block trades or any combination of such methods.

The Company may sell the securities to or through underwriters, dealers, agents or directly to one or more purchasers. The Company and

its agents reserve the right to accept and to reject, in whole or in part, any proposed purchase of securities. A prospectus supplement

or post-effective amendment, which the Company will file each time the Company effects an offering of any securities, will provide the

names of any underwriters, dealers or agents, if any, involved in the sale of such securities, and any applicable fees, commissions, or

discounts to which such persons shall be entitled to in connection with such offering.

The Company and its agents, dealers and underwriters,

as applicable, may sell the securities being offered by the Company in this prospectus from time to time in one or more transactions at:

| • | a fixed price or prices, which may be changed; |

| • | market prices prevailing at the time of sale; |

| • | prices related to such prevailing market prices; |

| • | varying prices determined at the time of sale; or |

The Company may determine the price or other terms

of the securities offered under this prospectus by use of an electronic auction. The Company will describe how any auction will determine

the price or any other terms, how potential investors may participate in the auction and the nature of the underwriters’ obligations

in the applicable prospectus supplement or amendment.

The Company may solicit directly offers to purchase

securities. The Company may also designate agents from time to time to solicit offers to purchase securities. Any agent that the Company

designates, who may be deemed to be an underwriter as such term is defined in the Securities Act, may then resell such securities to the

public at varying prices to be determined by such agent at the time of resale.

The Company may engage in at the market offerings

of the Company’s common stock. An at the market offering is an offering of the Company’s common stock at other than a fixed

price, and is conducted to or through a market maker. The Company shall name any underwriter that the Company engages for an at the market

offering in a post-effective amendment to the registration statement containing this prospectus. In the related prospectus supplement,

the Company shall also describe any additional details of the Company’s arrangement with such underwriter, including commissions

or fees paid or discounts offered by the Company, and whether such underwriter is acting as principal or agent.

If the Company uses underwriters to sell securities,

the Company will enter into an underwriting agreement with the underwriters at the time of the sale to them, which agreement shall be

filed as an exhibit to the related prospectus supplement. Underwriters may also receive commissions from purchasers of the securities.

Underwriters may also use dealers to sell securities. In such an event, the dealers may receive compensation in the form of discounts,

concessions or commissions from the underwriters and/or commissions from the purchasers for whom they may act as agents.

Under agreements that they may enter into with

the Company, underwriters, dealers, agents and other persons may be entitled to (i) indemnification by the Company against certain civil

liabilities, including liabilities under the Securities Act or (ii) contribution with respect to payments which they may be required to

make in respect of such liabilities. Underwriters and agents may engage in transactions with, or perform services for, the Company in

the ordinary course of business.

If so indicated in the applicable prospectus supplement,

the Company may authorize underwriters, dealers or other persons to solicit offers by certain institutions to purchase the securities

offered by the Company under this prospectus pursuant to contracts providing for payment and delivery on a future date or dates. The obligations

of any purchaser under these contracts will be subject only to those conditions described in the applicable prospectus supplement, and

the prospectus supplement will set forth the price to be paid for securities pursuant to those contracts and the commissions payable for

solicitation of the contracts.

Any underwriter may engage in over-allotment,

stabilizing and syndicate short covering transactions and penalty bids in accordance with Regulation M of the Exchange Act. Over-allotment

involves sales in excess of the offering size, which create a short position. Stabilizing transactions involve bids to purchase the underlying

security so long as the stabilizing bids do not exceed a specified maximum. Syndicate short covering transactions involve purchases of

securities in the open market after the distribution has been completed in order to cover syndicate short positions. Penalty bids permit

the underwriters to reclaim selling concessions from dealers when the securities originally sold by such dealers are purchased in covering

transactions to cover syndicate short positions. These transactions may cause the price of the securities sold in an offering to be higher

than it would otherwise be. These transactions, if commenced, may be discontinued by the underwriters at any time.

The Company’s common stock is quoted on

The NASDAQ Global Select Market under the trading symbol “ECOR.” The other securities are not listed on any securities exchange

or other stock market and, unless the Company states otherwise in the applicable prospectus supplement, the Company does not intend to

apply for listing of the other securities on any securities exchange or other stock market. Any underwriters to whom the Company sells

securities for public offering and sale may make a market in the securities that they purchase, but the underwriters will not be obligated

to do so and may discontinue any market making at any time without notice. Accordingly, the Company gives you no assurance as to the development

or liquidity of any trading market for the securities.

The anticipated date of delivery of the securities

offered hereby will be set forth in the applicable prospectus supplement relating to each offering.

In order to comply with certain state securities

laws, if applicable, the securities may be sold in such jurisdictions only through registered or licensed brokers or dealers. In certain

states, the securities may not be sold unless the securities have been registered or qualified for sale in such state or an exemption

from regulation or qualification is available and is complied with. Sales of securities must also be made by the Company in compliance

with all other applicable state securities laws and regulations.

The Company shall pay all expenses of the registration

of the securities.

DESCRIPTION OF DEBT SECURITIES

The following description, together with the additional

information the Company includes in any applicable prospectus supplements, summarizes the material terms and provisions of the debt securities

that the Company may offer under this prospectus. While the terms the Company has summarized below will apply generally to any future

debt securities the Company may offer under this prospectus, the Company will describe the particular terms of any debt securities that

the Company may offer in more detail in the applicable prospectus supplement. The terms of any debt securities the Company offers under

a prospectus supplement may differ from the terms described below. However, no prospectus supplement shall fundamentally change the terms

that are set forth in this prospectus or offer a security that is not registered and described in this prospectus at the time of its effectiveness.

As of the date of this prospectus, the Company had no outstanding indebtedness.

The Company will issue the senior debt securities

under the senior indenture that the Company will enter into with the trustee to be named in the senior indenture. The Company will issue

the subordinated debt securities under the subordinated indenture that the Company will enter into with the trustee to be named in the

subordinated indenture. The Company has filed forms of these documents as exhibits to the registration statement which includes this prospectus.

The Company uses the term “indentures” in this prospectus to refer to both the senior indenture and the subordinated indenture.

The indentures will be qualified under the Trust

Indenture Act of 1939, as amended (the “Trust Indenture Act”). The Company uses the term “trustee” to refer to

either the senior trustee or the subordinated trustee, as applicable.

The following summaries of material provisions

of the senior debt securities, the subordinated debt securities and the indentures are subject to, and qualified in their entirety by

reference to, all the provisions of the indenture applicable to a particular series of debt securities. Except as the Company may otherwise

indicate, the terms of the senior indenture and the subordinated indenture are identical.

General

Debt securities may be issued in separate series

without limitation as to aggregate principal amount. The Company may specify a maximum aggregate principal amount for the debt securities

of any series.

The Company is not limited as to the amount of

debt securities it may issue under the indentures. The prospectus supplement will set forth:

| • | whether the debt securities will be senior or subordinated; |

| • | any limit on the aggregate principal amount; |

| • | the person who shall be entitled to receive interest, if other than the record holder on the record date; |

| • | the date the principal will be payable; |

| • | the interest rate, if any, the date interest will accrue, the interest payment dates and the regular record

dates; |

| • | the place where payments may be made; |

| • | any mandatory or optional redemption provisions; |

| • | if applicable, the method for determining how the principal, premium, if any, or interest will be calculated

by reference to an index or formula; |

| • | if other than U.S. currency, the currency or currency units in which principal, premium, if any, or interest

will be payable and whether the Company or the holder may elect payment to be made in a different currency; |

| • | the portion of the principal amount that will be payable upon acceleration of stated maturity, if other

than the entire principal amount; |

| • | if the principal amount payable at stated maturity will not be determinable as of any date prior to stated

maturity, the amount which will be deemed to be the principal amount; |

| • | any defeasance provisions if different from those described below under “Satisfaction and Discharge;

Defeasance;” |

| • | any conversion or exchange provisions; |

| • | any obligation to redeem or purchase the debt securities pursuant to a sinking fund; |

| • | whether the debt securities will be issuable in the form of a global security; |

| • | any subordination provisions, if different from those described below under “Subordinated Debt Securities;” |

| • | any deletions of, or changes or additions to, the events of default or covenants; and |

| • | any other specific terms of such debt securities. Unless otherwise specified in the prospectus supplement: |

| • | the debt securities will be registered debt securities; and |

| • | registered debt securities denominated in U.S. dollars will be issued in denominations of $1,000 or an

integral multiple of $1,000. |

Debt securities may be sold at a substantial discount

below their stated principal amount, bearing no interest or interest at a rate which at the time of issuance is below market rates.

Exchange and Transfer

Debt securities may be transferred or exchanged

at the office of the security registrar or at the office of any transfer agent designated by the Company.

The Company will not impose a service charge for

any transfer or exchange, but the Company may require holders to pay any tax or other governmental charges associated with any transfer

or exchange.

In the event of any potential redemption of debt

securities of any series, the Company will not be required to:

| • | issue, register the transfer of, or exchange, any debt security of that series during a period beginning

at the opening of business 15 days before the day of mailing of a notice of redemption and ending at the close of business on the day

of the mailing; or |

| • | register the transfer of or exchange any debt security of that series selected for redemption, in whole

or in part, except the unredeemed portion being redeemed in part. |

The Company may initially appoint the trustee

to be named in the indenture as the security registrar. Any transfer agent, in addition to the security registrar, initially designated

by the Company will be named in the prospectus supplement. The Company may designate additional transfer agents or change transfer agents

or change the office of the transfer agent. However, the Company will be required to maintain a transfer agent in each place of payment

for the debt securities of each series.

Global Securities

The debt securities of any series may be represented,

in whole or in part, by one or more global securities. Each global security will:

| • | be registered in the name of a depositary that the Company will identify in a prospectus supplement; |

| • | be deposited with the depositary or nominee or custodian; and |

| • | bear any required legends. |

No global security may be exchanged in whole or

in part for debt securities registered in the name of any person other than the depositary or any nominee unless:

| • | the depositary has notified the Company that it is unwilling or unable to continue as depositary or has

ceased to be qualified to act as depositary; |

| • | an event of default is continuing; or |

| • | any other circumstances described in a prospectus supplement. |

As long as the depositary, or its nominee, is

the registered owner of a global security, the depositary or nominee will be considered the sole owner and holder of the debt securities

represented by the global security for all purposes under the indenture. Except in the above limited circumstances, owners of beneficial

interests in a global security:

| • | will not be entitled to have the debt securities registered in their names, |

| • | will not be entitled to physical delivery of certificated debt securities, and |

| • | will not be considered to be holders of those debt securities under the indentures. |

Payments on a global security will be made to

the depositary or its nominee as the holder of the global security. Some jurisdictions have laws that require that certain purchasers

of securities take physical delivery of such securities in definitive form. These laws may impair the ability to transfer beneficial interests

in a global security.

Institutions that have accounts with the depositary

or its nominee are referred to as “participants.” Ownership of beneficial interests in a global security will be limited to

participants and to persons that may hold beneficial interests through participants. The depositary will credit, on its book-entry registration

and transfer system, the respective principal amounts of debt securities represented by the global security to the accounts of its participants.

Ownership of beneficial interests in a global

security will be shown on and effected through records maintained by the depositary, with respect to participants’ interests, or

any participant, with respect to interests of persons held by participants on their behalf.

Payments, transfers and exchanges relating to

beneficial interests in a global security will be subject to policies and procedures of the depositary.

The depositary policies and procedures may change

from time to time. Neither the Company nor the trustee will have any responsibility or liability for the depositary’s or any participant’s

records with respect to beneficial interests in a global security.

Payment and Paying Agent

The provisions of this paragraph will apply to

debt securities unless otherwise indicated in the prospectus supplement. Payment of interest on a debt security on any interest payment

date will be made to the person in whose name the debt security is registered at the close of business on the regular record date. Payment

on debt securities of a particular series will be payable at the office of a paying agent or paying agents designated by the Company.

However, at the Company’s option, the Company may pay interest by mailing a check to the record holder. The corporate trust office

initially will be designated as the Company’s sole paying agent.

The Company may also name any other paying agents

in the prospectus supplement. The Company may designate additional paying agents, change paying agents or change the office of any paying

agent. However, the Company will be required to maintain a paying agent in each place of payment for the debt securities of a particular

series.

All moneys paid by the Company to a paying agent

for payment on any debt security which remain unclaimed at the end of two years after such payment was due will be repaid to the Company.

Thereafter, the holder may look only to the Company for such payment.

Consolidation, Merger and Sale of Assets

The Company may not consolidate with or merge

into any other person, in a transaction in which it is not the surviving corporation, or convey, transfer or lease the Company’s

properties and assets substantially as an entirety to, any person, unless:

| • | the Company shall be the surviving or continuing corporation in the transaction; |

| • | the successor assumes the Company’s obligations on the debt securities and under the indenture; |

| • | immediately after giving effect to the transaction, no default or event of default shall have happened

and be continuing; and |

| • | certain other conditions are met. |

If the debt securities are convertible for the

Company’s other securities or securities of other entities, the person with whom the Company consolidates or merges or to whom the

Company sells all of its property must make provisions for the conversion of the debt securities into securities which the holders of

the debt securities would have received if they had converted the debt securities before the consolidation, merger or sale.

Events of Default

Unless the Company informs you otherwise in the

prospectus supplement, the indenture will define an event of default with respect to any series of debt securities as one or more of the

following events:

| (1) | failure to pay principal of or any premium on any debt security of that series when due and payable; |

| (2) | failure to pay any interest on any debt security of that series when it becomes due and payable, and continuation

of that failure for a period of 90 days (unless the entire amount of such payment is deposited by the Company with the trustee or paying

agent prior to the expiration of the 90-day period); |

| (3) | failure to deposit any sinking fund payment, when and as due in respect of any debt security of that series; |

| (4) | failure to perform or breach of any other covenant or warranty by the Company in the indenture (other

than a covenant or warranty that has been included in the indenture solely for the benefit of a series of debt securities other than the

series), which failure continues uncured for a period of 90 days after the Company receives the notice required in the indenture; |

| (5) | the Company’s bankruptcy, insolvency or reorganization; and |

| (6) | any other event of default with respect to debt securities of that series that is described in the applicable

prospectus supplement accompanying this prospectus. |

An event of default of one series of debt securities

is not necessarily an event of default for any other series of debt securities.

If an event of default, other than an event of

default described in clause (5) above, shall occur and be continuing, after applicable notice and cure periods set forth in the indenture,