false

0001710072

0001710072

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 7, 2024

Edgewise Therapeutics, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-40236 |

|

82-1725586 |

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification No.) |

1715

38th St.

Boulder,

CO 80301

(Address of principal executive offices) (Zip Code)

(720)

262-7002

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ |

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

EWTX |

|

The

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 2.02 | Results of Operations and Financial Condition. |

On November 7, 2024,

Edgewise Therapeutics, Inc. issued a press release announcing its financial results for the third quarter ended September 30,

2024. The full text of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

All of the information

furnished in this Item 2.02 and Item 9.01 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EDGEWISE THERAPEUTICS, INC. |

| |

|

|

| |

By: |

/s/ R. Michael Carruthers |

| |

|

R. Michael Carruthers |

| |

|

Chief Financial Officer |

Date: November 7, 2024

Exhibit 99.1

Edgewise Therapeutics Reports Third Quarter

2024 Financial Results and Recent Business Highlights

– On track to announce top-line results

from Phase 2 CANYON trial of sevasemten in adults with Becker in December 2024 –

– Advanced Phase 2 LYNX and FOX trials

of sevasemten in children and adolescents with Duchenne –

– Advanced Phase 2 CIRRUS-HCM trial of

EDG-7500 in patients with obstructive and non-obstructive Hypertrophic Cardiomyopathy (HCM) –

– Announced positive top-line data from

Phase 1 trial in healthy subjects and Phase 2 CIRRUS-HCM trial in patients with obstructive HCM –

Boulder, Colo., (November 7, 2024) – Edgewise

Therapeutics, Inc., (Nasdaq: EWTX), a leading muscle disease biopharmaceutical company, today reported financial results for the

third quarter of 2024 and recent business highlights.

“We continue to make strong progress on our cardiac and skeletal

muscle programs,” said Kevin Koch, Ph.D., President and Chief Executive Officer of Edgewise. “Based on the strength of clinical

and preclinical data to-date, we are treating patients with obstructive and non-obstructive HCM in the 28-day part of CIRRUS-HCM trial.

We look forward to sharing important updates on both our CIRRUS-HCM and CANYON Phase 2 programs over the coming months.”

Recent Highlights

Muscular Dystrophy Program / Sevasemten

Becker Muscular Dystrophy (Becker)

Sevasemten is an orally administered first-in-class fast skeletal myosin

inhibitor designed to protect unstable muscle against contraction-induced muscle damage in muscular dystrophies including Becker and Duchenne.

There are currently no approved therapies for individuals with Becker,

a serious genetic, progressive neuromuscular disorder with significant unmet need.

CANYON Phase 2 placebo-controlled trial in adults with Becker:

CANYON, the largest interventional Becker trial, includes 40 adults and 29 adolescents with a sevasemten treatment period of 12 months.

The primary endpoint of CANYON is change from baseline in creatine kinase (CK) over the treatment period with additional measures collected,

including North Star Ambulatory Assessment (NSAA), North Star Assessment for Muscular Dystrophies (NSAD), 100-meter timed test, biomarkers

of muscle damage, MRI and patient-reported outcomes. The Company expects to report CANYON data in December 2024.

GRAND CANYON, a global pivotal cohort in Becker: GRAND CANYON,

an expansion of the CANYON placebo-controlled trial, is a multi-center, randomized, double-blind, placebo-controlled cohort to evaluate

the safety and efficacy of sevasemten over 18 months in 120 adults with Becker. The primary endpoint of GRAND CANYON is change from baseline

in NSAA. In addition, other functional assessments, biomarkers of muscle damage, MRI, patient-reported outcomes and safety will be assessed.

Data from GRAND CANYON, if positive, could support a marketing application. To learn more, go to clinicaltrials.gov (NCT05291091)

or the GRAND CANYON microsite: https://www.beckergcstudy.com.

MESA Phase 2 open label extension trial in adults with Becker:

The Company is advancing MESA, an open-label extension trial to assess the long-term effect of sevasemten in individuals with Becker.

MESA provides continued access to sevasemten to participants who were previously enrolled in ARCH, or completed CANYON, GRAND CANYON,

or DUNE. To date, MESA has enrolled 99% of eligible participants completing these prior trials.

Duchenne Muscular Dystrophy (Duchenne)

LYNX Phase 2 trial in boys with Duchenne: LYNX is a 2-part multi-center,

dose-finding Phase 2 trial to evaluate the effect of sevasemten on safety, PK, and biomarkers of muscle damage in children aged 4 to 9

years with Duchenne treated with oral, once-daily sevasemten. The trial will also explore changes from baseline in functional measures

such as NSAA, stride velocity 95th centile (SV95C) and self-reported/caregiver-reported outcomes.

The Company plans to report LYNX data in the fourth quarter of 2024.

The Company will rely on LYNX data, along with data from the FOX trial of Duchenne children previously

treated with gene therapy, to guide the design and powering of a Phase 3 trial in Duchenne, planned to be initiated in 2025. For

more information on LYNX go to clinicaltrials.gov to learn more about this trial (NCT05540860).

FOX Phase 2 trial in boys with Duchenne (previously treated with

gene therapy): The Company is advancing FOX, a Phase 2 placebo-controlled trial to assess the effect of sevasemten over 12 weeks

on safety, PK and biomarkers of muscle damage in children and adolescents aged 6 to 17 years with Duchenne who have been previously treated

with gene therapy. The trial will also explore changes in baseline in functional measures such as NSAA, SV95C and self-reported/caregiver-reported

outcomes. There has been exceptional enthusiasm from the Duchenne community for this trial, evident in the Company’s ability to

over-enroll the trial within two months. Go to clinicaltrials.gov to learn more about this trial (NCT06100887).

Cardiovascular Program / EDG-7500

EDG-7500 is a novel oral, selective, cardiac sarcomere modulator,

specifically designed to slow early contraction velocity and address impaired cardiac relaxation associated with HCM and other diseases

of diastolic dysfunction. Preclinical data in models of both obstructive and non-obstructive HCM suggest the ability to drive beneficial

responses with a low risk of decreasing left ventricular ejection fraction (LVEF) below normal. The Company is enrolling CIRRUS-HCM,

a four-part, multi-center, open-label trial, in approximately 55 patients with HCM at up to 20 clinical sites in the U.S. The primary

objective of Part A of the trial was to evaluate the safety and tolerability of a single oral dose of EDG-7500. Other key outcome

measures included pharmacokinetics (PK), LVEF, and resting and provocable left ventricular outflow tract (LVOT) gradient. Parts B and

C are evaluating safety and effects of multiple doses of EDG-7500 over 28 days in patients with obstructive or non-obstructive HCM. The

Company expects to report CIRRUS-HCM 28-day data in the first quarter of 2025. To learn more about CIRRUS-HCM, visit clinicaltrials.gov, NCT06347159

(Phase 2).

Phase 1 Trial of EDG-7500: During the quarter, the Company announced top-line

data of EDG-7500 from the Phase 1 trial in healthy subjects and the single-dose arm of the Phase 2 CIRRUS-HCM trial in patients with

obstructive HCM. In the placebo-controlled Phase 1 single ascending dose (SAD) trial (n=48), healthy subjects received single

doses of EDG-7500, ranging from 5 to 300 mg. In the multiple ascending dose (MAD) portion of the trial (n=24), healthy subjects received

25 to 100 mg once daily for 14 days. EDG-7500 was well tolerated in both the SAD and MAD; there were no clinically meaningful changes

or trends in vital signs, clinical chemistry, hematology, or electrocardiograms. There were no meaningful changes in LVEF for all SAD

and MAD subjects across a broad range of EDG-7500 exposures. In the MAD, a half-life of approximately 30 hours was observed, and steady

state was achieved in approximately 4 days after the start of once-daily dosing. Generally, dose proportional increases in exposure were

observed in both SAD and MAD.

Phase 2 CIRRUS-HCM trial of EDG-7500: In CIRRUS-HCM Part A,

patients with obstructive HCM received a single dose of 50, 100 or 200 mg of EDG-7500. A 67% mean reduction in resting LVOT pressure gradient

(LVOT-G) and a 55% mean reduction in provokable (Valsalva) LVOT-G were observed in patients receiving the 100 and 200 mg single doses.

LVOT gradients less than 30 mmHg at rest and less than 50 mmHg with Valsalva were each observed in 60% of patients receiving a single

dose of 100 or 200 mg of EDG-7500. Importantly, gradient reduction was achieved without a meaningful change in LVEF. Treatment with a

single dose of EDG-7500 also led to a 64% mean reduction in NT-proBNP, a key biomarker of heart failure, in the 200 mg cohort. This reduction

highlights the potential of our mechanism in the treatment of diseases of diastolic dysfunction, including non-obstructive HCM.

Across the Phase 1 and CIRRUS-HCM trials, no subjects had a meaningful

change to LVEF or a reduction to below 50% across a broad range of EDG-7500 exposures.

Strengthened Engagement with the Scientific and Patient Communities

The Company continued its education and outreach in the HCM and muscular

dystrophy medical and patient communities. Presentations were made at the HCM Society Scientific Sessions and the 29th International Annual

Congress of the World Muscle Society. The Company served in a leadership role at the Becker Education and Engagement Day (BEED) events

in the US and in Europe in September. These were the largest events of their kind for the Becker community. The Company continues to sponsor

and participate in numerous other clinician and patient-focused events.

Third Quarter Financial Results

Cash, cash equivalents and marketable securities were approximately

$492.5 million as of September 30, 2024.

Research and development (R&D) expenses were $32.2

million for the third quarter of 2024, compared to $30.7 million for the immediately preceding quarter. The increase of $1.5 million

was primarily driven by an additional $1.6 million in manufacturing expenses related to our sevasemten and EDG-7500 clinical trials and

research programs and $1.5 million higher personnel related costs primarily driven by stock based compensation, offset by a $1.6 million

decrease in clinical and clinical development activities for the EDG-7500 clinical programs related to the substantial completion

of Phase 1 trial in the second quarter 2024 and a $0.1 million decrease in professional fees and other research costs.

General and Administrative (G&A) expenses were $8.2

million for the third quarter of 2024, compared to $7.4 million for the immediately preceding quarter. The increase of $0.8 million was

driven by increased personnel-related costs primarily related to stock-based compensation.

Net loss and net loss per share for the third quarter of

2024 was $34.1 million or $0.36 per share, compared to $31.5 million or $0.34 per share for the immediately preceding quarter.

About Edgewise Therapeutics

Edgewise Therapeutics is a leading muscle disease biopharmaceutical

company developing novel therapeutics for muscular dystrophies and serious cardiac conditions. The Company’s deep expertise in

muscle physiology is driving a new generation of novel therapeutics. Sevasemten is an orally administered first-in-class fast skeletal

myosin inhibitor in late-stage clinical trials in Becker and Duchenne muscular dystrophies. EDG-7500 is a novel cardiac sarcomere modulator

for the treatment of hypertrophic cardiomyopathy and other diseases of diastolic dysfunction, currently in Phase 2 clinical development.

The entire team at Edgewise is dedicated to our mission: changing the lives of patients and families affected by serious muscle diseases.

To learn more, go to: www.edgewisetx.com or follow us on LinkedIn, X , Facebook and Instagram.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements as that term

is defined in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements in

this press release that are not purely historical are forward-looking statements. Such forward-looking statements include, among other

things, statements regarding the potential of, and expectations regarding, Edgewise’s product candidates and programs, including

sevasemten and EDG-7500; statements regarding Edgewise’s expectations relating to its clinical trials, including timing of reporting

data (including the CANYON Phase 2 trial, LYNX Phase 2 trial, CIRRUS-HCM 28-day data); statements regarding the advancement of Edgewise’s

research and development programs; the timing of the initiation of a Phase 3 trial of sevasemten in Duchenne; the possibility of data

from GRAND CANYON to support a marketing application; statements regarding Edgewise’s pipeline of product candidates and programs;

statements regarding Edgewise’s anticipated milestones; and statements by Edgewise’s President and Chief Executive Officer.

Words such as “believes,” “anticipates,” “plans,” “expects,” “intends,” “will,”

“goal,” “potential” and similar expressions are intended to identify forward-looking statements. The forward-looking

statements contained herein are based upon Edgewise’s current expectations and involve assumptions that may never materialize or

may prove to be incorrect. Actual results could differ materially from those projected in any forward-looking statements due to numerous

risks and uncertainties, including but not limited to: risks associated with Edgewise’s limited operating history, its products

being early in development and not having products approved for commercial sale; risks associated with Edgewise not having generated any

revenue to date; Edgewise’s ability to achieve objectives relating to the discovery, development and commercialization of its product

candidates, if approved; Edgewise’s need for substantial additional capital to finance its operations; Edgewise’s substantial

dependence on the success of its sevasemten; Edgewise’s ability to develop and commercialize sevasemten and EDG-7500 and discover,

develop and commercialize product candidates in future programs; risks related to Edgewise’s clinical trials of its product candidates

not demonstrating safety and efficacy; risks related to Edgewise’s product candidates causing serious adverse events, toxicities

or other undesirable side effects; the outcome of preclinical testing and early clinical trials not being predictive of the success of

later clinical trials and the risks related to the results of Edgewise’s clinical trials not satisfying the requirements of regulatory

authorities; delays or difficulties in the enrollment and/or maintenance of patients in clinical trials; risks related to failure to capitalize

on other indications or product candidates; risks related to competition; risks relating to interim, topline and preliminary data from

Edgewise’s clinical trials changing as more patient data becomes available; risks related to the regulatory approval processes being

lengthy, time consuming and inherently unpredictable; risks related to regulatory authorities not accepting data from trials conducted

in locations outside of their jurisdiction; risks relating to Edgewise’s ability to attract and retain highly skilled executive

officers and employees; Edgewise’s ability to obtain and maintain intellectual property protection for its product candidates; Edgewise’s

reliance on third parties; general economic and market conditions; and other risks. Information regarding the foregoing and additional

risks may be found in the section entitled “Risk Factors” in documents that Edgewise files from time to time with the U.S.

Securities and Exchange Commission. These forward-looking statements are made as of the date of this press release, and Edgewise assumes

no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected

in the forward-looking statements, except as required by law.

This press release contains hyperlinks to information that is not deemed

to be incorporated by reference into this press release.

Edgewise Therapeutics, Inc.

Condensed Statement of Operations

(in thousands except share and per share amounts, unaudited)

| | |

Three months ended | |

| | |

September 30,

2024 | | |

June 30,

2024 | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

$ | 32,222 | | |

$ | 30,680 | |

| General and administrative | |

| 8,210 | | |

| 7,427 | |

| Total operating expenses | |

| 40,432 | | |

| 38,107 | |

| Loss from operations | |

| (40,432 | ) | |

| (38,107 | ) |

| Interest income | |

| 6,303 | | |

| 6,610 | |

| Net loss | |

$ | (34,129 | ) | |

$ | (31,497 | ) |

| Net loss per share - basic and diluted | |

$ | (0.36 | ) | |

$ | (0.34 | ) |

| Weighted-average shares outstanding, basic and diluted | |

| 93,813,346 | | |

| 93,515,356 | |

Edgewise Therapeutics, Inc.

Condensed Balance Sheet Data

(in

thousands, unaudited)

| | |

September 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Assets | |

| | | |

| | |

| Cash, cash equivalents and marketable securities | |

$ | 492,536 | | |

$ | 318,393 | |

| Other assets | |

| 18,746 | | |

| 21,642 | |

| Total assets | |

$ | 511,282 | | |

$ | 340,035 | |

| Liabilities and stockholders' equity | |

| | | |

| | |

| Liabilities | |

| 22,405 | | |

| 21,205 | |

| Stockholders' equity | |

| 488,877 | | |

| 318,830 | |

| Total liabilities and stockholders' equity | |

$ | 511,282 | | |

$ | 340,035 | |

###

Edgewise Contacts

Investors:

Michael Carruthers, Chief Financial Officer

ir@edgewisetx.com

Media:

Maureen Franco, VP Corporate Communications

media@edgewisetx.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

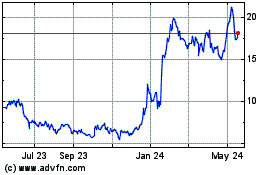

Edgewise Therapeutics (NASDAQ:EWTX)

Historical Stock Chart

From Oct 2024 to Nov 2024

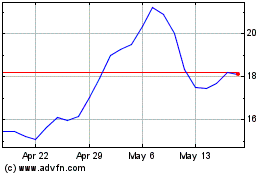

Edgewise Therapeutics (NASDAQ:EWTX)

Historical Stock Chart

From Nov 2023 to Nov 2024