Big Tech Earnings Expected to Drive S&P 500 This Week

April 24 2022 - 5:04PM

Finscreener.org

The equity markets have traded in

the red for three consecutive weeks after they rebounded in March.

In the last week ended on April 22, the S&P 500 lost 2.5%

while the Nasdaq Composite and Dow Jones indices were down by 3.6%

and 1.74% respectively.

Investors can expect stocks to

remain volatile in the upcoming week as they wrestle with inflation

and a string of earnings reports. In addition to the ongoing war

between Ukraine and Russia, stocks

have been hurt by concerns

over an economic

slowdown, steep valuations, rising commodity prices, and interest

rate hikes, all of which are likely to result in compressed

earnings for corporates in 2022.

All eyes on big tech earnings

Several tech giants such

as Microsoft (NASDAQ:

MSFT),

Apple (NASDAQ: AAPL), Meta (NASDAQ:

FB),

Amazon (NASDAQ:

AMZN), and Alphabet

(NASDAQ: GOOG)(NASDAQ: GOOGL) are

scheduled to report quarterly results for March this week. Until

now, companies part of the S&P 500 have delivered stellar

results and have outpaced Wall Street estimates in Q1.

However,

shares of streaming giant

Netflix (NASDAQ: NFLX)

were down 35% in a single trading session as the company confirmed

it lost 200,000 subscribers in Q1.

As big tech reports results for

the quarter ended in March, market participants will be watching

closely to gauge the impact of economic pressures that will hurt

subscription-related businesses part of the software and

cybersecurity businesses.

In the past decade, shares of

subscription-based tech stocks were on an absolute tear on the back

of a widening customer base. However, when a company valued at a

premium, experiences moderation in user growth, its underlying

stock is likely to trail the broader market by a wide

margin.

Inflation will be under the spotlight

Wall Street will continue to

consider the impact of inflation and rising costs as data for the

personal consumer expenditure or PCE index will be released on

Friday. The

core PCE which is also the preferred measure of inflation

by the Federal Reserve rose by 5.4% in February.

Here, the PCE excludes food and

energy prices that are volatile but have gained significant

momentum in the last 12-months, resulting in a subdued consumer

spending environment.

According to Steven Major, the

global head of fixed-income research at HSBC, “The surge in

inflation would not be a problem if it was entirely generated by

supply constraints, related to food and energy, but central banks

cannot just sit back and wait for it to normalise.”

Wall Street has priced an

aggressive outlook by the Federal Reserve in 2022. There is a

chance for the Central Bank to raise interest rates by a cumulative

125 basis points by June. Jerome Powell, the chairman of the Fed

explained the regulatory body cannot be complacent even though data

suggests inflation may have peaked as itU+02019s critical to

achieve price stability over time.

Further, in a client note

accessed by CNBC, Ethan Harris, who is the global economist at Bank

of America stated, “In our view, given the dovishness of this

group, the Fed will only deliberately risk a recession if inflation

gets stuck above 3%. Hence, rather than wait with baited breath for

the next Fed speaker, we are focused on one question: is the

economy on a path toward acceptable or unacceptable inflation. All

the rest is talk.”

In addition to the PCE, data for

the S&P/Case-Shiller home price index as well as new home

sales will be released on Tuesday. It will be supplemented by the

earnings of D.R. Horton (NYSE: DHI)

which will provide investors with a comprehensive view of the

housing market in the U.S.

Finally, preliminary data for the

GDP in Q1 will be published on Thursday and will give you a hint of

an impending economic slowdown.

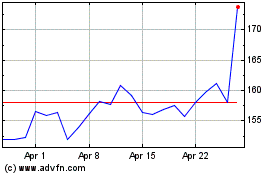

Alphabet (NASDAQ:GOOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

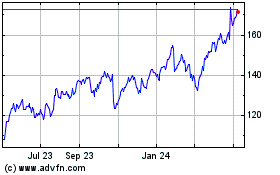

Alphabet (NASDAQ:GOOG)

Historical Stock Chart

From Apr 2023 to Apr 2024