false

0001095565

0001095565

2025-02-24

2025-02-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 24, 2025 (February 24, 2025)

HealthStream, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

Tennessee

|

000-27701

|

62-1443555

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

|

|

500 11th Avenue North, Suite 1000,

Nashville, Tennessee

|

|

37203

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

s Telephone Number, Including Area Code: 615-301-3100

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each Class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock (Par Value $0.00)

|

HSTM

|

Nasdaq

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 24, 2025, HealthStream, Inc. (the “Company”) issued a press release announcing results of operations for the fourth quarter and full year ended December 31, 2024 and provided guidance for the full year 2025, the text of which is set forth in Exhibit 99.1.

Item 7.01 Regulation FD Disclosure

On February 24, 2025, the Company issued a press release announcing results of operations for the fourth quarter and full year ended December 31, 2024 and provided guidance for the full year 2025, the text of which is set forth in Exhibit 99.1.

Item 8.01 Other Events.

On February 24, 2025, we announced that our Board of Directors declared a quarterly cash dividend under the Company's dividend policy in the amount of $0.031 per share of the Company’s outstanding common stock, which dividend will be payable on March 21, 2025 to holders of record on March 10, 2025.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

Number

|

|

Description

|

|

99.1*

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

Exhibit Index

|

Exhibit

Number

|

|

Description

|

|

99.1*

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

HealthStream, Inc.

|

| |

|

|

|

|

Date: February 24, 2025

|

|

By:

|

/s/ Scott A. Roberts

|

| |

|

|

Scott A. Roberts

|

| |

|

|

Chief Financial Officer

|

| HealthStream Announces Fourth Quarter and Full-Year 2024 Results

Page 1

February 24, 2025

|

Exhibit 99.1

|

| |

|

|

| |

Contact:

|

Scott A. Roberts

|

| |

|

Chief Financial Officer

|

| |

|

(615) 301-3182

|

| |

|

ir@healthstream.com

|

| |

|

|

| |

|

Media:

|

| |

|

Mollie Condra, Ph.D.

|

| |

|

Head, Investor Relations & Communications

|

| |

|

(615) 301-3237

|

| |

|

mollie.condra@healthstream.com

|

HealthStream Announces Fourth Quarter & Full-Year 2024 Results

NASHVILLE, Tenn. (February 24, 2025)—HealthStream, Inc. (the "Company") (Nasdaq: HSTM), a leading healthcare technology platform for workforce solutions, announced today results for the fourth quarter and full-year ended December 31, 2024.

Fourth Quarter 2024

| |

●

|

Earnings per share (EPS) of $0.16 per share (diluted), up from $0.15 per share (diluted) in the fourth quarter of 2023

|

| |

●

|

Adjusted EBITDA1 of $16.2 million, up 1.3% from $16.0 million in the fourth quarter of 2023

|

| |

● |

Completed the acquisitions of two clinical rotation management businesses: Total Clinical Placement System and The Clinical Hub, Inc. |

Full-Year 2024

| |

●

|

Earnings per share (EPS) of $0.66 per share (diluted) in 2024, up from $0.50 per share (diluted) in 2023

|

2025 Updates

| |

● |

Executive Leadership promotions made, affirming single platform strategy

|

| |

● |

Board of Directors has declared a quarterly cash dividend of $0.031 per share, an increase of 10.7% over the previous quarter's dividend of $0.028 per share |

| |

● |

HealthStream's Learning Center (LMS) and CredentialStream applications were named #1 and #5 best software products, respectively, among thousands of software products in healthcare by G2 |

Financial Results:

Fourth Quarter 2024 Compared to Fourth Quarter 2023

Revenues for the fourth quarter of 2024 increased by $3.7 million, or 5.2%, to $74.2 million, compared to $70.6 million for the fourth quarter of 2023. Subscription revenues increased $3.3 million, or 4.8%, and professional services revenues increased by $0.4 million.

Operating income was $4.7 million for the fourth quarter of 2024, up 10.2% from $4.3 million for the fourth quarter of 2023. The improvement in operating income was primarily attributable to the growth in revenues, but was partially offset by expense increases for labor and benefits, cloud hosting, sales commissions, and bad debt primarily related to customer bankruptcies during the fourth quarter of 2024.

1 Adjusted EBITDA is a non-GAAP financial measure. A reconciliation of adjusted EBITDA to net income and disclosure regarding why we believe adjusted EBITDA provides useful information to investors is included later in this release.

| HealthStream Announces Fourth Quarter and Full-Year 2024 Results

Page 2

February 24, 2025

|

|

Net income was $4.9 million in the fourth quarter of 2024, up 6.5% from $4.6 million in the fourth quarter of 2023, and EPS was $0.16 per share (diluted) in the fourth quarter of 2024, up from $0.15 per share (diluted) for the fourth quarter of 2023.

Adjusted EBITDA was $16.2 million for the fourth quarter of 2024, up 1.3% from $16.0 million in the fourth quarter of 2023.

At December 31, 2024, the Company had cash and cash equivalents and marketable securities of $97.2 million. Capital expenditures incurred during the fourth quarter of 2024 were $7.6 million.

Full-Year 2024 Compared to Full-Year 2023

For 2024, revenues were $291.6 million, an increase of 4.5% from revenues of $279.1 million for 2023. Operating income for 2024 increased by 32.9% to $21.3 million, compared to $16.0 million for 2023. The increase in operating income was primarily attributable to higher revenues and an increase in capitalized labor associated with software development activities. Operating income was also impacted by higher expenses, including labor and benefits costs, software, bad debt primarily related to customer bankruptcies during the second and fourth quarters of 2024, cloud hosting, commissions, travel, and marketing. Net income for 2024 was $20.0 million, compared to $15.2 million for 2023. Earnings per share were $0.66 per share (diluted) for 2024, compared to $0.50 per share (diluted) for 2023. Adjusted EBITDA increased by 9.0% to $66.8 million for 2024, compared to $61.3 million for 2023.

Other Business Updates

On February 24, 2025, the Board approved a quarterly cash dividend under the Company's dividend policy of $0.031 per share, reflecting an increase of 10.7% over the previous quarter's dividend of $0.028 per share. The dividend is payable on March 21, 2025 to holders of record on March 10, 2025.

On November 5, 2024, HealthStream announced the completion of two acquisitions, each enlarging the Company’s footprint among nursing and allied healthcare students as they prepare for careers in healthcare. On October 31, 2024, the Company acquired substantially all of the assets of Total Clinical Placement System (d/b/a “TCPS”), a Tennessee-based clinical rotation management business. On November 1, 2024, the Company acquired substantially all of the assets of The Clinical Hub, Inc., (d/b/a “The Clinical Hub”), an Oklahoma-based clinical rotation management business. The purchase price paid for TCPS and The Clinical Hub consisted of up to $1.65 million and $0.6 million in cash (the full payments of which will require earnout achievement), respectively, each subject to customary purchase price adjustments.

On February 19, 2025, G2 ranked HealthStream’s learning management system, the HealthStream Learning Center (HLC) in the #1 spot among the 2025 Best Software Awards, making it the highest rated software—of any software category—in healthcare. G2 also ranked CredentialStream in the #5 spot in the 2025 Best Software in Healthcare list, making it the highest ranked credentialing application in healthcare. G2’s ranking is based on verified user reviews and publicly available market presence data. Across all industries, their database includes over 180,000 software products and services listings and 2.8 million user reviews.

2025 Executive Leadership Promotions

As initially announced two years ago, HealthStream’s operations and executive leadership are increasingly shaped by our single platform strategy, as represented by the hStream technology platform. To advance the Company’s single platform approach throughout our operations, there were three promotions made in the management team in the first quarter of 2025, which takes into account the planned departure of another executive.

Kevin O’Hara has been promoted to Executive Vice President (EVP), Enterprise Workforce Platform from his prior role as Senior Vice President (SVP), Platform Strategy & Product Development Alignment. In his new role, Mr. O’Hara’s responsibilities have expanded to include both HealthStream Credentialing and HealthStream Scheduling, which form the Company’s Enterprise Applications solutions group. He will continue to be responsible for HealthStream Learning and the hStream platform, their growth strategy, and product alignment. Mr. O’Hara’s tenure at HealthStream spans 14 years cumulatively, which includes his leadership from 2001 - 2011 and then from 2021 - present. His broad technology and product development executive leadership makes him particularly qualified to lead these key areas of the Company.

| HealthStream Announces Fourth Quarter and Full-Year 2024 Results

Page 3

February 24, 2025

|

|

Michael Collier has been promoted to EVP, Corporate Strategy, Development, & Operations from his prior role as EVP, Corporate Strategy & Development. He will continue to be responsible for HealthStream’s enterprise growth strategy, corporate development, and the M&A program—where he has successfully completed 21 acquisitions. Mr. Collier will also continue to provide executive oversight to several departments, including legal, human resources, business enablement, and enterprise partnerships. Going forward in his new role, his responsibilities will extend to include a broader scope of the Company’s operations, including success management, implementations, and onboarding for all of the Company’s products and services.

Trisha Coady has been promoted to EVP, Workforce Development Solutions from her prior role as SVP, Workforce Development Solutions. Since joining HealthStream over 11 years ago, Ms. Coady’s accomplishments and broad expertise have made her the Company’s top clinical officer. Her leadership has been instrumental in the growth and expansion of our workforce development solutions, which have represented the largest component of HealthStream’s revenues over the last decade. In her new role, Ms. Coady will continue to provide executive leadership over the Company’s workforce development solutions, which include competency development, resuscitation, quality and safety, and revenue cycle—as well as HealthStream’s content marketplace.

Michael Sousa, EVP, Enterprise Applications, has announced plans to resign from his current position at the end of the first quarter of 2025. After 20 years at HealthStream, Mr. Sousa is leaving to pursue other opportunities, with the intent of both parties being for Mr. Sousa in his future endeavors to become a partner in HealthStream's ecosystem.

Financial Outlook for 2025

The Company is providing guidance for 2025 for the measures set forth below, including adjusted EBITDA, a non-GAAP financial measure as defined later in this release. For a reconciliation of projected adjusted EBITDA to projected net income (the most comparable GAAP measure) for 2025, see the table included on page nine of this release.

| |

Full Year 2025 Guidance

|

| |

|

Low

|

|

High

|

|

|

|

Revenue

|

|

$ 302.0

|

-

|

$ 307.0

|

|

million

|

| |

|

|

|

|

|

|

| Net Income |

|

$ 19.2 |

- |

$ 21.4 |

|

million |

| |

|

|

|

|

|

|

|

Adjusted EBITDA1

|

|

$ 70.0

|

-

|

$ 74.0

|

|

million

|

| |

|

|

|

|

|

|

|

Capital Expenditures

|

|

$ 31.0

|

-

|

$ 34.0

|

|

million

|

1 Adjusted EBITDA is a non-GAAP financial measure. A reconciliation of projected adjusted EBITDA to projected net income (the most comparable GAAP measure) is included later in this release.

The Company’s guidance for 2025, as set forth above, reflects the Company’s assumptions regarding, among other things, expectations for new sales and renewals and assumes that general economic conditions do not deteriorate. This consolidated guidance does not include the impact of any acquisitions or dispositions that we may complete during 2025, gains or losses from changes in the fair value of non-marketable equity investments, or impairment of long-lived assets.

Commenting on fourth quarter & full-year 2024 results, Robert A. Frist, Jr., Chief Executive Officer, HealthStream, said, “Our financial performance for 2024 was solid. Compared to the prior year, in 2024, our revenues were up 4.5 percent, adjusted EBITDA was up 9.0 percent, operating income was up 32.9 percent, and net income was up 31.5 percent.

“HealthStream is firing on all cylinders as we kick off 2025. We launched two significant products: the HealthStream Learning Experience (HLX) application and the American Red Cross Neonatal Advanced Life Support (NALS) program—and customers’ early responses to these innovations has been enthusiastic. Our LMS, the HealthStream Learning Center, was named by G2 as the #1 software in all of healthcare—across all of the varied types of software applications in the industry. Most importantly, we are starting to see powerful benefits of our hStream platform strategy and its exciting potential for the nation’s healthcare workforce.

“Alongside our emerging platform strategy, we’ve realigned our Company to optimize the opportunities ahead for us. To that end, we’ve made updates among our executive team that I believe enable us to make 2025 a banner year for moving HealthStream forward.”

| HealthStream Announces Fourth Quarter and Full-Year 2024 Results

Page 4

February 24, 2025

|

|

A conference call with Robert A. Frist, Jr., Chief Executive Officer, Scott A. Roberts, Chief Financial Officer and Senior Vice President, and Mollie Condra, Head, Investor Relations and Communications, will be held on Tuesday, February 25, 2025, at 9:00 a.m. (ET). Participants may access the conference call live via webcast using this link: https://edge.media-server.com/mmc/p/t7bbbexa. To participate via telephone, please register in advance using this link: https://register.vevent.com/register/BI709f5dbd0d1b4043b6decb8b34e41fe5. A replay of the conference call and webcast will be archived on the Company’s website in the Investor Relations section under “Events & Presentations.”

Use of Non-GAAP Financial Measures

This press release presents adjusted EBITDA, a non-GAAP financial measure used by management in analyzing the Company’s financial results and ongoing operational performance. In order to better assess the Company’s financial results, management believes that net income before interest, income taxes, stock-based compensation, depreciation and amortization, and changes in fair value of, including gains (losses) on the sale of, non-marketable equity investments (“adjusted EBITDA”) is a useful measure for evaluating the operating performance of the Company because adjusted EBITDA reflects net income adjusted for certain GAAP accounting, non-cash, and/or non-operating items which may not, in any such case, fully reflect the underlying operating performance of our business. In addition, as discussed below, for periods ended on or prior to December 31, 2023, adjusted EBITDA excludes the impact of the deferred revenue write-downs associated with fair value accounting for acquired businesses. We believe that adjusted EBITDA is useful to investors to assess the Company’s ongoing operating performance and to compare the Company’s operating performance between periods. In addition, certain short-term cash incentive bonuses and performance-based equity awards are based on the achievement of adjusted EBITDA (as defined in applicable bonus and equity grant documentation) targets.

As previously disclosed, prior to the Company early adopting ASU 2021-08 effective January 1, 2022, following the completion of any acquisition by the Company, the Company was required to record the acquired deferred revenue at fair value as defined in GAAP, which typically resulted in a write-down of the acquired deferred revenue. In connection therewith, management determined that including an adjustment in the definition of adjusted EBITDA for the impact of the deferred revenue write-downs associated with fair value accounting for businesses acquired prior to the January 1, 2022 effective date of the Company's adoption of ASU 2021-08 (the “Pre-2022 Acquisitions”) provided useful information to investors because the deferred revenue write-down recognized in periods after any such Pre-2022 Acquisitions could, given the nature of this non-cash accounting impact, cause our GAAP financial results during such periods to not fully reflect our underlying operating performance. Following the adoption of ASU 2021-08, contracts acquired in an acquisition completed on or after January 1, 2022 have been measured as if the Company had originated the contract (rather than the contract being measured at fair value) such that, for such acquisitions, the Company no longer records deferred revenue write-downs associated with acquired businesses. With respect to periods ended on or prior to December 31, 2023, the Company has included an adjustment in the calculation of adjusted EBITDA for the impact of deferred revenue write-downs associated with the Pre-2022 Acquisitions consistent with this prior accounting standard, given the ongoing impact of such deferred revenue on our financial results under GAAP over this time period. With respect to periods beginning on and after January 1, 2024, the Company no longer recognizes any deferred revenue write-downs associated with the Pre-2022 Acquisitions under GAAP, and accordingly such deferred revenue write-downs are not an adjustment in connection with the calculation of adjusted EBITDA for periods on and after January 1, 2024.

Adjusted EBITDA is a non-GAAP financial measure and should not be considered as a measure of financial performance under GAAP. Because adjusted EBITDA is not a measurement determined in accordance with GAAP, adjusted EBITDA is susceptible to varying calculations. Accordingly, adjusted EBITDA, as presented, may not be comparable to other similarly titled measures of other companies and has limitations as an analytical tool.

This non-GAAP financial measure should not be considered a substitute for, or superior to, measures of financial performance, which are prepared in accordance with GAAP. Investors are encouraged to review the reconciliations of adjusted EBITDA to net income (the most comparable GAAP measure), which is set forth below in this release.

About HealthStream

HealthStream (Nasdaq: HSTM) is the healthcare industry’s largest ecosystem of platform-delivered workforce solutions that empowers healthcare professionals to do what they do best: deliver excellence in patient care. For more information about HealthStream, visit www.healthstream.com or call 800-521-0574.

| HealthStream Announces Fourth Quarter and Full-Year 2024 Results

Page 5

February 24, 2025

|

|

HEALTHSTREAM, INC.

Condensed Consolidated Statements of Income

(In thousands, except per share data)

(Unaudited)

| |

|

Three Months Ended December 31,

|

|

|

Year Ended December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Revenues, net

|

|

$ |

74,235 |

|

|

$ |

70,580 |

|

|

$ |

291,646 |

|

|

$ |

279,063 |

|

|

Operating costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues (excluding depreciation and amortization)

|

|

|

25,111 |

|

|

|

24,010 |

|

|

|

97,936 |

|

|

|

95,021 |

|

|

Product development

|

|

|

12,682 |

|

|

|

11,929 |

|

|

|

48,890 |

|

|

|

45,540 |

|

|

Sales and marketing

|

|

|

12,482 |

|

|

|

11,418 |

|

|

|

47,158 |

|

|

|

45,743 |

|

|

General and administrative expenses

|

|

|

8,807 |

|

|

|

8,441 |

|

|

|

35,132 |

|

|

|

35,664 |

|

|

Depreciation and amortization

|

|

|

10,464 |

|

|

|

10,526 |

|

|

|

41,243 |

|

|

|

41,076 |

|

|

Total operating costs and expenses

|

|

|

69,546 |

|

|

|

66,324 |

|

|

|

270,359 |

|

|

|

263,044 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

4,689 |

|

|

|

4,256 |

|

|

|

21,287 |

|

|

|

16,019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income, net

|

|

|

794 |

|

|

|

1,162 |

|

|

|

3,516 |

|

|

|

2,492 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income tax provision

|

|

|

5,483 |

|

|

|

5,418 |

|

|

|

24,803 |

|

|

|

18,511 |

|

|

Income tax provision

|

|

|

594 |

|

|

|

828 |

|

|

|

4,796 |

|

|

|

3,298 |

|

|

Net income

|

|

$ |

4,889 |

|

|

$ |

4,590 |

|

|

$ |

20,007 |

|

|

$ |

15,213 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.16 |

|

|

$ |

0.15 |

|

|

$ |

0.66 |

|

|

$ |

0.50 |

|

|

Diluted

|

|

$ |

0.16 |

|

|

$ |

0.15 |

|

|

$ |

0.66 |

|

|

$ |

0.50 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares of common stock outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

30,423 |

|

|

|

30,326 |

|

|

|

30,386 |

|

|

|

30,571 |

|

|

Diluted

|

|

|

30,639 |

|

|

|

30,489 |

|

|

|

30,544 |

|

|

|

30,673 |

|

|

Dividends declared per share

|

|

$ |

0.028 |

|

|

$ |

0.025 |

|

|

$ |

0.112 |

|

|

$ |

0.100 |

|

| HealthStream Announces Fourth Quarter and Full-Year 2024 Results

Page 6

February 24, 2025

|

|

HEALTHSTREAM, INC.

Condensed Consolidated Balance Sheets

(In thousands)

(Unaudited)

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

59,469 |

|

|

$ |

40,333 |

|

|

Marketable securities

|

|

|

37,748 |

|

|

|

30,800 |

|

|

Accounts and unbilled receivables, net

|

|

|

35,322 |

|

|

|

38,446 |

|

|

Prepaid and other current assets

|

|

|

20,583 |

|

|

|

20,631 |

|

|

Total current assets

|

|

|

153,122 |

|

|

|

130,210 |

|

| |

|

|

|

|

|

|

|

|

|

Capitalized software development, net

|

|

|

43,370 |

|

|

|

40,643 |

|

|

Property and equipment, net

|

|

|

10,741 |

|

|

|

13,005 |

|

|

Operating lease right of use assets, net

|

|

|

17,453 |

|

|

|

20,114 |

|

|

Goodwill and intangible assets, net

|

|

|

246,768 |

|

|

|

259,410 |

|

|

Deferred commissions

|

|

|

34,671 |

|

|

|

31,700 |

|

|

Other assets

|

|

|

4,641 |

|

|

|

4,860 |

|

|

Total assets

|

|

$ |

510,766 |

|

|

$ |

499,942 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable, accrued, and other liabilities

|

|

$ |

31,466 |

|

|

$ |

34,738 |

|

|

Deferred revenue

|

|

|

84,227 |

|

|

|

83,623 |

|

|

Total current liabilities

|

|

|

115,693 |

|

|

|

118,361 |

|

|

Deferred tax liabilities

|

|

|

14,596 |

|

|

|

16,132 |

|

|

Deferred revenue, noncurrent

|

|

|

1,655 |

|

|

|

2,169 |

|

|

Operating lease liability, noncurrent

|

|

|

17,366 |

|

|

|

20,247 |

|

|

Other long-term liabilities

|

|

|

2,101 |

|

|

|

2,281 |

|

|

Total liabilities

|

|

|

151,411 |

|

|

|

159,190 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

252,432 |

|

|

|

249,075 |

|

|

Accumulated other comprehensive loss

|

|

|

(2,049 |

) |

|

|

(691 |

) |

|

Retained earnings

|

|

|

108,972 |

|

|

|

92,368 |

|

|

Total shareholders’ equity

|

|

|

359,355 |

|

|

|

340,752 |

|

|

Total liabilities and shareholders' equity

|

|

$ |

510,766 |

|

|

$ |

499,942 |

|

| HealthStream Announces Fourth Quarter and Full-Year 2024 Results

Page 7

February 24, 2025

|

|

HEALTHSTREAM, INC.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| |

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Operating activities:

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

20,007 |

|

|

$ |

15,213 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

41,243 |

|

|

|

41,076 |

|

|

Amortization of deferred commissions

|

|

|

12,480 |

|

|

|

11,495 |

|

|

Stock-based compensation

|

|

|

4,470 |

|

|

|

4,153 |

|

|

Deferred income taxes

|

|

|

(1,114 |

) |

|

|

(1,725 |

) |

|

Provision for credit losses

|

|

|

2,595 |

|

|

|

1,021 |

|

|

Loss on equity method investments

|

|

|

230 |

|

|

|

384 |

|

|

Change in fair value of non-marketable equity investments

|

|

|

— |

|

|

|

(425 |

) |

|

Other

|

|

|

(1,639 |

) |

|

|

(891 |

) |

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts and unbilled receivables

|

|

|

537 |

|

|

|

3,243 |

|

|

Deferred commissions

|

|

|

(15,451 |

) |

|

|

(14,852 |

) |

|

Prepaid and other assets

|

|

|

(974 |

) |

|

|

(2,046 |

) |

|

Accounts payable, accrued and other liabilities

|

|

|

(4,394 |

) |

|

|

3,938 |

|

|

Deferred revenue

|

|

|

(330 |

) |

|

|

3,386 |

|

|

Net cash provided by operating activities

|

|

|

57,660 |

|

|

|

63,970 |

|

| |

|

|

|

|

|

|

|

|

|

Investing activities:

|

|

|

|

|

|

|

|

|

|

Cash paid for acquisitions, net of cash acquired

|

|

|

(1,299 |

) |

|

|

(6,621 |

) |

|

Purchases of marketable securities, net of proceeds

|

|

|

(5,296 |

) |

|

|

(22,018 |

) |

|

Proceeds from sale of non-marketable equity investments

|

|

|

765 |

|

|

|

47 |

|

|

Purchases of property and equipment

|

|

|

(1,401 |

) |

|

|

(2,200 |

) |

|

Payments associated with capitalized software development

|

|

|

(26,741 |

) |

|

|

(25,806 |

) |

|

Net cash used in investing activities

|

|

|

(33,972 |

) |

|

|

(56,598 |

) |

| |

|

|

|

|

|

|

|

|

|

Financing activities:

|

|

|

|

|

|

|

|

|

|

Taxes paid related to net settlement of equity awards

|

|

|

(1,113 |

) |

|

|

(934 |

) |

|

Payment of debt issuance costs

|

|

|

— |

|

|

|

(118 |

) |

|

Repurchases of common stock

|

|

|

— |

|

|

|

(8,929 |

) |

|

Payment of cash dividends

|

|

|

(3,403 |

) |

|

|

(3,058 |

) |

|

Net cash used in financing activities

|

|

|

(4,516 |

) |

|

|

(13,039 |

) |

| |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents

|

|

|

(36 |

) |

|

|

(23 |

) |

|

Net increase (decrease) in cash and cash equivalents

|

|

|

19,136 |

|

|

|

(5,690 |

) |

|

Cash and cash equivalents at beginning of period

|

|

|

40,333 |

|

|

|

46,023 |

|

|

Cash and cash equivalents at end of period

|

|

$ |

59,469 |

|

|

$ |

40,333 |

|

| HealthStream Announces Fourth Quarter and Full-Year 2024 Results

Page 8

February 24, 2025

|

|

Reconciliation of GAAP to Non-GAAP Financial Measures(1)

Operating Results Summary

(In thousands)

(Unaudited)

| |

|

Three Months Ended December 31,

|

|

|

Year Ended December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

GAAP net income

|

|

$ |

4,889 |

|

|

$ |

4,590 |

|

|

$ |

20,007 |

|

|

$ |

15,213 |

|

|

Deferred revenue write-down

|

|

|

— |

|

|

|

84 |

|

|

|

— |

|

|

|

212 |

|

|

Interest income

|

|

|

(979 |

) |

|

|

(777 |

) |

|

|

(3,834 |

) |

|

|

(2,356 |

) |

|

Interest expense

|

|

|

26 |

|

|

|

26 |

|

|

|

100 |

|

|

|

124 |

|

|

Income tax provision

|

|

|

594 |

|

|

|

828 |

|

|

|

4,796 |

|

|

|

3,298 |

|

|

Stock-based compensation expense

|

|

|

1,185 |

|

|

|

1,077 |

|

|

|

4,470 |

|

|

|

4,153 |

|

|

Depreciation and amortization

|

|

|

10,464 |

|

|

|

10,526 |

|

|

|

41,243 |

|

|

|

41,076 |

|

|

Change in fair value of non-marketable equity investments

|

|

|

— |

|

|

|

(379 |

) |

|

|

— |

|

|

|

(425 |

) |

|

Adjusted EBITDA

|

|

$ |

16,179 |

|

|

$ |

15,975 |

|

|

$ |

66,782 |

|

|

$ |

61,295 |

|

(1) This press release presents adjusted EBITDA, which is a non-GAAP financial measure used by management in analyzing its financial results and ongoing operational performance.

| HealthStream Announces Fourth Quarter and Full-Year 2024 Results

Page 9

February 24, 2025

|

|

Reconciliation of GAAP to Non-GAAP Financial Measures

Financial Outlook for 2025

(In thousands)

(Unaudited)

| |

|

Low

|

|

|

High

|

|

|

Net income

|

|

$ |

19,200 |

|

|

$ |

21,400 |

|

|

Interest income

|

|

|

(3,000 |

) |

|

|

(3,400 |

) |

|

Interest expense

|

|

|

100 |

|

|

|

100 |

|

|

Income tax provision

|

|

|

5,100 |

|

|

|

6,100 |

|

|

Stock-based compensation expense

|

|

|

4,600 |

|

|

|

5,000 |

|

|

Depreciation and amortization

|

|

|

44,000 |

|

|

|

44,800 |

|

|

Adjusted EBITDA

|

|

$ |

70,000 |

|

|

$ |

74,000 |

|

| HealthStream Announces Fourth Quarter and Full-Year 2024 Results

Page 10

February 24, 2025

|

|

This press release includes certain forward-looking statements (statements other than solely with respect to historical fact), including statements regarding expectations for financial performance for 2025 and our quarterly dividend policy, that involve risks and uncertainties regarding HealthStream. These statements are based upon management’s beliefs, as well as assumptions made by and data currently available to management. This information has been, or in the future may be, included in reliance on the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. The Company cautions that forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by the forward-looking statements, including as a result of negative economic conditions, changes in U.S. policy, inflationary conditions, geopolitical instability (including as the result of the Russia/Ukraine conflict, the conflict in the Middle East, and the potential expansion of such conflicts), legal requirements and contractual restrictions which may affect continuation of our quarterly cash dividend policy and the declaration and/or payment of dividends thereunder, which may be modified, suspended, or canceled in any manner and at any time that our Board may deem necessary or appropriate, as well as risks referenced in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed on February 26, 2024, and in the Company’s other filings with the Securities and Exchange Commission from time to time. Consequently, such forward-looking information should not be regarded as a representation or warranty or statement by the Company that such projections will be realized. Many of the factors that will determine the Company’s future results are beyond the ability of the Company to control or predict. Readers should not place undue reliance on forward-looking statements, which reflect management’s views only as of the date hereof. The Company undertakes no obligation to update or revise any such forward-looking statements.

# # # #

v3.25.0.1

Document And Entity Information

|

Feb. 24, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

HealthStream, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 24, 2025

|

| Entity, Incorporation, State or Country Code |

TN

|

| Entity, File Number |

000-27701

|

| Entity, Tax Identification Number |

62-1443555

|

| Entity, Address, Address Line One |

500 11th Avenue North

|

| Entity, Address, City or Town |

Nashville

|

| Entity, Address, State or Province |

TN

|

| Entity, Address, Postal Zip Code |

37203

|

| City Area Code |

615

|

| Local Phone Number |

301-3100

|

| Title of 12(b) Security |

Common Stock (Par Value $0.00)

|

| Trading Symbol |

HSTM

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001095565

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

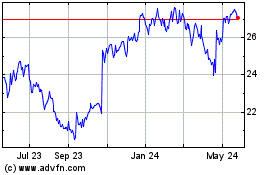

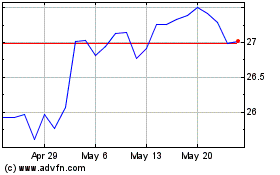

HealthStream (NASDAQ:HSTM)

Historical Stock Chart

From Jan 2025 to Feb 2025

HealthStream (NASDAQ:HSTM)

Historical Stock Chart

From Feb 2024 to Feb 2025