U.S. Stocks Get a Boost from Strong Corporate Results

April 16 2018 - 9:41AM

Dow Jones News

By Georgi Kantchev

U.S. stocks edged higher on Monday as companies that reported

strong corporate earnings helped push major indexes higher.

The Dow Jones Industrial Average gained 155 points, or 0.7%, to

24519 in early-morning trading. The S&P 500 added 0.5%, while

the Nasdaq Composite rose 0.2%.

The start of the latest earnings season contributed to the gains

major indexes accrued early Monday morning. Shares of trucking

company J.B. Hunt Transport Services were among the biggest gainers

in the S&P 500 after it reported stronger-than-expected revenue

for the first quarter of the year, leading the broad index's

industrial sector higher.

J.B. Hunt shares climbed 4.5%, while the broader industrial

segment of the S&P 500 added 0.8%.

However, while companies are expected to broadly report gains in

profit and revenue for the first three months of the year, some

investors worry that stocks will have a muted response since

valuations are still relatively high, even after the recent

pullback helped pull down forward-earning multiples for the S&P

500. Meanwhile, the labor market is tight, which could nudge

inflation to grow more quickly than expected and resource costs

could soon become problematic, said Jim Paulsen, chief investment

strategist of the Leuthold Group.

Shares of Bank of America, for example, added only 0.1% after

the bank said Monday that a boost from the U.S. tax law and

continued rising interest rates helped push first-quarter profit

higher, mirroring the weak performance among financial stocks that

had reported strong earnings on Friday.

"For a host of reasons, investors should probably moderate

upside expectations due to robust earnings results this year," Mr.

Paulsen said.

Investors breathed a sigh of relief after missile strikes late

Friday by the U.S., U.K. and France on Syria didn't lead to a major

escalation in the seven-year-old conflict. A Pentagon official said

that the single wave of strikes is complete for now, while in a

Twitter post Saturday, President Donald Trump said "Mission

Accomplished!"

"Uncertainties can escalate again, but so far the biggest fears

haven't been realized, which allows risky assets to recover," said

Viraj Patel, a strategist at ING Bank.

Geopolitical concerns, trade tensions and some

weaker-than-expected economic numbers rattled investor sentiment in

recent weeks amid fears those factors could hit a rare spurt of

synchronized global economic upswing.

Elsewhere, the Stoxx Europe 600 fell 0.4%, dragged down by

energy stocks, while Asian markets ended mixed.

Asian stocks' early gains eroded Monday, led by declines in Hong

Kong and mainland China over worries about the Hong Kong dollar,

though Japanese stocks rose.

The Hang Seng Index ended down 1.6% while the Shanghai Composite

Index of big-cap Chinese stocks was down 1.5%. Japan's Nikkei Stock

Average finished up 0.3%.

--Michael Wursthorn contributed to this article.

Write to Georgi Kantchev at georgi.kantchev@wsj.com

(END) Dow Jones Newswires

April 16, 2018 10:26 ET (14:26 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

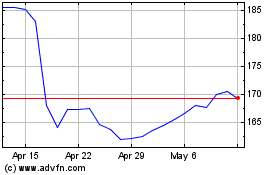

J B Hunt Transport Servi... (NASDAQ:JBHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

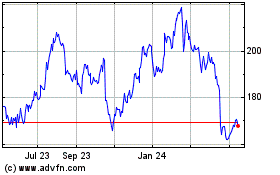

J B Hunt Transport Servi... (NASDAQ:JBHT)

Historical Stock Chart

From Apr 2023 to Apr 2024