false

0001491419

0001491419

2025-02-19

2025-02-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 19, 2025

LIVEONE,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38249 |

|

98-0657263 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

269

South Beverly Drive, Suite 1450

Beverly

Hills, CA 90212

(Address

of principal executive offices) (Zip Code)

(310)

601-2505

(Registrant’s

telephone number, including area code)

n/a

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common stock, $0.001

par value per share |

|

LVO |

|

The NASDAQ Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Effective

as of February 19, 2025 (the “Effective Date”), LiveOne, Inc. (the “Company”) appointed Ryan Carhart, the Company’s

current Vice President and Controller, as the Company’s Chief Financial Officer, Treasurer and Secretary, to succeed Aaron Sullivan,

the former Executive Vice President, Chief Financial Officer, Treasurer and Secretary of the Company, who notified the Company on the

Effective Date that he is leaving the Company to pursue another professional opportunity effective as of the Effective Date. Mr. Carhart

will also assume the role of Principal Accounting Officer of the Company. Mr. Carhart was also appointed to the same positions with PodcastOne,

Inc. (“PodcastOne”), the Company’s majority owned subsidiary, and Slacker, Inc., the Company’s wholly owned subsidiary.

Mr.

Sullivan’s departure was not as a result of any dispute with the Company.

Mr.

Carhart, age 45, has served as the Vice President and Controller of the Company and PodcastOne since September 2023. Mr. Carhart is a

seasoned financial professional with extensive experience in overseeing operations, corporate strategy and development, financial reporting,

mergers and acquisitions, establishing and overseeing operational excellence initiatives in growing organizations and public company

compliance. Prior to his appointment as the Company’s and PodcastOne’s Vice President and Controller, Mr. Carhart served

as the Chief Financial Officer at AUDIENCEX, an AI-powered digital ad partner, optimizing programmatic, social, and search campaigns

with data-driven strategy and creative solutions, and as the Principal Financial Officer and Principal Accounting Officer of Vado Corp

(“Vado”), since May, 2019, where he guided AUDIENCEX through its acquisition by Vado, while overseeing operations and corporate

strategy and development. Prior to that, Mr. Carhart served as the Senior Director of Finance and Controller at MNTN, a builder of advertising

software for brands to drive measurable conversions, revenue, site visits and more through the power of television. Mr. Carhart previously

worked at PricewaterhouseCoopers, a global public accounting firm, with a specialization in the technology and communications industries.

Mr. Carhart holds a Master of Science in Accounting and a Master of Business Administration (MSA/MBA) from Northeastern University, along

with a PhD from Claremont Graduate University, and is a Certified Public Accountant.

There

is no arrangement or understanding between Mr. Carhart and any other persons pursuant to which Mr. Carhart was appointed to

his positions. There are no family relationships between Mr. Carhart and any of the Company’s officers or directors. Other

than as described below, there are no other transactions to which the Company or any of its subsidiaries is a party in which Mr. Carhart has

a material interest subject to disclosure under Item 404(a) of Regulation S-K. In connection with his appointment, the Company may

provide additional compensation to Mr. Carhart in the future.

Item

7.01 Regulation FD Disclosure.

On

February 25, 2025, the Company issued a press release announcing that it named Mr. Carhart as the Company’s Chief Financial Officer,

Treasurer and Secretary. A copy of the Company’s press release is attached as Exhibit 99.1 to this Current Report.

The

information in this Item 7.01, including Exhibit 99.1 attached hereto, is furnished pursuant to Item 7.01 and shall not be deemed “filed”

for any other purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that Section. The information in this Item 7.01 of this Current Report shall

not be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act regardless of any general incorporation

language in such filing unless specifically provided otherwise.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

LIVEONE, INC. |

| |

|

| Dated: February 25, 2025 |

By: |

/s/

Robert S. Ellin |

| |

Name: |

Robert S. Ellin |

| |

Title: |

Chief Executive Officer and

Chairman of the Board of Directors |

2

Exhibit 99.1

LiveOne

(Nasdaq: LVO) and PodcastOne (Nasdaq: PODC) Promote Ryan Carhart to Chief Financial Officer

| ● | Expands

Cost Savings via Restructuring to Over $23 Million |

| ● | Paid

Down $3.7 Million to East West Bank |

LOS

ANGELES, CA, February 25, 2025 - LiveOne (Nasdaq: LVO), an award-winning, creator-first, music, entertainment, and technology

platform, announced today Ryan Carhart's promotion to Chief Financial Officer of LiveOne, PodcastOne and all their subsidiaries, effective

as of February 19, 2025. Robert Ellin, CEO of LiveOne, commented, "We're thrilled to promote Ryan to CFO. Ryan brings strong financial

discipline, respected relationships with analysts, bankers, and our financial team, and a proven track record of effective bank relations.

Since his promotion, Ryan has taken immediate action, implementing measures anticipated to result in additional $13 million in cost savings,

including significant reductions in expenses at CPS, to achieve anticipated total cash savings of over $23 million.”

Mr.

Ellin added, “Ryan has also played a key role in securing a new loan agreement with East West Bank after paying off $3.7 million

of East West Bank’s $7 million loan to LiveOne. Furthermore, Ryan has secured a Letter of Intent with a major commercial bank to

refinance the remaining East West Bank debt and provide growth capital to our company to expand our business, focusing on profitability.”

About

LiveOne

Headquartered

in Los Angeles, CA, LiveOne (Nasdaq: LVO) is an award-winning, creator-first, music, entertainment, and technology platform focused

on delivering premium experiences and content worldwide through memberships and live and virtual events. LiveOne's subsidiaries include

Slacker, PodcastOne (Nasdaq: PODC), PPVOne, CPS, LiveXLive, DayOne Music Publishing, Drumify and Splitmind. LiveOne is available

on iOS, Android, Roku, Apple TV, Spotify, Samsung, Amazon Fire, Android TV, and through STIRR's OTT applications. For more information,

visit liveone.com and follow us on Facebook, Instagram, TikTok, YouTube and Twitter at @liveone.

For more investor information, please visit ir.liveone.com.

About

PodcastOne

PodcastOne (NASDAQ: PODC) is a leading podcast platform that provides creators and advertisers with a comprehensive

360-degree solution in sales, marketing, public relations, production, and distribution. PodcastOne has surpassed 3.9 billion total downloads

with a community of 200 top podcasters, including Adam Carolla, Kaitlyn Bristowe, Jordan Harbinger, LadyGang, A&E's Cold Case Files,

and Varnamtown. PodcastOne has built a distribution network reaching over 1 billion monthly impressions across all channels, including

YouTube, Spotify, Apple Podcasts, and iHeartRadio. PodcastOne is also the parent company of PodcastOne Pro which offers fully

customizable production packages for brands, professionals, or hobbyists. For more information, visit www.podcastone.com and

follow us on Facebook, Instagram, YouTube, and X at @podcastone.

Forward-Looking

Statements

All

statements other than statements of historical facts contained in this press release are “forward-looking statements,” which

may often, but not always, be identified by the use of such words as “may,” “might,” “will,” “will

likely result,” “would,” “should,” “estimate,” “plan,” “project,” “forecast,”

“intend,” “expect,” “anticipate,” “believe,” “seek,” “continue,”

“target” or the negative of such terms or other similar expressions. These statements involve known and unknown risks, uncertainties

and other factors, which may cause actual results, performance or achievements to differ materially from those expressed or implied by

such statements, including: LiveOne’s reliance on its largest OEM customer for a substantial percentage of its revenue; LiveOne’s

ability to consummate any proposed financing, acquisition, spin-out, special dividend, merger, distribution or transaction, the timing

of the consummation of any such proposed event, including the risks that a condition to the consummation of any such event would not

be satisfied within the expected timeframe or at all, or that the consummation of any proposed financing, acquisition, spin-out, merger,

special dividend, distribution or transaction will not occur or whether any such event will enhance shareholder value; LiveOne’s

ability to continue as a going concern; LiveOne’s ability to attract, maintain and increase the number of its users and paid members;

LiveOne identifying, acquiring, securing and developing content; LiveOne’s intent to repurchase shares of its and/or PodcastOne’s

common stock from time to time under LiveOne’s announced stock repurchase program and the timing, price, and quantity of repurchases,

if any, under the program; LiveOne’s ability to maintain compliance with certain financial and other covenants; LiveOne successfully

implementing its growth strategy, including relating to its technology platforms and applications; management’s relationships with

industry stakeholders; LiveOne’s ability to extend and/or refinance its indebtedness and/or repay its indebtedness when due; uncertain

and unfavorable outcomes in legal proceedings and/or LiveOne’s ability to pay any amounts due in connection with any such legal

proceedings; changes in economic conditions; competition; risks and uncertainties applicable to the businesses of LiveOne’s subsidiaries;

and other risks, uncertainties and factors including, but not limited to, those described in LiveOne’s Annual Report on Form 10-K

for the fiscal year ended March 31, 2024, filed with the U.S. Securities and Exchange Commission (the “SEC”) on July 1, 2024,

Quarterly Report on Form 10-Q for the quarter ended December 31, 2024, filed with SEC on February 14, 2025, and in LiveOne’s

other filings and submissions with the SEC. These forward-looking statements speak only as of the date hereof, and LiveOne disclaims

any obligation to update these statements, except as may be required by law. LiveOne intends that all forward-looking statements be subject

to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995.

LiveOne

IR Contact:

Liviakis Financial Communications, Inc.

(415) 389-4670

john@liviakis.com

LiveOne

Press Contact:

LiveOne

press@liveone.com

Follow

LiveOne on social media: Facebook, Instagram, TikTok, YouTube, and Twitter at @liveone.

v3.25.0.1

Cover

|

Feb. 19, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 19, 2025

|

| Entity File Number |

001-38249

|

| Entity Registrant Name |

LIVEONE,

INC.

|

| Entity Central Index Key |

0001491419

|

| Entity Tax Identification Number |

98-0657263

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

269

South Beverly Drive

|

| Entity Address, Address Line Two |

Suite 1450

|

| Entity Address, City or Town |

Beverly

Hills

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90212

|

| City Area Code |

310

|

| Local Phone Number |

601-2505

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001

par value per share

|

| Trading Symbol |

LVO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

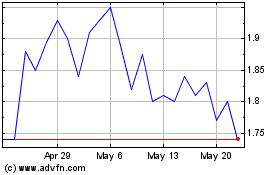

LiveOne (NASDAQ:LVO)

Historical Stock Chart

From Jan 2025 to Feb 2025

LiveOne (NASDAQ:LVO)

Historical Stock Chart

From Feb 2024 to Feb 2025