false

0001408443

A8

00-0000000

QC

0001408443

2024-08-08

2024-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 8, 2024

MILESTONE

PHARMACEUTICALS INC.

(Exact name of registrant as specified in its

charter)

| Québec |

|

001-38899 |

|

Not

applicable |

| (state or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| 1111

Dr. Frederik-Philips Boulevard, |

|

|

| Suite

420 |

|

|

| Montréal,

Québec CA |

|

H4M

2X6 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area

code: (514)

336-0444

(Former

name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common

Shares |

|

MIST |

|

The

Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company

x

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 2.02. |

Results of Operations and

Financial Condition. |

On August 8, 2024, Milestone Pharmaceuticals

Inc. (the “Company”) issued a press release announcing its financial results for the second quarter ended June 30, 2024,

which also provided a clinical and corporate update. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated

herein by reference.

| Item

9.01. |

Financial

Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

MILESTONE PHARMACEUTICALS INC. |

| |

|

| |

By: |

/s/Amit Hasija |

| |

|

Amit Hasija |

| |

|

Chief Financial Officer |

| |

|

| |

Dated: August 8, 2024 |

Exhibit 99.1

Milestone

Pharmaceuticals Reports Second Quarter 2024 Financial Results and Provides Regulatory and Corporate Update

– NDA for CARDAMYST™ in PSVT accepted by FDA in 2Q 2024; PDUFA in March 2025

– Cash of $83.3 million as of June 30, 2024 expected to fund operations into 2026

– Stuart Duty and Andrew Saik Appointed as Independent Board Directors

MONTREAL

and CHARLOTTE, N.C., August 8, 2024 (GLOBE NEWSWIRE) -- Milestone Pharmaceuticals Inc. (Nasdaq: MIST) today reported financial results

for the second quarter ended June 30, 2024 and provided a regulatory and corporate update.

“The

FDA acceptance of our New Drug Application (NDA) for CARDAMYST™ (etripamil) nasal spray (an investigational new drug), has

enabled our commercial team to advance preparations for potential approval and launch in 2025,” said Joseph Oliveto, President

and Chief Executive Officer of Milestone Pharmaceuticals. “Further, we are encouraged by the interest and input from

cardiology experts in our Phase 3 AFib-RVR study that we plan to commence in the first half of 2025.”

Second Quarter

and Recent Program Updates

CARDAMYST

for patients with paroxysmal supraventricular tachycardia (PSVT)

| · | FDA accepted the NDA

of CARDAMYST for PSVT. On May 26, 2024, the U.S. Food and Drug Administration (FDA) accepted the resubmission of the NDA for CARDAMYST.

The FDA Prescription Drug User Fee Act (PDUFA) target date has been set for March 2025. |

| · | Milestone

hosted a KOL webinar entitled “Learnings

from the Field: Expert Perspectives on Managing PSVT in the Community Setting.”

The event, which is the first of a series of planned webinars

learning from community-based health care providers, featured George

Mark, MD, FACC and Vivek Sailam, MD from The Heart

House and Cooper University Health Care.

Both physicians discussed the burden of PSVT on patients and their practice, current treatments

and unmet needs, and expectations for how the treatment landscape is likely to evolve in

coming years. A replay of the webinar is available on the Milestone corporate website here.

The second event of the webcast series is planned

for this Fall. |

Etripamil for patients with

atrial fibrillation with rapid ventricular rate (AFib-RVR)

| · | Planning and Design

of Phase 3 pivotal trial is ongoing, following guidance received from FDA in 1Q 2024 meeting. Milestone is working with experts

to finalize the design of a Phase 3 trial for etripamil in AFib-RVR. The Company plans to propose to the FDA a Phase

3 clinical study, conducted in the at-home setting, that will enroll patients with a history of symptomatic episodes and use a self-administered,

repeat-dose regimen of 70 mg of etripamil nasal spray, similar to what was investigated in the RAPID trial in patients with PSVT. Enrollment

is expected to commence in the first half of 2025. |

| · | Data

from previously published studies on etripamil in PSVT and AFib-RVR were featured in presentations

at ISPOR 2024 (May 5-8), the 2024 Stanford BioDesign Arrhythmia Technologies

Retreat (May 15),

and the Annual meeting of the Heart Rhythm Society, Heart

Rhythm 2024 (May 16-19).

The publications add to a growing body of literature on the patient- and system-burdens,

and costs of PSVT, and to the support for the potential of etripamil to reduce ED visits

for patients who are able to self-treat their PSVT episodes. Further information presented

included the findings from Milestone’s investigation of etripamil in patients with

AFib-RVR and the rationale for the Company’s Phase 3 program. Copies of the presentations and posters

can be found here.

|

Corporate Updates

| · | In July, Stuart

Duty and Andrew Saik were appointed as independent directors to the board

of directors. Mr. Duty brings over 30 years of experience in investment banking and operations primarily in the biotechnology and

specialty pharmaceuticals sectors. Mr. Saik brings over 25 years of accounting and finance experience, including leading numerous capital

structure transformations. |

Second

Quarter 2024 Financial Results

| · | As of June 30, 2024, Milestone

had cash, cash equivalents, and short-term investments of $83.3 million, compared to $66.0 million as of December 31, 2023. |

| · | Research and

development expense, net of tax credits for the second quarter of 2024 was $2.8 million, compared with

$8.6 million for the same period in 2023. For the six months ended June

30, 2024, research and development expense was $6.5 million compared

with $18.9 million for the same period in 2023. This decrease in research and development expenses was driven by lower

clinical development costs and clinical personnel-related costs driven by completion of phase 3 studies, as well as a decrease in

drug manufacturing professional fees and personnel-related costs. |

| · | General and administrative

expense for the second quarter of 2024 was $5.0 million, compared with the $4.4 million reported for the same

period in 2023. For the six months ended June 30, 2024,

general and administrative expense was $9.0 million, compared with the with $8.3 million for the prior year period.

The increases between the periods are primarily due to an increase in legal and professional fees, partially offset by a decrease in personnel

costs. |

| · | Commercial expense

for the second quarter of 2024 was $1.8 million, compared with $3.4 million for the same period in 2023. For

the six months ended June 30, 2024, commercial expense was $4.7 million compared with $5.7 million for

the prior year period. The decreases are a result of decreases in personnel costs, professional costs and other operational expenses related

to commercialization. |

| · | For the second

quarter of 2024, net loss was $9.4 million, compared to $16.0 million for the prior year period. For

the six months ended June 30, 2024, Milestone's net loss was $19.7 million,

compared to $31.0 million in the prior year period. |

For further

details on the Company’s financials, refer to the quarterly report on Form 10-Q for the quarter ended June 30, 2024, filed with

the SEC on August 8, 2024.

About

Paroxysmal Supraventricular Tachycardia

An estimated

two million people in the United States are currently diagnosed with PSVT which is a type of arrhythmia or abnormal heart rhythm. PSVT

is characterized by episodes of sudden onset rapid heartbeats often exceeding 150 to 200 beats per minute. The heart rate spike is unpredictable

and may last several hours. The rapid heart rate often causes disabling severe palpitations, shortness of breath, chest discomfort, dizziness

or lightheadedness, and distress, forcing patients to limit their daily activities. The uncertainty of when an episode of PSVT will strike

or how long it will persist can provoke anxiety in patients and negatively impact their day-to-day life between episodes. The impact and

morbidity from an attack can be especially detrimental in patients with underlying cardiovascular or medical conditions, such as heart

failure, obstructive coronary disease, or dehydration. Many health care providers are dissatisfied with the lack of effective treatment

options with patients often requiring prolonged, burdensome, and costly trips to the emergency department or even invasive cardiac ablation

procedures.

About

Atrial Fibrillation with Rapid Ventricular Rate

An estimated

five million Americans suffer from atrial fibrillation (AFib), a common arrhythmia marked by an irregular, disruptive and often rapid

heartbeat. The incidence of AFib is expected to grow to approximately 10 million by 2025 and up to about 12 million by 2030. A subset

of patients with AFib experience episodes of abnormally high heart rate most often accompanied by palpitations, shortness of breath, dizziness,

and weakness. While these episodes, known as AFib-RVR, may be treated by oral calcium channel blockers and/or beta blockers, patients

frequently seek acute care in the emergency department to address symptoms. In 2016, nearly 800,000 patients were admitted to the emergency

department due to AFib symptoms where treatment includes medically supervised intravenous administration of calcium channel blockers or

beta blockers, or electrical cardioversion. With little available data for AFib-RVR, Milestone's initial market research indicates that

30 to 40% of patients with AFib experience one or more symptomatic episodes of RVR per year that require treatment, suggesting a target

addressable market of approximately three to four million patients in 2030 for etripamil in patients with AFib-RVR.

About

Etripamil

Etripamil is Milestone's

lead investigational product. It is a novel calcium channel blocker nasal spray under clinical development for frequent and often highly

symptomatic episodes of PSVT and AFib-RVR. It is designed as a self-administered rapid response therapy for patients thereby bypassing

the need for immediate medical oversight. If approved, etripamil is intended to provide health care providers with a new treatment option

to enable on-demand care and patient self-management. This portable, self-administered treatment may provide patients with active management

and a greater sense of control over their condition. CARDAMYST™ (etripamil) nasal spray, the conditionally approved brand name for

etripamil nasal spray, is well studied with a robust clinical trial program that includes a completed Phase 3 clinical-stage program for

the treatment of PSVT and Phase 2 trial for the treatment of patients with AFib-RVR.

About

Milestone Pharmaceuticals

Milestone Pharmaceuticals

Inc. (Nasdaq: MIST) is a biopharmaceutical company developing and commercializing innovative cardiovascular solutions to improve the lives

of people living with complex and life-altering heart conditions. The Company’s focus on understanding unmet patient needs and improving

the patient experience has led us to develop new treatment approaches that provide patients with an active role in self-managing their

care. Milestone's lead investigational product is etripamil, a novel calcium channel blocker nasal spray that is being studied for patients

to self-administer without medical supervision to treat symptomatic episodic attacks associated with PSVT and AFib-RVR.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such

as “believe,” “continue,” “could,” “demonstrate,” “designed,” “develop,”

“estimate,” “expect,” “may,” “pending,” “plan,” “potential,” “progress,”

“will”, “intend” and similar expressions (as well as other words or expressions referencing future events, conditions,

or circumstances) are intended to identify forward-looking statements. These forward-looking statements are based on Milestone’s

expectations and assumptions as of the date of this press release. Each of these forward-looking statements involves risks and uncertainties.

Actual results may differ materially from these forward-looking statements. Forward-looking statements contained in this press release

include statements regarding: our expected cash runway into 2026; the timing and outcomes of future interactions with U.S. and foreign

regulatory bodies, including the FDA, including the timing of the FDA’s review of the NDA; the potential of etripamil to help patients

living with these serious heart arrythmias and to reduce ED visits for patients who are able to self-treat their PSVT episodes; the timing

of the launch of etripamil; and the timing, design and outcomes of our clinical trials, including our Phase 3 study in AFib-RVR. Important

factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited

to, whether our future interactions with the FDA will have satisfactory outcomes; whether and when, if at all, our NDA for etripamil will

be approved by the FDA; whether the FDA will require additional trials or data which may significantly delay and put at risk our efforts

to obtain approval and may not be successful, the risks inherent in biopharmaceutical product development and clinical trials, including

the lengthy and uncertain regulatory approval process; uncertainties related to the timing of initiation, enrollment, completion, evaluation

and results of our clinical trials; risks and uncertainty related to the complexity inherent in cleaning, verifying and analyzing trial

data; and whether the clinical trials will validate the safety and efficacy of etripamil for PSVT or other indications, among others,

general economic, political, and market conditions, including deteriorating market conditions due to investor concerns regarding inflation,

Russian hostilities in Ukraine and ongoing disputes in Israel and Gaza and overall fluctuations in the financial markets in the United

States and abroad, risks related to pandemics and public health emergencies, and risks related the sufficiency of Milestone’s capital

resources and its ability to raise additional capital in the current economic climate. These and other risks are set forth in Milestone’s

filings with the U.S. Securities and Exchange Commission (SEC), including in its annual report on Form 10-K for the year ended December

31, 2023 and its quarterly report on Form 10-Q for the quarter ended June 30, 2024, under the caption “Risk Factors,” as such

discussion may be updated from time to time by subsequent filings Milestone may make with the SEC. Except as required by law, Milestone

assumes no obligation to update any forward-looking statements contained herein to reflect any change in expectations, even as new information

becomes available.

Contact:

Kim Fox, Vice

President, Communications, kfox@milestonepharma.com

Investor Relations

Chris Calabrese,

ccalabrese@lifesciadvisors.com

Kevin Gardner,

kgardner@lifesciadvisors.com

Milestone Pharmaceuticals

Inc.

Condensed Consolidated

Statements of Loss (Unaudited)

(in thousands

of US dollars, except share and per share data)

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 1,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Research and development, net of tax credits | |

| 2,815 | | |

| 8,622 | | |

| 6,454 | | |

| 18,879 | |

| General and administrative | |

| 5,046 | | |

| 4,445 | | |

| 8,999 | | |

| 8,334 | |

| Commercial | |

| 1,801 | | |

| 3,369 | | |

| 4,685 | | |

| 5,725 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (9,662 | ) | |

| (16,436 | ) | |

| (20,138 | ) | |

| (31,938 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 1,186 | | |

| 1,213 | | |

| 2,180 | | |

| 1,801 | |

| Interest expense | |

| (887 | ) | |

| (820 | ) | |

| (1,759 | ) | |

| (856 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss and comprehensive loss | |

$ | (9,363 | ) | |

$ | (16,043 | ) | |

$ | (19,717 | ) | |

$ | (30,993 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares and pre-funded warrants outstanding, basic and diluted | |

| 66,165,461 | | |

| 42,937,036 | | |

| 58,160,286 | | |

| 42,895,387 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share, basic and diluted | |

$ | (0.14 | ) | |

$ | (0.37 | ) | |

$ | (0.34 | ) | |

$ | (0.72 | ) |

Milestone Pharmaceuticals

Inc.

Condensed Consolidated

Balance Sheets (Unaudited)

(in thousands

of US dollars, except share data)

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Assets | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 13,262 | | |

$ | 13,760 | |

| Short-term investments | |

| 69,991 | | |

| 52,243 | |

| Research and development tax credits receivable | |

| 776 | | |

| 643 | |

| Prepaid expenses | |

| 1,713 | | |

| 3,178 | |

| Other receivables | |

| 1,617 | | |

| 3,208 | |

| Total current assets | |

| 87,359 | | |

| 73,032 | |

| Operating lease right-of-use assets | |

| 1,651 | | |

| 1,917 | |

| Property and equipment | |

| 222 | | |

| 277 | |

| Total assets | |

$ | 89,232 | | |

$ | 75,226 | |

| | |

| | | |

| | |

| Liabilities, and Shareholders' Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 4,000 | | |

$ | 6,680 | |

| Operating lease liabilities | |

| 567 | | |

| 546 | |

| Total current liabilities | |

| 4,567 | | |

| 7,226 | |

| Operating lease liabilities, net of current portion | |

| 1,156 | | |

| 1,457 | |

| Senior secured convertible notes | |

| 51,531 | | |

| 49,772 | |

| Total liabilities | |

| 57,254 | | |

| 58,455 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Shareholders’ Equity | |

| | | |

| | |

| Common shares, no par value, unlimited shares authorized 53,269,565 shares issued and outstanding as of June 30, 2024, 33,483,111 shares issued and outstanding as of December 31, 2023 | |

| 287,932 | | |

| 260,504 | |

| Pre-funded warrants - 12,910,590 issued and outstanding as of June 30, 2024 and 9,577,257 as of December 31, 2023 | |

| 53,076 | | |

| 48,459 | |

| Additional paid-in capital | |

| 36,713 | | |

| 33,834 | |

| Accumulated deficit | |

| (345,743 | ) | |

| (326,026 | ) |

| | |

| | | |

| | |

| Total shareholders’ equity | |

| 31,978 | | |

| 16,771 | |

| | |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

$ | 89,232 | | |

$ | 75,226 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

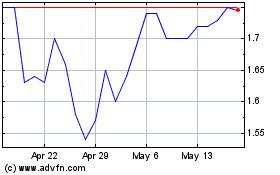

Milestone Pharmaceuticals (NASDAQ:MIST)

Historical Stock Chart

From Oct 2024 to Nov 2024

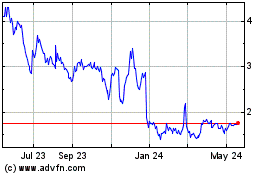

Milestone Pharmaceuticals (NASDAQ:MIST)

Historical Stock Chart

From Nov 2023 to Nov 2024