Everspin Technologies, Inc. (NASDAQ: MRAM), the world’s leading

developer and manufacturer of magnetoresistive random access memory

(MRAM) persistent memory solutions, today announced preliminary

unaudited financial results for the fourth quarter and full year

ended December 31, 2024.

“We are pleased to report fourth quarter results with revenue

above our expectations and earnings per share at the high end of

our guidance range,” said Sanjeev Aggarwal, President and Chief

Executive Officer. “We had a total of 178 design wins in 2024 and

we are excited about the opportunities ahead of us to expand our

reach in the NOR flash, SRAM and storage markets.”

Fourth Quarter 2024 Results

- Total revenue of $13.2 million, compared to $16.7 million in

the fourth quarter of 2023.

- MRAM product sales, which includes both Toggle and STT-MRAM

revenue, of $11.0 million, compared to $12.4 million in the fourth

quarter of 2023.

- Licensing, royalty, patent, and other revenue of $2.2 million,

compared to $4.3 million in the fourth quarter of 2023.

- Gross margin of 51.3%, compared to 58.1% in the fourth quarter

of 2023.

- GAAP operating expenses of $8.4 million, compared to $8.1

million in the fourth quarter of 2023.

- Other income, net of $2.6 million, compared to $0.4 million in

the fourth quarter of 2023.

- GAAP net income of $1.2 million, or $0.05 per diluted share,

compared to net income of $2.0 million, or $0.09 per diluted share,

in the fourth quarter of 2023.

- Adjusted EBITDA of $3.2 million, compared to $3.6 million in

the fourth quarter of 2023.

- Cash and cash equivalents as of December 31, 2024, increased to

$42.1 million.

Full Year 2024 Results

- Total revenue of $50.4 million, compared to $63.8 million in

2023.

- MRAM product sales, which includes both Toggle and STT-MRAM

revenue, of $42.2 million, compared to $53.1 million in 2023.

- Licensing, royalty, patent, and other revenue of $8.2 million,

compared to $10.6 million in 2023.

- Gross margin of 51.8%, compared to 58.4% in 2023.

- GAAP operating expenses of $33.2 million, compared to $31.4

million in 2023.

- Other income, net of $7.8 million, compared to $3.2 million in

2023.

- GAAP net income of $0.8 million, or $0.04 per diluted share,

compared to net income of $9.1 million, or $0.42 per diluted share,

in 2023.

- Adjusted EBITDA of $9.2 million, compared to $15.3 million in

2023.

“Our solid results this quarter were driven by strength in our

product revenue and RAD-Hard projects,” said Bill Cooper,

Everspin’s Chief Financial Officer. “Our balance sheet remains

strong and we remain committed to maintaining financial discipline

while scaling our business and converting additional design wins to

revenue.”

Business Outlook

For the first quarter 2025, Everspin expects total revenue in a

range of $12 million to $13 million and GAAP net loss per basic

share to be between $(0.10) and $(0.05). Non-GAAP net (loss) income

per basic share is anticipated to be between $(0.05) and $0.00.

A reconciliation of non-GAAP guidance measures to corresponding

GAAP guidance measures is not available on a forward-looking basis

without unreasonable effort due to the uncertainty regarding, and

the potential variability of, expenses that may be incurred in the

future. Stock-based compensation-related charges are impacted by

the timing of employee stock transactions, the future fair market

value of Everspin’s common stock, and Everspin’s future hiring and

retention needs, all of which are difficult to predict and subject

to constant change. These factors could be material to Everspin’s

results computed in accordance with GAAP. This outlook is dependent

on Everspin's current expectations, which may be impacted by, among

other things, evolving external conditions, such as public

health-related events or outbreaks, local safety guidelines,

worsening impacts due to supply chain constraints or interruptions,

including recent market volatility, semiconductor downturn and the

other risk factors described in Everspin's filings with the

Securities and Exchange Commission (the "SEC"), including its

Annual Report on Form 10-K for the fiscal year ended December 31,

2023, its Quarterly Reports on Form 10-Q filed with the SEC during

2024, as well as in its subsequent filings with the SEC.

Use of Non-GAAP Financial Measures

Everspin supplements the reporting of its financial information

determined under generally accepted accounting principles in the

United States of America (GAAP) with the following non-GAAP

financial measures:

- Non-GAAP net income (loss), which is defined as the GAAP

measure, excluding the effect of stock-based compensation

charges.

- Adjusted EBITDA, which is defined as net income adjusted for

interest expense, taxes, depreciation and amortization, stock-based

compensation expense, and restructuring costs (if any).

Everspin’s management and board of directors use these non-GAAP

measures to understand and evaluate its operating performance and

trends, to prepare and approve its annual budget and to develop

short-term and long-term operating and financing plans.

Accordingly, Everspin believes that these non-GAAP measures provide

useful information for investors in understanding and evaluating

its operating results in the same manner as its management and

board of directors. These non-GAAP financial measures should be

considered in addition to, not as superior to, or as a substitute

for, financial measures reported in accordance with GAAP. Moreover,

other companies may define these non-GAAP measures differently,

which limits the usefulness of this measure for comparisons with

such other companies. Everspin encourages investors to review its

financial statements and publicly-filed reports in their entirety

and not to rely on any single financial measure. Please see the

tables included at the end of this release for the reconciliation

of GAAP to non-GAAP results.

Conference Call

Everspin will host a conference call for analysts and investors

on Wednesday, February 26, 2025, at 5:00 p.m. Eastern Time.

Dial-in details: To access the call by phone, please go to this

link and you will be provided with dial-in details. To avoid

delays, we encourage participants to dial into the conference call

fifteen minutes ahead of the scheduled start time.

The live webcast of the call will be accessible on Everspin’s

website at investor.everspin.com. Approximately two hours after

conclusion of the live event, an archived webcast of the conference

call will be accessible from the Investor Relations section of

Everspin’s website for twelve months.

About Everspin Technologies

Everspin Technologies, Inc. is the world’s leading provider of

magnetoresistive RAM (MRAM). Everspin MRAM delivers the industry’s

most robust, highest-performance non-volatile memory for industrial

IoT, data centers and other mission-critical applications where

data persistence is paramount. Headquartered in Chandler, Arizona,

Everspin provides commercially available MRAM solutions to a large

and diverse customer base. For more information, visit

www.everspin.com. NASDAQ: MRAM.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking statements regarding

future results that involve risks and uncertainties that could

cause actual results or events to differ materially from the

expectations disclosed in the forward-looking statements,

including, but not limited to the statements made under the caption

“Business Outlook.” Forward-looking statements are identified by

words such as “expects” or similar expressions. These include, but

are not limited to, Everspin’s future financial performance,

including the outlook for first quarter 2025 results. Actual

results could differ materially from these forward-looking

statements as a result of certain risks and uncertainties,

including, without limitation, the risks set forth under the

caption “Risk Factors” in Everspin’s Annual Report on Form 10-K for

the year ended December 31, 2023 filed with the SEC on February 29,

2024, and its Quarterly Reports on Form 10-Q filed with the SEC

during 2024, as well as in its subsequent filings with the SEC. Any

forward-looking statements made by Everspin in this press release

speak only as of the date on which they are made and subsequent

events may cause these expectations to change. Everspin disclaims

any obligations to update or alter these forward-looking statements

in the future, whether as a result of new information, future

events or otherwise, except as required by law.

EVERSPIN TECHNOLOGIES, INC.

Balance Sheets (In thousands, except share and per share amounts)

(Unaudited)

December 31,

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

42,097

$

36,946

Accounts receivable, net

11,722

11,554

Inventory

9,110

8,391

Prepaid expenses and other current

assets

1,272

988

Total current assets

64,201

57,879

Property and equipment, net

3,220

3,717

Intangible assets, net

3,416

—

Right-of-use assets

4,549

5,495

Other assets

2,403

212

Total assets

$

77,789

$

67,303

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

2,278

$

2,916

Accrued liabilities

2,449

4,336

Deferred revenue

78

336

Lease liabilities, current portion

1,306

1,190

Contract obligations

2,034

—

Software liabilities, current portion

1,769

—

Total current liabilities

9,914

8,778

Lease liabilities, net of current

portion

3,336

4,390

Software liabilities, net of current

portion

1,784

—

Long-term income tax liability

162

214

Total liabilities

$

15,196

$

13,382

Commitments and contingencies (Note 5)

Stockholders’ equity:

Preferred stock, $0.0001 par value per

share; 5,000,000 shares authorized; no shares issued and

outstanding as of December 31, 2024 and 2023, respectively

—

—

Common stock, $0.0001 par value per share;

100,000 000 shares authorized; 22,059,697 and 21,080,472 shares

issued and outstanding as of December 31, 2024 and 2023,

respectively

2

2

Additional paid-in capital

199,460

191,569

Accumulated deficit

(136,869

)

(137,650

)

Total stockholders’ equity

62,593

53,921

Total liabilities and stockholders’

equity

$

77,789

$

67,303

EVERSPIN TECHNOLOGIES, INC.

Statements of Income and Comprehensive Income (In thousands, except

share and per share amounts) (Unaudited)

Year Ended December

31,

2024

2023

Product sales

$

42,203

$

53,123

Licensing, royalty, patent, and other

revenue

8,199

10,642

Total revenue

50,402

63,765

Cost of product sales

22,812

24,693

Cost of licensing, royalty, patent, and

other revenue

1,464

1,827

Total cost of sales

24,276

26,520

Gross profit

26,126

37,245

Operating expenses:

Research and development

13,686

11,776

General and administrative

14,141

14,296

Sales and marketing

5,390

5,288

Total operating expenses

33,217

31,360

(Loss) income from operations

(7,091

)

5,885

Interest expense

—

(63

)

Other income, net

7,832

3,214

Net income before income taxes

741

9,036

Income tax benefit

40

16

Net income and comprehensive income

$

781

$

9,052

Net income per common share:

Basic

$

0.04

$

0.44

Diluted

$

0.04

$

0.42

Weighted average shares of common stock

outstanding:

Basic

21,642,793

20,748,302

Diluted

22,156,420

21,367,304

EVERSPIN TECHNOLOGIES, INC.

Statements of Cash Flows (In thousands) (Unaudited)

Year Ended December

31,

2024

2023

Cash flows from operating

activities

Net income

$

781

$

9,052

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

1,731

1,205

Gain on sale of property and equipment

—

(15

)

Stock-based compensation

6,713

5,005

Loss on prepayment and termination of

credit facility

—

170

Non-cash warrant revaluation

—

(25

)

Non-cash interest expense

—

26

Changes in operating assets and

liabilities:

Accounts receivable

(168

)

(889

)

Inventory

(719

)

(1,708

)

Prepaid expenses and other current

assets

(284

)

(384

)

Other assets

(492

)

(150

)

Accounts payable

(374

)

499

Accrued liabilities

(1,939

)

803

Deferred revenue

(258

)

(485

)

Contract obligations

2,034

—

Lease liabilities, net

74

24

Net cash provided by operating

activities

7,099

13,128

Cash flows from investing

activities

Purchases of property and equipment

(3,049

)

(1,404

)

Purchases of intangible assets

(11

)

—

Proceeds received from sale of property

and equipment

—

19

Net cash used in investing activities

(3,060

)

(1,385

)

Cash flows from financing

activities

Payments on long-term debt

—

(2,790

)

Proceeds from exercise of stock options

and purchase of shares in employee stock purchase plan

1,178

1,198

Payments on finance leases

(66

)

—

Net cash provided by (used in) financing

activities

1,112

(1,592

)

Net increase in cash and cash

equivalents

5,151

10,151

Cash and cash equivalents at beginning of

period

36,946

26,795

Cash and cash equivalents at end of

period

$

42,097

$

36,946

Supplementary cash flow

information:

Interest paid

$

—

$

37

Cash paid for taxes

$

202

$

—

Operating cash flows paid for operating

leases

$

1,399

$

1,384

Financing cash flows paid for finance

leases

$

66

$

12

Non-cash investing and financing

activities:

Internal-use software asset obtained in

exchange for software liabilities

$

3,564

$

—

Right-of-use assets obtained in exchange

for finance lease liabilities

$

297

$

—

Purchases of property and equipment in

accounts payable and accrued liabilities

$

182

$

446

Cashless exercise of warrants

$

—

$

2

EVERSPIN TECHNOLOGIES, INC.

Supplemental Reconciliations of GAAP Results to Non-GAAP Financial

Measures (In thousands, except share and per share

amounts) (Unaudited)

Year Ended December

31,

2024

2023

(in thousands)

Adjusted EBITDA reconciliation:

Net income

$

781

$

9,052

Depreciation and amortization

1,731

1,205

Stock-based compensation expense

6,713

5,005

Interest expense

—

63

Income tax benefit

(40

)

(16

)

Adjusted EBITDA

$

9,185

$

15,309

Year Ended December

31,

2024

2023

Non-GAAP Net income per common share

reconciliation:

Net income per common share, diluted

$

0.04

$

0.42

Stock-based compensation expense

0.30

0.23

Non-GAAP Net income per common share,

diluted

$

0.34

$

0.65

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226733504/en/

Investor Relations: Monica Gould The Blueshirt Group T:

212-871-3927 ir@everspin.com

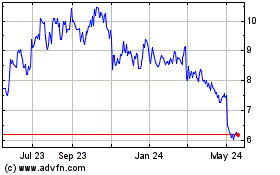

Everspin Technologies (NASDAQ:MRAM)

Historical Stock Chart

From Jan 2025 to Feb 2025

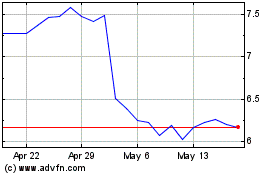

Everspin Technologies (NASDAQ:MRAM)

Historical Stock Chart

From Feb 2024 to Feb 2025