By Aaron Tilley

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 30, 2020).

Microsoft Corp. reported strong growth in quarterly sales and

profit and said the shift of more activities online amid the

coronavirus pandemic is helping propel growth in areas from

cloud-computing to videogames.

The world's most valuable public company showed it was largely

immune to any immediate ill effects from the pandemic even as many

U.S. companies have reported falling earnings and pulled their

full-year outlook because of economic uncertainty from the health

crisis.

Microsoft on Wednesday said sales rose 15% in the first three

months of the year to $35 billion, and it generated a net profit of

$10.75 billion. Both measures topped Wall Street expectations.

"As Covid-19 impacts every aspect of our work and life, we've

seen two years' worth of digital transformation in two months,"

Microsoft Chief Executive Satya Nadella told analysts.

The health crisis has spurred use of Microsoft's workplace

collaboration software suite, called Teams, that includes

videoconferencing and messaging functions. It now has 75 million

daily active users, Mr. Nadella said, more than double the number

in early March.

Cloud-computing, already an earnings driver before the pandemic,

has become more central for many Microsoft customers as they have

moved to support employees working remotely amid a boom in online

activity with people sheltering at home. That helped drive a 59%

jump in sales in the Azure cloud business in the latest period, the

Redmond, Wash., company said.

The broader intelligent cloud segment, which includes Azure,

booked revenue of $12.3 billion, up 21%, while the company's

productivity and business process division, which includes

LinkedIn, sales-management software Dynamics and commercial

subscriptions to the Office 360 product suite, had $11.7 billion in

sales, up 15% from the same quarter a year ago.

Microsoft's stock rose more than 2.56% in after-market

trading.

The results are the sharpest illustration of how some big tech

companies are avoiding many of the business ills afflicting other

industries, and in some cases benefiting from the dramatic shift in

the economy.

Microsoft's personal computer business held up relatively well.

The company in February has warned supply chain disruptions linked

to the Covid-19 outbreak were expected to cause first-quarter sales

in its personal-computing business -- which includes licensing

revenue from PC sales, the Xbox gaming platform and Surface laptops

-- to fall short of the previous revenue forecast of $10.75 billion

to $11.15 billion.

On Wednesday, the company said the PC group generated sales of

$11 billion, as demand to support remote work and teaching offset

some of the supply chain issues. The gaming business benefited from

people staying at home, with Xbox sales increasing 2% in the

quarter, an improvement from the 11% drop in the previous

three-month period. Surface laptop sales rose 1% as demand from

people rushing to buy devices to work remotely outpaced supply

chain issues.

Microsoft also said that the supply chain constraints it had

seen improved later in the quarter. "The supply chain in China

returned to more normal operations at a faster pace than we had

anticipated," Chief Financial Officer Amy Hood said.

Although demand for the cloud has been growing rapidly during

the pandemic, Microsoft has faced some capacity issues dealing with

the increased usage. Microsoft also said it had to slow some of its

cloud infrastructure spending because of the supplier constraints

in China.

"Cloud infrastructure investment will pick up quite a bit," said

Logan Purk, technology analyst for Edward Jones, as Microsoft, like

rival cloud-computing providers such as Amazon.com Inc. and China's

Alibaba Group Holding Ltd., tries to keep pace with demand.

Another challenge for Microsoft is maintaining its

cloud-computing momentum. Although remote working and people stuck

at home are increasing the appetite for tools that run on the

cloud, a broader economic downturn could dent spending plans for

some companies forced to cut costs.

Microsoft said that in the final weeks of the quarter there was

a slowdown in finalizing some licenses, particularly involving

smaller and medium-sized businesses, many of which have been hit

hard by the economic effects of the pandemic.

Microsoft's business social-media network LinkedIn also felt the

effect toward the end of the quarter, with reduced advertising

spending, the company said, though revenue over the full quarter

rose 21% from a year earlier. Advertising spending is expected to

remain muted in the current quarter, Ms. Hood said, and LinkedIn

also could be affected as hiring slows during the economic

downturn.

Microsoft gave a mixed outlook for the quarter ending June 30.

Some of the businesses that have benefited from working from home,

including Surface laptop sales and gaming, should see continued

demand, though growth could ease as stay-at-home guidances are

eased, Ms. Hood said.

Microsoft's sales outlook for the current quarter for the

personal computer segment was slightly ahead of Wall Street's

expectation, though the forecast for the Intelligence cloud and

business process segment was slightly short of analysts'

expectations.

Write to Aaron Tilley at aaron.tilley@wsj.com

(END) Dow Jones Newswires

April 30, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

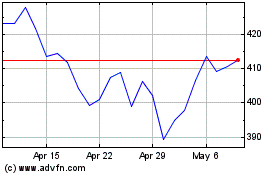

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

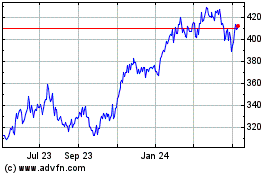

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024