By Sahil Patel

LinkedIn has begun testing advertisements within its fledgling

"stories" format in the U.S. and Canada as the Microsoft

Corp.-owned professional networking platform seeks to boost ad

revenue.

Stories are ephemeral full-screen vertical videos, photos and

text images for mobile devices, first popularized by Snap Inc.'s

Snapchat and later copied by others including Facebook Inc. and

Twitter Inc.

Since launching its own version of stories in the U.S. in

September and globally in October, LinkedIn said its members and

businesses have posted more than three million stories on the

platform. But it remains to be seen whether stories will take off

on a social network organized around careers and business the same

way they have on platforms intended for more personal and casual

communication.

LinkedIn already has been experimenting with ads within stories

in markets such as Latin America and Europe. Its stories

advertising tests now span about 1,000 campaigns from more than 600

advertisers, including WeWork Cos., Daimler AG, General Motors

Co.-owned Cadillac and Bank of New York Mellon Corp., the company

said. It plans to make the ads in stories widely available in

2021.

The visual nature of stories provide a way to interest

advertisers such as luxury-goods marketers and media companies that

haven't spent heavily on LinkedIn ads before, said Gyanda Sachdeva,

vice president of product for LinkedIn Marketing Solutions. News

publishers such as Axios, for example, are experimenting with the

format, she said.

"It's a place for marketers to explore in a way that they did

not think of on LinkedIn before," Ms. Sachdeva said.

Brands have been trying the ads for a variety of purposes,

including seeking new customers, reaching potential hires,

generating business leads and promoting coming virtual events.

WeWork has tested stories ads in Latin America to promote a

campaign on its efforts to ensure clean workspaces during the

pandemic, for example, as well as to drive interest in a virtual

conference it held in the region in September.

The stories format gives brands a chance to speak in a different

voice than they otherwise might have on LinkedIn, said Brenda Tsai,

chief marketing officer at BNY Mellon.

It makes sense for LinkedIn to introduce a more personal format,

Ms. Tsai added. "The question will be how comfortable people are

communicating in that fashion on a platform that is largely for

business professionals."

It would be strange if people used stories on LinkedIn the way

they do on Instagram, because that isn't LinkedIn's purpose, said

Tim Fullerton, vice president of content for WeWork. "But if people

are using them for conversations about business, it totally makes

sense," he said. "It's like TV channels: A cable news channel is

different from TNT, but they are still both channels."

The platform's users are probably less interested in seeing

other people's work-from-home setups -- one common early subject of

stories on LinkedIn -- and more focused on the things they need for

their jobs or careers, said Maggie Murphy, a senior strategist at

Codeword LLC, a marketing agency owned by Waggener Edstrom

Worldwide Inc. "It's not as much about personal content, which is

what it seems like they are trying to get into right now [with

stories], which I think is a distraction for LinkedIn," she

added.

LinkedIn's embrace of stories was driven by the format's growing

popularity elsewhere, according to Ms. Sachdeva. "If you get used

to communicating in ways that go beyond usual direct messaging, or

calling someone or sharing through a feed, we need to embrace

them," she said.

Stories have grown in importance on other platforms: Stories ads

on Instagram accounted for 10% ad spend going to Facebook in the

third quarter of 2020, according to social-media marketing firm

Socialbakers. The format's prevalence also spurred Twitter to

launch its own version, called "Fleets."

Administrators of LinkedIn's pages for businesses, nonprofits

and other organizations have accounted for 20% of stories posted

since the format went live earlier this fall, with the rest coming

from individual users, the company said.

Like other technology giants, LinkedIn is primarily a mobile

platform, with 80% of usage occurring on mobile devices, the

company said.

LinkedIn's revenue increased 16% in the three months ending in

September, compared with the period a year earlier, driven by

growth in its ad business, according to Microsoft's last earnings

report. After seeing a dip in the previous quarter, ad spend

returned to near prepandemic levels, up 40% year over year,

Microsoft Chief Executive Satya Nadella said on the earnings call.

LinkedIn last disclosed revenue numbers for its ad business in

2018, when it said it would hit $2 billion in its 2019 fiscal year,

which ended in June of that year.

LinkedIn is proving to be increasingly valuable for

business-to-business marketers seeking to reach executives and

other decision makers, said Ms. Murphy, the Codeword strategist. In

this context, ads within stories could prove to be valuable

alongside LinkedIn's other marketing products, she said.

Brands can target ads in stories to users based on criteria such

as job title, company name, industry and professional and personal

interests.

"Their ability to reach specific job titles is their value for a

marketer," said Ms. Murphy. "With all of the third-party data going

away in other places, LinkedIn is the only place where someone has

filled out info on themselves, such as where they went to school

and how experienced they are."

"If I'm trying to reach a technology buyer or an engineer, it's

much easier to do that on LinkedIn," she said. "You're not going to

find them on Facebook or Twitter."

Write to Sahil Patel at sahil.patel@wsj.com

(END) Dow Jones Newswires

December 10, 2020 16:04 ET (21:04 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

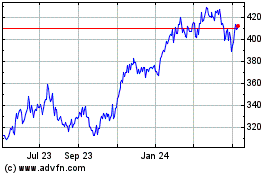

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

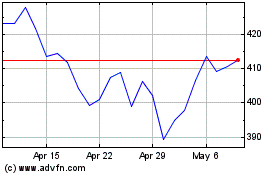

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024