UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 26, 2025

________________________

MATTERPORT, INC.

(Exact name of registrant as specified in its charter)

________________________

| | | | | | | | |

| Delaware | 001-39790 | 85-1695048 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

352 East Java Drive

Sunnyvale, CA 94089

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (650) 641-2241

N/A

(Former name or former address, if changed since last report.)

________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Class A Common Stock, par value of $0.0001 per share | | MTTR | | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 26, 2025, Matterport, Inc. (the “Company”) issued a press release announcing its financial and operational results for the fourth quarter of 2024. A copy of the press release is furnished as Exhibit 99.1 hereto.

The information furnished pursuant to this Item 2.02 and Item 7.01 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 7.01. Regulation FD Disclosure.

The information set forth under Item 2.02 is incorporated herein by reference.

Item 9.01. Financial Statement and Exhibits.

(d)List of Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| | |

| 99.1 | | Press release dated February 26, 2025 of Matterport, Inc. |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Matterport, Inc. |

| | |

Date: February 26, 2025 | By: | /s/ James D. Fay |

| Name: | James D. Fay |

| Title: | Chief Financial Officer |

Exhibit 99.1

Matterport Announces Fourth Quarter 2024 Financial Results, with Over 50 Billion in Square Feet Under Management, up 33%, and Total Subscription Revenue up 14%, Year-over-Year

•Record full year subscription revenue of $99.6 million, up 14% year-over-year

•Q4 annualized recurring revenue (ARR) grows to $104.2 million

•Record full year total revenue of $169.7 million

•Total subscribers grew to 1.2 million, up 23% year-over-year

SUNNYVALE, Calif. — February 26, 2025 — Matterport, Inc. (Nasdaq: MTTR) (“Mattterport” or the “Company”), the leading spatial data company driving the digital transformation of the built world, today announced financial results for the quarter and year ended December 31, 2024.

“I’m pleased to share our fourth quarter and full year 2024 results, highlighting our continued success driving efficient growth while doubling down on innovation. Total square feet digitized and managed reached a significant company milestone of 50.7 billion, up 33% year-over-year, with annual recurring revenue continuing to grow to a record $104.2 million,” said RJ Pittman, Chairman and CEO of Matterport.

“Matterport’s 2025 Winter Release redefines what’s possible for digital twins and real estate marketing, introducing advanced automation and AI-driven capabilities that streamline property workflows and elevate listings. With the launch of Matterport Marketing Cloud, agents now have an all-in-one platform that simplifies every step of the property marketing process. Customers are raving about our one-click defurnish tool, now available to all users, making listings cleaner and more market-ready in an instant. New features like tag management and Model Merge are unlocking new efficiencies for customers tackling large or complex projects,” Pittman added.

“In 2024, we achieved a record $99.6 million in total subscription revenue, representing a 14% increase from the prior year,” said JD Fay, Chief Financial Officer of Matterport. “In the fourth-quarter, we reported total revenue reaching a new high of $43.8 million and non-GAAP net loss per share saw a dramatic 50% improvement from the prior year, resulting in a net loss per share of only $0.02. These accomplishments highlight our steadfast dedication to achieving strong revenue growth and profitability, which we believe positions Matteport for continued success in the future.”

Fourth Quarter and Full Year 2024 Financial Highlights

•Q4 Annualized Recurring Revenue (ARR) was $104.2 million

•Q4 total revenue of $43.8 million

•Q4 net loss of $0.12 per share, and Q4 Non-GAAP net loss of $0.02 per share, a 50% improvement year-over-year

•FY2024 total revenue of $169.7 million, up 8% from prior year

•FY2024 net loss of $0.80 per share, and annual Non-GAAP net loss of $0.06 per share, a 73% improvement year-over-year

•FY2024 square feet under management reached 50.7 billion, up 33 % year-over-year

•FY2024 spaces under management reached 14.1 million, up 21 % year-over-year

•FY2024 total subscribers reached 1.2 million, up 23 % year-over-year

Recent Business Highlights

•Just launched the 2025 Winter Release: Productivity Multiplied, a suite of new capabilities designed to boost productivity and streamline workflows for real estate agents, designers, property managers, and contractors. Key developments include:

◦Unveiled Matterport Marketing Cloud, powered by Property Intelligence, Matterport’s proprietary AI, delivering a seamless, all-in-one platform that simplifies property marketing from start to finish. Marketing Cloud integrates media creation, editing, distribution, and analytics into a single, intuitive experience—fully optimized for MLS listings.

◦Model Merge – Multiple users can now scan a property simultaneously and combine their work into a single digital twin, significantly accelerating project completion.

◦Field tags – Teams can now create real-time annotations while capturing a space, ensuring accurate documentation from the start.

◦Tag management – Easily copy tags from one digital twin to another, eliminating redundant work.

•Launched the 2024 Fall Release: Insights Meets Imagination introducing generative AI-powered design tools that transform digital twins into interactive, creative canvases—helping professionals reimagine, redesign, and market spaces with ease.

•Achieved Manufacturing and Industrial Competency status, along with AWS Energy Competency status in the Health, Safety, and Environment category. These recognitions underscore Matterport’s leadership in helping businesses leverage AWS cloud technology through advanced software and service offerings.

•Celebrated the Top 5 Most Viewed Spaces of 2024, showcasing the world’s most captivating digital twins—from iconic landmarks to immersive travel experiences. This annual list highlights the most-loved digital destinations while reinforcing Matterport’s industry-defining innovation.

Transaction with CoStar Group, Inc.

Given the pending acquisition of Matterport by CoStar Group, Inc. that was announced on April 22, 2024, Matterport will not be holding a conference call or live webcast to discuss quarterly financial results. Also, in light of the pending transaction, the Company had previously suspended its financial guidance and will not be providing financial guidance for the upcoming fiscal quarter. At a special meeting of stockholders held on July 26, 2024, Matterport stockholders approved the transaction with CoStar Group, Inc. The completion of the transaction remains subject to the satisfaction or waiver of customary closing conditions specified in Matterport’s agreement with CoStar Group, Inc. The transaction is expected to close in the first quarter of 2025.

Non-GAAP Financial Information

Matterport has provided in this press release financial information that has not been prepared in accordance with generally accepted accounting principles in the United States (GAAP). We believe that the presentation of non-GAAP financial information provides important supplemental information to management and investors regarding financial and business trends relating to Matterport’s financial condition and results of operations.

The presentation of these non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with the Company’s consolidated financial statements prepared in accordance with GAAP. For further information regarding these non-GAAP measures, including the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, please refer to the financial tables below.

Non-GAAP Net Loss and Non-GAAP Net Loss Per Share, Basic and Diluted. Matterport defines non-GAAP net loss as net loss, adjusted to exclude stock-based compensation-related charges (including share-based payroll tax expense), fair value change of warrants liability, amortization of acquired intangible assets, litigation expense, restructuring charges, and acquisition transaction costs related to the pending transaction with CoStar Group, in order to provide investors and management with greater visibility to the underlying performance of Matterport’s recurring core business operations. We define non-GAAP net loss per share, as non-GAAP net loss divided by the weighted-average shares outstanding, which includes the dilutive effect of potentially diluted common stock equivalents outstanding during the period if any.

About Matterport

Matterport, Inc. (Nasdaq: MTTR) is leading the digital transformation of the built world. Our groundbreaking spatial data platform turns buildings into data to make nearly every space more valuable and accessible. Millions of buildings in more than 177 countries have been transformed into immersive Matterport digital twins to improve every part of the building lifecycle from planning, construction, and operations to documentation, appraisal and marketing. Learn more at matterport.com and browse a gallery of digital twins.

©2025 Matterport, Inc. All rights reserved. Matterport is a registered trademark and the Matterport logo is a trademark of Matterport, Inc. All other marks are the property of their respective owners.

Investor Contact:

ir@matterport.com

Media Contact:

press@matterport.com

Forward-Looking Statements

This communication contains certain forward-looking statements within the meaning of the federal securities laws, including statements regarding the proposed transaction, the products and services offered by Matterport and the markets in which Matterport operates, business strategies, debt levels, industry environment including the global supply chain, potential growth opportunities, and the effects of regulations and Matterport’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “forecast,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions (including the negative versions of such words or expressions).

Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including the inability to consummate the proposed transaction with CoStar Group, Inc. (the “proposed transaction”) within the anticipated time period, or at all, due to any reason, including the failure to satisfy the conditions to the consummation of the proposed transaction; the risk that the proposed transaction disrupts Matterport’s current plans and operations or diverts management’s attention from its ongoing business; the effects of the proposed transaction on Matterport’s business, operating results, and ability to retain and hire key personnel and maintain relationships with customers, suppliers and others with whom Matterport does business; the risk that Matterport’s stock price may decline significantly if the proposed transaction is not consummated; the nature, cost and outcome of any legal proceedings related to the proposed transaction; Matterport’s ability to grow market share in existing markets or any new markets Matterport may enter; Matterport’s ability to respond to general economic conditions; supply chain disruptions; Matterport’s ability to manage growth effectively; Matterport’s success in retaining or recruiting officers, key employees or directors, or changes required in the retention or recruitment of officers, key employees or directors; the impact of restructuring plans; the impact of the regulatory environment and complexities with compliance related to such environment; factors relating to Matterport’s business, operations and financial performance, including the impact of infectious diseases, health epidemics and pandemics; Matterport’s ability to maintain an effective system of internal controls over financial reporting; Matterport’s ability to achieve and maintain profitability in the future; Matterport’s ability to access sources of capital; Matterport’s ability to maintain and enhance Matterport’s products and brand, and to attract customers; Matterport’s ability to manage, develop and refine Matterport’s technology platform; the success of Matterport’s strategic relationships with third parties; Matterport’s history of losses and whether Matterport will continue to incur continuing losses for the foreseeable future; Matterport’s ability to protect and enforce Matterport’s intellectual property rights; Matterport’s success in defending or appealing any pending or future litigation, claims or demands; Matterport’s ability to implement business plans, forecasts, and other expectations and identify and realize additional opportunities; Matterport’s ability to attract and retain new subscribers; the size of the total addressable market for Matterport’s products and services; the continued adoption of spatial data; any inability to complete acquisitions and integrate acquired businesses; general economic uncertainty and the effect of general economic conditions in Matterport’s industry; environmental uncertainties and risks related to adverse weather conditions and natural disasters; the volatility of the market price and liquidity of Matterport’s Class A common stock and other securities; the increasingly competitive environment in which Matterport operates; and other factors detailed under the section entitled “Risk Factors” in Matterport’s Annual Report on Form 10-K and subsequently filed Quarterly Reports on Form 10-Q. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in documents filed by Matterport from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Matterport assumes no obligation and, except as required by law, does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Matterport does not give any assurance that it will achieve its expectations.

MATTERPORT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue: | | | | | | | |

| Subscription | $ | 26,055 | | | $ | 23,701 | | | $ | 99,590 | | | $ | 87,348 | |

| | | | | | | |

| Services | 10,195 | | | 8,297 | | | 41,264 | | | 37,621 | |

| Product | 7,568 | | | 7,547 | | | 28,845 | | | 32,779 | |

| Total revenue | 43,818 | | | 39,545 | | | 169,699 | | | 157,748 | |

| Costs of revenue: | | | | | | | |

| Subscription | 8,443 | | | 7,431 | | | 32,567 | | | 29,007 | |

| | | | | | | |

| Services | 6,545 | | | 5,665 | | | 28,293 | | | 26,643 | |

| Product | 6,589 | | | 8,231 | | | 25,926 | | | 31,608 | |

| Total costs of revenue | 21,577 | | | 21,327 | | | 86,786 | | | 87,258 | |

| Gross profit | 22,241 | | | 18,218 | | | 82,913 | | | 70,490 | |

| Operating expenses: | | | | | | | |

| Research and development | 15,410 | | | 14,594 | | | 60,931 | | | 67,305 | |

| Selling, general, and administrative | 50,767 | | | 52,764 | | | 200,836 | | | 217,424 | |

| Litigation expense | — | | | — | | | 95,000 | | | — | |

| Total operating expenses | 66,177 | | | 67,358 | | | 356,767 | | | 284,729 | |

| Loss from operations | (43,936) | | | (49,140) | | | (273,854) | | | (214,239) | |

| Other income (expense): | | | | | | | |

| Interest income | 3,510 | | | 1,881 | | | 11,608 | | | 6,406 | |

| | | | | | | |

| | | | | | | |

| Change in fair value of warrants liability | 62 | | | (51) | | | (833) | | | 513 | |

| | | | | | | |

| Other income (expense), net | (197) | | | 3,352 | | | 6,565 | | | 8,427 | |

| Total other income | 3,375 | | | 5,182 | | | 17,340 | | | 15,346 | |

| Loss before provision (benefit) for income taxes | (40,561) | | | (43,958) | | | (256,514) | | | (198,893) | |

| Provision for (benefit from) income taxes | (55) | | | (13) | | | 107 | | | 184 | |

| Net loss | $ | (40,506) | | | $ | (43,945) | | | $ | (256,621) | | | $ | (199,077) | |

| | | | | | | |

| | | | | | | |

| Net loss per share, basic and diluted | $ | (0.12) | | | $ | (0.14) | | | $ | (0.80) | | | $ | (0.66) | |

| Weighted-average shares used in per share calculation, basic and diluted | 325,010 | | | 308,030 | | | 319,015 | | | 300,697 | |

MATTERPORT INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

| | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 |

| (unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 57,228 | | | $ | 82,902 | |

| Restricted cash | 96,330 | | | — | |

| Short-term investments | 189,372 | | | 305,264 | |

Accounts receivable, net | 13,180 | | | 16,925 | |

| Inventories | 5,576 | | | 9,115 | |

| Prepaid expenses and other current assets | 8,723 | | | 8,635 | |

| Total current assets | 370,409 | | | 422,841 | |

| Property and equipment, net | 29,718 | | | 32,471 | |

| Operating lease right-of-use assets | 91 | | | 625 | |

| Long-term investments | 57,611 | | | 34,834 | |

| Goodwill | 69,593 | | | 69,593 | |

| Intangible assets, net | 7,350 | | | 9,120 | |

| Other assets | 8,896 | | | 7,671 | |

| Total assets | $ | 543,668 | | | $ | 577,155 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities | | | |

| Accounts payable | $ | 9,254 | | | $ | 7,586 | |

| | | |

| Deferred revenue | 27,861 | | | 23,294 | |

| Accrued expenses and other current liabilities | 106,613 | | | 13,354 | |

| | | |

| Total current liabilities | 143,728 | | | 44,234 | |

| Warrants liability | 1,123 | | | 290 | |

| | | |

| | | |

| Deferred revenue, non-current | 1,674 | | | 3,141 | |

| Other long-term liabilities | — | | | 206 | |

| Total liabilities | 146,525 | | | 47,871 | |

Commitments and contingencies | | | |

| | | |

| Stockholders’ equity: | | | |

Common stock | 33 | | | 31 | |

| Additional paid-in capital | 1,432,064 | | | 1,307,324 | |

| Accumulated other comprehensive income | 141 | | | 403 | |

| Accumulated deficit | (1,035,095) | | | (778,474) | |

| Total stockholders’ equity | 397,143 | | | 529,284 | |

| Total liabilities and stockholders’ equity | $ | 543,668 | | | $ | 577,155 | |

MATTERPORT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands, unaudited)

| | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net Loss | $ | (256,621) | | | $ | (199,077) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 23,242 | | | 19,437 | |

| | | |

| Amortization of investment premiums, net of accretion of discounts | (7,999) | | | (8,919) | |

| | | |

| Stock-based compensation, net of amounts capitalized | 113,055 | | | 118,775 | |

| Cease use of certain leased facilities | — | | | 961 | |

| Change in fair value of warrants liability | 833 | | | (513) | |

| | | |

| | | |

| Deferred income taxes | 70 | | | (121) | |

| | | |

| Allowance for doubtful accounts | 699 | | | 601 | |

| Loss of excess inventory and purchase obligation | — | | | 1,821 | |

| Other | 374 | | | (185) | |

| Changes in operating assets and liabilities, net of effects of businesses acquired: | | | |

| Accounts receivable | 3,046 | | | 3,318 | |

| Inventories | 3,539 | | | (3,830) | |

| Prepaid expenses and other assets | 677 | | | 3,036 | |

| Accounts payable | 1,618 | | | (745) | |

| Deferred revenue | 3,100 | | | 8,503 | |

| Accrued expenses and other liabilities | 93,054 | | | (1,775) | |

| Net cash used in operating activities | (21,313) | | | (58,713) | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchases of property and equipment | (246) | | | (139) | |

| Capitalized software and development costs | (9,320) | | | (9,765) | |

| Purchase of investments | (210,780) | | | (444,695) | |

| Maturities of investments | 310,106 | | | 478,253 | |

| | | |

| | | |

| Business acquisitions, net of cash acquired | — | | | (4,116) | |

| Net cash provided by (used in) investing activities | 89,760 | | | 19,538 | |

| CASH FLOW FROM FINANCING ACTIVITIES: | | | |

| | | |

| | | |

| | | |

| Proceeds from sales of shares through employee equity incentive plans | 2,583 | | | 5,124 | |

| Payments for taxes related to net settlement of equity awards | — | | | (329) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by financing activities | 2,583 | | | 4,795 | |

| Net change in cash, cash equivalents, and restricted cash | 71,030 | | | (34,380) | |

| Effect of exchange rate changes on cash | (374) | | | 154 | |

| Cash, cash equivalents, and restricted cash at beginning of year | 82,902 | | | 117,128 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 153,558 | | | $ | 82,902 | |

MATTERPORT, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| GAAP net loss | | $ | (40,506) | | | $ | (43,945) | | | $ | (256,621) | | | $ | (199,077) | |

Stock-based compensation expense (1) | | 31,278 | | | 30,474 | | | 125,071 | | | 127,755 | |

Restructuring charges (2) | | — | | | 1,149 | | | — | | | 4,296 | |

Acquisition-related costs (3) | | 3,714 | | | — | | | 15,908 | | | — | |

| Amortization expense of acquired intangible assets | | 443 | | | 443 | | | 1,772 | | | 1,772 | |

Change in fair value of warrants liabilities (4) | | (62) | | | 51 | | | 833 | | | (513) | |

| | | | | | | | |

| | | | | | | | |

Litigation expense (5) | | — | | | — | | | 95,000 | | | — | |

| | | | | | | | |

| Non-GAAP net loss | | $ | (5,133) | | | $ | (11,828) | | | $ | (18,037) | | | $ | (65,767) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| GAAP net loss per share attributable to common stockholders, basic and diluted | | $ | (0.12) | | | $ | (0.14) | | | $ | (0.80) | | | $ | (0.66) | |

| Non-GAAP net loss per share attributable to common stockholders, basic and diluted | | $ | (0.02) | | | $ | (0.04) | | | $ | (0.06) | | | $ | (0.22) | |

| | | | | | | | |

| Weighted-average shares used to compute net loss per share, basic and diluted | | 325,010 | | | 308,030 | | | 319,015 | | | 300,697 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(1) Consists primarily of non-cash share-based compensation expense related to our stock incentive plans, and the employer payroll taxes related to our stock options and restricted stock units.

(2) Consists of severance and other employee separation costs, and cease use charges for operating lease right-of-use assets due to the reduction of leased office spaces.

(3) Consists of acquisition transaction costs incurred for the pending transaction with CoStar Group, Inc.

(4) Consists of the non-cash fair value measurement change for private warrants.

(5) Represents charges associated with litigation during the year ended December 31, 2024.

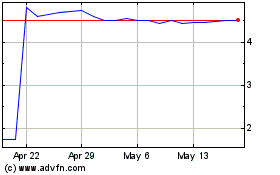

Matterport (NASDAQ:MTTR)

Historical Stock Chart

From Jan 2025 to Feb 2025

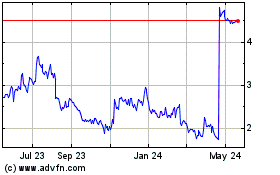

Matterport (NASDAQ:MTTR)

Historical Stock Chart

From Feb 2024 to Feb 2025