0001593538false00015935382024-08-072024-08-070001593538us-gaap:CommonStockMember2024-08-072024-08-070001593538navi:M6SeniorNotesDueDecember160152043Member2024-08-072024-08-070001593538navi:PreferredStocksMember2024-08-072024-08-07iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2024

________________________________

Navient Corporation |

(Exact name of registrant as specified in its charter) |

________________________________

Delaware | | 001-36228 | | 46-4054283 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

13865 Sunrise Valley Drive, Herndon, Virginia | | 20171 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (703) 810-3000

Not Applicable

(Former name or former address, if changed since last report)

___________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common stock, par value $.01 per share | NAVI | The Nasdaq Global Select Market |

6% Senior Notes due December 15, 2043 | JSM | The Nasdaq Global Select Market |

Preferred Stock Purchase Rights | None | TheNasdaqGlobal Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement

On August 7, 2024 (the “Signing Date”), Navient Corporation, a Delaware corporation (the “Company”), entered into a Sale and Purchase Agreement (the “Purchase Agreement”) with Coding Solutions Acquisition, Inc., a Delaware corporation (“CorroHealth” or the “Buyer”).

Pursuant to the Purchase Agreement, and upon the terms and subject to the conditions therein, the Company agreed to sell to the Buyer the Company’s equity interests in Xtend Healthcare, LLC, a Tennessee limited liability company (“Xtend”), for cash consideration of $365 million, subject to certain customary adjustments (the “Transaction”). The Transaction covers and is intended to sell the healthcare services business of the Company’s Business Processing Segment.

The Purchase Agreement provides that the closing of the Transaction is subject to the satisfaction or waiver of customary closing conditions, including, among other things, (i) the accuracy of each party’s representations and warranties (subject to customary materiality standards), (ii) each party’s compliance in all material respects with its pre-closing covenants, (iii) the expiration or termination of the waiting period (and any extension thereof) applicable to the consummation of the Transaction under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), (iv) the absence of any law or governmental order preventing, making illegal or prohibiting the consummation of the Transaction, (v) the absence of a Material Adverse Effect (as defined in the Purchase Agreement) that has occurred since August 7, 2024 and (vi) the delivery of customary closing deliverables, including entry into a transition services agreement, pursuant to which a subsidiary of the Company will agree to provide certain services to the Buyer for a period of time to be determined following the closing.

The Buyer has access to debt financing from certain lenders that will be used to fund the Transaction. However, the closing of the Transaction is not conditioned upon the Buyer obtaining any financing.

The Purchase Agreement contains customary termination provisions, including the right of either the Company or the Buyer to terminate if the closing of the Transaction has not occurred by October 6, 2024, subject to automatic extension to December 5, 2024 if the only then-outstanding closing conditions relate to the termination or expiration of the waiting period (and any extension thereof) applicable to the consummation of the Transaction under the HSR Act or any governmental order related to the HSR Act preventing, making illegal or prohibiting the consummation of the Transaction.

The Purchase Agreement provides that, for a period of two years following the closing of the Transaction, the Company, together with its subsidiaries, will not engage in a business that is competitive with Xtend’s revenue cycle management business (or any other business of Xtend) as conducted as of, or during the 12 months prior to, the Signing Date, subject to certain exceptions.

The foregoing description of the Purchase Agreement is qualified in its entirety by the full text of the Purchase Agreement, a copy of which is attached as Exhibit 2.1 hereto and incorporated by reference herein.

The Purchase Agreement has been attached as an exhibit to provide investors and security holders with information regarding its terms. It is not intended to provide any other factual information about the Company or the Buyer. The representations, warranties and covenants contained in the Purchase Agreement were made only for the purposes of such agreement and as of specified dates, were solely for the benefit of the parties to such agreement and may be subject to limitations agreed upon by the contracting parties. The representations and warranties may have been made for the purposes of allocating contractual risk between the parties to the Purchase Agreement instead of establishing these matters as facts and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors are not third-party beneficiaries under the Purchase Agreement and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company or the Buyer or any of their respective subsidiaries or affiliates. In addition, the assertions embodied in the representations and warranties contained in the Purchase Agreement are qualified by information in a confidential disclosure schedule that the parties have exchanged. Accordingly, investors should not rely on the representations and warranties as characterizations of the actual state of facts, since (i) they were made only as of the date of such agreement or a prior, specified date, (ii) in some cases they are subject to qualifications with respect to materiality, knowledge and/or other matters, and (iii) they may be modified in important part by the underlying disclosure schedule. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

Item 7.01. Regulation FD Disclosure

On August 13, 2024, the Company issued a press release announcing the Transaction. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The information furnished under this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Cautionary Note Regarding Forward-Looking Statements.

This Current Report on Form 8-K includes information that constitutes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on the Company’s current beliefs, assumptions and expectations regarding future events, which in turn are based on information currently available to the Company. Such forward-looking statements include, without limitation, statements regarding the ability of the parties to close the Transaction, including the satisfaction and waiver of customary closing conditions and regulatory approvals, the impact of the Transaction on the Company’s stock price; the anticipated benefits of the Transaction for the Company’s financial results, business performance, and/or product offerings; and other risks and uncertainties contained in our filings with the U.S. Securities and Exchange Commission (“SEC”), including the Company’s most recently filed Annual Report on Form 10-K. By their nature, forward-looking statements address matters that are subject to risks and uncertainties. These forward-looking statements speak only as of the date of this Current Report on Form 8-K, and the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by applicable laws.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

*Pursuant to Item 601(a)(5) of Regulation S-K, certain schedules to this Exhibit have been omitted. A copy of any omitted schedule will be furnished to the SEC upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| NAVIENT CORPORATION | |

| | | |

| By: | /s/ Joe Fisher | |

| | Name: Joe Fisher | |

| | Title: Chief Financial Officer | |

Date: August 13, 2024

nullnull

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=navi_M6SeniorNotesDueDecember160152043Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=navi_PreferredStocksMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

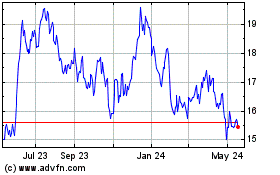

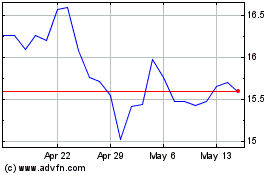

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Nov 2023 to Nov 2024