Nasdaq, Inc. (Nasdaq: NDAQ) (“Nasdaq” or the “Company”) announced

today the consideration payable in connection with its previously

announced offers to purchase for cash up to an aggregate principal

amount of $218,053,000 (the “Aggregate Notes Cap”) (reflecting an

$18,053,000 increase from the previously announced cap of

$200,000,000) of its outstanding Notes, comprised of (i) up to

$41,360,000 aggregate principal amount (the “2028 Notes Cap”) of

the Company’s 5.350% Senior Notes due 2028 (the “2028 Notes”), (ii)

up to $57,583,000 aggregate principal amount (the “2034 Notes Cap”)

of the Company’s 5.550% Senior Notes due 2034 (the “2034 Notes”)

and (iii) up to $119,110,000 aggregate principal amount (the “2052

Notes Cap”) of the Company’s 3.950% Senior Notes due 2052 (the

“2052 Notes”), for a total aggregate purchase price, excluding

accrued and unpaid interest, of approximately $197 million. The

2028 Notes, the 2034 Notes and the 2052 Notes are referred to

collectively herein as the “Notes,” such offers to purchase are

referred to collectively herein as the “Tender Offers” and each a

“Tender Offer,” and the 2028 Notes Cap, the 2034 Notes Cap and the

2052 Notes Cap are referred to collectively herein as the “Series

Notes Caps” and each a “Series Notes Cap.”

The table below sets forth, among other things, the Total

Consideration (as defined below) for each series of Notes, as

calculated at 10:00 a.m., New York City time, today, February 25,

2025.

|

|

Title of Security |

Security Identifiers |

Principal Amount Outstanding |

Series Notes Cap |

U.S. Treasury Reference

Security(1) |

Fixed Spread(basis points) |

Reference Yield |

Total

Consideration(2)(3) |

|

2028 Tender Offer |

5.350% Senior Notes due 2028 |

CUSIP: 63111X AH4ISIN:US63111XAH44 |

$921,360,000 |

$41,360,000 |

4.250% UST due January 15, 2028 |

45 bps |

4.109% |

$1,023.63 |

|

2034 Tender Offer |

5.550% Senior Notes due 2034 |

CUSIP: 63111X AJ0ISIN:US63111XAJ00 |

$1,187,583,000 |

$57,583,000 |

4.250% UST due November 15, 2034 |

73 bps |

4.311% |

$1,035.58 |

|

2052 Tender Offer |

3.950% Senior Notes due 2052 |

CUSIP: 631103 AM0ISIN:US631103AM02 |

$549,105,000 |

$119,110,000 |

4.500% UST due November 15, 2054 |

82 bps |

4.585% |

$794.48 |

|

(1) |

The applicable page on Bloomberg from which the dealer manager

quoted the bid side price of the U.S. Treasury Security is

FIT1. |

|

(2) |

Per $1,000 principal amount of Notes validly tendered on or prior

to the Early Tender Date (as defined below) and accepted for

purchase by the Company. Includes the Early Tender Premium (as

defined below). |

|

(3) |

Does not include Accrued Interest (as defined below), which will

also be payable as described below. |

|

|

|

The Tender Offers are being made upon the terms and subject to

conditions described in the Offer to Purchase, dated February 10,

2025 (as it may be amended or supplemented from time to time, the

“Offer to Purchase”), which sets forth a detailed description of

the Tender Offers. The Company refers investors to the Offer to

Purchase for the complete terms and conditions of the Tender

Offers.

Withdrawal rights for the Notes expired at 5:00 p.m., New York

City time, on February 24, 2025 (the “Early Tender Date”). The

Tender Offers for the Notes will continue to expire at 5:00 p.m.,

New York City time, on March 11, 2025, or any other date and time

to which the Company extends the applicable Tender Offer, unless

earlier terminated. As previously announced, all conditions were

satisfied or waived by the Company at the Early Tender Date. As

previously announced, the Company has elected to exercise its right

to make payment for Notes that were validly tendered on or prior to

the Early Tender Date and that are accepted for purchase on

February 27, 2025 (the “Early Settlement Date”). As the aggregate

principal amount of the Notes validly tendered and not validly

withdrawn on or prior to the Early Tender Date exceeds the

Aggregate Notes Cap, the Company will accept for purchase the Notes

on a prorated basis and will not accept for purchase any Notes

validly tendered after the Early Tender Date.

The applicable consideration (the “Total Consideration”) listed

in the table above will be paid per $1,000 principal amount of the

Notes validly tendered (and not validly withdrawn) on or prior to

the Early Tender Date and accepted for purchase pursuant to each

Tender Offer on the Early Settlement Date. The Total Consideration

includes an early tender premium of $30.00 per $1,000 principal

amount of Notes accepted for purchase (the “Early Tender Premium”).

Only holders of Notes who validly tendered and did not validly

withdraw their Notes on or prior to the Early Tender Date are

eligible to receive the applicable Total Consideration for Notes

accepted for purchase. All holders of Notes accepted for purchase

in the Tender Offers will receive accrued and unpaid interest on

such Notes from the last interest payment date with respect to such

Notes to, but not including, the Early Settlement Date (“Accrued

Interest”).

All Notes accepted for purchase will be retired and canceled and

will no longer remain outstanding obligations of the Company.

Information Relating to the Tender Offers

The complete terms and conditions of the Tender Offers are set

forth in the Offer to Purchase. J.P. Morgan Securities LLC is

serving as dealer manager in connection with the Tender Offers.

Investors with questions regarding the terms and conditions of the

Tender Offers may contact the dealer manager as follows:

|

J.P. Morgan Securities LLC383 Madison AvenueNew York, New York

10179United StatesAttention: Liability Management GroupU.S.

Toll-Free: (866) 834-4666Collect: (212) 834-7489 |

|

|

D.F. King & Co., Inc. is the Tender and Information Agent

for the Tender Offers. Any questions regarding procedures for

tendering Notes or request for copies of the Offer to Purchase

should be directed to D.F. King & Co., Inc. by any of the

following means: by telephone at (866) 342-4881 (toll-free) or

(212) 269-5550 (collect) or by email at nasdaq@dfking.com.

This press release does not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, or the

solicitation of tenders with respect to, the Notes. No offer,

solicitation, purchase or sale will be made in any jurisdiction in

which such an offer, solicitation or sale would be unlawful. The

Tender Offers are being made solely pursuant to the Offer to

Purchase made available to holders of the Notes. None of the

Company or its affiliates, their respective boards of directors,

the dealer manager, the tender and information agent or the trustee

with respect to any series of Notes is making any recommendation as

to whether or not holders should tender or refrain from tendering

all or any portion of their Notes in response to the Tender Offers.

Holders are urged to evaluate carefully all information in the

Offer to Purchase, consult their own investment and tax advisors

and make their own decisions whether to tender Notes in the Tender

Offers, and, if so, the principal amount of Notes to tender.

About Nasdaq

Nasdaq (Nasdaq: NDAQ) is a global technology company serving

corporate clients, investment managers, banks, brokers, and

exchange operators as they navigate and interact with the global

capital markets and the broader financial system. We aspire to

deliver world-leading platforms that improve the liquidity,

transparency, and integrity of the global economy. Our diverse

offering of data, analytics, software, exchange capabilities, and

client-centric services enables clients to optimize and execute

their business vision with confidence.

Cautionary Note Regarding Forward Looking

Statements

This press release contains forward-looking information that

involves substantial risks, uncertainties and assumptions that

could cause actual results to differ materially from those

expressed or implied by such statements. When used in this

communication, words such as “enables,” “intends,” “will,” and

similar expressions and any other statements that are not

historical facts are intended to identify forward-looking

statements. Forward-looking statements in this press release

include, among other things, statements about the proposed Tender

Offers and the expected source of funds. Risks and uncertainties

include, among other things, risks related to the ability of Nasdaq

to consummate the Tender Offers on the terms and timing described

herein, or at all, Nasdaq’s ability to implement its strategic

vision, initiatives, economic, political and market conditions and

fluctuations, government and industry regulation, interest rate

risk, U.S. and global competition, and other factors detailed in

Nasdaq’s reports filed on Forms 10-K, 10-Q and 8-K and in other

filings Nasdaq makes with the SEC from time to time and available

at www.sec.gov. These documents are also available under the

Investor Relations section of the Company’s website at

http://ir.nasdaq.com. The forward-looking statements included in

this communication are made only as of the date hereof. Nasdaq

disclaims any obligation to update these forward-looking

statements, except as required by law.

Media Relations Contacts:

Nick Jannuzzi+1.973.760.1741Nicholas.Jannuzzi@Nasdaq.com

Nick Eghtessad+1.929.996.8894Nick.Eghtessad@Nasdaq.com

Investor Relations Contact:

Ato Garrett+1.212.401.8737Ato.Garrett@Nasdaq.com

NDAQF

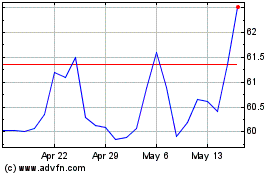

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Feb 2024 to Feb 2025