Form 424B5 - Prospectus [Rule 424(b)(5)]

February 26 2025 - 5:06AM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-276722

AMENDMENT NO. 1 dated February 26, 2025

(To Prospectus dated February 8, 2024)

Up to $5,311,508

Common Stock

This Amendment No. 1 to Prospectus (this “Amendment”) amends

and supplements the information in the prospectus, dated February 8, 2024, filed as part of our registration statement on Form S-3 (File

No. 333-276722). This Amendment should be read in conjunction with the prospectus and is qualified in its entirety by reference thereto,

except to the extent that the information herein amends or supersedes the information contained in prospectus. This Amendment is not complete

without, and may only be delivered or utilized in connection with, the prospectus and any future amendments or supplements thereto.

We previously filed the prospectus to register the offer and sale of

shares of our common stock from time to time pursuant to the terms of a sales agreement dated March 16, 2018 (the “Sales Agreement”)

that we entered into with H.C. Wainwright & Co., LLC and JonesTrading Institutional Services LLC (each an “Agent” and

together, the “Agents”), pursuant to which we may offer and sell shares of our common stock through the Agents, having an

aggregate offering price of up to $2,605,728. Of the shares of our common stock covered by the Sales Agreement and the prospectus dated

February 8, 2024 covering the issuance of shares of our common stock pursuant to the Sales Agreement, as of February 25, 2025, we have

issued and sold an aggregate of 1,762,757 shares of our common stock for gross proceeds of approximately $1,954,514.

We are filing this Amendment to amend the prospectus to update the

amount of shares of our common stock we are eligible to sell under General Instruction I.B.6 of Form S-3. As of February 25, 2025, the

aggregate market value of our outstanding common stock held by non-affiliates was approximately $21,798,068, based on 17,163,833 shares

of our outstanding common stock that were held by non-affiliates on such date and a price of $1.27 per share, which was the price at which

our common stock was last sold on the Nasdaq Capital Market on February 25, 2025 (a date within 60 days of the date hereof). In the past

12 calendar months, we have offered and sold pursuant to General Instruction I.B.6 of Form S-3 an aggregate of 1,762,757 shares of our

common stock for gross proceeds of approximately $1,954,514.

We are filing this Amendment to amend and supplement the information

in the prospectus based on the amount of securities that we are eligible to sell under General Instruction I.B.6 of Form S-3. After giving

effect to the $7,266,022 offering limit imposed by General Instruction I.B.6 of Form S-3 and deducting amounts offered and sold pursuant

to General Instruction I.B.6 of Form S-3 in the past 12 months, we may offer and sell additional shares of our common stock having an

aggregate offering price of up to $5,311,508 from time to time through the Agents in accordance with the terms of the Sales Agreement.

In the event that we become eligible to sell additional amounts under the Sales Agreement in accordance with General Instruction I.B.6

or otherwise, we will file another amendment prior to making such additional sales.

We are also filing this Amendment to reflect that H.C. Wainwright &

Co., LLC has withdrawn as an Agent under the Sales Agreement and that JonesTrading Institutional Services LLC will continue to act as

the sole sales agent under the Sales Agreement. As a result, each reference to the term “Agent” or “Agents” in

the prospectus is hereby amended to refer only to JonesTrading Institutional Services LLC as the sole Agent under the Sales Agreement.

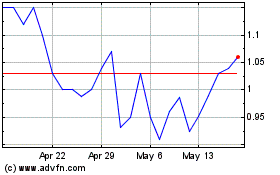

Our common stock is listed on the Nasdaq Capital Market under the symbol

“ONVO”. On February 25, 2025, the last reported sale price of our common stock on the Nasdaq Capital Market was $1.27 per

share.

Investing in our securities involves risks. You should read this

Amendment and the documents we incorporate herein by reference carefully before you make your investment decision. See “Risk Factors”

set forth in the prospectus and the documents we file with the Securities and Exchange Commission that are incorporated by reference herein

for more information.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this Amendment. Any representation

to the contrary is a criminal offense.

The date of this Amendment No. 1 to Prospectus

is February 26, 2025

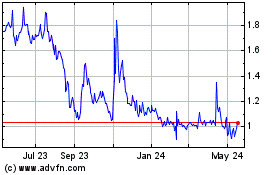

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Feb 2024 to Feb 2025