Plus Therapeutics, Inc. (Nasdaq: PSTV) (the “Company,” or

“Plus Therapeutics”), a clinical-stage pharmaceutical company

developing targeted radiotherapeutics with advanced platform

technologies for central nervous system (CNS) cancers, announced

today that it has closed a private placement with aggregate initial

upfront proceeds of approximately $3.7 million and received a $2.0

million advance payment from CPRIT as part of its existing $17.6

million grant award. The funding from the private placement and the

CPRIT advance will support the Company’s clinical development of

Rhenium (186Re) Obisbemeda for leptomeningeal metastases (LM), as

well as further development of the Company’s CNSide LM diagnostic

test as a pivotal trial endpoint.

“We are grateful for the enthusiasm and ongoing

support from both existing investors and key funding agencies,

including CPRIT, the National Institutes of Health, and the U.S.

Department of Defense,” said Marc H. Hedrick, M.D., Plus

Therapeutics’ President and Chief Executive Officer. “This capital,

along with expected grant allocations later in 2025, is expected to

fully support the completion of two planned LM trials,

strategically positioning the company for a pivotal trial in

2026."

Private Placement Financing

The private placement comprised the issuance and

sale of secured convertible promissory notes, or Funding Notes, in

the aggregate amount of $3,362,251 and common stock purchase

warrants to purchase up to an aggregate of 3,002,009 shares of the

Company common stock at an exercise price of $1.12 per share. The

notes have a maturity date of one year from the closing of the

financing and are convertible in future financings of the Company

or into common stock at the election of the investors. The

financing includes participation from AIGH Capital Management LLC

with additional participation from existing healthcare-focused

institutional investors.

The accompanying Warrants will be exercisable

until the five-year anniversary of the closing of the

financing.

The Notes are convertible, under certain

circumstances, to shares of common stock of the Company at an

exercise price of $1.12 per share. The Notes are senior,

secured obligations of the Company. The Notes bear interest at the

rate of ten percent (10%) per annum, payable on the last business

day of each quarter, except as provided therein.

The gross proceeds to the Company from the

private placement were approximately $3.7 million, before

deducting offering expenses payable by the Company. The Company

currently intends to use the net proceeds from the private

placement for general corporate and working capital purposes.

The securities offered in the private placement

and described above were offered in transactions not involving a

public offering under Section 4(a)(2) of the Securities Act of

1933, as amended (the “Securities Act”) and/or Rule 506(b) of

Regulation D promulgated thereunder and have not been registered

under the Securities Act or applicable state securities laws.

Accordingly, the securities in the private placement may not be

reoffered or resold in the United States except pursuant

to an effective registration statement with the SEC or an

applicable exemption from the registration requirements of the

Securities Act and such applicable state securities laws.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy the securities, nor

shall there be any sale of the securities in any state in which

such offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of such

state. Any offering of the securities under the resale registration

statement will only be made by means of a prospectus.

CPRIT Funding Advance

In addition to the $3.7 million private

placement financing from existing investors, the Company announced

a $2.0 million advance payment from CPRIT as part of its existing

$17.6 million grant award. The funding will support and accelerate

the Company’s clinical development of Rhenium (186Re) Obisbemeda

for the ReSPECT-LM P2a single-dose expansion trial and further

develop the Company’s CNSide LM diagnostic test as a key pivotal

trial endpoint.

To date, the Company has received multiple

disbursements under its CPRIT grant. Following this $2.0 million

advance payment, approximately $5.2 million remains from the

original $17.6 million grant award.

Exchange and Financing

Waiver

On February 13, 2025, the Company also issued

secured convertible promissory notes, or Exchange Notes, in the

aggregate amount of $3,188,922 in exchange for existing investors

agreeing to cancel 3,543,247 Series A common stock purchase

warrants issued by the Company in May 2024 and waive certain

existing restrictions on the Company’s ability to raise capital.

The terms of the Exchange Notes are substantially similar to the

terms of the Funding Notes.

Additional information on the terms of the

Funding Notes, Warrants, Exchange Notes and related matters can be

found in the Company’s Current Report on Form 8-K that is being

filed by the Company on February 18, 2025.

About Leptomeningeal Metastases (LM)

LM is a rare complication of cancer in which the

primary cancer spreads to the cerebrospinal fluid (CSF) and

leptomeninges surrounding the brain and spinal cord. All

malignancies originating from solid tumors, primary brain tumors,

or hematological malignancies have this LM complication potential

with breast cancer as the most common cancer linked to LM, with

3-5% of breast cancer patients developing LM. Additionally, lung

cancer, GI cancers and melanoma can also spread to the CSF and

result in LM. LM occurs in approximately 5% of people with cancer

and is usually terminal with 1-year and 2-year survival of just 7%

and 3%, respectively. The incidence of LM is on the rise, partly

because cancer patients are living longer and partly because many

standard chemotherapies cannot reach sufficient concentrations in

the spinal fluid to kill the tumor cells, yet there are no

FDA-approved therapies specifically for LM patients, who often

succumb to this complication within weeks to several months, if

untreated.

About Rhenium (186Re)

obisbemeda

Rhenium (186Re) obisbemeda is a novel injectable

radiotherapy specifically formulated to deliver direct targeted

high dose radiation in CNS tumors in a safe, effective, and

convenient manner to optimize patient outcomes. Rhenium (186Re)

obisbemeda has the potential to reduce off target risks and improve

outcomes for CNS cancer patients, versus currently approved

therapies, with a more targeted and potent radiation dose.

Rhenium-186 is an ideal radioisotope for CNS therapeutic

applications due to its short half-life, beta energy for destroying

cancerous tissue, and gamma energy for real-time imaging. Rhenium

(186Re) obisbemeda is being evaluated for the treatment of

recurrent glioblastoma and leptomeningeal metastases in the

ReSPECT-GBM and ReSPECT-LM clinical trials. ReSPECT-GBM is

supported by an award from the National Cancer Institute (NCI),

part of the U.S. National Institutes of Health (NIH), and

ReSPECT-LM is funded by a three-year $17.6M grant by the Cancer

Prevention & Research Institute of Texas (CPRIT).

About the Cancer Prevention &

Research Institute of Texas (CPRIT)

CPRIT was created by the Texas Legislature and

approved by a statewide vote in 2007 to lead the Lone Star State’s

fight against cancer. In 2019, Texas voters again voted

overwhelmingly to continue CPRIT with an additional $3 billion for

a total $6 billion investment in cancer research and

prevention.

To date, CPRIT has awarded over $3 billion in

grants to Texas research institutions and organizations through its

academic research, prevention and product development research

programs. CPRIT has recruited 281 distinguished researchers,

supported the establishment, expansion or relocation of 52

companies to Texas and generated over $7.66 billion in additional

public and private investment. CPRIT funding has advanced

scientific and clinical knowledge and provided 8.2 million

life-saving cancer prevention and early detection services reaching

Texans from all 254 counties. Learn more at

https://cprit.texas.gov/about-us

About CNSide Diagnostic,

LLCCNSide Diagnostics, LLC is a wholly owned subsidiary of

Plus Therapeutics, Inc. that develops and commercializes

proprietary clinical diagnostic laboratory assays, such as CNSide,

designed to identify tumor cells that have metastasized to the

central nervous system in patients with carcinomas and melanomas.

The CNSide™ Assay Platform enables quantitative analysis and

molecular characterization of tumor cells and circulating tumor DNA

in the cerebrospinal fluid that inform and improve the clinical

management of patients with leptomeningeal metastases. The Company

is planning to commercialize CNSide in the U.S. in 2025.

About CNSide TestThe CNSide

Cerebrospinal Fluid (CSF) Assay Platform consists of four

laboratory developed tests (LDTs) used for diagnosis, treatment

selection, and treatment monitoring of patients with Leptomeningeal

Metastases (LM) from carcinomas or melanoma. The CNSide platform

facilitates tumor cell detection / enumeration and biomarker

identification using cellular assays (immunocytochemistry (ICC) and

fluorescence in situ hybridization (FISH)) and molecular assays

(next generation sequencing (NGS)). The CNSide CSF tumor cell

enumeration LDT is currently being used in the ReSPECT-LM trial as

an exploratory endpoint and will be commercially available in

2025.

About Plus TherapeuticsPlus

Therapeutics, Inc. is a clinical-stage pharmaceutical company

developing targeted radiotherapeutics for difficult-to-treat

cancers of the central nervous system with the potential to enhance

clinical outcomes for patients. Combining image-guided local beta

radiation and targeted drug delivery approaches, the Company is

advancing a pipeline of product candidates with lead programs in

recurrent glioblastoma (GBM) and leptomeningeal metastases (LM).

The Company has built a supply chain through strategic partnerships

that enable the development, manufacturing and future potential

commercialization of its products. Plus Therapeutics is led by an

experienced and dedicated leadership team and has operations in key

cancer clinical development hubs, including Austin and San Antonio,

Texas. For more information, visit

https://plustherapeutics.com/.

Cautionary Statement Regarding

Forward-Looking StatementsThis press release contains

statements that may be deemed “forward-looking statements” within

the meaning of U.S. securities laws, including statements regarding

clinical trials, expected operations, use of proceeds and upcoming

developments. All statements in this press release other than

statements of historical fact are forward-looking statements. These

forward-looking statements may be identified by future verbs, as

well as terms such as “expect” “potential,” “should,” “will,”

“future,” “predict,” “project,” “continue,” “anticipate,”

“estimate,” “plans,” “intends,” “may,” “could,” or other words that

convey uncertainty of the future events or outcomes to identify

these forward-looking statements. Our forward-looking statements

are based on current beliefs and expectations of our management

team and on information currently available to management that

involve risks, potential changes in circumstances, assumptions, and

uncertainties. All statements contained in this press release other

than statements of historical fact are forward-looking statements,

including but not limited to statements regarding the Company’s use

of the estimated proceeds from the private placement, grants

amounts available to the Company under the CPRIT funding program,

the ReSPECT-LM clinical development program, including the

registrational trial for ReSPECT-LM, and the development of the

CNSide LM diagnostic test. Any or all of the forward-looking

statements may turn out to be wrong or be affected by inaccurate

assumptions we might make or by known or unknown risks and

uncertainties. These forward-looking statements are subject to

risks and uncertainties including, without limitation, risks

related to the fact that the Company may never receive proceeds

from the exercise of the warrants issued in the private placement;

the Company’s ability to continue as a going concern; the early

stage of the Company’s product candidates and therapies; the

results of the Company’s research and development activities,

including uncertainties relating to the clinical trials of its

product candidates and therapies; the Company’s liquidity and

capital resources and its ability to raise additional cash; the

outcome of the Company’s partnering/licensing efforts, risks

associated with laws or regulatory requirements applicable to it,

including the ability of the Company to come into compliance with

The Nasdaq Capital Market listing requirements; market conditions,

product performance, litigation or potential litigation, and

competition within the cancer diagnostics and therapeutics field;

ability to develop and protect proprietary intellectual property or

obtain licenses to intellectual property developed by others on

commercially reasonable and competitive terms; challenges

associated with radiotherapeutic manufacturing, production and

distribution capabilities necessary to support the Company’s

clinical trials and any commercial level product demand; and

material security breach or cybersecurity attack affecting the

Company’s operations or property. This list of risks,

uncertainties, and other factors is not complete. Plus Therapeutics

discusses some of these matters more fully, as well as certain risk

factors that could affect Plus Therapeutics’ business, financial

condition, results of operations, and prospects, in its reports

filed with the SEC, including Plus Therapeutics’ annual report on

Form 10-K for the fiscal year ended December 31, 2023, quarterly

reports on Form 10-Q, and current reports on Form 8-K. These

filings are available for review through the SEC’s website at

www.sec.gov. Any or all forward-looking statements Plus

Therapeutics makes may turn out to be wrong and can be affected by

inaccurate assumptions Plus Therapeutics might make or by known or

unknown risks, uncertainties, and other factors, including those

identified in this press release. Accordingly, you should not place

undue reliance on the forward-looking statements made in this press

release, which speak only as of its date. The Company assumes no

responsibility to update or revise any forward-looking statements

to reflect events, trends or circumstances after the date they are

made unless the Company has an obligation under U.S. federal

securities laws to do so.

Investor ContactCharles Y. Huang, MBADirector

of Capital Markets and Investor RelationsOffice: (202)-209-5751 |

Direct (301)-728-7222chuang@plustherapeutics.com

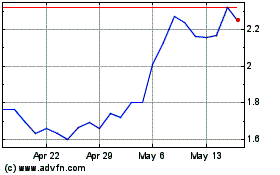

Plus Therapeutics (NASDAQ:PSTV)

Historical Stock Chart

From Jan 2025 to Feb 2025

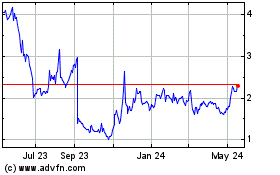

Plus Therapeutics (NASDAQ:PSTV)

Historical Stock Chart

From Feb 2024 to Feb 2025