false 0001671858 0001671858 2023-09-25 2023-09-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

September 25, 2023

Date of Report (Date of earliest event reported)

ARS Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-39756 |

|

81-1489190 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 11682 El Camino Real, Suite 120 San Diego, California |

|

92130 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (858) 771-9307

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

SPRY |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. |

Regulation FD Disclosure. |

On September 25, 2023, ARS Pharmaceuticals, Inc. (the “Company”) updated its corporate presentation for use in meetings with investors, analysts and others. The presentation is available through the Company’s website and a copy is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

The information under this Item 7.01 of this Current Report on 8-K, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information shall not be deemed incorporated by reference into any other filing with the Securities and Exchange Commission made by the Company, whether made before or after today’s date, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific references in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Company Presentation |

|

|

| 104 |

|

Cover Page of Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: September 25, 2023 |

|

|

|

ARS Pharmaceuticals, Inc. |

|

|

|

|

| |

|

|

|

By: |

|

/s/ Richard Lowenthal, M.S., MSEL |

| |

|

|

|

Name: |

|

Richard Lowenthal, M.S., MSEL |

| |

|

|

|

Title: |

|

President and Chief Executive Officer |

ARS Corporate Presentation Q4 2023

Exhibit 99.1

Forward looking statements This

presentation contains forward-looking statements which include, but are not limited to, statements regarding: ARS’s ability to complete the newly required trial and provide the additional information requested by the FDA in the CRL on the

timing anticipated, or at all; the potential approval of neffy and the expected timing of the U.S. launch of neffy; the potential market, demand and expansion opportunities for neffy; ARS’s expected competitive position; the design and

potential benefits of neffy if approved, including the likelihood that doctors will prescribe neffy and that allergy patients and caregivers will choose to carry and dose neffy compared to needle-bearing options; the likelihood of neffy attaining

favorable coverage; ARS’s anticipated cash, cash equivalents and short-term investments on hand upon any future approval and launch of neffy; the expected intellectual property protection for neffy; and any statements of assumptions underlying

any of the foregoing. These forward-looking statements are subject to the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. ARS’s expectations and beliefs regarding these matters may not materialize. Actual

outcomes and results may differ materially from those contemplated by these forward-looking statements as a result of uncertainties, risks, and changes in circumstances, including but not limited to risks and uncertainties related to: the ability to

obtain and maintain regulatory approval for neffy; the ability to successful complete the newly requested trial on the timeframe anticipated, or at all, as a result of challenges inherent to enrolling, conducting and completing clinical trials; the

results of the new clinical trial may not support the approval of neffy; results from clinical trials may not be indicative of results that may be observed in the future; potential safety and other complications from neffy; the labelling for neffy,

if approved; the scope, progress and expansion of developing and commercializing neffy; the size and growth of the market therefor and the rate and degree of market acceptance thereof vis-à-vis intramuscular injectable products; ARS’s

ability to protect its intellectual property position; and the impact of government laws and regulations. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the

forward-looking statements are included under the caption “Risk Factors” in ARS’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, filed with the Securities and Exchange

Commission (“SEC”) on August 10, 2023. This and other documents ARS files with the SEC can also be accessed on ARS’s website at ir.ars-pharma.com by clicking on the link “Financials &

Filings.” The forward-looking statements included in this presentation are made only as of the date hereof. ARS assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

Potential to Transform the Treatment

of Type I Allergic Reactions neffy®: first potential “no needle, no injection” solution for Type I allergic reactions to address an unmet market need Registration program demonstrates comparable PK and PD, without risk of

needle-related safety concerns, fear and hesitation Rapid and statistically significant response on PD surrogates for efficacy (SBP, HR) observed even 1 minute after dosing with neffy vs. injection Significant opportunity to disrupt current

epinephrine injectables market FDA AdCom supports favorable benefit-risk assessment, but FDA requested one additional study (twice-dosing nasal challenge study) Anticipated NDA resubmission in H1 2024, with FDA action in H2 2024 Potential

multi-billion-dollar market driven by HCP and consumer preference and adoption NCE-like IP exclusivity potential until at least 2038 $252 million in cash and securities as of 6/30/2023 with an anticipated $195 million in cash and securities at

anticipated FDA action in H2 2024

Rapid administration without a needle

No risk of needle-related injuries; lacerations2 or cardiotoxic blood vessel injections Less hesitation to dose NO NEEDLE NO INJECTION SMALL Fits in your pocket; can carry more than 1 ~10% of cases require multiple doses of epinephrine1 EASIER AND

MORE CONSISTENT DOSING 0% critical dosing errors in registration self-administration study Low 2 mg dose of neffy achieves comparable PK without overexposure risk RELIABLE 99.999% delivery of effective dose in reliability testing; no inhalation

required 24 month shelf-life at room temperature, with up to 3 months at high temperatures (122oF) ~50% of patients carry1 (<20% carry two) ~25% - 60%1, 3, 5, 6 do not administer PROBLEM ONLY 10% - 20% of patients with active Rx use as indicated7

1. Warren et al. Ann Allergy Asthma Immunol (2018), 2. Data on file from ARS market research, 3. Brooks et al. Ann Allergy Asthma Immunol (2017), 4. El Turki et al. Emerg Med J (2017), 5. Asthma and Allergy Foundation of America Patient Survey

Report (2019), 6, Mehta et al. Expert Review of Clinical Immunology (2023), 7. Company estimates based on prior references (1) through (6) and IQVIA data NO TREATMENT AVAILABLE REFUSAL OF TREATMENT ~40 - 60%2 of patients delay DELAY IN TREATMENT 23

- 35%4 fail to dose correctly USER ERROR IN TREATMENT neffy SOLUTIONS Unmet need / current challenges

neffy Designed for Needle-free, Easier

Carriage

Registrational studies demonstrate

comparability on both PD surrogates for efficacy and PK with neffy Safety Data 2 mg neffy met all clinical endpoints PD surrogates for efficacy comparable to approved products (SBP/HR approved injection products) Rapid and significant response on PD

surrogates for efficacy observed even 1 minute after dosing PK bracketed by approved products (exposures IM/SC for efficacy, < EpiPen for safety) Adverse events generally mild in nature with no meaningful nasal irritation or pain up to 4

mg dose Most common adverse events (>5%) were mild nasal discomfort (9.7%) and mild headache (6%), with no correlation of nasal discomfort to pain or irritation Mean VAS pain scores between 5 to 8 out of 100 No irritation based on formal

assessment No serious adverse events in any clinical study No risk of needle-related injuries or blood vessel injections with neffy PD and PK Data

Robust response on PD surrogate

markers for efficacy Mean Change HR (BPM) Time (Minutes) Heart Rate Response Mean Change SBP (mmHg) Time (Minutes) Systolic Blood Pressure Response First PD 1 minute First PD 1 minute neffy 2 mg IM 0.3 mg neffy 2 mg IM 0.3 mg ** Significance level:

** p <0.01, *** p <0.001 **** p <0.0001 **** **** *** ** **** **** **** Epi 53 pg/mL (2 min PK) Epi 53 pg/mL (2 min PK) Integrated analysis of ARS clinical studies (EPI-15 and EPI-16)

neffy shows enhanced absorption during

critical period of clinical response following nasal allergen-challenge (NAC) Time to observe clinical response, and re-dose per guidelines (within 5 to 15 min) * * * * * * neffy 2.0 mg neffy 2.0 mg rhinitis IM 0.3 mg Mean Epinephrine Concentration

(pg/mL) Nasal congestion accelerates absorption of neffy in first 20 min Treatment guidelines recommend giving a second dose if no response is observed within 5 to 15 minutes of administration FDA Advisory Committee viewed NAC study data as

“encouraging” and “favorable” due to the greater concentration levels during the time period when clinical response is observed with epinephrine FDA reported that the rate of nasal mucosal symptoms in anaphylaxis patients

ranges from 2 to 11% Single-dose nasal challenge results in allergic rhinitis subjects * Statistically significant differences between neffy with rhinitis compared to IM injection (p <0.05)

FDA Complete Response Letter requests

nasal allergen challenge (NAC) study with repeat doses of neffy Mean Plasma Concentration (pg/mL) Time (mins) Repeat-dosing (10 min apart) results in healthy subjects neffy with repeat dosing is dose-proportional, whereas the approved injection

products are not, and therefore overall exposure of neffy is higher FDA requested additional study to confirm that neffy’s repeat dose PK profile is at least comparable to repeat doses of injection under nasal allergen challenge conditions NDA

resubmission expected in 1H 2024 with FDA action expected in 2H 2024

neffy market exclusivity potential

until at least 2038 Issued composition of matter patent (US10,576,156) on Intravail® + epinephrine provides foundational exclusivity blocking any generic products. Method of treatment patents (US11,173,209; US11,191,838) block other alkyl

glycosides. Issued method of treatment patent (US10,682,414) blocks any intranasal epinephrine product using a different technology using a low dose (<2.5 mg) PCT patent granted in Europe (EP19751807), UK (GB2583051), Japan (JP6941224), Canada

(3088909), Australia (AUS2019217643), Korea (10-2375232), China (2019800010042), with same claims as the US Extensive studies in the lab and clinic completed to develop a proprietary product with expected NCE-like exclusivity EXPECTED LAUNCH FIRST

PATENT EXPIRATION (without patent term extension) ADDITIONAL PROTECTION 2024 2038

Commercialization

Strategy

Significant opportunity to address

unmet needs in current US severe allergic reaction market (~$1B1) 1. Based on IQVIA data (~5 million two-packs sold per year) and weighted average generic/branded epinephrine auto-injector net pricing, 2. Gupta RS et al. Pediatrics (2011), Gupta RS

et al. Pediatrics (2018), McGowan EC et al. JACI (2013), Jackson KD et al. NCHS (2013), Black LI et al. CDC (2019), Gupta RS et al. JAMA Open Network (2019), Verrill et al. Allergy Asthma Pro (2015), Bilo BM et al. Current Opin Allergy Clin Immunol

(2008), 3. IQVIA Claims Data Promotional Responsiveness 16M diagnosed and under physician care3 Prevalence data estimates 40M patients with type 1 allergic reactions2 ~3.3M patients fill Rx, but ~80-90% do not use as indicated3 (1) do not carry

(~50%), (2) do not inject (25-60%), (3) wait to inject (40-60%) or (4) dose incorrectly (23-35%) ~2.5M haven’t filled or refilled ~11M Type 1 diagnosed and under care; no treatment ~30% historic lift with meaningful promotion1 Currently no

meaningful promotion Consistent Market Growth +5% y/y in the last ~15 years1

neffy has the ability to address

the unmet need and is aligned with what healthcare providers, patients and parents want1 72% OF THE TIME, PEOPLE WHO USE AN OTC WOULD USE neffy FIRST2 81% OF PEOPLE WOULD USE neffy SOONER THAN CURRENT AUTOINJECTOR3 OF

NON-FILLING PATIENTS STATED THEY WOULD ASK THEIR PHYSICIAN ABOUT neffy RX1 89% n = 392 Current Users OF PATIENTS LIKELY TO VERY LIKELY TO ASK THEIR PHYSICIAN ABOUT neffy Rx1 88% n = 88 Non-fillers 1. ARS patient market research on file (2023), 2.

Lowenthal et al. AAAAI 2023 (Poster #20), 3. Kaplan et al. ACAAI 2022 (Poster P008)

Physicians supportive of adopting

neffy into practice Would prescribe neffy if their patients asked for it 100% 10 = MAJOR ADVANCE / 1 = NOT AN ADVANCE AT ALL 8.5 out of 10 rating1 viewed as a major advance in therapy n = 75 Physicians No difference in uptake of neffy by physician

specialty1 1. ARS physician market research on file (n = 75)

neffy: innovative treatment to

overcome known challenges with injectables for SAR patients 1. Kaplan et al. ACAAI 2022 (Poster P008). 2. Warren et al. Ann Allergy Asthma Immunol 2018. 3. ARS patient survey data on file Carry 55% N = 9172 Would Carry 85% N = 1503 % of Time

Carrying at least One Epinephrine Device2,3 Current Device neffy Market Research N = 100 Patient N = 100 Caregiver 45% REDUCTION IN TIME TO USE Average Time (minutes) from Symptom Start to Device Use1 N = 200 More allergy patients and caregivers are

likely to carry neffy compared to current needle-bearing options Patients are likely to dose neffy more rapidly with a needle-free device Benefits of needle-free alternative to major unmet medical needs

neffy strategic objectives ACTIVATE

PATIENTS Create awareness and motivate patients and caregivers to seek neffy FACILITATE ACCESS neffy access, affordability and support services EDUCATE PRESCRIBERS Drive adoption within specialty and high decile prescribers on the compelling

value-proposition of neffy

neffy: the first needle-free way to

administer epinephrine Rapid, reliable delivery Small and easy to carry Place and Press administration Well-tolerated in extensive trials Expected availability in 8 weeks

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

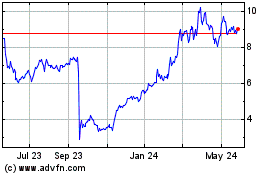

ARS Pharmaceuticals (NASDAQ:SPRY)

Historical Stock Chart

From Oct 2024 to Nov 2024

ARS Pharmaceuticals (NASDAQ:SPRY)

Historical Stock Chart

From Nov 2023 to Nov 2024