false

0001872525

0001872525

2024-08-23

2024-08-23

0001872525

SWAG:CommonStockParValue0.0001PerShareMember

2024-08-23

2024-08-23

0001872525

SWAG:WarrantsEachWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf4.81375Member

2024-08-23

2024-08-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 23, 2024

| STRAN & COMPANY, INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

001-41038 |

|

04-3297200 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 2 Heritage Drive, Suite 600, Quincy, MA |

|

02171 |

| (Address of principal executive offices) |

|

(Zip Code) |

| 800-833-3309 |

| (Registrant’s telephone number, including area code) |

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

SWAG |

|

The Nasdaq Stock Market LLC |

| Warrants, each warrant exercisable for one share of Common Stock at an exercise price of $4.81375 |

|

SWAGW |

|

The Nasdaq Stock Market LLC |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities

Exchange Act of 1934.

Emerging Growth Company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item

3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously reported in the Notification of

Late Filing on Form 12b-25 (the “Form 12b-25”) filed by Stran & Company, Inc., a Nevada corporation (the “Company”),

with the Securities and Exchange Commission (the “SEC”) on August 15, 2024, the Company’s Quarterly Report on Form 10-Q

for the quarterly period ended June 30, 2024 (the “Form 10-Q”) could not be filed within the prescribed time period without

unreasonable effort or expense for the reasons set forth in the Form 12b-25.

On August 23, 2024, the Company received a written

notification (the “Notification Letter”) from the Listing Qualifications staff (the “Staff”) of The Nasdaq Stock

Market LLC (“Nasdaq”), notifying the Company that it is not in compliance with the periodic financial report filing requirement

set forth in Nasdaq Listing Rule 5250(c)(1) for continued listing on The Nasdaq Capital Market tier of Nasdaq since the Company had not

yet filed the Form 10-Q.

Previously, the Staff granted the Company an exception

until December 16, 2024 to file its delinquent Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024 (the “Initial

Delinquent Filing”). As a result, any additional Staff exception to allow the Company to regain compliance with all delinquent filings

will be limited to a maximum of 180 calendar days from the due date of the Initial Delinquent Filing, or until December 16, 2024. In accordance

with Nasdaq’s listing rules, the Company has until September 24, 2024 to submit to the Staff an update to the Company’s original

plan to regain compliance with the Nasdaq listing rules (the “Updated Plan”).

The Company intends to submit the Updated Plan

and take the necessary steps to regain compliance with Nasdaq’s listing rules as soon as practicable. As previously disclosed, the

filing of the Form 10-Q is delayed due to the matters described in the Form 12b-25. There can be no assurance that the Updated Plan will

be accepted by the Staff or that the Company will be able to regain compliance with the minimum requirements of the Nasdaq listing rules.

Item

7.01 Regulation FD Disclosure.

On August 29, 2024,

the Company issued a press release announcing that the Company had received the Notification Letter. A copy of the press release is furnished

as Exhibit 99.1 to this report.

The

information furnished pursuant to this Item 7.01 (including Exhibit 99.1 hereto), shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference into any filing under the Exchange Act or the Securities

Act of 1933, as amended (the “Securities Act”), except as expressly set forth by specific reference in such a

filing.

Forward-Looking Statements

The press release and the

statements contained therein may include “forward-looking” statements within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act, which statements involve substantial risks and uncertainties. Forward-looking statements generally

relate to future events or the Company’s future financial or operating performance. In some cases, you can identify these statements

because they contain words such as “may,” “will,” “believes,” “expects,” “anticipates,”

“estimates,” “projects,” “intends,” “should,” “seeks,” “future,”

“continue,” “plan,” “target,” “predict,” “potential,” or the negative of such

terms, or other comparable terminology that concern the Company’s expectations, strategy, plans, or intentions. Forward-looking statements relating

to expectations about future results or events are based upon information available to the Company as of today’s date and are not

guarantees of the future performance of the Company, and actual results may vary materially from the results and expectations discussed.

The Company’s expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject

to risks and uncertainties that could cause actual results to differ materially from those projected, including risks and uncertainties

described in the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and other

filings with the SEC. All subsequent written and oral forward-looking statements concerning the Company or other matters

and attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements

above. The Company does not undertake any obligation to publicly update any of these forward-looking statements to reflect

events or circumstances that may arise after the date hereof, except as required by law.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: August 29, 2024 |

STRAN & COMPANY, INC. |

| |

|

| |

/s/ Andrew Shape |

| |

Name: |

Andrew Shape |

| |

Title: |

President and Chief Executive Officer |

2

Exhibit 99.1

Stran & Company

Receives Notification Of Deficiency From Nasdaq Related To Delayed Filing Of Quarterly Report On Form 10-Q

Quincy, MA / August 29, 2024 / Stran &

Company, Inc. (“Stran” or the “Company”) (NASDAQ: SWAG) (NASDAQ: SWAGW), a leading outsourced marketing solutions

provider that leverages its promotional products and loyalty incentive expertise, today announced that it has received a written notification

(the “Notification Letter”) from the Listing Qualifications staff of The Nasdaq Stock Market (“Nasdaq”) as a result

of its failure to file its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 (the “Form 10-Q”) in a timely fashion.

The Notification Letter advised the Company that it was not in compliance with Nasdaq’s continued listing requirements under the

timely filing criteria established in Nasdaq Listing Rule 5250(c)(1).

As reported by the Company in its Form 12b-25

filed with the Securities and Exchange Commission (the “SEC”) on August 15, 2024, the Form 10-Q cannot be filed within the

prescribed time period without unreasonable effort or expense primarily because the Company was required to dismiss BF Borgers CPA PC

(“BF Borgers”) as the Company’s former independent registered public accounting firm on May 13, 2024 as a result of

an SEC order (the “Order”) permanently barring BF Borgers and its sole audit partner, Benjamin F. Borgers CPA, from appearing

or practicing before the SEC as an accountant, and needs additional time to assess the impact of BF Borgers’ and Mr. Borgers’

conduct as described in the Order on the Company’s financial statements for prior fiscal periods.

Previously, Nasdaq granted the Company an exception

until December 16, 2024 to file its delinquent Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 (the “Initial Delinquent

Filing”). As a result, any additional Nasdaq exception will be limited to a maximum of 180 calendar days from the due date of the

Initial Delinquent Filing, or until December 16, 2024. In accordance with Nasdaq’s listing rules, the Company has until September

24, 2024 to submit to Nasdaq an update to its original plan to regain compliance with Nasdaq’s listing rules.

As noted above, the Company is working diligently

to complete the Form 10-Q. The Company intends to file the Form 10-Q as soon as practicable to regain compliance with the Nasdaq Listing

Rules.

No assurance can be given that the Company will

be able to regain compliance with the aforementioned listing requirement or maintain compliance with the other continued listing requirements

set forth in the Nasdaq Listing Rules.

The Notification Letter has no immediate effect

on the listing of the Company’s common stock or warrants on The Nasdaq Capital Market.

About Stran

For over 29 years, Stran has grown to become a

leader in the promotional products industry, specializing in complex marketing programs to help recognize the value of promotional products,

branded merchandise, and loyalty incentive programs as a tool to drive awareness, build brands and impact sales. Stran is the chosen promotional

programs manager of many Fortune 500 companies, across a variety of industries, to execute their promotional marketing, loyalty and incentive,

sponsorship activation, recruitment, retention, and wellness campaigns. Stran provides world-class customer service and utilizes cutting-edge

technology, including efficient ordering and logistics technology to provide order processing, warehousing, and fulfillment functions.

The Company’s mission is to develop long-term relationships with its clients, enabling them to connect with both their customers

and employees in order to build lasting brand loyalty. Additional information about the Company is available at: www.stran.com.

Forward Looking Statements

This press release contains “forward-looking

statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained

in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by

the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,”

“expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,”

“predict,” “project,” “target,” “aim,” “should,” “will,” “would,”

or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking

statements are based on the Company’s current expectations and are subject to inherent uncertainties, risks and assumptions that

are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove

to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in the

Company’s periodic reports which are filed with the Securities and Exchange Commission. Forward-looking statements contained in

this announcement are made as of this date, and the Company undertakes no duty to update such information except as required under applicable

law.

Contacts:

Investor Relations Contact:

Crescendo Communications, LLC

Tel: (212) 671-1021

SWAG@crescendo-ir.com

Press Contact:

Howie Turkenkopf

press@stran.com

v3.24.2.u1

Cover

|

Aug. 23, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 23, 2024

|

| Entity File Number |

001-41038

|

| Entity Registrant Name |

STRAN & COMPANY, INC.

|

| Entity Central Index Key |

0001872525

|

| Entity Tax Identification Number |

04-3297200

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2 Heritage Drive

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, City or Town |

Quincy

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02171

|

| City Area Code |

800

|

| Local Phone Number |

833-3309

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

SWAG

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each warrant exercisable for one share of Common Stock at an exercise price of $4.81375 |

|

| Title of 12(b) Security |

Warrants, each warrant exercisable for one share of Common Stock at an exercise price of $4.81375

|

| Trading Symbol |

SWAGW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SWAG_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SWAG_WarrantsEachWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf4.81375Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

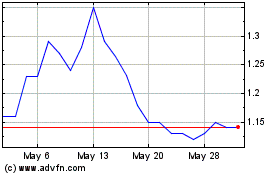

Stran (NASDAQ:SWAG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Stran (NASDAQ:SWAG)

Historical Stock Chart

From Nov 2023 to Nov 2024