TMC Announces June 27, 2025 Submission Date for Subsidiary NORI’s ISA Application, and Expanded Company Strategy

November 12 2024 - 3:05PM

TMC the metals company Inc. (Nasdaq: TMC) (“TMC” or “the Company”),

an explorer of lower-impact battery metals from seafloor

polymetallic nodules, today provided a corporate update on the

expected submission date of the application to the ISA for an

exploitation contract, and an expanded company strategy.

Update Highlights:

- Following discussions between TMC subsidiary Nauru Ocean

Resources Inc (NORI) and its sponsoring state, the Republic of

Nauru, NORI has set the date of June 27, 2025 for the expected

submission of its ISA exploitation application

- Given it is unlikely the ISA would consider an application

prior to its March 2025 session, the Republic of Nauru has

requested in a formal letter that the ISA clarify the submission

and review process during the March session, with the goal of

providing certainty for all stakeholders and allowing for review to

begin immediately after NORI’s submission under an agreed-upon

process

- Following the expected submission of NORI’s application, the

Company expects quarterly cash use of less than $5 million as the

application is reviewed, and does not expect to raise funds for

capital expenditures relating to the preparation of the Hidden Gem

vessel for commercial production until increased regulatory

certainty is achieved or non-dilutive financing is secured

- The Company has begun to explore a new strategy to (1) develop

a services business for seafloor resource development and (2)

optimize and diversify its resource portfolio within international

waters and in certain national jurisdictions

Gerard Barron, TMC Chairman and CEO, commented: “After many

years of conversations with current and prospective shareholders,

it remains clear that the key catalyst everyone is waiting for is

the delivery of the Mining Code. Following discussions with Member

States and the incoming ISA Secretary-General during the UN General

Assembly in September, I remain confident that the work on the

Mining Code remains on track. These discussions have also informed

the decision to submit the NORI application in June 2025, in

consultation with Nauru. Investors can be assured that we will not

be raising funds for CAPEX related to the Hidden Gem vessel until

we see sufficient regulatory progress, whether through delivery of

the Mining Code or additional clarity on the ISA’s review of our

application based on the draft regulations.

But TMC’s value proposition extends beyond a narrow focus on the

Mining Code and NORI application. We are now in a strong position

to leverage our investment of over half a billion dollars and

capabilities developed over the last decade-plus, as the eyes of

the world’s largest economies turn to the seafloor to produce the

metals needed for the energy transition, defense, infrastructure

and the needs of a growing world population. I look forward to

providing further color on this strategy.”

Application Submission and StrategyNORI has set

the date of June 27, 2025 for its expected submission of its ISA

exploitation application. According to the ISA Council's decisions

ISBA/28/C/24 and ISBA/28/C/25, if NORI submits an application for a

plan of work for exploitation before the RRPs have been adopted,

the ISA Council at its next meeting, as a matter of priority, will

consider the process for considering such an application. The ISA

Council is not scheduled to meet again until March 2025 and the

Company believes it is unlikely that the ISA Council would consider

an application for a plan of work for exploitation before this

session. In light of this, Nauru has formally requested that the

ISA clarify the submission and review process for such an

application at the March 2025 meetings before NORI submits the

Application and, therefore, has decided to submit the Application

after the March 2025 meetings on June 27, 2025.

ISA Progress on the Mining CodeThe ISA Council

completed a first reading of the consolidated text of the draft

Mining Code at the July 2024 Council meeting. It was agreed that a

revised consolidated text of the draft Mining Code would be

provided to the ISA Council by the end of November 2024. The

Company has engaged with Leticia Reis de Carvalho, the

newly-elected Secretary General of the ISA, and expects to work

with Ms. Carvalho in a constructive manner as the ISA continues to

work to have the final Mining Code adopted.

Operating Expense Reductions and Deferral of Capital

ExpendituresFollowing the expected submission of the

Application by NORI, the Company expects quarterly cash use of less

than $5 million as the Application is reviewed. The Company has

already begun the process of reducing or eliminating certain

operating expenses to ensure the Company’s financial

resiliency.

Further, the Company does not expect to raise funds for capital

expenditures related to the preparation of the Hidden Gem vessel

for commercial production until such time as the final Mining Code

is adopted, the Application is approved, or until other potential

non-dilutive strategic financing is in place. The Company expects

to provide further updates on the potential timing of the start of

commercial production following sufficient clarity on these

items.

Expanded Company StrategyGiven the significant

rise in seafloor resource exploration opportunities around the

globe and the Company’s leadership position and experience in this

industry, having invested over $500 million since inception to

achieve milestones in environmental research, resource definition,

test mining and test processing, the Company is exploring a new

strategy to (1) develop a services business for seafloor resource

development and (2) optimize and diversify its resource portfolio

within international waters and in national jurisdictions. We are

in discussions with several parties on services contracts to

provide our expertise in the areas of new exploration plans of

work, resource definition, environmental impact assessments, data

management and offshore campaign execution. We are also actively

evaluating opportunities for the Company to enter new exploration

contract areas, already permitted properties and producing

properties.

About The Metals CompanyThe Metals Company is

an explorer of lower-impact battery metals from seafloor

polymetallic nodules, on a dual mission: (1) supply metals for the

global energy transition with the least possible negative impacts

on planet and people and (2) trace, recover and recycle the metals

we supply to help create a metal commons that can be used in

perpetuity. The Company through its subsidiaries holds exploration

and commercial rights to three polymetallic nodule contract areas

in the Clarion Clipperton Zone of the Pacific Ocean regulated by

the International Seabed Authority and sponsored by the governments

of Nauru, Kiribati and the Kingdom of Tonga. More information is

available at www.metals.co.

More Info Media | media@metals.coInvestors

| investors@metals.co

Forward Looking Statements This press release

contains “forward-looking” statements and information within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally are accompanied by words such

as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “should,” “would,” “plan,” “predict,”

“potential,” “seem,” “seek,” “future,” “outlook” and similar

expressions that predict or indicate future events or trends or

that are not statements of historical matters, including related to

statements regarding the Application and the timing of the

submission and review thereof, the adoption of the final Mining

Code, the Company’s expected future operating results and expenses,

the timing and amount of capital expenses, new business

opportunities and strategies for the Company and the Company's

preliminary unaudited financial information as of and for the three

months ended September 30, 2024. These forward-looking statements

involve significant risks and uncertainties that could cause the

actual results to differ materially from those discussed in the

forward-looking statements. Most of these factors are outside TMC’s

control and are difficult to predict. Factors that may cause such

differences include, but are not limited to: changes in the

Company's financial results for the period ended September 30, 2024

from those set forth in the preliminary unaudited financial

information as of and for the three months ended September 30,

2024; TMC’s strategies and future financial performance; the ISA’s

ability to timely adopt the final Mining Code and/or willingness to

review and/or approve a plan of work for exploitation under UNCLOS;

TMC’s ability to obtain exploitation contracts or approved plans of

work for exploitation for its areas in the CCZ; regulatory

uncertainties and the impact of government regulation and political

instability on TMC’s resource activities; TMC’s ability to comply

with its exploration contracts and maintain their effectiveness

without monetary penalty, suspension or termination; changes to any

of the laws, rules, regulations or policies to which TMC is

subject, including the terms of the final Mining Code, if any,

adopted by ISA and the potential timing thereof; the impact of

extensive and costly environmental requirements on TMC’s

operations; environmental liabilities; the impact of polymetallic

nodule collection on biodiversity in the CCZ and recovery rates of

impacted ecosystems; TMC’s ability to develop minerals in

sufficient grade or quantities to justify commercial operations;

the lack of development of seafloor polymetallic nodule deposit;

TMC’s ability to successfully enter into binding agreements with

Allseas Group S.A. and other parties in which it is in discussions,

if any; uncertainty in the estimates for mineral resource

calculations from certain contract areas and for the grade and

quality of polymetallic nodule deposits; risks associated with

natural hazards; uncertainty with respect to the specialized

treatment and processing of polymetallic nodules that the Company

may recover; risks associated with collective, development and

processing operations, including with respect to the development of

onshore processing capabilities and capacity and Allseas Group

S.A.’s expected development efforts with respect to the Project

Zero offshore system; TMC’s dependence on Allseas Group S.A.; TMC’s

ability to successfully adopt and profitably execute a new business

strategy to develop a services business and to optimize and expand

its resource portfolio; fluctuations in transportation costs;

fluctuations in metals prices; testing and manufacturing of

equipment; risks associated with TMC’s limited operating history,

limited cash resources and need for additional financing; risks

associated with TMC’s intellectual property; Low Carbon Royalties’

limited operating history; and other risks and uncertainties,

including those under Part I, Item 1A “Risk Factors” in TMC’s

Annual Report on Form 10-K for the year ended December 31, 2023,

filed by TMC with the SEC on March 25, 2024, and in TMC’s other

future filings with the SEC, including TMC’s Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K. TMC cautions that the

foregoing list of factors is not exclusive. TMC cautions readers

not to place undue reliance upon any forward-looking statements,

which speak only as of the date made. TMC does not undertake or

accept any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements to reflect

any change in its expectations or any change in events, conditions,

or circumstances on which any such statement is based except as

required by law.

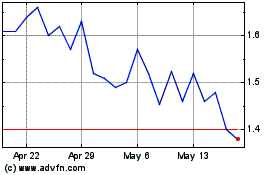

TMC the Metals (NASDAQ:TMC)

Historical Stock Chart

From Oct 2024 to Nov 2024

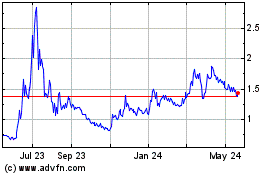

TMC the Metals (NASDAQ:TMC)

Historical Stock Chart

From Nov 2023 to Nov 2024