Tandem Diabetes Care, Inc. (Nasdaq: TNDM), a global insulin

delivery and diabetes technology company, today reported its

financial results for the quarter and fiscal year ended December

31, 2024 and provided its financial guidance for the year ending

December 31, 2025.

Fourth Quarter 2024 Financial Highlights compared to Fourth

Quarter 2023

- Achieved record sales as worldwide GAAP sales grew 44 percent

to $282.6 million and worldwide non-GAAP sales(1) grew 21 percent

to $252.4 million.

- Increased worldwide pump shipments by more than 25

percent.

- Grew the United States insulin pump market by achieving a

double-digit increase in people converting from multiple daily

injections.

Full Year 2024 Financial Highlights compared to Full Year

2023

- Achieved record sales, as worldwide GAAP sales grew 26 percent

to $940.2 million and worldwide non-GAAP sales(1) grew 18 percent

to $910.0 million.

- Increased Tandem Mobi pump shipments quarter-over-quarter

throughout 2024.

- Demonstrated a return to positive free cash flow.

Fourth Quarter 2024 and Recent Strategic Highlights

- Received U.S. Food and Drug Administration clearance for

Control-IQ+ to include people living with type 2 diabetes.

- Successfully launched multi-channel durable medical equipment

and pharmacy strategy for Tandem Mobi in the United States, with

approximately 20 percent of covered lives currently under pharmacy

rebate agreements.

- Signed multi-year collaboration agreement with the University

of Virginia Center for Diabetes Technology to advance research and

development efforts on fully automated closed-loop insulin delivery

systems.

“2024 was a pivotal year for Tandem, as we returned to strong

sales growth both in and outside of the United States, while

delivering industry-leading customer satisfaction,” said John

Sheridan, president and chief executive officer. “We are continuing

to transform our business in 2025 through the recent expansion of

our U.S. sales force, commencing pharmacy coverage, and adding new

features and indications to our robust portfolio as we work to

improve the lives of people with diabetes.”

Fourth Quarter and Full Year 2024 Sales Results Compared to

2023

From September 2022 through February 2024, the Company offered

the Tandem Choice Program (Tandem Choice) to eligible t:slim X2

customers to provide a pathway to ownership of Tandem Mobi, for a

fee when available. The Company offered eligible t:slim X2 owners

the opportunity to switch to a Tandem Mobi under the terms of

Tandem Choice beginning in the second quarter of 2024 through the

conclusion of the program at the end of 2024. As a result of this

program, the Company is providing select financial results on both

a GAAP and non-GAAP basis. Additional information, including the

accounting treatment of this program and other non-GAAP measures,

can be found under Table D “Reconciliation of GAAP versus Non-GAAP

Financial Results” attached to this press release. See also

“Non-GAAP Financial Measures” below.

Three Months Ended

Year Ended

December 31,

December 31,

2024

2023

2024

2023

($ in millions)

GAAP

Non-GAAP(1)

GAAP

Non-GAAP(1)

GAAP

Non-GAAP(1)

GAAP

Non-GAAP(1)

United States

$

214.6

$

184.4

$

150.9

$

163.5

$

672.7

$

642.5

$

554.9

$

580.0

Outside United States

68.0

68.0

45.9

45.9

267.5

267.5

192.8

192.8

Total Worldwide

$

282.6

$

252.4

$

196.8

$

209.4

$

940.2

$

910.0

$

747.7

$

772.8

Fourth Quarter 2024 Additional Results Compared to Fourth

Quarter 2023

- Sales: In the United States, GAAP sales included $30.2

million incremental net sales relating to Tandem Choice, compared

to a sales deferral of $12.5 million. Non-GAAP sales exclude Tandem

Choice-related sales and sales deferrals. Shipments in the United

States grew to more than 24,000 pumps, which does not include pumps

fulfilled under Tandem Choice. Shipments outside the United States

were nearly 10,000 pumps.

- Gross profit: GAAP gross profit was $157.5 million,

compared to $93.3 million. GAAP gross margin was 56 percent,

compared to 47 percent. Non-GAAP gross profit(1) was $127.9

million, compared to $105.8 million. Non-GAAP gross margin(1) was

51 percent in both periods.

- Operating income (loss): GAAP operating loss was $0.6

million, or zero percent of sales, compared to $35.1 million, or

negative 18 percent of sales. Non-GAAP operating loss(1) was $30.2

million, compared to $22.5 million. Non-GAAP operating margin(1)

was negative 12 percent of sales, compared to negative 11 percent

of sales.

- Net income (loss): GAAP net income was $0.8 million,

compared to net loss of $30.0 million. Non-GAAP net loss(1) was

$28.8 million, compared to net loss of $17.5 million. Adjusted

EBITDA(1) was $2.3 million, or 1 percent of sales, compared to $4.3

million, or 2 percent of sales.

Full Year 2024 Additional Financial Results Compared to Full

Year 2023

- Sales: In the United States, GAAP sales include $30.2

million incremental net sales relating to Tandem Choice, compared

to a deferral of $25.1 million. Non-GAAP sales exclude Tandem

Choice-related sales and sales deferrals.

- Gross profit: GAAP gross profit was $489.6 million,

compared to $367.7 million. GAAP gross margin was 52 percent,

compared to 49 percent. Non-GAAP gross profit(1) was $460.6

million, compared to $392.8 million. Non-GAAP gross margin(1) was

51 percent for both periods.

- Operating loss: GAAP operating loss totaled $99.1

million, or negative 11 percent of sales, compared to $233.2

million, or negative 31 percent of sales. Non-GAAP operating

loss(1) totaled $128.1 million, or negative 14 percent of sales,

compared to $112.6 million, or negative 15 percent of sales.

- Net loss: GAAP net loss was $96.0 million, compared to

$222.6 million. Non-GAAP net loss(1) was $125.0 million, compared

to $102.0 million. Adjusted EBITDA(1) was negative $10.1 million,

compared to negative $9.2 million, or negative 1 percent of sales

in both periods.

(1) A reconciliation of non-GAAP financial measures to their

most directly comparable GAAP financial measures and additional

information can be found in Table D “Reconciliation of GAAP versus

Non-GAAP Financial Results” attached to this press release. Also

see “Non-GAAP Financial Measures” below for additional

information.

See tables for additional financial information.

2025 Financial Guidance

“We are committed to delivering sustained profitable growth and

are funding key commercial investments while driving operating

leverage,” said Leigh Vosseller, executive vice president and chief

financial officer. “These investments focus on our U.S. sales

infrastructure, business systems and technology, as well as the

establishment of operations to support a direct launch in select

European countries and are fundamental to achieving our longer-term

financial objectives.”

For the year ending December 31, 2025, the Company is providing

its full year and first quarter GAAP financial guidance as

follows:

- Sales for the full year are estimated to be approximately $997

million to $1.007 billion.

- Sales in the United States of approximately $725 million to

$730 million.

- Sales outside the United States of approximately $272 million

to $277 million, which reflects a $15 million to $20 million

headwind associated with the Company’s preparation for direct

commercial operations in select countries.

- Sales for the first quarter are estimated to be approximately

$219 million to $224 million.

- Sales in the United States of approximately $144 million to

$147 million.

- Sales outside the United States of approximately $75 million to

$77 million.

- Gross margin is estimated to be approximately 54 percent for

the full year and approximately 51 percent for the first

quarter.

- Adjusted EBITDA margin(1) is estimated to be approximately 3

percent for the full year and negative 6 percent for the first

quarter.

- Non-cash charges included in cost of goods sold and operating

expenses are estimated to be approximately $115 million. This

includes:

- Approximately $95 million non-cash, stock-based compensation

expense.

- Approximately $20 million depreciation and amortization

expense.

Non-GAAP Financial Measures

Certain non-GAAP financial measures are presented in this press

release to provide information that may assist investors in

understanding the Company’s financial results and assessing its

prospects for future performance. The Company believes these

non-GAAP financial measures are important operating performance

indicators because they exclude items that are unrelated to, and

may not be indicative of, the Company’s core operating results.

These non-GAAP financial measures, as calculated, may not

necessarily be comparable to similarly titled measures of other

companies and may not be appropriate measures for comparing the

performance of other companies relative to the Company. These

non-GAAP financial results are not intended to represent, and

should not be considered to be more meaningful measures than, or

alternatives to, measures of operating performance as determined in

accordance with GAAP. To the extent the Company uses such non-GAAP

financial measures in the future, they will be calculated using a

consistent method from period to period. A reconciliation of each

of the historical GAAP financial measures to the most directly

comparable historical non-GAAP financial measures has been provided

in Table D “Reconciliation of GAAP versus Non-GAAP Financial

Results” attached to this press release.

The Company has not provided a reconciliation of forward-looking

non-GAAP financial measures to the most directly comparable GAAP

financial measures in reliance on the “unreasonable efforts”

exception set forth in the applicable regulations, because there is

substantial uncertainty associated with predicting any future

adjustments that may be made to the Company’s GAAP financial

measures in calculating the non-GAAP financial measures.

The accounting treatment for Tandem Choice had a high degree of

complexity. In September 2022 when the program was launched, the

Company began deferring a portion of sales for each eligible t:slim

X2 pump shipped in the United States. When a customer elected to

participate in Tandem Choice, the Company recognized the existing

deferral, incremental fees received and the associated costs of

providing the new insulin pump at the time of fulfillment. The

timing of recognition was based on either a) an affirmative

election to participate in Tandem Choice or b) expiration of the

right to participate at program expiration, provided all obligation

under the Tandem Choice program were satisfied.

Notably:

- Offering the program did not impact the economics associated

with how or when the initial pump sale is reimbursed.

- Customer eligibility for Tandem Choice was automatic at the

time of a t:slim X2 purchase. Customer eligibility ended in

February 2024 with the commercial availability of Tandem Mobi.

- Qualifying customers were able to elect participation in Tandem

Choice starting at the end of the second quarter of 2024.

- An affirmative election was required for the customer to

participate in Tandem Choice, at which time any customer fees were

received and recognized as a sale. The Tandem Choice program

expired on December 31, 2024.

Although the Tandem Choice program has ended, non-GAAP sales are

presented in this press release for consistency with the Company’s

historical presentation of non-GAAP sales in its earnings releases

since the launch of Tandem Choice and as a comparison to the

Company’s previously provided non-GAAP sales guidance for the year

ended December 31, 2024.

Conference Call

The Company will hold a conference call and simultaneous webcast

today at 4:30pm Eastern Time (1:30pm Pacific Time). The link to the

webcast will be available by accessing the Events &

Presentations tab in the Investor Center of the Tandem Diabetes

Care website at http://investor.tandemdiabetes.com, and will be

archived for 30 days. To access the call by phone, please use this

link

(https://register.vevent.com/register/BIa9ac5a072bb648bea94c0f0db43e70d3)

and you will be provided with dial-in details, including a personal

pin.

About Tandem Diabetes Care, Inc.

Tandem Diabetes Care, a global insulin delivery and diabetes

technology company, manufactures and sells advanced automated

insulin delivery systems that reduce the burden of diabetes

management, while creating new possibilities for patients, their

loved ones, and healthcare providers. The Company’s pump portfolio

features the Tandem Mobi system and the t:slim X2 insulin pump,

both of which feature Control-IQ advanced hybrid closed-loop

technology. Tandem Diabetes Care is headquartered in San Diego,

California. For more information, visit tandemdiabetes.com.

Tandem Diabetes Care, the Tandem logo, Control-IQ, Control-IQ+,

Tandem Mobi and t:slim X2 are either registered trademarks or

trademarks of Tandem Diabetes Care, Inc. in the United States

and/or other countries.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, that concern matters that involve risks and uncertainties

that could cause actual results to differ materially from those

anticipated or projected in the forward-looking statements. These

forward-looking statements include statements regarding, among

other things, the Company’s projected financial results and the

ability to achieve other operational and commercial goals. The

Company’s actual results may differ materially from those indicated

in these forward-looking statements due to numerous risks and

uncertainties. For instance, the Company’s ability to achieve

projected financial results will be impacted by market acceptance

of the Company’s products; products marketed and sold or under

development by competitors; the Company’s ability to establish and

sustain operations to support international sales, including

expanding into additional geographies; changes in reimbursement

rates or insurance coverage for the Company’s products; the

Company’s ability to meet increasing operational and infrastructure

requirements from higher customer interest and a larger base of

existing customers; the Company’s ability to successfully

commercialize its products; the Company’s ability to develop and

launch new products; risks associated with the regulatory approval

process outside the United States for new products; the potential

that newer products, or other technological breakthroughs for the

monitoring, treatment or prevention of diabetes, may render the

Company’s products obsolete or less desirable, or may otherwise

negatively impact the purchasing trends of customers; reliance on

third-party relationships, such as outsourcing and supplier

arrangements; global economic conditions; and other risks

identified in the Company’s most recent Annual Report on Form 10-K

and other documents that the Company files with the Securities and

Exchange Commission. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date of this release. Tandem undertakes no obligation to

update or review any forward-looking statement in this press

release because of new information, future events or other

factors.

TANDEM DIABETES CARE,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

Table A

(in thousands)

December 31,

December 31,

2024

2023

Assets

Current assets:

Cash, cash equivalents and short-term

investments

$

438,329

$

467,912

Accounts receivable, net

114,585

105,555

Inventories

149,612

157,937

Other current assets

21,965

16,585

Total current assets

724,491

747,989

Property and equipment, net

78,150

76,542

Operating lease right-of-use assets

85,306

87,791

Equity method investment

74,545

—

Other long-term assets

5,166

40,336

Total assets

$

967,658

$

952,658

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable, accrued expenses and

employee-related liabilities

$

127,028

$

105,742

Current portion of convertible senior

notes, net

40,670

—

Operating lease liabilities

18,208

17,060

Deferred revenue

11,831

43,994

Other current liabilities

49,312

28,462

Total current liabilities

247,049

195,258

Convertible senior notes, net -

long-term

308,266

285,035

Operating lease liabilities -

long-term

106,421

113,572

Deferred revenue - long-term

10,455

13,331

Other long-term liabilities

32,369

31,830

Total liabilities

704,560

639,026

Total stockholders’ equity

263,098

313,632

Total liabilities and stockholders’

equity

$

967,658

$

952,658

TANDEM DIABETES CARE,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Table B

(in thousands, except per

share data)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Sales

$

282,648

$

196,796

$

940,203

$

747,718

Cost of sales

125,193

103,501

450,629

380,028

Gross profit

157,455

93,295

489,574

367,690

Operating expenses:

Selling, general and administrative

105,836

85,751

389,824

352,503

Research and development

52,200

42,604

198,877

169,667

Acquired in-process research and

development expenses

—

—

—

78,750

Total operating expenses

158,036

128,355

588,701

600,920

Operating income (loss)

(581

)

(35,060

)

(99,127

)

(233,230

)

Total other income (expense), net

598

3,750

7,257

12,976

Income (loss) before income taxes

16

(31,310

)

(91,870

)

(220,254

)

Income tax expense (benefit)

(739

)

(1,308

)

4,155

2,357

Net income (loss)

$

755

$

(30,002

)

$

(96,025

)

$

(222,611

)

Net income (loss) per share - basic and

diluted

$

0.01

$

(0.46

)

$

(1.47

)

$

(3.43

)

Weighted average shares used to compute

basic net income (loss) per share

65,939

65,369

65,451

64,969

Weighted average shares used to compute

diluted net income (loss) per share

66,157

65,369

65,451

64,969

TANDEM DIABETES CARE,

INC.

SALES BY GEOGRAPHY

Table C(1)

(Unaudited)

($'s in thousands)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

% Change

2024

2023

% Change

United States:

Pump

$

98,438

$

82,364

20%

$

328,625

$

289,546

13%

Supplies and other

85,923

81,088

6%

313,811

290,439

8%

Net revenue recognized (deferred) for

Tandem Choice

30,202

(12,539

)

341%

30,249

(25,107

)

220%

Total GAAP Sales in the United States

$

214,563

$

150,913

42%

$

672,685

$

554,878

21%

Adjustment for Tandem Choice

(30,202

)

12,539

(341)%

(30,249

)

25,107

(220)%

Total Non-GAAP Sales in the United

States

$

184,361

$

163,452

13%

$

642,436

$

579,985

11%

Outside the United States:

Pump

$

25,770

$

9,060

184%

$

105,544

$

76,296

38%

Supplies and other

42,315

36,823

15%

161,974

116,544

39%

Total Sales Outside the United States

$

68,085

$

45,883

48%

$

267,518

$

192,840

39%

Total GAAP Worldwide Sales

$

282,648

$

196,796

44%

$

940,203

$

747,718

26%

Adjustment for Tandem Choice

(30,202

)

12,539

(341)%

(30,249

)

25,107

(220)%

Total Non-GAAP Worldwide Sales

$

252,446

$

209,335

21%

$

909,954

$

772,825

18%

(1)

A reconciliation of non-GAAP financial

measures to their closest GAAP equivalent and additional

information can be found in Table D and under the heading

“Reconciliation of GAAP versus Non-GAAP Financial Results.”

TANDEM DIABETES CARE,

INC.

Reconciliation of GAAP versus

Non-GAAP Financial Results (Unaudited)

Table D

($'s in thousands)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

GAAP sales

$

282,648

$

196,796

$

940,203

$

747,718

Adjustment for Tandem Choice (1)

(30,201

)

12,539

(30,249

)

25,107

Non-GAAP sales

$

252,447

$

209,335

$

909,954

$

772,825

GAAP cost of sales

$

125,193

$

103,501

$

450,629

$

380,028

Adjustment for Tandem Choice (1)

625

—

1,317

—

Non-GAAP cost of sales

$

125,818

$

103,501

$

451,946

$

380,028

GAAP gross profit

$

157,455

$

93,295

$

489,574

$

367,690

Adjustment for Tandem Choice(1)

(29,576

)

12,539

(28,931

)

25,107

Non-GAAP gross profit

$

127,879

$

105,834

$

460,643

$

392,797

GAAP gross margin(2)

56

%

47

%

52

%

49

%

Non-GAAP gross margin(3)

51

%

51

%

51

%

51

%

GAAP operating income (loss)

$

(581

)

$

(35,060

)

$

(99,127

)

$

(233,230

)

Acquired in-process research and

development(4)

—

—

—

78,750

Non-recurring facility consolidation

costs(5)

—

—

—

14,099

Severance costs - cash and noncash

—

—

—

2,680

Adjustment for Tandem Choice(1)

(29,576

)

12,539

(28,931

)

25,107

Non-GAAP operating loss

$

(30,157

)

$

(22,521

)

$

(128,058

)

$

(112,594

)

GAAP operating margin(2)

—

%

(18

)%

(11

)%

(31

)%

Non-GAAP operating margin(3)

(12

)%

(11

)%

(14

)%

(15

)%

GAAP net income (loss)

$

755

$

(30,002

)

$

(96,025

)

$

(222,611

)

Income tax expense (benefit)

(739

)

(1,308

)

4,155

2,357

Interest income, interest expense and

other, net

(598

)

(3,750

)

(7,257

)

(12,976

)

Depreciation and amortization

4,245

4,031

16,607

15,715

Stock-based compensation expense

28,166

22,742

101,383

87,688

Acquired in-process research and

development(4)

—

—

—

78,750

Non-recurring facility consolidation

costs(5)

—

—

—

14,099

Severance costs - cash and noncash

—

—

—

2,680

Adjustment for Tandem Choice(1)

(29,576

)

12,539

(28,931

)

25,107

Adjusted EBITDA

$

2,253

$

4,252

$

(10,068

)

$

(9,191

)

Adjusted EBITDA margin(3)

1

%

2

%

(1

)%

(1

)%

GAAP net income (loss)

$

755

$

(30,002

)

$

(96,025

)

$

(222,611

)

Acquired in-process research and

development(4)

—

—

—

78,750

Non-recurring facility consolidation

costs(5)

—

—

—

14,099

Severance costs - cash and noncash

—

—

—

2,680

Adjustment for Tandem Choice(1)

(29,576

)

12,539

(28,931

)

25,107

Non-GAAP net loss

$

(28,821

)

$

(17,463

)

$

(124,956

)

$

(101,975

)

(1)

The accounting treatment for Tandem Choice

had a high degree of complexity. Additional information can be

found under the heading “Non-GAAP Financial Measures.”

(2)

GAAP margins including GAAP gross margin

and GAAP operating margin are calculated using GAAP sales.

(3)

Non-GAAP margins including non-GAAP gross

margin, non-GAAP operating margin, and adjusted EBITDA margin are

calculated using non-GAAP sales and non-GAAP cost of sales.

(4)

Acquired in-process research and

development charges represent the value of acquired in-process

research and development assets with no alternative future use and

acquisition related expenses recorded in connection with the

acquisitions of AMF Medical SA in 2023.

(5)

The Company recorded $14.1 million of

facility consolidation costs related to our Vista Sorrento lease in

San Diego, California in 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226019096/en/

Media Contact: 858-366-6900 media@tandemdiabetes.com

Investor Contact: 858-366-6900 IR@tandemdiabetes.com

Tandem Diabetes Care (NASDAQ:TNDM)

Historical Stock Chart

From Jan 2025 to Feb 2025

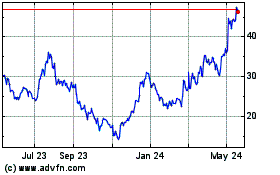

Tandem Diabetes Care (NASDAQ:TNDM)

Historical Stock Chart

From Feb 2024 to Feb 2025