DR Bank Chooses Upstart’s Small-Dollar Loan Product to Expand Access to Credit

November 19 2024 - 8:00AM

Business Wire

Upstart (NASDAQ: UPST), the leading artificial intelligence (AI)

lending marketplace, today announced that DR Bank, an FDIC-insured

member bank, is using Upstart’s small-dollar loan product to

support customers with short-term financial needs.

These small relief loans are available in amounts between

$250-$2,500, for periods of time between three to 18 months—at or

below 36% APR. The loans are fast, simple, and far more affordable

than many higher-cost credit options traditionally available to

consumers facing urgent financial challenges.

“We’re excited DR Bank has chosen our small-dollar loan product

to expand access to bank-quality credit,” said Upstart co-founder

and CEO Dave Girouard. “This innovative and effective credit

solution allows lenders to deepen their relationships with existing

customers while also attracting new ones.”

Banks and credit unions in recent years have increased their

issuance of small-dollar loans, though economic and regulatory

constraints have made it difficult to run these programs profitably

and at scale. Upstart offers a product that helps lenders serve the

millions of consumers in need of small-dollar loans.

DR Bank said the venture with Upstart continues the company’s

goal of leveraging technological innovation to increase credit

opportunities to customers across the country.

"This partnership signifies our commitment to innovation and

excellence in the fintech industry," said DR Bank CEO Jason

Hardgrave. "By leveraging Upstart's advanced AI technology, we can

reach a broader set of consumers who might not otherwise have

access to credit, in a more efficient way.”

Learn more about small-dollar loans here:

upstart.com/relief-loans

About Upstart

Upstart (NASDAQ: UPST) is the leading AI lending marketplace,

connecting millions of consumers to more than 100 banks and credit

unions that leverage Upstart’s AI models and cloud applications to

deliver superior credit products. With Upstart AI, lenders can

approve more borrowers at lower rates across races, ages, and

genders, while delivering the exceptional digital-first experience

customers demand. More than 80% of borrowers are approved

instantly, with zero documentation to upload. Founded in 2012,

Upstart’s platform includes personal loans, automotive retail and

refinance loans, home equity lines of credit, and small-dollar

“relief” loans. Upstart is based in San Mateo, California, and also

has offices in Columbus, Ohio and Austin, Texas.

About DR Bank

DR Bank is a digital centric bank dedicated to partnering with

fintechs and businesses to help them achieve their financial

objectives. DR Bank has a history of innovation and fintech

expertise, having previously incubated and sold a consumer-lending

digital platform. In addition to its fintech banking programs, DR

Bank offers a wide product set of commercial and small business

lending, cash management and digital personal banking tools.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241119107665/en/

Press press@upstart.com

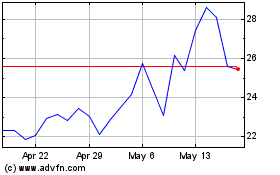

Upstart (NASDAQ:UPST)

Historical Stock Chart

From Oct 2024 to Nov 2024

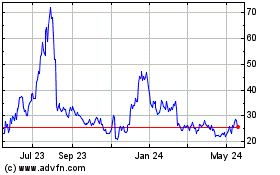

Upstart (NASDAQ:UPST)

Historical Stock Chart

From Nov 2023 to Nov 2024