via NewMediaWire – Utah Medical Products, Inc. [Nasdaq: UTMD],

despite a difficult third calendar quarter (3Q), achieved financial

results for nine months (9M) 2023 consistent with those anticipated

in its beginning of year projections.

Currencies in this release are denoted as $ or USD

= U.S. Dollars; AUD = Australia Dollars; £ or GBP = UK Pound

Sterling; C$ or CAD = Canadian Dollars; and € or EUR = Euros.

Currency amounts throughout this report are in thousands, except

per share amounts and where noted.

Overview of Results The following is a summary

comparison of 3Q and first nine months (9M) of calendar 2023 with

3Q and 9M 2022 income statement measures:

| |

3Q |

9M |

|

| 2023 to 2022

Comparison |

(July–September) |

(January-September) |

| Revenues

(Sales): |

-3 |

% |

-2 |

% |

|

| Gross Profit

(GP): |

-10 |

% |

-4 |

% |

|

| Operating

Income (OI): |

-23 |

% |

-13 |

% |

|

| Income

Before Tax (EBT): |

-10 |

% |

- |

|

|

| Net Income

(NI): |

-8 |

% |

4 |

% |

| Earnings Per

Share (EPS): |

-8 |

% |

4 |

% |

|

Worldwide (WW) consolidated sales in 3Q 2023 were

$450 lower than in 3Q 2022, and were $816 lower in 9M 2023 compared

to 9M 2022. This essentially was because 3Q 2023 biopharmaceutical

OEM sales were $1,217 lower than in 3Q 2022, and were $1,847 lower

in 9M 2023 compared to 9M 2022. Sales invoiced in foreign

currencies, which did not include any biopharmaceutical OEM sales,

represented 25% of total WW consolidated 3Q 2023 sales (when

expressed in USD) and 29% of 9M 2023 total WW consolidated sales.

Constant currency sales, U.S. dollar sales using the same foreign

currency exchange (FX) rates as in the prior year’s same periods,

were $155 higher in 3Q 2023 as a result of a stronger EUR and GBP

compared to 3Q 2022, but $33 lower for 9M 2023 because of a weaker

AUS and CAD, despite a stronger EUR, for 9M 2023 year-to-date.

Profit margins in 3Q and 9M 2023 compared to 3Q

and 9M 2022 follow:

| |

3Q 2023 |

3Q 2022 |

9M 2023 |

9M 2022 |

| (Jul – Sep) |

(Jul – Sep) |

(Jan – Sep) |

(Jan – Sep) |

| Gross Profit

Margin (GP/ sales): |

58.80 |

% |

63.20 |

% |

60.50 |

% |

61.70 |

% |

| Operating

Income Margin (OI/ sales): |

31.70 |

% |

39.70 |

% |

33.90 |

% |

38.00 |

% |

| EBT Margin

(EBT/ sales): |

38.20 |

% |

41.20 |

% |

39.80 |

% |

38.90 |

% |

| Net Income

Margin (NI/ sales): |

31.50 |

% |

33.00 |

% |

32.60 |

% |

30.80 |

% |

EBT = Income Before Taxes = (Operating Income +

Non-Operating Income)

In 9M 2023, UTMD achieved its targeted GP Margin

(GPM), although somewhat lower than in 9M 2022 due to planned

higher manufacturing overhead costs with less absorption because of

lower sales. Because of the relatively short span of time, results

for any given three-month period in comparison with a previous

three-month period may not be indicative of comparative results for

the year as a whole. The lower 3Q 2023 GPM was a good example of

this. In addition to the lower absorption of higher overhead costs,

the Company had an unfavorable product mix due to much higher

foreign distributor sales compared to 3Q 2022, and experienced

higher than normal medical expenses in its self-funded U.S. health

care plan. International distributor prices are lower than prices

of products sold directly to medical facilities WW.

In addition to the 4.4 percentage point lower 3Q

2023 GPM and the 1.2 percentage point lower 9M 2023 GPM, the OI

Margins in both periods were reduced another 2.8 percentage points

by 2023 litigation expenses captured in General &

Administrative (G&A) expenses. Due primarily to interest earned

on cash balances included in Non-operating income, UTMD was able to

achieve higher EBT, NI and EPS in 9M 2023 compared to the prior 9M

2022.

UTMD’s September 30, 2023 Balance Sheet, in the

absence of debt, continued to strengthen with total assets up $0.8

million from the end of 2022. Ending Cash and Investments were

$88.2 million on September 30, 2023 compared to $75.1 million on

December 31, 2022, after paying $3.2 million in cash dividends to

stockholders and purchasing $0.5 million in new Property and

Equipment in 9M 2023. UTMD’s cash balance increased $3.62/

outstanding share at September 30, 2023 from the end of 2022 with a

4% increase in Net Income, while the stock price declined $14.53/

share. Stockholders’ Equity (SE) increased $9.4 million in the

nine-month period from December 31, 2022 despite the fact that $3.2

million in dividends reduced SE.

Foreign currency exchange (FX) rates for Balance

Sheet purposes are the applicable rates at the end of each

reporting period. The FX rates from the applicable foreign currency

to USD for assets and liabilities at the end of 3Q 2023 compared to

the end of calendar year 2022 and the end of 3Q 2022 follow:

| |

9-30-23 |

12-31-22 |

Change |

9-30-22 |

Change |

| GBP |

1.22134 |

1.20771 |

1.1 |

% |

1.11303 |

9.7 |

% |

| EUR |

1.05841 |

1.06940 |

(1.0 |

%) |

0.97878 |

8.1 |

% |

| AUD |

0.64494 |

0.68050 |

(5.2 |

%) |

0.64366 |

0.2 |

% |

| CAD |

0.73873 |

0.73899 |

- |

|

0.72722 |

1.6 |

% |

Revenues (sales) -3Q 2023 Total WW UTMD

consolidated 3Q 2023 sales were $450 (3.0%) lower than in 3Q 2022.

WW constant currency sales were $605 (4.7%) lower. U.S. domestic

sales were 15.7% lower (obviously without any FX impact), and

outside the U.S. (OUS) sales were 20.8% higher. Without the benefit

of a weaker USD in converting foreign currency sales, 3Q 2023 OUS

sales were 17.2% higher.

Domestic U.S. sales in 3Q 2023 were $7,265

compared to $8,615 in 3Q 2022. Domestic sales are invoiced in USD

and not subject to FX rate fluctuations. The components of domestic

sales include 1) “direct other device sales” of UTMD’s medical

devices to user facilities (and med/surg stocking distributors for

hospitals), excluding Filshie device sales, 2) “OEM sales” of

components and other products manufactured by UTMD for other

medical device and non-medical device companies, and 3) “direct

Filshie device sales”. UTMD separates Filshie device sales from

other medical device sales direct to medical facilities because of

their significance, and acquisition history. Domestic direct other

device sales, representing 56% of total domestic sales, were $9

(+0.2%) higher in 3Q 2023 than in 3Q 2022. Domestic OEM sales,

representing 28% of total domestic sales, were $1,019 (33.4%)

lower, including $1,103 lower U.S. biopharmaceutical OEM sales.

Direct Filshie device sales, representing 16% of total domestic

sales, were $341 (23.0%) lower in 3Q 2023 compared to 3Q 2022.

OUS sales in 3Q 2023 were 20.8% higher at $5,240

compared to $4,340 in 3Q 2022. The increase in USD-denominated OUS

sales was leveraged as a result of a weaker USD relative to the EUR

and GBP, which added $155 to OUS sales that were invoiced in GBP,

EUR, AUD and CAD foreign currencies in constant currency terms. FX

rates for income statement purposes are transaction-weighted

averages. The weighted-average FX rates from the applicable foreign

currency to USD during 3Q 2023 and 3Q 2022 for revenue purposes

follow:

3Q

2023 3Q 2022

Change

GBP

1.2669

1.1760 + 7.7%

EUR

1.0711

1.0040 + 6.7%

AUD

0.6572

0.6828 ( 3.7%)

CAD

0.7462

0.7663 ( 2.6%)

The weighted average favorable FX rate difference

impact on 3Q 2023 foreign currency OUS sales was 5.2%, increasing

reported USD sales by $155 relative to the same foreign currency

sales in 3Q 2022. In constant currency terms, foreign currency

sales in 3Q 2023 were 17.2% higher than in 3Q 2022. The portion of

OUS sales invoiced in foreign currencies in USD terms were 25.0% of

total consolidated 3Q 2023 sales compared to 19.3% in 3Q 2022.

OUS sales invoiced in foreign currencies are due

to direct end-user sales in Ireland, the UK, France, Canada,

Australia and New Zealand, and to shipments to OUS distributors of

products manufactured by UTMD subsidiaries in Ireland and the UK.

Export sales from the U.S. to OUS distributors are invoiced in USD.

Direct to end-user foreign currency OUS 3Q 2023 sales in USD terms

were 19.6% higher in Ireland, 21.6% lower in Canada, 8.2% higher in

France, 30.8% lower in AUS/NZ and 17.2% higher in the UK than in 3Q

2022. Sales to OUS distributors/ international OEM (including

biopharmaceutical) customers were 35.5% higher in 3Q 2023 than in

3Q 2022.

Sales -9M 2023 Total consolidated 9M 2023 UTMD WW

consolidated sales were $816 (2.1%) lower than in 9M 2022. Constant

currency 9M 2023 sales were $33 (+0.1%) lower due to a slightly

stronger USD year-to-date. U.S. domestic sales were 12.1% lower and

OUS sales were 15.0% higher.

Domestic U.S. sales in 9M 2023 were $21,467

compared to $24,429 in 9M 2022. Direct other device sales,

representing 53% of total domestic sales, were $689 (5.7%) lower in

9M 2023 than in 9M 2022. The lower direct other device sales

year-to-date resulted from continued supply chain disruption.

Domestic OEM sales, representing 30% of total domestic sales, were

$1,919 (22.8%) lower. The biopharmaceutical portion of domestic OEM

sales were $1,963 (28.2%) lower. Direct domestic Filshie device

sales, representing 17% of total domestic sales, were $354 (9.0%)

lower in 9M 2023 compared to 9M 2022 due to lower demand.

OUS sales in 9M 2023 were 15.0% higher at $16,424

compared to $14,278 in 9M 2022. The increase in 9M 2023

USD-denominated OUS sales was only slightly diminished as a result

of a stronger USD which subtracted $33 from OUS sales that were

invoiced in GBP, EUR, AUD and CAD foreign currencies (in constant

currency terms). FX rates for income statement purposes are

transaction-weighted averages. The weighted-average FX rates from

the applicable foreign currency to USD during 9M 2023 and 9M 2022

for revenue purposes follow:

9M

2023 9M 2022

Change

GBP

1.2434

1.2488 ( 0.4%)

EUR

1.0790

1.0672 + 1.1%

AUD

0.6708

0.7058 ( 5.0%)

CAD

0.7432

0.7797 ( 4.7%)

The weighted-average unfavorable impact on 9M 2023

foreign currency OUS sales was just 0.3%, reducing reported USD

sales by $33 relative to the same foreign currency sales in 9M

2022. In constant currency terms, OUS sales in 9M 2023 were 15.3%

higher than in 9M 2022. The portion of OUS sales invoiced in

foreign currencies in USD terms was 28.8% of total consolidated 9M

2023 sales compared to 23.9% in 9M 2022. Direct to end-user foreign

currency OUS 9M 2023 sales in USD terms were 5.3% higher in

Ireland, 14.1% lower in Canada, 9.5% higher in France, 21.7% higher

in the UK and 18.2% lower in AUS/NZ. Sales to OUS distributors/OEM

(including biopharmaceutical) customers were 21.2% higher in 9M

2023 than in 9M 2022.

Since shipments to OEM customers and OUS

distributors typically have long lead times, the current order

backlog added to 9M 2023 sales results for those segments provides

a fair estimate for 2023 sales as a whole, barring new unresolved

raw material supply constraints and further third-party

sterilization capacity limits. Based on the current backlog,

management expects that WW biopharmaceutical OEM sales to its

largest customer will be about $3 million lower in 2023 than in

2022, representing about 17% of 2023 total consolidated sales

compared to 22% in 2022. This projection is consistent with

management’s beginning of year 2023 sales estimates, and suggests a

net total annual 2023 consolidated sales decline of about $2

million.

Gross Profit (GP) GP results from subtracting the

costs of manufacturing, quality assurance and receiving materials

from suppliers from revenues. UTMD’s GP was $827 (10.1%) lower in

3Q 2023 than in 3Q 2022, and $929 (3.9%) lower in 9M 2023 than in

9M 2022. UTMD price increases to customers since early 2022 were

substantially lower than its continued cost increases, with

continued “sticky” inflation. Although direct labor productivity

remained consistent with the past, raw material costs continued to

increase and higher manufacturing overhead costs were less absorbed

by lower revenues.

Operating Income (OI) OI results from subtracting

Operating Expenses (OE) from GP. OI in 3Q 2023 was $3,969 compared

to $5,141 in 3Q 2022, a $1,171 (22.8%) decline; and was $12,833 in

9M 2023 compared to $14,720 in 9M 2022, a $1,887 (12.8%)

decline.

OE are comprised of Sales and Marketing (S&M)

expenses, General and Administrative (G&A) expenses and Product

Development (R&D) expenses. The following table summarizes OE

in 3Q and 9M 2023 compared to the same periods in 2022 by OE

category:

| OE

Category |

3Q 2023 |

% of sales |

3Q 2022 |

% of sales |

9M 2023 |

% of sales |

9M 2022 |

% of

sales |

|

S&M: |

$ |

417 |

3.3 |

$ |

373 |

2.9 |

$ |

1,209 |

3.2 |

$ |

1,066 |

2.7 |

|

G&A: |

|

2,835 |

22.7 |

|

2,560 |

19.8 |

|

8,484 |

22.4 |

|

7,713 |

19.9 |

|

R&D: |

|

138 |

1.1 |

|

112 |

0.8 |

|

414 |

1.1 |

|

370 |

1.0 |

| Total

OE: |

|

3,390 |

27.1 |

|

3,045 |

23.5 |

|

10,107 |

26.7 |

|

9,149 |

23.6 |

Changes in foreign currency exchange rates did not

have a significant impact on consolidated financial results in

2023. A stronger EUR and GBP in 3Q2023 helped increase OUS S&M

expense by $3 and OUS G&A expense by $51. An average slightly

stronger USD for 9M 2023, reduced OUS S&M expenses by $4, OUS

G&A expenses by $26 and OUS R&D expenses by $1. The

following table summarizes “constant currency” OE in 3Q and 9M 2023

compared to the same periods in 2022 by OE category:

| OE

Category |

3Q 2023 const FX |

|

3Q 2022 |

|

9M 2023 const FX |

|

9M 2022 |

|

|

S&M: |

$ |

414 |

|

$ |

373 |

|

$ |

1,213 |

|

$ |

1,066 |

|

|

G&A: |

|

2,784 |

|

|

2,560 |

|

|

8,510 |

|

|

7,713 |

|

|

R&D: |

|

138 |

|

|

112 |

|

|

415 |

|

|

370 |

|

| Total

OE: |

|

3,336 |

|

|

3,045 |

|

|

10,138 |

|

|

9,149 |

|

S&M and R&D expenses were higher primarily

as a result of cost-of-living adjustments to employee salaries.

A division of G&A expenses by location

follows. G&A expenses include non-cash expenses from the

amortization of IIA associated with the Filshie Clip System, which

is also separated out below:

| G&A Exp

Category |

3Q 2023 |

% of sales |

3Q 2022 |

% of sales |

9M 2023 |

% of sales |

9M 2022 |

% of

sales |

| IIA Amort-

UK: |

$ |

504 |

4.0 |

$ |

467 |

3.6 |

$ |

1,484 |

3.9 |

$ |

1,497 |

3.9 |

| IIA Amort–

CSI: Other– UK: Other– US: IRE: AUS: CAN: Total G&A: |

|

1,105 171 912 74 38 31 2,835 |

8.8 22.7 |

|

1,105 132 710 73 39 34 2,560 |

8.5 19.8 |

|

3,316 498 2,752 227 107 100 8,484 |

8.8 22.4 |

|

3,316 428 2,018 224 124 106 7,713 |

8.6

19.9 |

Although the IIA amortization expense in either

USD or GBP, depending on where expensed, was the same as in the

prior year’s same periods, the 3Q 2023 OI margin was diluted by 0.7

percentage points, and the 9M 2023 OI margin was diluted by 0.2

percentage points, due to a lower sales denominator and the GBP FX

rate difference. Non-cash IIA amortization expense was 57% of total

G&A expenses in both 3Q 2023 and 9M 2023. Litigation expenses,

included in the Other-US G&A Expense category above, were about

2.8% of sales in both 3Q 2023 and 9M 2023. Litigation expenses were

1.4% of sales in 3Q 2022 and 1.1% of sales in 9M 2022. In other

words, higher litigation expenses reduced UTMD’s OI margin by

another 1.4 percentage points in 3Q 2023, and another 1.7

percentage points in 9M 2023.

OUS G&A expenses in USD terms were $818 in 3Q

2023 compared to $745 in 3Q 2022. OUS G&A expenses were $2,416

in 9M 2023 compared to $2,379 in 9M 2022. The constant currency

table below shows how the changes in FX rates affected reported OUS

G&A expenses for 3Q 2023 ($51 higher) and 9M 2023 ($26

lower):

| G&A Exp

Category |

3Q 2023 const FX |

|

3Q 2022 |

|

9M 2023 const FX |

|

9M 2022 |

|

| IIA Amort-

UK: |

$ 468 |

|

$ 467 |

|

$1,471 |

|

$1,497 |

|

| Other–

UK:IRE:AUS:CAN:Total OUS G&A: |

159 69

39 32 767 |

|

132 73

39 34 745 |

|

494

230 101

94 2,390 |

|

428

224 124

106 2,379 |

|

Summary explanation for changes in OI Margin from

prior year’s same periods:

|

Expense Category |

3Q %- Point Reduction |

9M %- Point Reduction |

|

GPM: |

4.4 |

1.2 |

|

Litigation Expense (G&A) |

1.4 |

1.7 |

|

IIA Amortization Expense (G&A) |

0.7 |

0.2 |

|

All Other Operating Expenses |

1.5 |

1 |

|

Reduction in OI Margin: |

8 |

4.1 |

Income Before Tax (EBT) EBT results from

subtracting net non‑operating expense (NOE) or adding net

non-operating income (NOI) from or to, as applicable, OI.

Consolidated 3Q 2023 EBT was $4,781 (38.2% of sales) compared to

$5,339 (41.2% of sales) in 3Q 2022. Consolidated 9M 2023 EBT was

$15,072 (39.8% of sales) compared to $15,068 (38.9% of sales) in 9M

2022. The improvement in 9M EBT was due to higher net NOI.

NOE/NOI includes the combination of 1) expenses

from loan interest and bank fees; 2) expenses or income from losses

or gains from remeasuring the value of EUR cash bank balances in

the UK, and GBP cash balances in Ireland, in USD terms; and 3)

income from rent of underutilized property, investment income and

royalties received from licensing the Company’s technology.

Negative NOE is NOI. Net NOI in 3Q 2023 was $811 compared to $198

NOI in 3Q 2022. Net NOI in 9M 2023 was $2,239 compared to $348 NOI

in 9M 2022. UTMD realized a $7 remeasured currency balance loss in

both 9M 2023 and 9M 2022. With higher cash balances and interest

rates in 9M 2023 compared to 9M 2022, UTMD received $1,826 more in

WW interest income. NOI generated in Ireland from renting unused

warehouse space to a third party yielded a further increase in 9M

2023 NOI compared to 9M 2022.

EBITDA is a non-US GAAP metric that measures

profitability performance without factoring in effects of

financing, accounting decisions regarding non-cash expenses,

capital expenditures or tax environments. Excluding the noncash

effects of depreciation, amortization of intangible assets and

stock option expense, 3Q 2023 consolidated EBT excluding the

remeasured bank balance currency gain or loss and interest expense

(“adjusted consolidated EBITDA”) was $6,604 compared to $7,111 in

3Q 2022.

Adjusted consolidated EBITDA was $20,520 in 9M

2023 compared to $20,487 in 9M 2022. Adjusted consolidated EBITDA

for the previous four calendar quarters (TTM) was $27,924 as of

September 30, 2023.

UTMD’s adjusted consolidated EBITDA as a

percentage of sales was 52.8% in 3Q 2023 compared to 54.9% in 3Q

2022, reflecting the lower 3Q 2023 GPM. UTMD’s adjusted

consolidated EBITDA as a percentage of sales was 54.2% in 9M 2023

compared to 52.9% in 9M 2022.

Management believes that this operating

performance metric provides meaningful supplemental information to

both management and investors and confirms UTMD’s ongoing excellent

financial operating performance during a difficult economic period

of time.

UTMD’s non-US GAAP adjusted consolidated EBITDA is

the sum of the elements in the following table, each element of

which is a US GAAP number:

| |

3Q 2023 |

3Q 2022 |

9M 2023 |

9M 2022 |

|

|

| EBT |

$ |

4,781 |

|

$ |

5,339 |

$ |

15,072 |

$ |

15,068 |

|

|

| Depreciation

Expense |

|

155 |

|

|

152 |

|

465 |

|

454 |

|

|

| Femcare IIA

Amortization Expense |

|

503 |

|

|

467 |

|

1,484 |

|

1,497 |

|

|

| CSI IIA

Amortization Expense |

|

1,105 |

|

|

1,105 |

|

3,316 |

|

3,316 |

|

|

| Other

Non-Cash Amortization Expense |

|

8 |

|

|

8 |

|

24 |

|

24 |

|

|

| Stock Option

Compensation Expense Interest Expense |

53 - |

38 - |

152 - |

121 - |

|

|

|

Remeasured Foreign Currency Balances |

|

(1 |

) |

|

2 |

|

7 |

|

7 |

|

|

|

UTMD non-US GAAP EBITDA: |

$ |

6,604 |

|

$ |

7,111 |

$ |

20,520 |

$ |

20,487 |

|

|

Net Income (NI) NI in 3Q 2023 of $3,935 (31.5% of

sales) was 8.1% lower than NI of $4,280 (33.0% of sales) in 3Q

2022. NI in 9M 2023 of $12,349 (32.6% of sales) was 3.6% higher

than NI of $11,918 (30.8% of sales) in 9M 2022.

The average consolidated income tax provisions (as

a % of the same period EBT) in 3Q 2023 and 3Q 2022 were 17.7% and

19.8% respectively, and were 18.1% and 20.9% in 9M 2023 and 9M 2022

respectively. The consolidated income tax provision rate varies as

the mix in taxable income among U.S. and foreign subsidiaries with

differing income tax rates differs from period to period. In

addition, a portion of UTMD’s 2023 NOI generated from interest on

high grade tax-exempt municipal bonds helped reduce the overall

income tax provision rate. UTMD has consistently paid millions of

dollars in income taxes annually. The basic corporate income tax

rates in each of the sovereignties were the same as in the prior

year.

Earnings per share (EPS). Diluted EPS in 3Q 2023

were $1.081 compared to $1.178 in 3Q 2022, an 8.2% decrease.

Diluted EPS in 9M 2023 were $3.394 compared to diluted EPS of

$3.265 in 9M 2022, a 4.0% increase. Diluted shares were 3,638,723

in 3Q 2023 compared to 3,634,235 in 3Q 2022. The higher diluted

shares in 3Q 2023 were the result of exercise of employee

options.

The number of shares used for calculating 3Q 2023

EPS was higher than September 30, 2023 actual outstanding shares

because of a time-weighted calculation of average outstanding

shares plus dilution from unexercised employee and director

options. Outstanding shares at the end of 3Q 2023 were 3,629,525

compared to 3,627,767 at the end of calendar year 2022. The

difference was due to 1,758 shares in employee option exercises

during 9M 2023. For comparison, actual outstanding shares were

3,625,195 at the end of 3Q 2022. The total number of outstanding

unexercised employee and outside director options at September 30,

2023 was 65,301 at an average exercise price of $73.83, including

shares awarded but not yet vested. This compares to 49,895

unexercised option shares at the end of 3Q 2022 at an average

exercise price of $69.00/ share, including shares awarded but not

vested.

The number of shares added as a dilution factor

for 3Q 2023 was 9,309 compared to 9,220 in 3Q 2022. The number of

shares added as a dilution factor for 9M 2023 was 9,918 compared to

9,424 in 9M 2022. In October 2022, 20,600 option shares were

awarded to 40 employees at an exercise price of $82.60. No options

have been awarded in 2023. UTMD paid $1,071 ($0.295/share) in

dividends to stockholders in 3Q 2023 compared to $1,051 ($0.290/

share) paid in 3Q 2022. Dividends paid to stockholders during 3Q

2023 were 27% of 3Q 2023 NI. UTMD paid $3,211 ($0.295/share) in

dividends to stockholders in 9M 2023 compared to $2,111 ($0.290/

share) paid in 9M 2022. The difference was due to an earlier

payment of a special dividend at the end of 2021 instead of in 1Q

2022. No UTMD shares have been purchased in the open market in

2023. In 2Q 2022, the Company purchased 30,105 UTMD shares at an

average cost of $82.88/ share. The Company retains the strong

desire and financial ability for repurchasing its shares at a price

it believes is attractive for remaining stockholders.

UTMD’s closing share price at the end of 3Q 2023

was $86.00, down from the closing price of $93.20 three months

earlier at the end of 2Q 2023, and the closing price of $100.53

nine months earlier at the end of 2022.

Balance Sheet. At September 30, 2023, UTMD’s cash

and investments increased $13,157 to $88,209 from $75,052 at the

end of 2022, despite using cash during 9M 2023 to pay $3,211 in

dividends to stockholders and $549 to purchase new manufacturing

equipment, plus changes in working capital. The net increase in

cash was provided by UTMD’s excellent operating 9M EBITDA of

$20,520. At September 30, 2023, Net Intangible Assets decreased to

14.5% of total consolidated assets from 19.2% on December 31, 2022.

The 2019 $21,000 purchase of remaining exclusive U.S. distribution

rights for the Filshie Clip System will be fully amortized in

October.

Financial ratios as of September 30, 2023 which

may be of interest to stockholders follow:

1) Current Ratio =

24.4 2) Days in

Trade Receivables (based on 3Q 2023 sales activity) = 24.7

3) Average Inventory

Turns (based on 3Q 2023 average inventory and CGS) = 2.1

4) 2023 YTD ROE

(before dividends) = 14%

Investors are cautioned that this press release

contains forward looking statements and that actual events may

differ from those projected. Risk factors that could cause results

to differ materially from those projected include global economic

conditions, market acceptance of products, regulatory approvals of

products, regulatory intervention in current operations, government

intervention in healthcare in general, tax reforms, the Company’s

ability to efficiently manufacture, market and sell products,

cybersecurity and foreign currency exchange rates, among other

factors that have been and will be outlined in UTMD’s public

disclosure filings with the SEC. UTMD’s 3Q 2023 SEC Form 10-Q will

be filed on or before November 14, 2023, and can be accessed on

www.utahmed.com.

Utah Medical Products, Inc., with particular

interest in health care for women and their babies, develops,

manufactures and markets a broad range of disposable and reusable

specialty medical devices recognized by clinicians in over one

hundred countries around the world as the standard for obtaining

optimal long-term outcomes for their patients. For more information

about Utah Medical Products, Inc., visit UTMD’s website at

www.utahmed.com.

Utah Medical Products, Inc.

INCOME STATEMENT, Third Quarter (three months

ended September 30) (in thousands except earnings per share):

| |

3Q 2023 |

3Q 2022 |

Percent Change |

|

|

| Net

Sales |

$ |

12,505 |

$ |

12,955 |

|

-3.50 |

% |

|

|

| Gross

Profit |

|

7,359 |

|

8,186 |

|

-10.10 |

% |

|

|

| Operating

Income |

|

3,969 |

|

5,141 |

|

-22.80 |

% |

|

|

| Income

Before Tax |

|

4,781 |

|

5,339 |

|

-10.50 |

% |

|

|

| Net Income

(US GAAP) |

|

3,935 |

|

4,280 |

|

-8.10 |

% |

|

|

| Earnings Per

Share (US GAAP) |

$ |

1.08 |

$ |

1.18 |

|

-8.20 |

% |

|

|

| Shares

Outstanding (diluted) |

|

3,639 |

|

3,634 |

|

|

|

| |

|

|

|

|

|

| INCOME STATEMENT, First Nine Months (nine months ended

September 30)(in thousands except earnings per share): |

|

|

|

|

|

| |

|

|

|

|

|

| |

9M 2023 |

9M 2022 |

Percent Change |

|

|

| Net

Sales |

$ |

37,891 |

$ |

38,707 |

|

-2.10 |

% |

|

|

| Gross

Profit |

|

22,940 |

|

23,869 |

|

-3.90 |

% |

|

|

| Operating

Income |

|

12,833 |

|

14,720 |

|

-12.80 |

% |

|

|

| Income

Before Tax |

|

15,072 |

|

15,068 |

|

- |

|

|

|

| Net Income

(US GAAP) |

|

12,349 |

|

11,918 |

|

3.60 |

% |

|

|

| EPS (US

GAAP) |

$ |

3.39 |

$ |

3.27 |

|

4.00 |

% |

|

|

| Shares

Outstanding (diluted) |

|

3,638 |

|

3,650 |

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

BALANCE SHEET(in thousands) |

(unaudited) |

(unaudited) |

(audited) |

(unaudited) |

|

| 30-Sep-23 |

30-Jun-23 |

31-Dec-22 |

30-Sep-22 |

|

| Assets |

|

|

|

|

|

|

Cash & Investments |

$ |

88,209 |

$ |

84,619 |

$ |

75,052 |

|

$ |

69,511 |

|

|

Accounts & Other Receivables, Net |

|

3,487 |

|

3,603 |

|

5,538 |

|

|

6,034 |

|

|

Inventories |

|

9,709 |

|

10,118 |

|

8,814 |

|

|

8,310 |

|

|

Other Current Assets |

|

442 |

|

467 |

|

515 |

|

|

387 |

|

|

Total Current Assets |

|

101,847 |

|

98,807 |

|

89,919 |

|

|

84,242 |

|

| Property

& Equipment, Net |

|

10,347 |

|

10,541 |

|

10,224 |

|

|

10,257 |

|

| Intangible

Assets, Net |

|

19,049 |

|

21,127 |

|

23,731 |

|

|

23,914 |

|

|

Total Assets |

$ |

131,243 |

$ |

130,475 |

$ |

123,874 |

|

$ |

118,413 |

|

| Liabilities

& Stockholders’ Equity |

|

|

|

|

|

| Accounts

Payable |

$ |

511 |

$ |

1,336 |

$ |

1,218 |

|

$ |

1,289 |

|

| REPAT Tax

Payable |

|

419 |

|

419 |

|

419 |

|

|

220 |

|

| Other

Accrued Liabilities |

|

3,247 |

|

3,389 |

|

4,323 |

|

|

4,760 |

|

|

Total Current Liabilities |

$ |

4,177 |

$ |

5,144 |

$ |

5,960 |

|

$ |

6,269 |

|

| Deferred Tax

Liability – Intangible Assets |

|

1,196 |

|

1,370 |

|

1,513 |

|

|

1,479 |

|

| Long Term

Lease Liability |

|

305 |

|

315 |

|

341 |

|

|

354 |

|

| Long Term

REPAT Tax Payable |

|

1,256 |

|

1,256 |

|

1,256 |

|

|

1,675 |

|

| Deferred

Revenue and Income Taxes |

|

607 |

|

628 |

|

549 |

|

|

450 |

|

|

Stockholders’ Equity |

|

123,702 |

|

121,762 |

|

114,255 |

|

|

108,186 |

|

|

Total Liabilities &

Stockholders’ Equity |

$ |

131,243 |

$ |

130,475 |

$ |

123,874 |

|

$ |

118,413 |

|

Contact: Brian Koopman (801) 566-1200

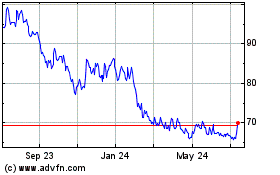

Utah Medical Products (NASDAQ:UTMD)

Historical Stock Chart

From Oct 2024 to Nov 2024

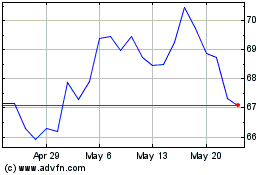

Utah Medical Products (NASDAQ:UTMD)

Historical Stock Chart

From Nov 2023 to Nov 2024