Vacasa (Nasdaq: VCSA), North America’s leading vacation rental

management platform, today announced the closing of an initial $30

million senior secured convertible notes (“Initial Notes”)

financing with an affiliate of Davidson Kempner Capital Management

LP ("Davidson Kempner"). The note purchase agreement permits the

issuance of up to an additional $45 million of senior secured

convertible notes (“Additional Notes”, and together with the

Initial Notes, the “Notes”), subject to certain conditions.

Further, the agreement provides Davidson Kempner the right, subject

to certain conditions, to designate directors to Vacasa’s

board.

Select Financing Terms

Vacasa’s subsidiary, V-Revolver Sub LLC (the “Issuer”) issued

$30 million of Initial Notes to an affiliate of Davidson Kempner.

The transaction closed and funded on August 7, 2024. An additional

$20 million of Additional Notes may be issued to Davidson Kempner

pursuant to an option exercisable at Davidson Kempner’s discretion

within six months following the initial closing date on the same

terms and conditions as the Initial Notes. Further, an additional

$25 million of Additional Notes may be issued by the Issuer to

Davidson Kempner pursuant to the mutual agreement between both

parties on the same terms and conditions as the Initial Notes.

The Notes bear interest at an annual rate of 11.25%, which is

payable in kind for the first three years by adding the amount of

such accrued interest to the principal amount of the Notes, or, at

the Issuer’s option, 9.75% payable in cash. Beginning on August 7,

2027, the Notes will bear interest at an annual rate equal to 9.75%

payable in cash. The Notes will mature on August 7, 2029, unless

earlier repurchased, redeemed, or converted. The Notes are

guaranteed by Vacasa and certain of its subsidiaries, and are

secured by a first priority lien on substantially all of their

respective assets, other than certain excluded assets pari passu in

priority with the Company’s existing revolving credit facility.

Subject to certain conditions, the Notes are convertible into

shares of Vacasa’ s Class A Common Stock at the option of Davidson

Kempner. The initial conversion price of the Notes is $4.16 per

share of Vacasa’s Class A Common Stock, subject to certain

customary anti-dilution adjustments.

Beginning on August 7, 2027, the Issuer may redeem the Notes, in

whole or in part, at a redemption price equal to 102% of the

aggregate principal amount of Notes to be redeemed plus accrued and

unpaid interest. In addition, beginning on August 7, 2027, if the

closing price per share of Vacasa’s Class A Common Stock exceeds

225% of the conversion price for 20 out of 30 consecutive trading

days, the Issuer may redeem all, but not less than all, of the

Notes at a redemption price equal to 100% of the principal amount

to be redeemed, plus accrued and unpaid interest. Upon a change of

control transaction, the Issuer may also redeem all, but not less

than all, of the Notes then outstanding in an amount equal to 130%

of the initial principal amount of the Notes to be redeemed, less

all accrued and unpaid interest previously paid in cash.

Board Appointments

In connection with the issuance of the Initial Notes, Davidson

Kempner has designated two individuals to Vacasa’s board of

directors, with the potential to add up to two additional directors

in certain circumstances.

Additional Details

PJT Partners acted as the exclusive financial advisor and

placement agent to Vacasa in connection with the transaction.

Additional details regarding the Notes, including further

information on the financing terms and board appointments, can be

found on the Current Report Form 8-K filed by Vacasa with the

Securities and Exchange Commission on August 8, 2024.

About Vacasa

Vacasa is the leading vacation rental management platform in

North America, transforming the vacation rental experience by

integrating purpose-built technology with expert local and national

teams. Homeowners enjoy earning significant incremental income on

one of their most valuable assets, delivered by the company’s

unmatched technology that is designed to adjust rates in real time

to maximize revenue. Guests can relax comfortably in Vacasa’s

40,000+ homes in hundreds of destinations across the United States,

and in Belize, Canada, Costa Rica and Mexico, knowing that 24/7

support is just a phone call away. In addition to enabling guests

to search, discover and book its properties on Vacasa.com and the

Vacasa Guest App, Vacasa provides valuable, professionally managed

inventory to top channel partners, including Airbnb, Booking.com

and Vrbo.

For more information, visit https://investors.vacasa.com.

About Davidson Kempner Capital Management

Davidson Kempner Capital Management LP is a global investment

management firm with over 40 years of experience and a focus on

fundamental investing with a multi-strategy approach. Davidson

Kempner has more than $37 billion in assets under management and

over 500 employees across seven offices: New York, Philadelphia,

London, Dublin, Hong Kong, Shenzhen and Mumbai.

For more information, visit www.davidsonkempner.com.

Forward-Looking Statements

Certain statements made in this press release are considered

"forward-looking statements" within the meaning of the "safe

harbor" provisions of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements may be identified by the use of

words such as "anticipate," "believe," "expect," "estimate,"

"plan," "outlook," and "project" and other similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters. These forward-looking statements

reflect Vacasa's current analysis of existing information and are

subject to various risks and uncertainties. As a result, caution

must be exercised in relying on forward-looking statements.

Due to known and unknown risks, actual results may differ

materially from Vacasa's expectations and projections. The

following factors, among others, could cause actual results to

differ materially from those described in these forward-looking

statements: Vacasa's ability to execute its business plan and

achieve the expected benefits of its reorganization and other cost

saving measures it may take in the future; any indebtedness Vacasa

may incur from time to time (including the Initial Notes issued on

August 7, 2024 and any Additional Notes), Vacasa's cash position

and its ability to raise additional capital or generate the

significant capital necessary to expand its operations and invest

in new offerings, including that additional financing (including

Additional Notes) may not be available on acceptable terms or at

all, or could be dilutive to Vacasa’s stockholders or impose

additional restrictive debt covenants on its activities; Vacasa's

ability to achieve profitability; Vacasa's ability to manage the

impacts the reorganization will have on its systems, process and

controls, including its ability to address competitive challenges,

manage its employee base, or maintain its corporate culture;

Vacasa's past growth not being indicative of its future prospects;

Vacasa's ability to compete in its industry; Vacasa's ability to

attract and retain homeowners and guests; Vacasa's ability to

provide high-quality customer service; Vacasa's ability to develop

new or enhanced offerings and services; Vacasa's ability to

maintain relationships with distribution partners; Vacasa's ability

to cost-effectively drive traffic to its platform; Vacasa's ability

to maintain and enhance its brand and reputation, and avoid

negative publicity that could damages its brand; the safety of

Vacasa's platform; Vacasa's ability to manages its international

operations; Vacasa's ability to consummate or successfully

integrate recent and future acquisitions; Vacasa's ability to

attract and retain capable management and employees; increased

personnel costs or labor shortages; declines or disruptions to the

travel and hospitality industries or general economic downturns;

the effects of seasonal and other trends on Vacasa's results of

operations; Vacasa's ability to obtain adequate insurance coverage

for the needs of its business; any future impairment of Vacasa's

long-lived assets or goodwill; significant fluctuations in Vacasa's

results of operations from quarter to quarter and year to year as a

result of seasonality and other factors; operational metrics

subject to inherent challenges in measurement and real or perceived

inaccuracies; upticks or downturns in bookings are not immediately

reflected in Vacasa's results of operations; Vacasa's ability to

manage funds held on behalf of customers; Vacasa's expectations

regarding its tax liabilities and the adequacy of its reserves; any

undetected errors on Vacasa's platform; Vacasa's reliance on

third-party service providers in connection with key aspects of its

platform and operations; Vacasa's ability to adapt to changes in

technology and the evolving demands of homeowners and guests;

Vacasa's ability to protect its intellectual property and its data;

Vacasa's use of "open source" software; Vacasa's use of artificial

intelligence in its business and risks related to cyberattacks,

data security breaches, or other security incidents; Vacasa's

ability to stay in compliance with laws and regulations, including

tax laws, that currently apply or may become applicable to its

business both in the United States and internationally and its

expectations regarding the impact of various laws, regulations and

restrictions that relate to its business; and risks related to the

ownership of Vacasa's Class A Common Stock, including the

significant influence its principal stockholders and holders of its

convertible notes have over Vacasa.

You should carefully consider the foregoing factors and the

other risks and uncertainties described in the "Risk Factors"

section of Vacasa's Annual Report on Form 10-K for the fiscal year

ended December 31, 2023 filed with the Securities and Exchange

Commission (the "SEC"), its Form 10-Q filed with the SEC on May 10,

2024, as well as its other filings with the SEC. These filings

identify and address other important risks and uncertainties that

could cause actual events and results to differ materially from

those contained in the forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808901320/en/

Vacasa Contacts Investor Relations Contact

ir@vacasa.com

Press Contact pr@vacasa.com

Davidson Kempner Contact Press Contact

DKMedia@dkp.com

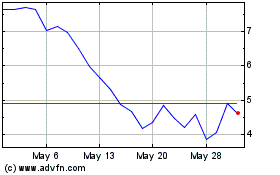

Vacasa (NASDAQ:VCSA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vacasa (NASDAQ:VCSA)

Historical Stock Chart

From Nov 2023 to Nov 2024