Vislink Technologies, Inc. (“Vislink” or

the “Company”) (Nasdaq: VISL), a global technology leader

in the capture, delivery, and management of high-quality, live

video and associated data in the media and entertainment, public

safety, and defense markets, today reported results for the second

quarter ended June 30, 2024.

Second Quarter 2024 Financial

Results

- Revenue increased

73% to $8.7 million, up from $5.0 million in the prior year period.

The revenue increase resulted from strong growth in sales to both

MilGov and Live Production customers.

- Gross margin

increased to 56%, up from 53% in the prior year period. The

year-over-year improvement in gross margin reflects greater

operating efficiency and a higher mix of new products. Gross margin

performance was slightly offset by delayed revenue recognition of

higher margin services revenue due to longer customer integration

and installation cycles with large MilGov customers.

-

Net loss improved to $(2.3) million, or $(0.93)

per share, from $(3.0) million, or $(1.27) per share, in the prior

year period. This improvement is largely attributed to increased

revenue and improved gross margins when compared to the prior

period.

- Cash and short-term

investments were $11.5 million at June 30, 2024, compared

to $14.2 million at March 31, 2024. Longer acceptance timeframes

for new products delivered to MilGov customers caused a greater

proportion of working capital to be concentrated in customer

accounts. Working capital was $29.0 million at the end of the

second quarter compared to $31.8 million at December 31, 2023. The

Company expects to continue enhancing working capital performance

by optimizing inventory management and accelerating customer

acceptance of new products.

Second Quarter 2024 and Recent

Operational Highlights

- Delivered initial shipments

for significant orders with MilGov customers, including U.S.

Customs and Border Protection. These orders demonstrate

Vislink’s ability to convert Broadcast Microwave Services, LLC

(“BMS”) customers and meet the stringent technical requirements of

MilGov clients, including installation and integration with

airborne assets.

- Grew weighted sales

pipeline to $51 million, reflecting strong demand across all

markets.

- Strengthened MilGov market

position by securing NATO Stock Numbers for its AVDS

products, facilitating streamlined procurement and

distribution within NATO member countries. This milestone raises

Vislink’s credibility and market access in the defense sector and

augments Vislink’s achieving approved supplier status from three

global aerospace OEMs earlier in the year.

- Service/software revenue

was 8% of total revenue for 2024 with a continued focus on

leveraging the infrastructure platform to drive recurring revenues

through the LinkMatrix platform.

- Accelerated expansion into

the large and growing Drone Command and Control (Drone C2)

market, increasing its R&D investment, driven by high

customer interest in the rapidly growing Drone C2 market, focusing

on manned and unmanned applications. The Company continues

demonstrating its ability to leverage its current IP portfolio and

adapt its technology to support emerging use cases.

- Appointed Donnie Gilliam as

Vice President of Operations to enhance operational efficiency and

drive successful customer outcomes.

Management

Commentary “Vislink’s second quarter results show our

continuing progress, highlighting the effectiveness of our

strategic initiatives and the continued execution of our growth

plans,” stated Mickey Miller, CEO of Vislink. “We achieved a 73%

increase in revenue, reaching $8.7 million, driven by continued

advancement in both the MilGov and Live Broadcast markets. Our

weighted sales pipeline grew to $51 million, reflecting strong

customer optimism for our refreshed product portfolio. Recent

shipments to U.S. Customs and Border Protection and other MilGov

End Users and OEMs demonstrate our ability to seamlessly integrate

existing AVDS products with assets acquired from BMS to expand our

customer base and capabilities.

“As we progress through the second half of the

year, we are driving innovation by increasing our investment in

R&D in multiple areas. Our developments in AVDS and unmanned

and manned drone systems demonstrate how we are strengthening our

position in aerial and terrestrial solutions. These efforts are

expected to improve our market position and ability to capitalize

on the growing demand for Unmanned Control, Command, and Payload

solutions. Recent significant orders and market penetration

underscore our momentum and expanding impact in this exciting,

high-growth market.

“With the upcoming launch of our upgraded and

unified ERP system this fall, we anticipate further improvements in

supply chain efficiency and operational performance. These

improvements will support our ongoing efforts to enhance gross

margins and reduce operating costs. While we continue to target

cash flow neutrality by the end of 2024, timing may vary as we

strategically prioritize incremental R&D investments that meet

customer needs in high-growth markets. Our goal is to develop

differentiated IP that can be leveraged for a high return on

investment. We expect to offset the additional R&D investment

through operational improvements that will allow us to achieve

positive cash flow in 2025.”

Conference CallManagement will

host a conference call today, August 14, 2024, at 8:30 a.m. Eastern

Time to discuss its financial results for the second quarter ended

June 30, 2024.

Vislink management will host the presentation,

followed by a question-and-answer period.

Toll-Free Number:

1-833-953-2432International Number:

1-412-317-5761Webcast: Click here to register

Please register online at least 10 minutes

before the start time (although you may register, dial in, or

access the webcast anytime during the call). If you have difficulty

registering or connecting to the conference call, please contact

Gateway Group at 949-574-3860.

The conference call will be broadcast live here

and available for replay via the Investor Relations section of

Vislink’s website.

A replay of the conference call will be

available after 11:30 a.m. Eastern Time on the same day through

Wednesday, August 28, 2024.

Toll-Free Replay Number:

1-877-344-7529International Replay Number:

1-412-317-0088Replay ID: 8830402

Non-GAAP Financial Measure:

EBITDATo supplement our financial results presented in

accordance with Generally Accepted Accounting Principles (GAAP), we

are presenting EBITDA in this earnings release and the related

earnings conference call. EBITDA is a non-GAAP financial measure

that is not based on any standardized methodology prescribed by

GAAP and is not necessarily comparable to similarly titled measures

presented by other companies. We define EBITDA as our net income

(loss), excluding the impact of depreciation and amortization

expense and interest income and tax). We have presented EBITDA

because it is a key measure used by our management and board of

directors to understand and evaluate our operating performance,

establish budgets, and develop operational goals for managing our

business. In particular, we believe that excluding the impact of

these expenses in calculating EBITDA can provide a useful measure

for period-to-period comparisons of our core operating performance.

A reconciliation of non-GAAP EBITDA to GAAP net loss appears in the

financial tables accompanying this press release as set forth

below.

Note on Forward-looking

StatementsCertain statements in this press release are

forward-looking statements that involve substantial risks and

uncertainties for purposes of the safe harbor provided by the

Private Securities Litigation Reform Act of 1995. This press

release contains forward-looking statements that involve

substantial risks and uncertainties for purposes of the safe harbor

provided by the Private Securities Litigation Reform Act of 1995.

Any statements, other than statements of historical fact included

in this press release, including those regarding the Company’s

strategy, future operations, future revenues, growth, profitability

results, and financial position, risks of supply chain constraints

and inflationary pressures, projected expenses, prospects, plans

including footprint and technology asset consolidations, objectives

of management, new capabilities, product and solutions launches

including AI-assisted and 5G streaming technologies, implementation

of the ERP, R&D investments including AVDS and drone-related

projects, expected contract values, projected pipeline sales

opportunities and transactions in our sales pipeline, backlog

realization, and order acquisitions integration including the

recently acquired BMS assets, cost savings, and expected market

opportunities across the Company’s operating segments including the

live event production, AVDS and MilGov markets, the sufficiency of

the Company’s capital resources to fund the Company’s operations

and any statements regarding future results are forward-looking

statements. Vislink may not actually achieve the plans, carry out

the intentions or meet the expectations or projections disclosed in

any forward-looking statements such as the foregoing, and you

should not place undue reliance on such forward-looking statements.

Such statements are based on management’s current expectations and

involve risks and uncertainties, including those discussed in

Vislink’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, filed with the Securities and Exchange

Commission (“SEC”) on April 3, 2024, and in subsequent filings

with, or submissions to, the SEC from time to time.

The statements made in this press release speak

only as of the date stated herein, and subsequent events and

developments may cause the Company’s expectations and beliefs to

change. While the Company may elect to update these forward-looking

statements publicly at some point in the future, the Company

specifically disclaims any obligation to do so, whether as a result

of new information, future events, or otherwise, except as required

by law. These forward-looking statements should not be relied upon

as representing the Company’s views as of any date after the date

stated herein.

About Vislink Technologies,

Inc.Vislink Technologies is a global technology leader in

capturing, delivering, and managing high-quality live video and

associated data. With a renowned heritage in video communications

encompassing over 50 years, Vislink has revolutionized live video

communications by delivering the highest-quality video from the

scene, even in the most challenging transmission

conditions—enabling broadcasters and public safety agencies to

capture and share live video seamlessly and securely. Through its

Mobile Viewpoint product lines, Vislink also provides live

streaming solutions using bonded cellular, 5G, and AI-driven

technologies for automated news and sports productions. Vislink’s

shares of common stock are publicly traded on the Nasdaq Capital

Market under the ticker symbol “VISL.” For more information, visit

www.vislink.com.

Media Contact:Adrian

LambertAdrian.lambert@vislink.com

Investor Relations Contact:Alec Wilson and Matt

GloverGateway Group, Inc.VISL@gateway-grp.com

-Financial Tables to Follow-

VISLINK TECHNOLOGIES, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(IN THOUSANDS EXCEPT SHARE AND PER SHARE

DATA)

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

| |

|

(unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,649 |

|

|

$ |

8,482 |

|

|

Accounts receivable, net |

|

|

9,517 |

|

|

|

8,680 |

|

|

Inventories, net |

|

|

14,883 |

|

|

|

14,029 |

|

|

Investments held to maturity |

|

|

5,886 |

|

|

|

5,731 |

|

|

Prepaid expenses and other current assets |

|

|

2,295 |

|

|

|

1,560 |

|

|

Total current assets |

|

|

38,230 |

|

|

|

38,482 |

|

|

Right of use assets, operating leases |

|

|

995 |

|

|

|

742 |

|

|

Property and equipment, net |

|

|

2,053 |

|

|

|

1,902 |

|

|

Intangible assets, net |

|

|

3,292 |

|

|

|

3,866 |

|

|

Total assets |

|

$ |

44,570 |

|

|

$ |

44,992 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

4,172 |

|

|

$ |

3,183 |

|

|

Accrued expenses |

|

|

1,669 |

|

|

|

1,578 |

|

|

Notes payable |

|

|

398 |

|

|

|

— |

|

|

Operating lease obligations, current |

|

|

744 |

|

|

|

463 |

|

|

Customer deposits and deferred revenue |

|

|

2,261 |

|

|

|

1,490 |

|

|

Total current liabilities |

|

|

9,244 |

|

|

|

6,714 |

|

|

Operating lease obligations, net of current portion |

|

|

655 |

|

|

|

755 |

|

|

Deferred tax liabilities |

|

|

436 |

|

|

|

546 |

|

|

Total liabilities |

|

|

10,335 |

|

|

|

8,015 |

|

| Commitments and contingencies

(See Note 11) |

|

|

|

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

|

|

|

Series A Preferred stock, $0.00001 par value per share: -0- shares

authorized on June 30, 2024, and December 31, 2023, respectively;

-0- shares issued and outstanding on June 30, 2024, and December

31, 2023, respectively. |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.00001 par value per share, 100,000,000 shares

authorized on June 30, 2024, and December 31, 2023, respectively:

Common stock, 2,452,482 and 2,439,923 were issued, and 2,452,349

and 2,439,790 were outstanding on June 30, 2024, and December 31,

2023, respectively. |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

348,349 |

|

|

|

347,507 |

|

|

Accumulated other comprehensive loss |

|

|

(1,393 |

) |

|

|

(1,027 |

) |

|

Treasury stock, at cost – 133 shares as of June 30, 2024, and

December 31, 2023, respectively |

|

|

(277 |

) |

|

|

(277 |

) |

|

Accumulated deficit |

|

|

(312,444 |

) |

|

|

(309,226 |

) |

|

Total stockholders’ equity |

|

|

34,235 |

|

|

|

36,977 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

44,570 |

|

|

$ |

44,992 |

|

VISLINK TECHNOLOGIES, INC. AND

SUBSIDIARIESUNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS ANDOTHER COMPREHENSIVE

LOSS(IN THOUSANDS EXCEPT NET LOSS PER SHARE

DATA)

|

|

|

For the Three Months Ended |

|

|

For the Six Months Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue, net |

|

$ |

8,702 |

|

|

$ |

5,043 |

|

|

$ |

17,300 |

|

|

$ |

12,231 |

|

|

Cost of revenue and operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of components and personnel |

|

|

3,806 |

|

|

|

2,361 |

|

|

|

7,361 |

|

|

|

5,675 |

|

|

Inventory valuation adjustments |

|

|

233 |

|

|

|

175 |

|

|

|

434 |

|

|

|

304 |

|

|

General and administrative expenses |

|

|

5,918 |

|

|

|

4,679 |

|

|

|

11,212 |

|

|

|

9,707 |

|

|

Research and development expenses |

|

|

966 |

|

|

|

908 |

|

|

|

1,765 |

|

|

|

1,675 |

|

|

Depreciation and amortization |

|

|

343 |

|

|

|

304 |

|

|

|

690 |

|

|

|

602 |

|

|

Total cost of revenue and operating expenses |

|

|

11,266 |

|

|

|

8,427 |

|

|

|

21,462 |

|

|

|

17,963 |

|

|

Loss from operations |

|

|

(2,564 |

) |

|

|

(3,384 |

) |

|

|

(4,162 |

) |

|

|

(5,732 |

) |

|

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on investments held to maturity |

|

|

82 |

|

|

|

(35 |

) |

|

|

145 |

|

|

|

(63 |

) |

|

Other income (loss) |

|

|

(1 |

) |

|

|

(11 |

) |

|

|

374 |

|

|

|

330 |

|

|

Dividend income |

|

|

72 |

|

|

|

128 |

|

|

|

138 |

|

|

|

219 |

|

|

Interest income, net |

|

|

87 |

|

|

|

220 |

|

|

|

178 |

|

|

|

353 |

|

|

Total other income |

|

|

240 |

|

|

|

302 |

|

|

|

835 |

|

|

|

839 |

|

|

Net loss before income taxes |

|

|

(2,324 |

) |

|

|

(3,082 |

) |

|

|

(3,327 |

) |

|

|

(4,893 |

) |

|

Income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred tax benefits |

|

|

54 |

|

|

|

54 |

|

|

|

109 |

|

|

|

109 |

|

|

Net loss |

|

$ |

(2,270 |

) |

|

$ |

(3,028 |

) |

|

$ |

(3,218 |

) |

|

$ |

(4,784 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share |

|

$ |

(0.93 |

) |

|

$ |

(1.27 |

) |

|

$ |

(1.31 |

) |

|

$ |

(2.02 |

) |

|

Weighted average number of shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

2,452 |

|

|

|

2,377 |

|

|

|

2,448 |

|

|

|

2,374 |

|

|

Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(2,270 |

) |

|

$ |

(3,028 |

) |

|

$ |

(3,218 |

) |

|

$ |

(4,784 |

) |

| Unrealized gain (loss) on

currency translation adjustment |

|

|

(156 |

) |

|

|

145 |

|

|

|

(366 |

) |

|

|

300 |

|

|

Comprehensive loss |

|

$ |

(2,426 |

) |

|

$ |

(2,883 |

) |

|

$ |

(3,584 |

) |

|

$ |

(4,484 |

) |

Reconciliation of GAAP to Non-GAAP

ResultsVISLINK TECHNOLOGIES,

INC.RECONCILIATION OF GAAP to NON-GAAP

RESULTSQUARTER ENDING June 30,

2024(IN THOUSANDS)

|

|

|

For the Three

Months Ended |

|

|

For the Six

Months Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of net income to EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(2,270 |

) |

|

|

(3,028 |

) |

|

$ |

(3,218 |

) |

|

|

(4,784 |

) |

|

Amortization and depreciation |

|

|

343 |

|

|

|

304 |

|

|

|

690 |

|

|

|

602 |

|

|

Dividend income |

|

|

(72 |

) |

|

|

(128 |

) |

|

|

(138 |

) |

|

|

(219 |

) |

|

Interest income, net |

|

|

(87 |

) |

|

|

(220 |

) |

|

|

(178 |

) |

|

|

(353 |

) |

|

Tax |

|

|

(54 |

) |

|

|

(54 |

) |

|

|

(109 |

) |

|

|

(109 |

) |

|

EBITDA |

|

$ |

(2,140 |

) |

|

$ |

(3,196 |

) |

|

$ |

(2,953 |

) |

|

$ |

(4,863 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

218 |

|

|

|

336 |

|

|

|

682 |

|

|

|

1,257 |

|

|

Severance |

|

|

— |

|

|

|

9 |

|

|

|

— |

|

|

|

359 |

|

|

EBITDA Non-GAAP Adjusted |

|

$ |

(1,922 |

) |

|

$ |

(2,781 |

) |

|

$ |

(2,271 |

) |

|

$ |

(3,247 |

) |

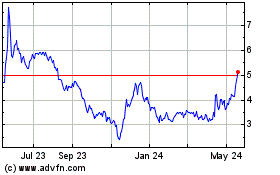

Vislink Technologies (NASDAQ:VISL)

Historical Stock Chart

From Oct 2024 to Nov 2024

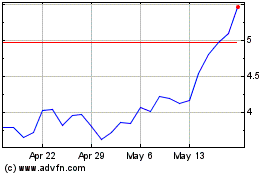

Vislink Technologies (NASDAQ:VISL)

Historical Stock Chart

From Nov 2023 to Nov 2024