Viper Energy Launches Offering of Class A Common Stock

September 11 2024 - 3:31PM

Viper Energy, Inc. (NASDAQ: VNOM) (“Viper”) announced today the

launch of an underwritten public offering of 8,500,000 shares

of its Class A common stock, subject to market and other conditions

(the “Primary Offering”). The underwriters will have an option to

purchase up to an additional 1,275,000 shares of Class A

common stock from Viper in the Primary Offering.

Viper intends to use the net proceeds from the Primary Offering,

together with cash on hand and borrowings under its revolving

credit facility, to fund a portion of the cash consideration for

its previously announced pending acquisition of certain mineral and

royalty-interest owning subsidiaries of Tumbleweed Royalty IV, LLC

(the “Pending Acquisition”).

Goldman Sachs & Co. LLC, BofA Securities and Truist

Securities are acting as joint book-running managers for the

Primary Offering. Copies of the written base prospectus and

prospectus supplement for the Primary Offering may be obtained on

the website of the Securities and Exchange Commission, www.sec.gov

or, when available, may be obtained from Goldman Sachs & Co.

LLC, 200 West Street, New York, NY 10282, Attention: Prospectus

Department, by telephone at (866) 471-2526 or by emailing

prospectus-ny@ny.email.gs.com; BofA Securities, NC1-022-02-25, 201

North Tryon Street, Charlotte, NC 28255-0001, Attn: Prospectus

Department, or by emailing dg.prospectus_requests@bofa.com; and

Truist Securities, Inc., Attention: Equity Capital Markets, 3333

Peachtree Road NE, 9th Floor, Atlanta, GA 30326, by telephone at

(800) 685-4786, or by emailing

truistsecurities.prospectus@truist.com.

The Class A common stock will be issued and sold pursuant to an

effective automatic shelf registration statement on Form S-3ASR

previously filed with the Securities and Exchange Commission

(the “Registration Statement”).

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of such

state or jurisdiction. The Primary Offering may only be made by

means of a prospectus supplement and related base prospectus.

About Viper Energy, Inc.

Viper is a publicly traded Delaware corporation

that owns and acquires mineral and royalty interests in oil and

natural gas properties primarily in the Permian Basin.

Cautionary Note Regarding

Forward-Looking Statements

The information in this press release includes

“forward-looking statements” within the meaning of Section 27A of

the Securities Act and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements, other than statements of

historical fact included in this press release, regarding the

completion of the Primary Offering, Viper’s strategy, future

operations, financial position, estimated revenues and losses,

projected costs, prospects, plans and objectives of management are

forward-looking statements. When used in this press release, the

words “could,” “may,” “believe,” “anticipate,” “intend,”

“estimate,” “expect,” “project,” “goal,” “plan,” “target” and

similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

such identifying words. These forward-looking statements are based

on management’s current expectations and assumptions about future

events and are based on currently available information as to the

outcome and timing of future events. Be cautioned that these

forward-looking statements are subject to all of the risk and

uncertainties, most of which are difficult to predict and many of

which are beyond Viper’s control, incident to the development,

production, gathering and sale of oil and natural gas. These risks

include, but are not limited to, commodity price volatility,

inflation, lack of availability of drilling and production

equipment and services, risks relating to the Pending Acquisition,

including its consummation or the realization of the anticipated

benefits and synergies therefrom. Actual results could differ

materially from those anticipated in these forward-looking

statements as a result of certain factors, including, but not

limited to, those set forth in Viper’s filings with the SEC,

including the prospectus and prospectus supplement relating to the

Primary Offering, the Registration Statement, its Annual Report on

Form 10-K for the fiscal year ended December 31, 2023, under the

caption “Risk Factors,” as may be updated from time to time in

Viper’s periodic filings with the SEC. Any forward-looking

statement in this press release speaks only as of the date of this

release. Viper undertakes no obligation to publicly update or

review any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be

required by any applicable securities laws.

Investor Contacts:Adam Lawlis+1

432.221.7467alawlis@diamondbackenergy.com

Austen Gilfillian+1

432.221.7420agilfillian@diamondbackenergy.com

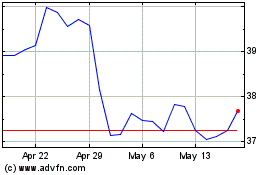

Viper Energy (NASDAQ:VNOM)

Historical Stock Chart

From Oct 2024 to Nov 2024

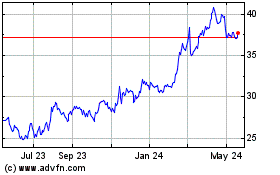

Viper Energy (NASDAQ:VNOM)

Historical Stock Chart

From Nov 2023 to Nov 2024