Current Report Filing (8-k)

April 13 2023 - 3:14PM

Edgar (US Regulatory)

0001552198

false

0001552198

2023-04-12

2023-04-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 12, 2023

WhiteHorse Finance, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

814-00967 |

|

45-4247759 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification Number) |

| 1450 Brickell Avenue, 31st Floor |

|

|

| Miami, Florida |

|

33131 |

| (Address of principal executive offices) |

|

(Zip Code) |

(305) 381-6999

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on

Which Registered |

| Common Stock, par value $0.001 per share |

|

WHF |

|

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive

Agreement.

On April 12, 2023, WhiteHorse Finance Credit I,

LLC (“WhiteHorse Credit”), a wholly owned subsidiary of WhiteHorse Finance, Inc. (the “Company”), entered into

a Sixth Amendment by and among WhiteHorse Credit, as borrower, JPMorgan Chase Bank, National Association, as lender and administrative

agent, Citibank, N.A., as collateral agent and securities intermediary, the Company, as portfolio manager, and Virtus Group LP, as collateral

administrator (the “Sixth Amendment”) to amend the terms of the Fifth Amended and Restated Loan Agreement, dated April 28,

2021 (as previously amended on July 15, 2021, October 4, 2021, January 4, 2022, February 4, 2022 and March 30, 2022), by and among WhiteHorse

Credit, as borrower, JPMorgan Chase Bank, National Association, as lender and administrative agent, Citibank, N.A., as collateral agent

and securities intermediary, the Company, as portfolio manager, and Virtus Group LP, as collateral administrator (as amended, the “Amended

Loan Agreement”). As amended by the Sixth Amendment, the Amended Loan Agreement, among other things: (i) applies an annual interest

rate equal to applicable SOFR plus 2.50% to any borrowings under the credit facility and (ii) adds recurring revenue loans as a permitted

investment type. The inclusion of recurring revenue loans as a permitted investment type is subject to certain limitations, including

that (A) not more than 15% of the aggregate principal balance of WhiteHorse Credit’s portfolio debt instruments may consist of recurring

revenue loans and certain other loan types and (B) not more than 5% of the principal balance of WhiteHorse Credit’s portfolio debt

instruments may consist of recurring revenue loans.

The description above is only a summary of the

modifications pursuant to the Sixth Amendment and is qualified in its entirety by reference to a copy of the Sixth Amendment which attaches

the Amended Loan Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Item 2.03. Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information in Item 1.01 of this Current Report

on Form 8-K is incorporated by reference into this Item 2.03.

Forward-Looking Statements

This Current Report on Form 8-K may contain “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical

facts included in this Current Report on Form 8-K may constitute forward-looking statements and are not guarantees of future performance

or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements

as a result of a number of factors, including those described from time to time in filings with the Securities and Exchange Commission.

The Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the

date of this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| 10.1 |

Sixth Amendment to Fifth Amended and Restated Loan Agreement, dated April 12, 2023, by and among WhiteHorse Finance Credit I, LLC, as borrower, JPMorgan Chase Bank, National Association, as lender and administrative agent, Citibank, N.A., as collateral agent and securities intermediary, WhiteHorse Finance, Inc., as portfolio manager, and Virtus Group LP, as collateral administrator |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: April 13, 2023 |

WHITEHORSE FINANCE, INC. |

| |

|

| |

/s/ Joyson C. Thomas |

| |

By: |

Joyson C. Thomas |

| |

Title: |

Chief Financial Officer |

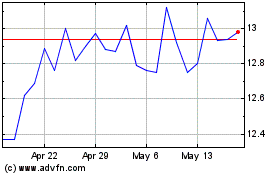

WhiteHorse Finance (NASDAQ:WHF)

Historical Stock Chart

From Oct 2024 to Nov 2024

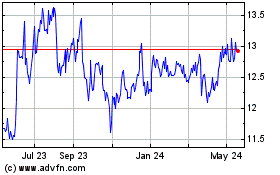

WhiteHorse Finance (NASDAQ:WHF)

Historical Stock Chart

From Nov 2023 to Nov 2024