UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number 001-39564

Mingzhu Logistics Holdings Limited

(Translation of registrant’s name into English)

27F, Yantian Modern Industry Service Center

No. 3018 Shayan Road, Yantian District

Shenzhen, Guangdong, China 518081

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark whether by furnishing the information contained

in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): 82-______

On October 21, 2024, Mingzhu

Logistics Holdings Limited., a Cayman Islands company (the “Company”), as the issuer, and its indirect wholly owned

subsidiary, Shenzhen Yangang Mingzhu Freight Industries Co., Ltd., a company incorporated in China (“Shenzhen Mingzhu”),

as the purchaser, entered into a software purchase agreement (the “Software Purchase Agreement”) with H&P International

Holdings Limited, a company incorporated in Hong Kong (the “Seller”), as the seller, with respect to a certain Simulation

Modeling Subsystem and Physical Simulation Subsystem of Intelligent Logistics Simulation System and related assets, as described more

particularly therein (the “Software”).

Pursuant to the Software Purchase

Agreement, Shenzhen Mingzhu agreed to acquire from the Seller all of the rights, title, and interests in the Software for consideration

of an aggregate of 1,900,000 ordinary shares, at US$1.20 per share, with an aggregate value of US$2,280,000 (the “Consideration

Shares”). In connection with the Software Purchase Agreement, on October 21, 2024, the Seller and four assignees (the “Assignees”)

entered into a deed of assignment (the “Deed of Assignment”) with respect to the assignment of the Seller’s right

to receive the Consideration Shares, and the Seller delivered to the Company and Shenzhen Mingzhu a notice of assignment (the “Notice

of Assignment”).

The Software Purchase Agreement

and the transactions contemplated thereby were approved and authorized by the board of directors of the Company on October 21, 2024.

On October 21, 2024, the “Company,

completed the share issuance (the “Share Issuance”) and closed the acquisition of the Software, pursuant to the Software

Purchase Agreement. The Company issued an aggregate of 1,900,000 ordinary shares, at US$1.20 per share, with an aggregate value of US$2,280,000

to the Assignees as consideration for all of the rights, title, and interests in Software.

The ordinary shares in the

Share Issuance were issued in reliance on Rule 902 of Regulation S promulgated under the Securities Act of 1933, as amended, and the Assignees

represented that they were not residents of the United States or “U.S. persons” as defined in Rule 902(k) of Regulation S

and were not acquiring the Class A ordinary shares for the account or benefit of any U.S. person.

The foregoing description

of the Software Purchase Agreement, the Deed of Assignment and the Notice of Assignment do not purport to be complete and are qualified

in their entirety by reference to the full text of the Software Purchase Agreement and the Deed of Assignment, which were filed as Exhibit

10.1, Exhibit 10.2 and Exhibit 10.3, respectively.

This Form 6-K is hereby incorporated

by reference into the registration statements on Form F-3 of the Company (File No. 333-267839), as amended, and into the base prospectus

and the prospectus supplement outstanding under each of the foregoing registration statements, to the extent not superseded by documents

or reports subsequently filed or furnished by the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act

of 1934, as amended.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

MINGZHU LOGISTICS HOLDINGS LIMITED |

| |

|

|

| Date: October 24, 2024 |

By: |

/s/ Jinlong Yang |

| |

|

Name: |

Jinlong Yang |

| |

|

Title: |

Chief Executive Officer |

EXHIBIT INDEX

Exhibit

Number |

|

Description |

| 10.1 |

|

Software Purchase Agreement, among Mingzhu Logistics Holdings Limited, SHENZHEN YANGANG MINGZHU FREIGHT INDUSTRIES CO., LTD, and H&P INTERNATIONAL HOLDINGS LIMITED, dated October 21, 2024 |

| 10.2 |

|

Deed of Assignment, between H&P INTERNATIONAL HOLDINGS LIMITED and the person listed in Schedule 1 therein, dated October 21, 2024 |

| 10.3 |

|

Notice of Assignment, dated October 21, 2024 |

Exhibit 10.1

SOFTWAREPURCHASE AGREEMENT

AMONG

H&P INTERNATIONAL HOLDINGS LIMITED

(REGISTRATION NO. 52061844)

(THE “SELLER”)

AND

SHENZHEN YANGANG MINGZHU FREIGHT INDUSTRIES

CO., LTD

(REGISTRATION NO. 914403007412009230)

(THE “PURCHASER”)

AND

MINGZHU LOGISTICS HOLDINGS LIMITED

(REGISTRATION NO. OC-330886)

(THE “ISSUER”)

This Agreement has been entered into on the date

of

October 21, 2024

TABLE OF CONTENTS

| 1 |

DEFINITIONS AND INTERPRETATION |

1 |

| 2 |

SALE AND PURCHASE OF SOFTWARE |

4 |

| 3 |

PURCHASE CONSIDERATION OF SOFTWARE |

4 |

| 4 |

COMPLETION OF SALE AND PURCHASE OF SOFTWARE |

5 |

| 5 |

REPRESENTATIONS AND WARRANTIES |

5 |

| 6 |

INDEMNIFICATION |

7 |

| 7 |

DURATION AND TERMINATION OF AGREEMENT |

7 |

| 8 |

SPECIFIC PERFORMANCE |

7 |

| 9 |

FURTHER ASSURANCE |

7 |

| 10 |

TAXES |

8 |

| 11 |

CONFIDENTIALITY |

8 |

| 12 |

NOTICES |

9 |

| 13 |

RIGHTS AND REMEDIES |

9 |

| 14 |

FORCE MAJEURE |

9 |

| 15 |

AMENDMENTS AND WAIVERS |

10 |

| 16 |

ASSIGNMENT |

10 |

| 17 |

SUCCESSORS AND ASSIGNS |

10 |

| 18 |

NO AGENCY |

10 |

| 19 |

ENTIRE AGREEMENT |

10 |

| 20 |

TIME |

10 |

| 21 |

COST AND EXPENSES |

10 |

| 22 |

INVALIDITY AND SEVERABILITY |

11 |

| 23 |

COUNTERPARTS AND E-SIGNATURES |

11 |

| 24 |

GOVERNING LAW AND JURISDICTION |

11 |

| SCHEDULE 1 |

13 |

THIS AGREEMENT has been agreed and signed between:

| 1) | H&P INTERNATIONAL HOLDINGS LIMITED ( ),

a company incorporated in Hong Kong (SAR) with its registered address at

(the “Seller”); |

| 2) | SHENZHEN YANGANG MINGZHU FREIGHT INDUSTRIES CO., LTD ( ),

a company incorporated in China with its registered address at (the “Purchaser”); and |

| 3) | MINGZHU LOGISTICS HOLDINGS LIMITED ( ),

a company incorporated in Cayman with its registered address at 89 Nexus Way, Camana Bay, Grand Cayman,

KY1-9009, Cayman Islands. (the “Issuer”), |

(the Seller, the Purchaser and the Issuer are,

collectively, the “Parties” and, individually, a “Party”). Whereas:

| a) | As at the date of this Agreement, the Seller is the legal and beneficial owner of the Software (as defined

below). |

| b) | The Seller has agreed to sell to the Purchaser, and the Purchaser has agreed to purchase from the Seller,

the Software upon the terms and subject to the conditions of this Agreement. |

| c) | The Parties agree to assume the obligations imposed on them under this Agreement. It is agreed as follows: |

| 1 | DEFINITIONS AND INTERPRETATION |

| 1.1 | In this Agreement, unless the subject or context otherwise requires, the following words and expressions

shall have the following meanings respectively ascribed to them: |

“Affiliate” means,

with respect to any person, any other person directly or indirectly controlling, controlled by, or under common control with, such person;

“Agreement” means

this software purchase agreement;

“Business Day” means

a day on which banks are open for business and is not a Saturday, Sunday, a “public holiday” or a “bank holiday”

in Hong Kong and China;

“Completion” means

the completion of the sale and purchase of the Software pursuant to Clause 4;

“Completion Date”

means the date on which the Consideration Shares are issued to the Seller’s Assignees pursuant to Clause 3.2 of this Agreement,

or such other date as may be agreed upon between the Parties upon which Completion is to take place;

“Encumbrances” means

(a) any mortgage, charge (whether fixed or floating), pledge, lien, hypothecation, assignment, deed of trust, security interest or other

encumbrance of any kind securing, or conferring any priority of payment in respect of, any obligation of any person, including any right

granted by a transaction which, in legal terms, is not the granting of security but which has an economic or financial effect similar

to the granting of security under the Law, (b) any voting agreement, interest, option, right of first offer, refusal or transfer restriction

in favor of any person and (c) any adverse claims as to title, possession or use;

“Governmental Authority”

means any relevant governmental or quasi-governmental authority, statutory authority or quasi-statutory or regulatory authority, administrative,

monetary, fiscal or judicial body, department, commission, authority, tribunal, agency or stock exchange or taxing authority or anybody

entitled to exercise executive power or power of any nature or body or other organization to the extent that the rules, regulations,

standards, requirements, procedures or orders of such authority, body or other organization have the force of Law;

“Good Industry Practice”

means the exercise of that degree of skill, care, prudence, efficiency, foresight and timeliness as would be expected from a leading company

within the relevant industry or business sector;

“Intellectual Property Rights”

means patents, utility models, rights to inventions, copyright and neighboring and related rights, trademarks and service marks, business

names and domain names, rights in get-up and trade dress, goodwill and the right to sue for passing off or unfair competition, rights

in designs, database rights, rights to use, and protect the confidentiality of, confidential information (including know-how and trade

secrets), and all other intellectual property rights, in each case whether registered or unregistered and including all applications and

rights to apply for and be granted, renewals or extensions of, and rights to claim priority from, such rights and all similar or equivalent

rights or forms of protection which subsist or will subsist now or in the future in any part of the world;

“Issuer” means MINGZHU

LOGISTICS HOLDINGS LIMITED (Registration No. OC-330886), a company incorporated in Cayman with its registered address at 89 Nexus Way,

Camana Bay, Grand Cayman, KY1-9009, Cayman Islands;

“Laws” shall mean

and include all applicable statutes, enactments, acts of legislature or Parliament, laws, ordinances, rules, by-laws, regulations, notifications,

guidelines, policies, directions, directives and orders of any Governmental Authority, tribunal, board or court of competent jurisdiction;

“Parties” means

collectively, the Seller, the Purchaser and the Issuer, and “Party” means any of them;

“Purchaser”

means SHENZHEN YANGANG MINGZHU FREIGHT INDUSTRIES CO., LTD (

),

a company incorporated in China with its registered address at

;

“Seller” means H&P

INTERNATIONAL HOLDINGS LIMITED ( ),

a company incorporated in Hong Kong with its registered address at

;

“Seller’s Assignees”

has the meaning ascribed to it in Clause 3.2.1;

“Software” means

“Simulation Modeling Subsystem and Physical Simulation Subsystem of Intelligent Logistics Simulation System”, as more specifically

described in the Software Specifications and all updates, upgrades, releases and versions including:

| i. | the source code and object code; and |

| ii. | all other works or materials recorded or embodied in the Software, including the audio or visual content

in any screen-displays in the user interface; |

“Software Deliverables”

has the meaning ascribed to it in Clause 4.1;

“Software Documentation”

means all and any documents (whether in human or machine- readable form) relating to the Software, including all:

| i. | operating manuals, user instruction manuals and training materials; and |

| ii. | documents associated with the creation, design, development or modification of the Software, including

technical or functional specifications, flow charts, algorithms, architectural diagrams, data models, build instructions, testing or configuration

documents and technical data; |

“Software Specifications”

means the specifications of the Software as set out in Schedule 1;

“Software Trade Secret”

means any scientific or technical information, design, process, procedure, formula, or improvement included in the Software that is valuable,

not generally known in the industry, and gives the owner of the Software a competitive advantage over those competitors who do not know

or use such information;

“Tangible Software Assets”

means all physical or tangible embodiments of the Software, including all object code and source code of the Software;

“Tax” means all

forms of taxation, whether direct or indirect and whether levied by reference to income, profits, gains, net wealth, asset values, turnover,

added value or other reference and statutory, governmental, state, provincial, local governmental or municipal impositions, duties, contributions,

rates and levies, whenever and wherever imposed (whether imposed by way of withholding or deduction for or on account of tax or otherwise)

and in respect of any person and all penalties, charges, costs and interest relating thereto; and

“Tax Authority”

means any taxing or other authority competent to impose any liability in respect of Tax or responsible for the administration and/or collection

of Tax or enforcement of any Law in relation to Tax.

| 1.2 | Unless the context otherwise requires, in this Agreement: |

| 1.2.1 | any reference to a statute or statutory provision is a reference to it as it is in force from time to

time, taking account of any change, extension, consolidation or re-enactment and includes any subordinate legislation for the time being

in force made under it; |

| 1.2.2 | any and all headings contained in this Agreement are for convenience only and do not affect the interpretation

of any provision of this Agreement; |

| 1.2.3 | references to any gender shall include the other genders and references to the singular shall include

the plural and vice versa and references to natural persons shall include bodies corporate and vice versa; |

| 1.2.4 | any reference to a person which for the purposes of this Agreement means any individual, corporation,

partnership, association, limited liability company, trust, Governmental Authority or body or other entity or organization (whether or

not having a separate legal personality) shall include its successors in title; |

| 1.2.5 | all obligations and liabilities on the part of the Parties are (unless expressly stated otherwise) several

and shall be construed accordingly; |

| 1.2.6 | any reference to “day”, “week”, “month” or “year” is a

reference to a day, week, month or year respectively in the Gregorian calendar; |

| 1.2.7 | any phrase introduced by the terms “including”, “ include” or any similar expression

shall be construed as illustrative and shall not limit the sense of the words preceding those terms; |

| 1.2.8 | references to “writing”, or cognate expressions, include any communication effected electronically,

by telex, cable, facsimile transmission or other comparable means of communication; |

| 1.2.9 | any reference to an agreement (including this Agreement), contract or document is a reference to such

agreement, contract or document as the same may be amended, restated or replaced from time to time; and |

| 1.2.10 | references to this Agreement include any Recitals and Appendices to it and references to Clauses, Recitals

and Appendices are to the clauses, recitals and appendices to this Agreement. |

| 1.3 | If any period of time is specified from a given day, or the day of a given act or event, it is to be calculated exclusive of that day and

if any period of time falls on a day which is not a Business Day, then that period is to be deemed to only expire on the next Business

Day. |

| 1.4 | The Recitals to this Agreement shall have effect and be construed as an integral part of this Agreement,

but in the event of any conflict or discrepancy between any of the provisions of this Agreement, such conflict or discrepancy shall, for

the purposes of the interpretation and enforcement of this Agreement, be resolved by giving the provisions contained in the Clauses of

this Agreement priority and precedence over the provisions contained in the Recitals to this Agreement. |

| 1.5 | No provision of this Agreement will be construed adversely to a Party solely on the ground that the Party

was responsible for the preparation of this Agreement or that provision. |

| 2 | SALE AND PURCHASE OF SOFTWARE |

| 2.1 | The Seller agrees to sell to the Purchaser, and the Purchaser agrees to purchase from the Seller the Software

on the terms and subject to the conditions of this Agreement. |

| 2.2 | In connection with the sale of the Software, the Seller hereby absolutely transfers, grants, conveys,

assigns and relinquishes in favor of the Purchaser all of its rights (including all Intellectual Property Rights), title and interests

in and to the following: |

| 2.2.2 | the Software Documentation; |

| 2.2.3 | the Software Trade Secret; |

| 2.2.4 | the Tangible Software Assets. |

| 2.3 | The Software shall be sold by the Seller to the Purchaser free and clear from all Encumbrances and with

full legal and beneficial title and the Seller further agrees to waive any moral rights that the Seller may have with respect to the Software

in favor of the Purchaser. |

| 3 | PURCHASE CONSIDERATION OF SOFTWARE |

| 3.1 | Purchase Consideration |

| 3.1.1 | The sale and purchase consideration for the Software is United States Dollar Two Million Two Hundred and

Eighty Thousand (USD 2,280,000) only (the “Purchase Consideration”). |

| 3.1.2 | The Parties agree that the Purchase Consideration shall be satisfied by way of allotment and issuance

to the Seller of 1,900,000 new ordinary shares of the Issuer at the issue price of USD1.20 per ordinary share (“Consideration Shares”),

the total value of which is equivalent to the Purchase Consideration. |

| 3.2 | Issuance of Consideration Shares |

| 3.2.1 | Notwithstanding Clause 3.1.2 above, the Seller hereby instructs and authorizes the Issuer to allot and

issue the Consideration Shares to the Seller’s assignees (“Seller’s Assignees”), the details of which will be

notified by the Seller to the Purchaser and the Issuer. The Seller agrees that it shall enter into a separate deed of assignment with

the Seller’s Assignees for the purposes of assigning its right and entitlement to receive the Consideration Shares in favor of the

Seller’s Assignees. |

| 3.2.2 | Subject to receipt by the Purchaser of the Software Deliverables in accordance with Clause 4.1 below,

the Consideration Shares shall be issued by the Issuer to the Seller’s Assignees on the Completion Date. |

| 3.2.3 | The Consideration Shares shall be issued free from all Encumbrances and with full legal and beneficial

title. |

| 3.2.4 | The Parties agree and acknowledge that issuance of the Consideration Shares by the Issuer to the Seller’s

Assignees on the Completion Date shall constitute a full and final discharge of the Purchaser’s payment obligation in respect of

the Purchase Consideration under this Agreement. |

| 4 | COMPLETION OF SALE AND PURCHASE OF SOFTWARE |

| 4.1 | On the Completion Date, the Seller shall deliver, or procure delivery to the Purchaser of, or make available

to the Purchaser all physical and/or digital copies (as applicable) of the following: |

| 4.1.2 | the Software Documentation; |

| 4.1.3 | the Software Trade Secret; |

| 4.1.4 | the Tangible Software Assets; and |

| 4.1.5 | such other documents and instruments in relation to any of the aforesaid as the Purchaser may request, |

(collectively, the “Software

Deliverables”) and any and all digital files of the Software Deliverables shall be delivered by the Seller to the Purchaser in a

structured, commonly used and machine- readable format.

The Purchaser may, at its sole discretion,

waive all or any of the Software Deliverables unless it is mandatorily required by Laws.

| 4.2 | Upon receipt by the Purchaser of the Software Deliverables, the Issuer shall issue the Consideration Shares

to the Seller’s Assignees pursuant to Clause 3.2 above. |

| 5 | REPRESENTATIONS AND WARRANTIES |

| 5.1 | Each Party represents and warrants to and for the benefit of the other Parties that: |

| 5.1.1 | it has the full power, authority and capacity to execute, deliver and lawfully perform the terms of this

Agreement; |

| 5.1.2 | all necessary actions, conditions and things have been or will be taken, fulfilled and done (including

the obtaining of any necessary consents) in order to enable it to lawfully exercise its rights and perform and comply with its obligations

under this Agreement; |

| 5.1.3 | this Agreement will when executed constitute legally valid and binding obligations on it, enforceable

in accordance with their respective terms; |

| 5.1.4 | the execution, delivery and performance of this Agreement will not exceed the power granted to it or violate

the provisions of any Law or any order or decree of any Governmental Authority, agency or court to which it is subject to; |

| 5.1.5 | there are no pending or threatened actions or proceedings before any court or administrative tribunal

which may materially and adversely affect its ability to discharge its obligations under this Agreement; and |

| 5.1.6 | in negotiating and executing this Agreement, it has at all times sought and followed the advice of competent

legal counsel and, based on that advice, has entered into this Agreement based on its own freewill. |

| 5.2 | The Seller hereby represents and warrants to and for the benefit of the Purchaser and the Issuer that: |

| 5.2.1 | it is the sole legal and beneficial owner of the Software, free and clear from any Encumbrances whatsoever,

with good and marketable title; |

| 5.2.2 | it has not licensed or assigned any part of the Software to any third party in any part of the world; |

| 5.2.3 | there is no violation, infringement or misappropriation or likely violation, or misappropriation of the

Software; |

| 5.2.4 | the exploitation of the Software will not infringe the rights (including Intellectual Property Rights)

of any third party; |

| 5.2.5 | the Software contains nothing that is defamatory or indecent; |

| 5.2.6 | except for the Purchaser and certain employees of the Seller (all of whom are subject to an enforceable

obligation of confidentiality), the Software Trade Secret has not been disclosed to any person, firm or company; |

| 5.2.7 | complete and accurate particulars of the Software are set out in the Software Specifications; |

| 5.2.8 | the Seller has exclusive possession and control of all source code relating to the Software and there

has been no unauthorized disclosure of such source code (which will, following Completion, be in the exclusive possession or control of

the Purchaser); |

| a) | is functioning properly in accordance with all applicable specifications (including the Software Specifications); |

| b) | is not defective in any material respect and has not been defective or failed to function during the last

two (2) years; |

| c) | has been developed in accordance with Good Industry Practice; |

| d) | has been operated and used substantially in accordance with the Software Documentation; and |

| e) | meets all applicable legal or regulatory requirements; |

| 5.2.10 | the Software Documentation includes sufficient user and technical information reduced to writing and in

a commonly readable format so as to enable reasonably skilled personnel of the Purchaser to use, operate and maintain the Software without

the need for reference to any other documents or further assistance from any person; |

| 5.2.11 | all information and documents delivered to the Purchaser and the Issuer in connection with this Agreement

are true, accurate and complete in all respects; |

| 5.2.12 | it has disclosed fully and frankly any and all circumstances that may be reasonably deemed to have a material

influence on the Purchaser’s decision to purchase the Software; and |

| 5.2.13 | it will not, as a consequence of entering into or performing this Agreement, be in breach of any terms

binding upon it of any contract, agreement, undertaking, or arrangement with, or any obligation to, any third party. |

| 5.3 | All representations and warranties given by the respective Parties expressed in this Clause 5 are true,

correct and not misleading at the time of execution of this Agreement and shall be deemed to be repeated and continue to be true, correct

and not misleading on Completion as if they had been given afresh on Completion. |

| 6.1 | Without prejudice to any other right or remedy which the Purchaser and/or the Issuer may have against

the Seller, the Seller undertakes to indemnify, defend and hold harmless the Purchaser, the Issuer and their respective Affiliates, directors,

employees, advisers, agents and representatives from and against any and all actions, claims, demands, proceedings, investigations, liabilities

or judgments and any and all losses, damages, costs, charges and expenses (including all reasonable legal fees and expenses) of whatever

nature which relates to or arises, directly or indirectly, in connection with or arising out of: |

| 6.1.1 | any breach by the Seller of its obligations under this Agreement and/or the warranties given by the Seller

under Clause 5 above; |

| 6.1.2 | any breach by the Seller of any applicable Laws; or |

| 6.1.3 | any claims involving fraud or misconduct involving dishonesty on the part of the Seller and/or misrepresentation

which results in a breach of the warranties given by the Seller under Clause 5 above or otherwise. |

| 7 | DURATION AND TERMINATION OF AGREEMENT |

| 7.1 | This Agreement shall come into effect from the date of this Agreement and shall, unless otherwise terminated

in accordance with this Clause 7, continue in full force and effect until all the obligations of the Parties under this Agreement are

fully carried out. |

| 7.2 | This Agreement may be terminated at anytime by the unanimous agreement of the Parties, subject to the

condition that such agreement to terminate is made in writing and consented to by all Parties. |

Notwithstanding any provisions of this

Agreement, each Party shall be at liberty to take such action in Law or inequity as may be necessary to compel the other Parties by way

of specific performance to complete the transactions contemplated in this Agreement (in which respect the alternative remedy of monetary

compensation shall not be regarded as compensation or sufficient compensation for any default of the other Parties in the performance

of the terms and conditions herein) or to claim damages for the breach of the other Parties.

The Seller shall give all such assistance

and information to the Purchaser and the Issuer and execute and do and procure all other necessary persons, if any, to execute and do

all such further acts, deeds, assurance and things as may be required by the Purchaser or the Issuer from time to time in order to carry

out, evidence and perform the Parties’ obligations and the intended purpose of this Agreement.

The Seller shall be fully responsible

to pay any and all Taxes arising out of or in connection with this Agreement which may be imposed on the Seller by the relevant Tax Authority.

For the avoidance of doubt, the Purchaser or the Issuer shall not be responsible nor obligated to pay any Taxes which are imposed on the

Seller.

| 11.1 | All communications among the Parties and all information and other materials supplied to or received,

by any Party, from the other Parties which is either marked “confidential” or is by its nature intended to be exclusively

for the knowledge of the recipient alone, or to be used by the recipient only for the benefit of this Agreement, coming to the knowledge

of the recipient shall be kept confidential by the recipient and shall be used by the recipient solely and exclusively for the benefit

of this Agreement unless: |

| 11.1.1 | the disclosure or use is required by Law or any Governmental Authority; |

| 11.1.2 | 11.1.2. the disclosure or use is required to vest the full benefit of this Agreement in any Party; |

| 11.1.3 | 11.1.3. the disclosure or use is required for the purpose of any judicial proceedings arising out of this

Agreement; |

| 11.1.4 | the disclosure is made to professional advisors of any Party on terms that such professional advisors

undertake to comply with the provisions of this Clause 11 in respect of such information as if they were a party to this Agreement; |

| 11.1.5 | the information becomes publicly available (other than by breach of this Agreement); |

| 11.1.6 | the Party whose information is to be disclosed or used has given prior written approval to the disclosure

or use; or |

| 11.1.7 | the information is independently developed by the recipient, which independent development can be shown

by written evidence, provided that prior to disclosure or use of any information pursuant to Clause 11.1.1,11.1.2 or 11.1.3, the Party

concerned shall promptly notify the other Parties of such requirement with a view to providing the other Parties with the opportunity

to contest such disclosure or use or otherwise to agree on the timing and content of such disclosure or use. |

| 11.2 | The Parties shall procure the observance of the abovementioned restrictions and shall take all reasonable

steps to minimize the risk of disclosure of confidential information, by ensuring that only their employees and professional advisers

whose duties will require them to possess any of such information shall have access thereto, and that they shall be instructed to treat

the same as confidential. |

| 11.3 | None of the Parties shall divulge to any third party any information regarding the existence or subject

matter of this Agreement, or any other agreement referred to in, or executed in connection with, this Agreement, without the prior agreement

of the other Parties. |

| 11.4 | The obligations contained in this Clause 11 shall endure, even after the termination of this Agreement,

without limit in point of time except and until any confidential information enters the public domain as set out above. |

| 12.1 | All notices, demands or other communications required or permitted to be given or made hereunder shall be in writing and

in English and delivered personally or sent by prepaid registered post (by air-mail if to an overseas address) with recorded delivery,

or by courier or email addressed to the intended recipient thereof at its address or at its email address set out hereunder (or to such

other address or email address as a Party may from time to time duly notify the other Parties). Any such notice, demand or communication

shall be deemed to have been duly served (if delivered personally or given or made by email) immediately or (if given or made by registered

post or courier) forty-eight (48) hours after posting or (if made or given to an overseas address) five (5) Business Days after posting,

and in proving the same it shall be sufficient to show that personal delivery was made or that the envelope containing such notice was

properly addressed as a prepaid registered letter or that the email was properly addressed and sent. |

| 12.2 | The addresses and email addresses of the Parties for the purposes of Clause 12.1 above are: |

| 12.2.1 | in the case of service on the Seller to: |

| |

Address: |

|

| |

Email Address: |

|

| |

Attention to: |

|

| 12.2.2 | in the case of service on the Purchaser to: |

| |

Address: |

|

| |

Email Address: |

|

| |

Attention to: |

|

| 12.2.3 | in the case of service on the Issuer to: |

| |

Address: |

|

| |

Email Address: |

|

| |

Attention to: |

|

| 12.3 | In this Clause 12, if deemed receipt occurs before 9am on a Business Day, the notice shall be deemed to

have been received at 9am on that day, and if deemed receipt occurs after 5pm on a Business Day, or on a day which is not a Business Day,

the notice shall be deemed to have been received at 9am on the next Business Day. |

The rights and remedies provided in

this Agreement are cumulative, and are not exclusive of any rights or remedies of the Parties provided at Law, in equity, by statute or

otherwise and no failure or delay in the exercise or the partial exercise of any such right or remedy or the exercise of any other right

or remedy shall affect or impair any such right or remedy.

Notwithstanding anything herein contained,

none of the Parties will be liable to the other Parties for any breach or failure to perform any of its obligations under this Agreement

where such breach or failure is caused directly or indirectly by war, civil commotion, hostilities, strikes, lockouts, pandemic, acts

of God, governmental regulations or directions or the action or omission or purported action or omission of any Governmental Authority,

or any other cause or causes beyond that Party’s reasonable control, whether similar to any of the foregoing or not, but if any

Party is or is likely to be, affected by any such cause it will immediately notify the other Parties of the occurrence of the relevant

event and will use all reasonable endeavors to overcome or mitigate the effects thereof.

| 15.1 | No amendment, variation, revocation, cancellation, substitution or waiver of, or addition or supplement

to, any of the provisions of this Agreement will be effective unless it is in writing and signed by all the Parties. |

| 15.2 | No waiver of any breach of any provision of this Agreement will be effective or binding unless made in

writing and signed by the Party purporting to give the same and, unless otherwise provided in the written waiver, will be limited to the

specific breach waived. |

Unless otherwise specified in this

Agreement, none of the Parties shall be entitled to transfer or otherwise assign its rights and obligations under this Agreement to a

third party without the prior written consent of the other Parties and any assignment, transfer or delegation which is made without such

prior written approval shall constitute a breach of this Agreement.

This Agreement will be binding upon

and inure for the benefit of the respective heirs, personal representatives, successors-in-title or permitted assigns, as the case may

be, of the Parties.

Nothing in this Agreement is intended

to or shall operate to create a partnership, or to authorize any Party to act as agent for the other Parties or to establish any other

fiduciary relationship between the Parties. No Party has the power or the right to bind, commit or pledge the credit of the other Parties.

This Agreement constitutes the entire

agreement and full understanding among the Parties hereto with respect to all of the matters herein and it supersedes any previous negotiations,

discussions, correspondence, arrangements, agreements and understandings among them, oral or written, with respect to the matters addressed

herein.

| 20.1 | Time shall be of the essence in this Agreement. |

| 20.2 | No time or indulgence given by any Party to the other shall be deemed or in any way construed as a waiver

of any of its rights and remedies hereunder. |

Purchaser shall bear all the legal

and other professional costs and expenses incurred by it in the negotiation and preparation of this Agreement and any other agreements

or documents entered into or signed under or in connection with this Agreement.

| 22 | INVALIDITY AND SEVERABILITY |

| 22.1 | If any provision of this Agreement is or may become invalid or unenforceable under any written Law, or

is found by any court or administrative body or competent jurisdiction to be, illegal, void, invalid, prohibited or unenforceable then: |

| 22.1.1 | such provision shall be ineffective to the extent of such illegality, voidness, invalidity, prohibition

or unenforceability; |

| 22.1.2 | the remaining provisions of this Agreement shall remain in full force and effect; and |

| 22.1.3 | the Parties shall use their respective best endeavors to negotiate and agree on a substitute provision

which is valid and enforceable and achievable to the greatest extent possible the economic, legal and commercial objectives of such illegal,

void, invalid, prohibited or unenforceable term, condition, stipulation, provision, covenant or undertaking. |

| 23 | COUNTERPARTS AND E-SIGNATURES |

| 23.1 | This Agreement may be executed in separate counterparts, each of whom shall together be deemed an original,

but all such counterparts shall together constitute but one and the same Agreement of the Parties. |

| 23.2 | This Agreement, may be accepted, executed or agreed to, through the use of an electronic signature, whether

digital or encrypted, in accordance with the applicable Laws. Any document accepted, executed or agreed to in conformity with such Law

will be binding on each party and shall have the same legal effect, validity or enforceability as if it were physically executed. |

| 24 | GOVERNING LAW AND JURISDICTION |

| 24.1 | This Agreement shall be governed by, and construed in accordance with, the Laws of [ ]. |

| 24.2 | The Parties irrevocably agree that the courts of [ ] are to have exclusive jurisdiction to settle any

disputes which may arise out of or in connection with this Agreement and that, accordingly, any legal action or proceedings arising out

of or in connection with this Agreement shall be brought in those courts and the Parties irrevocably submit to the jurisdiction of those

courts. |

[the rest of this page is intentionally

left blank]

| THE SELLER |

|

|

|

| |

|

| Signed |

|

|

| |

/s/ H&P INTERNATIONAL HOLDINGS LIMITED |

| for and on behalf of H&P INTERNATIONAL HOLDINGS LIMITED ( ) |

Name:

Designation: |

|

| |

|

|

| |

|

|

|

| THE PURCHASER |

|

|

| |

|

|

| Signed |

|

|

| |

/s/ SHENZHEN YANGANG MINGZHU FREIGHT INDUSTRIES CO., LTD |

| for and on behalf of SHENZHEN YANGANG MINGZHU FREIGHT INDUSTRIES CO., LTD ( ) |

Name:

Designation: Director

|

|

| |

|

|

|

| THE ISSUER |

|

|

| |

|

|

| Signed |

|

| |

/s/ MINGZHU LOGISTICS HOLDINGS LIMITED |

| for and on behalf of MINGZHU LOGISTICS HOLDINGS LIMITED ( ) |

Name:

Designation: Director |

|

SCHEDULE 1

SOFTWARE SPECIFICATIONS

Exhibit

10.2

DEED

OF ASSIGNMENT

BETWEEN

H&P

INTERNATIONAL HOLDINGS LIMITED

(REGISTRATION

NO. 52061844)

(THE

“ASSIGNOR”)

AND

THE

PERSONS NAMED IN SCHEDULE 1

(THE

“ASSIGNEES”)

| THIS DEED OF

ASSIGNMENT (“DEED”) is made on |

October 21, 2024 |

between: |

| (1) | H&P

International Holdings Limited (Registration No. 52061844),

a company incorporated in Hong Kong (SAR) with its registered address at (the

“Assignor”); and |

| (2) | THE

PERSONS NAMED IN SCHEDULE 1 OF THIS DEED (the “Assignees”), |

(the

Assignor and the Assignees are collectively, the “Parties” and individually, a “Party”).

Whereas:

| (A) | By way

of a software purchase agreement dated October 21, 2024 (“Software Purchase Agreement”)

entered into between the Assignor, Shenzhen Yangang Mingzhu Freight Industries Co., Ltd (Registration

No. 914403007412009230) (“Purchaser”) and Mingzhu Logistics Holdings Limited.

(Registration No. OC-330886) (“Issuer”), the Assignor has agreed to sell to

the Purchaser and the Purchaser has agreed to purchase the Software (as defined in the Software

Purchase Agreement) at the purchase consideration of United States Dollar Two Million Two Hundred

Eighty Thousand (USD2,280,000) only (“Purchase Consideration”). |

| (B) | Pursuant

to the Software Purchase Agreement, the Assignor and the Purchaser have agreed that the Purchase

Consideration shall be satisfied by way of allotment and issuance to the Assignor of 1,900,000

new ordinary shares of the Issuer at the issue price of USD1.20 per ordinary share (“Consideration

Shares”), the total value of which is equivalent to the Purchase Consideration. |

| (C) | In consideration

of the mutual covenants contained in this Deed, the Assignor is desirous of assigning its right

and entitlement to receive the Consideration Shares in favour of the Assignees upon the terms

and subject to conditions of this Deed. |

It

is agreed as follows:

| 1. | INTERPRETATION

AND DEFINITIONS |

| 1.1. | In

this Deed, unless the subject or context otherwise requires, the following words and expressions

shall have the following meanings respectively ascribed to them: |

“Assignees”

means the persons named in Schedule 1 of this Deed;

“Assignor”

means H&P International Holdings Limited (Registration No. 52061844), a company

incorporated in Hong Kong (SAR) with its registered address at 6/F Manulife Place, 348 Kwung Tong Road, KL;

“Business

Day” means a day on which banks are open for business and is not a Saturday, Sunday, a “public holiday” or a “bank

holiday” in China and Hong Kong;

“Consideration

Shares” shall have the meaning ascribed to it in Recital (B);

“Issuer”

means MINGZHU LOGISTICS HOLDINGS LIMITED (Registration No. OC-330886), a company incorporated in China with its registered address

at 89 Nexus Way, Camana Bay, Grand Cayman, KY1-9009,Cayman Islands;

“Parties”

means collectively, the Assignor and the Assignees, and “Party” means any of them;

“Purchase

Consideration” shall have the meaning ascribed to it in Recital (A);

“Purchaser”

means Shenzhen Yangang Mingzhu Freight Industries Co., Ltd (Registration No. 914403007412009230),

a company incorporated in China with its registered address at 27/F, Yantian Modern Industry Service Centre, No. 3018 Shayan Road, Yantian

District, Shenzhen, Guangdong, China 518081; and

“Software

Purchase Agreement” shall have the meaning ascribed to it in Recital (A).

| 1.2. | Unless

the context otherwise requires, in this Deed: |

| 1.2.1. | any

reference to a statute or statutory provision is a reference to it as it is in force from

time to time, taking account of any change, extension, consolidation or re-enactment and

includes any subordinate legislation for the time being in force made under it; |

| 1.2.2. | any

and all headings contained in this Deed are for convenience only and do not affect the interpretation

of any provision of this Deed; |

| 1.2.3. | references

to any gender shall include the other genders and references to the singular shall include

the plural and vice versa and references to natural persons shall include bodies corporate

and vice versa; |

| 1.2.4. | any

reference to a person which for the purposes of this Deed means any individual, corporation,

partnership, association, limited liability company, trust, Governmental Authority or body

or other entity or organisation (whether or not having a separate legal personality) shall

include its successors in title; |

| 1.2.5. | all

obligations and liabilities on the part of the Parties are (unless expressly stated otherwise)

several and shall be construed accordingly; |

| 1.2.6. | any

reference to “day”, “week”, “month”

or “year” is a reference to a day, week, month or year respectively in

the Gregorian calendar; |

| 1.2.7. | any

phrase introduced by the terms “including”, “include”

or any similar expression shall be construed as illustrative and shall not limit the sense

of the words preceding those terms; |

| 1.2.8. | references

to “writing”, or cognate expressions, include any communication effected

electronically, by telex, cable, facsimile transmission or other comparable means of communication; |

| 1.2.9. | any

reference to this Deed shall be construed as references to such documents as the same may

be amended, restated or replaced from time to time; and |

| 1.2.10. | references

to this Deed include any Recitals and Appendix to it and references to Clauses, Recitals

and Appendix are to the clauses, recitals and appendix to this Deed. |

| 1.3. | If

any period of time is specified from a given day, or the day of a given act or event, it is

to be calculated exclusive of that day and if any period of time falls on a day which is not

a Business Day, then that period is to be deemed to only expire on the next Business Day. |

| 1.4. | The

Recitals to this Deed shall have effect and be construed as an integral part of this Deed, but

in the event of any conflict or discrepancy between any of the provisions of this Deed, such

conflict or discrepancy shall, for the purposes of the interpretation and enforcement of this

Deed, be resolved by giving the provisions contained in the Clauses of this Deed priority and

precedence over the provisions contained in the Recitals to this Deed. |

| 1.5. | No

provision of this Deed will be construed adversely to a Party solely on the ground that the

Party was responsible for the preparation of this Deed or that provision. |

| 2.1. | In

consideration of United States Dollar Ten (USD10.00) paid to the Assignor by the Assignees (the

receipt of which the Assignor hereby acknowledges), the Assignor hereby assigns, transfers and

conveys its right and entitlement to receive the Consideration Shares in favour of the Assignees. |

| 2.2. | The

Assignor hereby agrees and undertakes that it shall irrevocably authorise and instruct the Issuer

to allot and issue the Consideration Shares directly to the Assignees. The number of Consideration

Shares to be allotted and issued to each of the Assignees are as specified against each of the

Assignees’ names in Schedule 1 of this Deed. Such authorisation and instruction

shall be done by way of serving a notice of assignment substantially in the same form and content

as set out in Appendix A to this Deed. |

| 2.3. | For

the avoidance of doubt, all of the existing terms in the Software Purchase Agreement shall not

be affected by this Deed and shall remain in full force and effect until the expiry or termination

of the Software Purchase Agreement. |

| 3.1. | All

notices, demands or other communications required or permitted to be given or made hereunder

shall be in writing and in English and delivered personally or sent by prepaid registered post

with recorded delivery, or by courier or email addressed to the intended recipient thereof at

its address or at its email address set out hereunder (or to such other address or email address

as a Party to this Deed may from time to time duly notify the other Parties). Any such notice,

demand or communication shall be deemed to have been duly served (if delivered personally or

given or made by email) immediately or (if given or made by registered post or courier) forty-eight

(48) hours after posting, and in proving the same it shall be sufficient to show that personal

delivery was made or that the envelope containing such notice was properly addressed as a prepaid

registered letter or that the email was properly addressed and sent. |

| 3.2. | The

addresses and email addresses of the Parties for the purposes of Clause 3.1 are as follows: |

| 3.2.1. | in

the case of service on the Assignor to: |

| |

Address |

: |

|

| |

Email

Address |

: |

|

| |

Attention

to |

: |

|

| 3.2.2. | in

the case of service on the Assignees to: |

| |

Address |

: |

|

| |

Email

Address |

: |

|

| |

Attention

to |

: |

|

| |

Address |

: |

|

| |

Email

Address |

: |

|

| |

Attention

to |

: |

|

| |

|

|

|

| |

Address |

: |

|

| |

Email

Address |

: |

|

| |

Attention

to |

: |

|

| |

|

|

|

| |

Address |

: |

|

| |

Email

Address |

: |

|

| |

Attention

to |

: |

|

| 3.3. | In

this Clause 3, if deemed receipt occurs before 9am on a Business Day, the notice shall

be deemed to have been received at 9am on that day, and if deemed receipt occurs after 5pm on

a Business Day, or on a day which is not a Business Day, the notice shall be deemed to have

been received at 9am on the next Business Day. |

| 3.4. | Any

Party may change the address to which such notices to it are to be delivered by giving not less

than three (3) Business Days’ notice to the other Parties. |

| 4.1. | The

Purchaser shall pay all costs and expenses incurred in connection with the preparation, negotiation

or entry into this Deed. |

| 4.2. | Each

Party shall do or cause to be done all such acts and things and execute or cause to be executed

all such instruments and other documents as may be necessary to give full effect to the provisions

contained in this Deed and the transactions contemplated under this Deed. |

| 4.3. | No

amendment, variation, revocation, cancellation, substitution or waiver of, or addition or supplement

to, any of the provisions of this Deed will be effective unless it is in writing and signed

by all the Parties. |

| 4.4. | If

any provision of this Deed or part thereof is rendered void, illegal or unenforceable in any

respect under the law, the validity, legality and enforceability of the remaining provisions

or part of the provision (as the case may be) shall not in any way be affected or impaired thereby. |

| 4.5. | None

of the Parties shall assign all or any of its rights, interests or benefits or transfer all

or any of its obligations under this Deed except with the prior written approval of the other

Parties. |

| 4.6. | This

Deed shall be binding upon and enure for the benefit of the respective successors-in-title and

permitted assigns of the Parties. |

| 4.7. | This

Deed shall be governed by and construed in accordance with the laws of Malaysia and the Parties

hereto irrevocably submit to the exclusive jurisdiction of the Malaysia courts for the purpose

of resolving any disputes arising from this Deed. |

| 4.8. | This

Deed may be entered into in any number of counterparts, all of which taken together and when

delivered to the Parties shall constitute one and the same instrument. The Parties may enter

into this Deed by executing any such counterpart. |

| 4.9. | This

Deed, may be accepted, executed or agreed to through the use of an electronic signature, whether

digital or encrypted, in accordance with the applicable laws. Any document accepted, executed

or agreed to in conformity with such law will be binding on each Party and shall have the same

legal effect, validity or enforceability as if it were physically executed. |

[the

remainder of this page is intentionally left blank]

SCHEDULE

1

The

Assignees

[the

remainder of this page is intentionally left blank]

APPENDIX A

Notice of Assignment

APPENDIX TO NOTICE OF ASSIGNMENT

Software Purchase Agreement

and Deed of Assignment

This Deed

has been entered into on the date stated at the beginning.

The

Assignor

| Signed |

|

|

|

| for and on behalf of |

|

|

| H&P INTERNATIONAL HOLDINGS LIMITED |

|

|

| |

|

|

| |

/s/ H&P INTERNATIONAL HOLDINGS LIMITED |

| |

Name: |

|

| |

Designation: |

|

The

Assignees

| Signed by |

|

|

|

Chinnaiyan Nagalingam |

|

|

| ( ) |

|

|

| |

|

|

| |

/s/ Chinnaiyan Nagalingam |

| Signed by |

|

|

|

SIVAGNANAM THANUSKODI |

|

|

| ) |

|

|

| |

|

|

| |

/s/ SIVAGNANAM THANUSKODI |

| Signed by |

|

|

|

Srinivasan Veeramani |

|

|

| ) |

|

|

| |

|

|

| |

/s/ Srinivasan Veeramani

|

| Signed by |

|

|

|

San River International Sdn Bhd |

|

|

| |

|

|

| |

|

|

| |

/s/ San River International Sdn Bhd |

Exhibit 10.3

Notice of Assignment

H&P INTERNATIONAL HOLDINGS LIMITED

MINGZHU LOGISTICS HOLDINGS LIMITED

SHENZHEN YANGANG MINGZHU FREIGHT INDUSTRIES

CO., LTD

Dear Sirs,

RE: SOFTWARE

PURCHASE AGREEMENT DATED OCTOBER 21, 2024

We refer to the following documents:

| (i) | Software

purchase agreement dated October 21, 2024 (“Agreement”) entered into between

H&P INTERNATIONAL HOLDINGS LIMITED (Registration No. )

(“Assignor”), Shenzhen Yangang Mingzhu Freight Industries Co.,

Ltd (Registration No. )

and Mingzhu Logistics Holdings Limited (Registration No. 6);

and |

| (ii) | Deed of Assignment dated October 21, 2024 (“Deed”) entered into between Assignor and

the persons named in Schedule 1 of the Deed (the “Assignees”). |

The aforementioned documents are appended hereto

for your reference. Unless otherwise defined herein, capitalised terms used in this notice shall have the same meanings given to them

in the Agreement and the Deed.

We write to notify that, pursuant to the Deed,

we have assigned, transferred and conveyed our right and entitlement to receive the Consideration Shares in favour of the Assignees.

Accordingly, we hereby authorise and instruct

you to allot and issue the Consideration Shares directly to the Assignees. The number of Consideration Shares to be allotted and issued

to each of the Assignees are as specified against each of the Assignees’ names in Schedule 1 of the Deed. Upon your issuance of

the Consideration Shares to the Assignees, we agree and acknowledge that your payment obligation in respect of the Purchase Consideration

under the Agreement shall be fully satisfied and discharged.

| Yours faithfully, |

|

| |

|

| For and on behalf of |

|

| H&P International Holdings Limited |

|

| |

|

/s/ H&P International Holdings Limited

|

|

| Name: |

|

| Designation: |

|

ACCEPTANCE

We, MINGZHU LOGISTICS HOLDINGS LIMITED (Registration

No. OC-330886), hereby acknowledge the receipt of the notice and agree to the terms and conditions as stated in the notice above.

| Signed by |

|

| For and on behalf of |

|

| MINGZHU LOGISTICS HOLDINGS LIMITED |

|

| |

|

/s/ MINGZHU LOGISTICS HOLDINGS LIMITED

|

|

| Name: |

|

| Designation: |

|

| |

|

| Date: October 21,

2024 |

|

We, SHENZHEN YANGANG MINGZHU FREIGHT INDUSTRIES

CO., LTD (Registration No. ),

hereby acknowledge the receipt of the notice and agree to the terms and conditions as stated in the notice above.

| Signed by |

|

| For and on behalf of |

|

| SHENZHEN YANGANG MINGZHU FREIGHT INDUSTRIES CO., LTD |

| |

|

/s/ SHENZHEN YANGANG MINGZHU FREIGHT INDUSTRIES CO., LTD

|

|

| Name: |

|

| Designation: |

|

| |

|

| Date: October 21,

2024 |

|

MingZhu Logistics (NASDAQ:YGMZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

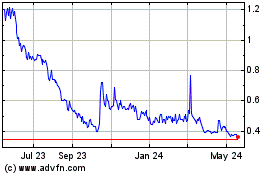

MingZhu Logistics (NASDAQ:YGMZ)

Historical Stock Chart

From Dec 2023 to Dec 2024