Liquid Media Group, Ltd. Receives Nasdaq Notice of Deficiency Regarding Minimum Bid Price Requirement and Provides Update on 2021 Audit Filing

March 04 2022 - 7:00PM

Liquid Media Group Ltd. (“the Company”, “Liquid Media” or “Liquid”)

(Nasdaq: YVR) today announced that it received a written notice

(the “Notice”) from the Nasdaq Listing Qualifications Department of

The Nasdaq Stock Market (“Nasdaq”) indicating that the Company is

not in compliance with the minimum bid price requirement of US$1.00

per share under the Nasdaq Listing Rules (the “Listing Rules”).

Based on the closing bid price of the Company’s listed securities

for the last 30 consecutive business days from January 14, 2022, to

February 28, 2022, the Company no longer meets the minimum bid

price requirement set forth in Listing Rule 5550(a)(2). The Notice

is only a notification of deficiency, not of imminent action, and

has no current effect on the listing or trading of the Company’s

securities on the Nasdaq Capital Market.

The Notice states that under Listing Rule

5810(c)(3)(A), the Company is provided with a compliance period of

180 calendar days, or until August 29, 2022, to regain compliance

under the Listing Rules. To regain compliance under the Listing

Rules, the Company’s common shares must be at least US$1.00 for a

minimum of ten consecutive business days. In the event the Company

does not regain compliance by August 29, 2022, the Company may be

eligible for additional time to regain compliance or may face

delisting.

The Company intends to monitor the closing bid

price of its common shares between now and August 29, 2022, and to

evaluate its available options to regain compliance within the

compliance period.

In addition, the Company has received default

notices from the British Columbia Securities Commission (“BCSC”)

for failure to timely file its Annual Information Form, annual

financial statements, related management discussion and analysis

and management certifications in respect of the same. The Company

has experienced unexpected delays in consolidating financial

information from, and completing purchase accounting for its

recently acquired operations, however it expects to be able to make

all required filings in the coming weeks and will provide updates

in due course.

“We remain confident in Liquid’s business

strategy and in the synergies and revenues of our recently closed

acquisitions,” said Ron Thomson, CEO of Liquid. “Our team is

committed to reviewing all available options to regain compliance

with the Bid Price Rule and to comply with the BSCS requirements,

and we appreciate the continued support of our investors during

this time.”

About Liquid Media Group

Ltd.

Liquid Media Group Ltd. (Nasdaq: YVR) is a

business solutions company empowering independent IP creators.

Liquid’s end-to-end solution will enable professional video

(film/TV and streaming) creation, packaging, financing, delivery,

and monetization, empowering IP creators to take their professional

content from inception through the entire process to

monetization.

Liquid’s blockchain framework, developed with

Eluvio, is enabling independent producers and content creators to

leverage blockchain technology and NFTs to reach new audiences,

achieve lower-cost, decentralized distribution, access production

funding, sell merchandise and other special access experiences, and

broadcast directly to global audiences on their own terms.

Additional information is available at

www.LiquidMediaGroup.co.

Further information:

Primoris Group Inc.+1 (416)

489-0092pg@liquidmediagroup.co

Media requests:

Investor / BusinessAdam

BelloMedia & Analyst Relations ManagerPrimoris Group Inc.+1

(416) 489-0092 x 226media@primorisgroup.com

IndustryJane OwenJane Owen PR+1

(323) 819-1122 jane@janeowenpr.com

Cautionary Note Regarding Forward-Looking

Statements

This news release includes statements containing

certain "forward-looking information" within the meaning of

applicable securities law ("forward-looking statements").

Forward-looking statements are typically identified by words such

as: "believe", "expect", "anticipate", "intend", "estimate",

"potentially" and similar expressions, or are those, which, by

their nature, refer to future events. These statements include, but

are not limited to, that the Company will regain compliance under

the Nasdaq’s listing requirements, file its financial year 2021

annual filings, and should not be read as guarantees of future

performance or results. Such statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results, performance or achievements to be materially different

from those implied by such statements. Such factors include, but

are not limited to, developments related to the COVID-19 pandemic,

regulatory actions, market prices, continued availability of

capital and financing, and general economic, market or business

conditions, as well as additional risks disclosed in the Company’s

annual and quarterly financial reports available at www.sedar.com.

and www.sec.gov. Investors are cautioned that any such statements

are not guarantees of future performance and actual results or

developments may differ materially from those projected in the

forward-looking statements. Forward-looking statements are based on

the beliefs, estimates and opinions of the Company's management on

the date the statements are made. The Company is under no

obligation, and expressly disclaims any intention or obligation, to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

expressly required by applicable law.

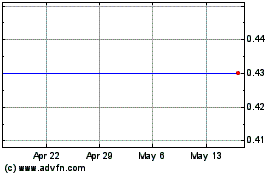

Liquid Media (NASDAQ:YVR)

Historical Stock Chart

From Jan 2025 to Feb 2025

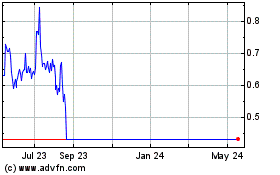

Liquid Media (NASDAQ:YVR)

Historical Stock Chart

From Feb 2024 to Feb 2025