false 0001876588 0001876588 2025-02-26 2025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 26, 2025

ZimVie Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

001-41242 |

|

87-2007795 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 4555 Riverside Drive Palm Beach Gardens, FL |

|

33410 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (800) 342-5454

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

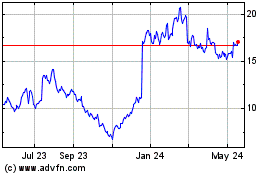

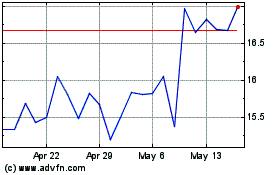

| Common Stock, par value $0.01 per share |

|

ZIMV |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On February 26, 2025, ZimVie Inc. (the “Company”) issued a press release reporting its financial results for the quarter and year ended December 31, 2024. The press release is attached hereto as Exhibit 99.1 and the information set forth therein is incorporated herein by reference and constitutes a part of this report.

| Item 7.01 |

Regulation FD Disclosure. |

On February 26, 2025, the Company also made available a presentation that contains supplemental financial information, including full-year 2025 financial guidance. A copy of the presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K and the information set forth therein is incorporated herein by reference.

The information contained in Item 2.02 and Item 7.01 of this report, including Exhibit 99.1 and Exhibit 99.2 hereto, is being furnished and shall not be deemed to be “filed” with the Securities and Exchange Commission for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section and is not incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ZimVie Inc. |

|

|

|

|

| Date: February 26, 2025 |

|

|

|

By: |

|

/s/ Heather Kidwell |

|

|

|

|

Name: |

|

Heather Kidwell |

|

|

|

|

Title: |

|

Senior Vice President, Chief Legal, Compliance and Human Resources Officer and Corporate Secretary |

Exhibit 99.1

ZimVie Reports Fourth Quarter and Full Year 2024 Financial Results

| |

• |

|

FY2024 Third Party Net Sales from Continuing Operations of $449.7 million |

| |

• |

|

FY2024 Net Loss from Continuing Operations of $(33.8) million; Net Loss margin of (7.5%)

|

| |

• |

|

FY2024 Adjusted EBITDA[1] from Continuing Operations of

$60.0 million; Adjusted EBITDA[1] margin of 13.3% |

| |

• |

|

FY2024 GAAP diluted EPS from Continuing Operations of $(1.23) and adjusted diluted EPS[1] of $0.62 |

PALM BEACH GARDENS, Florida, February 26, 2025 (GLOBE NEWSWIRE)

– ZimVie Inc. (Nasdaq: ZIMV), a global life sciences leader in the dental market, today reported financial results for the quarter and year ended December 31, 2024. Management will host a corresponding conference call today,

February 26, 2025, at 4:30 p.m. Eastern Time.

“2024 was a transformational year for ZimVie. We became a pure play dental companyand reshaped

our financial profile, reducing net debt[1] by more than $290 million. We also streamlined our organization through corporate cost

reduction, introduced manufacturing and supply chain efficiency initiatives, and increased Adjusted EBITDA margins by over 4 percentage points in the fourth quarter of 2024 compared to the fourth quarter of 2023 despite a softer end market,”

said Vafa Jamali, President and Chief Executive Officer. “We continue to be optimistic about the long-term drivers of the dental implant market, supported by the continued success of our training and education programs in 2024. I believe ZimVie

is well positioned to take advantage of the growth in the dental implant and digital solutions market for 2025 and beyond.”

Fourth Quarter 2024

Financial Results: Continuing Operations

Third party net sales for the fourth quarter of 2024 were $111.5 million, a decrease of 1.4% on a

reported basis and 0.9% in constant currency[1], versus the fourth quarter of 2023.

Net loss for the

fourth quarter of 2024 was $(9.7) million, an improvement of $12.5 million versus a net loss of $(22.2) million in the fourth quarter of 2023. Net loss margin for the fourth quarter of 2024 was (8.7)% of third party net sales, an improvement of

1,090 basis points versus a net loss margin of (19.6)% in the fourth quarter of 2023.

Adjusted net

income[1] for the fourth quarter of 2024 was $7.6 million, an increase of $5.0 million versus the fourth quarter of 2023.

Basic and diluted EPS were $(0.35) and adjusted diluted EPS[1] was $0.27 for the fourth quarter

of 2024. Weighted average shares outstanding for both basic and adjusted diluted EPS was 27.6 million.

Adjusted EBITDA[1] for the fourth quarter of 2024 was $18.4 million, or 16.5% of third party net sales, an increase of $4.5 million, or 420 basis points, versus the fourth quarter of 2023.

Full Year 2024 Financial Results: Continuing Operations

Third party net sales for the full year 2024 were $449.7 million, a decrease of 1.6% on a reported basis and 1.2% in constant currency[1], versus the full year 2023.

Net loss for the full year 2024 was $(33.8) million, an improvement of

$22.2 million versus a net loss of $(56.0) million for the full year 2023. Net loss margin for the full year 2024 was (7.5)% of third party net sales, an improvement of 480 basis points versus a net loss margin of (12.3)% for the full year

2023.

Adjusted net income[1] for the full year 2024 was $17.0 million, an increase of

$11.1 million versus the full year 2023.

Basic and diluted EPS were $(1.23) and adjusted diluted

EPS[1] was $0.62 for the full year 2024. Weighted average shares outstanding for both basic and adjusted diluted EPS was 27.4 million.

Adjusted EBITDA[1] for the full year 2024 was

$60.0 million, or 13.3% of third party net sales, an increase of $9.2 million, or 220 basis points, versus the full year 2023.

Full Year

2025 Continuing Operations Financial Guidance:

|

|

|

|

|

|

|

| Projected Year Ending December 31, 2025 |

|

Guidance |

|

Reported Growth |

|

Constant

Currency Growth[2] |

| Net Sales |

|

$445M to $460M |

|

(1%) to 2% |

|

Flat to 3% |

| Adjusted EBITDA [2] |

|

$65M to $70M |

|

8% to 17% |

|

8% to 17% |

| Adjusted EPS[2] |

|

$0.80 to $0.95 |

|

29% to 53% |

|

31% to 55% |

| [1] |

This is a non-GAAP financial measure. Refer to “Note on Non-GAAP Financial Measures” and the reconciliations in this release for further information. |

| [2] |

This is a non-GAAP financial measure for which a reconciliation to

the most directly comparable GAAP financial measure is not available without unreasonable efforts. Refer to “Forward-Looking Non-GAAP Financial Measures” in this release, which identifies the

information that is unavailable without unreasonable efforts and provides additional information. It is probable that this forward-looking non-GAAP financial measure may be materially different from the

corresponding GAAP financial measure. |

Conference Call

ZimVie will host a conference call today, February 26, 2025, at 4:30 p.m. ET to discuss its fourth quarter and full year 2024 financial results. To access

the call, please register online at https://investor.zimvie.com/events-presentations/event-calendar. A live and archived audio webcast will also be available on this site.

About ZimVie

ZimVie is a global life sciences leader in

the dental market that develops, manufactures, and delivers a comprehensive portfolio of products and solutions designed to support dental tooth replacement and restoration procedures. From its headquarters in Palm Beach Gardens, Florida, and

additional facilities around the globe, ZimVie works to improve smiles, function, and confidence in daily life by offering comprehensive tooth replacement solutions, including trusted dental implants, biomaterials, and digital workflow solutions. As

a worldwide leader in this space, ZimVie is committed to advancing clinical science and technology foundational to restoring daily life. For more information about ZimVie, please visit us at www.ZimVie.com. Follow @ZimVie on Twitter, Facebook,

LinkedIn, or Instagram.

Note on Non-GAAP Financial Measures

This press release includes non-GAAP financial measures that differ from financial measures calculated in accordance

with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures may not be comparable to similar measures reported by other companies and should be considered in

addition to, and not as a substitute for, or superior to, other measures prepared in accordance with GAAP.

Net debt is provided in this release for

certain periods and is calculated by subtracting cash and cash equivalents on a GAAP basis from the non-current portion of debt on a GAAP basis, as detailed in the reconciliations presented later in this press

release.

Sales change information in this release is presented on a GAAP (reported) basis and on a constant currency basis. Constant currency percentage

changes exclude the effects of foreign currency exchange rates. They are calculated by translating current and prior-period sales from Continuing Operations at the same predetermined exchange rate. The translated results are then used to determine

year-over-year percentage increases or decreases.

Net income (loss) and diluted earnings (loss) per share in this release are presented on a GAAP

(reported) basis and on an adjusted basis. Adjusted net income (loss) and adjusted diluted earnings (loss) per share exclude the effects of certain items, which are detailed in the reconciliations of these

non-GAAP financial measures to the most directly comparable GAAP financial measures presented later in this press release.

2

Adjusted EBITDA is a non-GAAP financial measure provided in this

release for certain periods and is calculated by excluding certain items from net income (loss) from Continuing Operations on a GAAP basis, as detailed in the reconciliations presented later in this press release. Adjusted EBITDA margin is Adjusted

EBITDA divided by third party net sales from Continuing Operations for the applicable period.

Adjusted cost of products sold (excluding intangible asset

amortization). adjusted R&D and adjusted SG&A (on an actual basis and as a percentage of sales) are non-GAAP financial measures provided in this presentation for certain periods and are calculated by

excluding the effects of certain items from cost of products sold (excluding intangible asset amortization), R&D and SG&A, respectively, on a GAAP basis. as detailed in the reconciliations presented later in this presentation.

Reconciliations of these non-GAAP measures to the most directly comparable GAAP financial measures are included in

this press release.

Management uses non-GAAP financial measures internally to evaluate the performance of the

business. Additionally, management believes these non-GAAP measures provide meaningful incremental information to investors to consider when evaluating the performance of the company. Management believes these

measures offer the ability to make period-to-period comparisons that are not impacted by certain items that can cause dramatic changes in reported income, but that do

not impact the fundamentals of our operations. The non-GAAP measures enable the evaluation of operating results and trend analysis by allowing a reader to better identify operating trends that may otherwise be

masked or distorted by these types of items that are excluded from the non-GAAP measures.

Forward-Looking Non-GAAP Financial Measures

This press release also includes certain forward-looking

non-GAAP financial measures for the year ending December 31, 2025. We calculate forward-looking non-GAAP financial measures based on internal forecasts that omit

certain amounts that would be included in GAAP financial measures. We have not provided quantitative reconciliations of these forward-looking non-GAAP financial measures to the most directly comparable

forward-looking GAAP financial measures because the excluded items are not available on a prospective basis without unreasonable efforts. For example, the timing of certain transactions is difficult to predict because management’s plans may

change. In addition, the company believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. It is probable that these forward-looking non-GAAP financial

measures may be materially different from the corresponding GAAP financial measures.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of federal securities laws, including, among others, any statements about our

expectations, plans, intentions, strategies, or prospects. We generally use the words “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,”

“projects,” “assumes,” “guides,” “targets,” “forecasts,” “sees,” “seeks,” “should,” “could,” “would,” “predicts,” “potential,”

“strategy,” “future,” “opportunity,” “work toward,” “intends,” “guidance,” “confidence,” “positioned,” “design,” “strive,” “continue,”

“track,” “look forward to,” “optimistic” and similar expressions to identify forward-looking statements. All statements other than statements of historical or current fact are or may be deemed to be forward-looking

statements. Such statements are based upon the current beliefs, expectations, and assumptions of management and are subject to significant risks, uncertainties, and changes in circumstances that could cause actual outcomes and results to differ

materially from the forward-looking statements. These risks, uncertainties and changes in circumstances include, but are not limited to: dependence on new product development, technological advances and innovation; shifts in the product category or

regional sales mix of our products and services; supply and prices of raw materials and products, including impacts from tariffs; pricing pressures from competitors, customers, dental practices and insurance providers; changes in customer demand for

our products and services caused by demographic changes or other factors; challenges relating to changes in and compliance with governmental laws and regulations affecting our U.S. and international businesses, including regulations of the U.S. Food

and Drug Administration and foreign government regulators, such as more stringent requirements for regulatory clearance of products; competition; the impact of healthcare reform measures; reductions in reimbursement levels by third-party payors;

cost containment efforts sponsored by government agencies, legislative bodies, the private sector and healthcare group purchasing organizations, including the volume-based procurement process in China; control of costs and expenses; dependence on a

limited number of suppliers for key raw materials and outsourced activities; the ability to obtain and maintain adequate intellectual property protection; breaches or

3

failures of our information technology systems or products, including by cyberattack, unauthorized access or theft; the ability to retain the independent agents and distributors who market our

products; our ability to attract, retain and develop the highly skilled employees we need to support our business; the effect of mergers and acquisitions on our relationships with customers, suppliers and lenders and on our operating results and

businesses generally; a determination by the Internal Revenue Service that the distribution of our shares of common stock by Zimmer Biomet Holdings, Inc. in 2022 (the “distribution”) or certain related transactions should be treated as

taxable transactions; financing transactions undertaken in connection with the separation and risks associated with additional indebtedness; the impact of the separation on our businesses and the risk that the separation and the results thereof may

be more difficult, time consuming and/or costly than expected, which could impact our relationships with customers, suppliers, employees and other business counterparties; restrictions on activities following the distribution in order to preserve

the tax-free treatment of the distribution; the ability to form and implement alliances; changes in tax obligations arising from tax reform measures, including European Union rules on state aid, or

examinations by tax authorities; product liability, intellectual property and commercial litigation losses; changes in general industry and market conditions, including domestic and international growth rates; changes in general domestic and

international economic conditions, including inflation and interest rate and currency exchange rate fluctuations; and the effects of global pandemics and other adverse public health developments on the global economy, our business and operations and

the business and operations of our suppliers and customers, including the deferral of elective procedures and our ability to collect accounts receivable. You are cautioned not to rely on these forward-looking statements, since there can be no

assurance that these forward-looking statements will prove to be accurate. Forward-looking statements speak only as of the date they are made, and we expressly disclaim any intention or obligation to update or revise any forward-looking statements,

whether as a result of new information, future events, or otherwise.

Media Contact Information:

ZimVie

Grace Flowers •

Grace.Flowers@ZimVie.com

(561) 319-6130

Investor Contact Information:

Gilmartin Group LLC

Webb Campbell • Webb@gilmartinir.com

4

ZIMVIE INC.

CONSOLIDATED STATEMENT OF OPERATIONS

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(unaudited)

For the Three Months

Ended December 31, |

|

|

For the Years

Ended December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Third party, net |

|

$ |

111,521 |

|

|

$ |

113,066 |

|

|

$ |

449,749 |

|

|

$ |

457,197 |

|

| Related party, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

236 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Net Sales |

|

|

111,521 |

|

|

|

113,066 |

|

|

|

449,749 |

|

|

|

457,433 |

|

| Cost of products sold, excluding intangible asset amortization |

|

|

(38,707 |

) |

|

|

(42,573 |

) |

|

|

(162,303 |

) |

|

|

(166,819 |

) |

| Related party cost of products sold, excluding intangible asset amortization |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(231 |

) |

| Intangible asset amortization |

|

|

(5,994 |

) |

|

|

(6,134 |

) |

|

|

(24,053 |

) |

|

|

(26,512 |

) |

| Research and development |

|

|

(6,621 |

) |

|

|

(6,893 |

) |

|

|

(26,905 |

) |

|

|

(26,162 |

) |

| Selling, general and administrative |

|

|

(58,564 |

) |

|

|

(62,909 |

) |

|

|

(238,589 |

) |

|

|

(248,964 |

) |

| Restructuring and other cost reduction initiatives |

|

|

(2,017 |

) |

|

|

717 |

|

|

|

(5,681 |

) |

|

|

(4,489 |

) |

| Acquisition, integration, divestiture and related |

|

|

(5,948 |

) |

|

|

(10,548 |

) |

|

|

(12,882 |

) |

|

|

(15,195 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

(117,851 |

) |

|

|

(128,340 |

) |

|

|

(470,413 |

) |

|

|

(488,372 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Loss |

|

|

(6,330 |

) |

|

|

(15,274 |

) |

|

|

(20,664 |

) |

|

|

(30,939 |

) |

| Other income, net |

|

|

2,748 |

|

|

|

1,515 |

|

|

|

8,908 |

|

|

|

326 |

|

| Interest income |

|

|

2,111 |

|

|

|

583 |

|

|

|

7,050 |

|

|

|

2,512 |

|

| Interest expense |

|

|

(4,120 |

) |

|

|

(5,559 |

) |

|

|

(18,887 |

) |

|

|

(22,746 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing operations before income taxes |

|

|

(5,591 |

) |

|

|

(18,735 |

) |

|

|

(23,593 |

) |

|

|

(50,847 |

) |

| Provision for income taxes from continuing operations |

|

|

(4,077 |

) |

|

|

(3,428 |

) |

|

|

(10,237 |

) |

|

|

(5,202 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss from Continuing Operations of ZimVie Inc. |

|

|

(9,668 |

) |

|

|

(22,163 |

) |

|

|

(33,830 |

) |

|

|

(56,049 |

) |

| Income (loss) from discontinued operations, net of tax |

|

|

(2,097 |

) |

|

|

(312,689 |

) |

|

|

8,005 |

|

|

|

(337,233 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss of ZimVie Inc. |

|

$ |

(11,765 |

) |

|

$ |

(334,852 |

) |

|

$ |

(25,825 |

) |

|

$ |

(393,282 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic (Loss) Earnings Per Common Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

(0.35 |

) |

|

$ |

(0.83 |

) |

|

$ |

(1.23 |

) |

|

$ |

(2.12 |

) |

| Discontinued operations |

|

|

(0.08 |

) |

|

|

(11.76 |

) |

|

|

0.29 |

|

|

|

(12.75 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(0.43 |

) |

|

$ |

(12.59 |

) |

|

$ |

(0.94 |

) |

|

$ |

(14.87 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted (Loss) Earnings Per Common Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

(0.35 |

) |

|

$ |

(0.83 |

) |

|

$ |

(1.23 |

) |

|

$ |

(2.12 |

) |

| Discontinued operations |

|

|

(0.08 |

) |

|

|

(11.76 |

) |

|

|

0.29 |

|

|

|

(12.75 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(0.43 |

) |

|

$ |

(12.59 |

) |

|

$ |

(0.94 |

) |

|

$ |

(14.87 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5

ZIMVIE INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

| |

|

As of December 31, |

|

| |

|

2024 |

|

|

2023 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

74,974 |

|

|

$ |

71,511 |

|

| Accounts receivable, net |

|

|

65,211 |

|

|

|

65,168 |

|

| Inventories |

|

|

75,018 |

|

|

|

79,600 |

|

| Prepaid expenses and other current assets |

|

|

23,295 |

|

|

|

23,825 |

|

| Current assets of discontinued operations |

|

|

18,787 |

|

|

|

242,773 |

|

|

|

|

|

|

|

|

|

|

| Total Current Assets |

|

|

257,285 |

|

|

|

482,877 |

|

| Property, plant and equipment, net |

|

|

47,268 |

|

|

|

54,167 |

|

| Goodwill |

|

|

257,605 |

|

|

|

262,111 |

|

| Intangible assets, net |

|

|

92,734 |

|

|

|

114,354 |

|

| Note receivable |

|

|

64,643 |

|

|

|

— |

|

| Other assets |

|

|

26,611 |

|

|

|

26,747 |

|

| Noncurrent assets of discontinued operations |

|

|

7,528 |

|

|

|

265,089 |

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

753,674 |

|

|

$ |

1,205,345 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

32,958 |

|

|

$ |

27,785 |

|

| Income taxes payable |

|

|

3,263 |

|

|

|

2,863 |

|

| Other current liabilities |

|

|

62,905 |

|

|

|

67,108 |

|

| Current liabilities of discontinued operations |

|

|

34,818 |

|

|

|

75,858 |

|

|

|

|

|

|

|

|

|

|

| Total Current Liabilities |

|

|

133,944 |

|

|

|

173,614 |

|

| Deferred income taxes |

|

|

— |

|

|

|

265 |

|

| Lease liability |

|

|

8,218 |

|

|

|

9,080 |

|

| Other long-term liabilities |

|

|

9,232 |

|

|

|

9,055 |

|

| Non-current portion of debt |

|

|

220,451 |

|

|

|

508,797 |

|

| Noncurrent liabilities of discontinued operations |

|

|

122 |

|

|

|

95,041 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

|

371,967 |

|

|

|

795,852 |

|

|

|

|

|

|

|

|

|

|

| Commitments and Contingencies |

|

|

|

|

|

|

|

|

| Stockholders’ Equity: |

|

|

|

|

|

|

|

|

| Common stock, $0.01 par value, 150,000 shares authorized Shares, issued and outstanding, of 27,677

and 27,076, respectively |

|

|

277 |

|

|

|

271 |

|

| Preferred stock, $0.01 par value, 15,000 shares authorized, 0 shares issued and

outstanding |

|

|

— |

|

|

|

— |

|

| Additional paid in capital |

|

|

938,630 |

|

|

|

922,996 |

|

| Accumulated deficit |

|

|

(466,639 |

) |

|

|

(440,814 |

) |

| Accumulated other comprehensive loss |

|

|

(90,561 |

) |

|

|

(72,960 |

) |

|

|

|

|

|

|

|

|

|

| Total Stockholders’ Equity |

|

|

381,707 |

|

|

|

409,493 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Stockholders’ Equity |

|

$ |

753,674 |

|

|

$ |

1,205,345 |

|

|

|

|

|

|

|

|

|

|

6

ZIMVIE INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

|

|

|

|

|

|

|

|

|

| |

|

For the Years Ended December 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Cash flows provided by operating activities: |

|

|

|

|

|

|

|

|

| Net loss of ZimVie Inc. |

|

$ |

(25,825 |

) |

|

$ |

(393,282 |

) |

| Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

|

| Depreciation and amortization |

|

|

34,312 |

|

|

|

121,686 |

|

| Share-based compensation |

|

|

16,592 |

|

|

|

27,020 |

|

| Deferred income tax provision |

|

|

(4,243 |

) |

|

|

(17,088 |

) |

| Loss on disposal of fixed assets |

|

|

5,518 |

|

|

|

2,996 |

|

| Other non-cash items |

|

|

4,985 |

|

|

|

3,245 |

|

| Gain on sale of spine disposal group |

|

|

(11,079 |

) |

|

|

— |

|

| Adjustment of spine disposal group to fair value |

|

|

(11,143 |

) |

|

|

289,456 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Income taxes |

|

|

3,253 |

|

|

|

(15,054 |

) |

| Accounts receivable |

|

|

(4,202 |

) |

|

|

21,083 |

|

| Related party receivables |

|

|

— |

|

|

|

8,483 |

|

| Inventories |

|

|

6,443 |

|

|

|

25,446 |

|

| Prepaid expenses and other current assets |

|

|

(3,015 |

) |

|

|

5,340 |

|

| Accounts payable and accrued liabilities |

|

|

8,323 |

|

|

|

(24,759 |

) |

| Related party payable |

|

|

— |

|

|

|

(13,176 |

) |

| Other assets and liabilities |

|

|

(5,745 |

) |

|

|

(4,248 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

14,174 |

|

|

|

37,148 |

|

|

|

|

|

|

|

|

|

|

| Cash flows provided by (used in) investing activities: |

|

|

|

|

|

|

|

|

| Additions to instruments |

|

|

(1,330 |

) |

|

|

(5,978 |

) |

| Additions to other property, plant and equipment |

|

|

(5,352 |

) |

|

|

(6,509 |

) |

| Proceeds from sale of spine disposal group, net of cash disposed |

|

|

290,918 |

|

|

|

— |

|

| Other investing activities |

|

|

(1,940 |

) |

|

|

(2,687 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) investing activities |

|

|

282,296 |

|

|

|

(15,174 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows used in financing activities: |

|

|

|

|

|

|

|

|

| Proceeds from debt |

|

|

— |

|

|

|

4,760 |

|

| Payments on debt |

|

|

(290,000 |

) |

|

|

(29,304 |

) |

| Payments related to tax withholding for share-based compensation |

|

|

(2,825 |

) |

|

|

(3,402 |

) |

| Proceeds from stock plan activity |

|

|

1,872 |

|

|

|

2,280 |

|

| Business combination contingent consideration payments |

|

|

(3,712 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities |

|

|

(294,665 |

) |

|

|

(25,666 |

) |

|

|

|

|

|

|

|

|

|

| Effect of exchange rates on cash and cash equivalents |

|

|

(13,001 |

) |

|

|

1,859 |

|

|

|

|

|

|

|

|

|

|

| Decrease in cash and cash equivalents |

|

|

(11,196 |

) |

|

|

(1,833 |

) |

| Cash and cash equivalents, beginning of year |

|

|

87,768 |

|

|

|

89,601 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents, end of period |

|

$ |

76,572 |

|

|

$ |

87,768 |

|

|

|

|

|

|

|

|

|

|

Presentation includes cash of both continuing and discontinued operations

7

RECONCILIATION OF NET DEBT

Continuing Operations ($ in thousands)

|

|

|

|

|

|

|

|

|

| |

|

As of December 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Non-current portion of debt |

|

$ |

220,451 |

|

|

$ |

508,797 |

|

| Less: Cash and cash equivalents |

|

|

(74,974 |

) |

|

|

(71,511 |

) |

|

|

|

|

|

|

|

|

|

| Net Debt |

|

$ |

145,477 |

|

|

$ |

437,286 |

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF CONSTANT CURRENCY NET SALES

Continuing Operations ($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months

Ended December 31, |

|

|

Change (%) |

|

|

Foreign

Exchange

Impact |

|

|

Constant

Currency %

Change |

|

| |

|

2024 |

|

|

2023 |

|

| United States |

|

$ |

64,402 |

|

|

$ |

65,383 |

|

|

|

(1.5 |

%) |

|

|

0.0 |

% |

|

|

(1.5 |

%) |

| International |

|

|

47,119 |

|

|

|

47,683 |

|

|

|

(1.2 |

%) |

|

|

(1.2 |

%) |

|

|

(0.0 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Dental Third Party Sales |

|

|

111,521 |

|

|

|

113,066 |

|

|

|

(1.4 |

%) |

|

|

(0.5 |

%) |

|

|

(0.9 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Related Party Net Sales |

|

|

— |

|

|

|

— |

|

|

|

0.0 |

% |

|

|

0.0 |

% |

|

|

0.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Dental Net Sales |

|

$ |

111,521 |

|

|

$ |

113,066 |

|

|

|

(1.4 |

%) |

|

|

(0.5 |

%) |

|

|

(0.9 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Years

Ended December 31, |

|

|

Change (%) |

|

|

Foreign

Exchange

Impact |

|

|

Constant

Currency %

Change |

|

| |

|

2024 |

|

|

2023 |

|

| United States |

|

$ |

266,816 |

|

|

$ |

269,557 |

|

|

|

(1.0 |

%) |

|

|

0.0 |

% |

|

|

(1.0 |

%) |

| International |

|

|

182,933 |

|

|

|

187,640 |

|

|

|

(2.5 |

%) |

|

|

(1.0 |

%) |

|

|

(1.5 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Dental Third Party Sales |

|

|

449,749 |

|

|

|

457,197 |

|

|

|

(1.6 |

%) |

|

|

(0.4 |

%) |

|

|

(1.2 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Related Party Net Sales |

|

|

— |

|

|

|

236 |

|

|

|

(100.0 |

%) |

|

|

0.0 |

% |

|

|

(100.0 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Dental Net Sales |

|

$ |

449,749 |

|

|

$ |

457,433 |

|

|

|

(1.7 |

%) |

|

|

(0.4 |

%) |

|

|

(1.3 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8

RECONCILIATION OF ADJUSTED NET INCOME AND DILUTED EPS

Continuing Operations (in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended December 31, 2024 |

|

| |

|

Net Sales |

|

|

Cost of

products sold,

excluding

intangible

asset

amortization |

|

|

Operating

expenses,

excluding

cost of

products

sold |

|

|

Operating

(Loss)

Income |

|

|

Net

(Loss)

Income |

|

|

Diluted EPS |

|

| Reported |

|

$ |

111,521 |

|

|

$ |

(38,707 |

) |

|

$ |

(79,144 |

) |

|

$ |

(6,330 |

) |

|

$ |

(9,668 |

) |

|

$ |

(0.35 |

) |

| Restructuring and other cost reduction initiatives

[1] |

|

|

— |

|

|

|

— |

|

|

|

2,017 |

|

|

|

2,017 |

|

|

|

2,017 |

|

|

|

0.07 |

|

| Acquisition, integration, divestiture and related

[2] |

|

|

— |

|

|

|

— |

|

|

|

5,948 |

|

|

|

5,948 |

|

|

|

5,948 |

|

|

|

0.22 |

|

| Intangible asset amortization |

|

|

— |

|

|

|

— |

|

|

|

5,994 |

|

|

|

5,994 |

|

|

|

5,994 |

|

|

|

0.22 |

|

| European union medical device regulation

[3] |

|

|

— |

|

|

|

— |

|

|

|

766 |

|

|

|

766 |

|

|

|

766 |

|

|

|

0.03 |

|

| Other charges [4] |

|

|

— |

|

|

|

(289 |

) |

|

|

— |

|

|

|

(289 |

) |

|

|

(289 |

) |

|

|

(0.01 |

) |

| Litigation settlement [5] |

|

|

— |

|

|

|

— |

|

|

|

1,095 |

|

|

|

1,095 |

|

|

|

1,095 |

|

|

|

0.04 |

|

| Share-based compensation modification

[6] |

|

|

— |

|

|

|

— |

|

|

|

283 |

|

|

|

283 |

|

|

|

283 |

|

|

|

0.01 |

|

| Tax effect of above adjustments & other

[7] |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,419 |

|

|

|

0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted |

|

$ |

111,521 |

|

|

$ |

(38,996 |

) |

|

$ |

(63,041 |

) |

|

$ |

9,484 |

|

|

$ |

7,565 |

|

|

$ |

0.27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended December 31, 2023 |

|

| |

|

Net Sales |

|

|

Cost of

products sold,

excluding

intangible

asset

amortization |

|

|

Operating

expenses,

excluding

cost of

products

sold |

|

|

Operating

(Loss)

Income |

|

|

Net (Loss)

Income |

|

|

Diluted EPS |

|

| Reported |

|

$ |

113,066 |

|

|

$ |

(42,573 |

) |

|

$ |

(85,767 |

) |

|

$ |

(15,274 |

) |

|

$ |

(22,163 |

) |

|

$ |

(0.83 |

) |

| Restructuring and other cost reduction initiatives

[1] |

|

|

— |

|

|

|

— |

|

|

|

(717 |

) |

|

|

(717 |

) |

|

|

(717 |

) |

|

|

(0.03 |

) |

| Acquisition, integration, divestiture and related

[2] |

|

|

— |

|

|

|

— |

|

|

|

10,548 |

|

|

|

10,548 |

|

|

|

10,548 |

|

|

|

0.41 |

|

| Intangible asset amortization |

|

|

— |

|

|

|

— |

|

|

|

6,134 |

|

|

|

6,134 |

|

|

|

6,134 |

|

|

|

0.23 |

|

| European union medical device regulation

[3] |

|

|

— |

|

|

|

— |

|

|

|

347 |

|

|

|

347 |

|

|

|

347 |

|

|

|

0.01 |

|

| Other charges [4] |

|

|

— |

|

|

|

278 |

|

|

|

286 |

|

|

|

564 |

|

|

|

564 |

|

|

|

0.02 |

|

| Spin-related share-based compensation expense

[8] |

|

|

— |

|

|

|

— |

|

|

|

5,335 |

|

|

|

5,335 |

|

|

|

5,335 |

|

|

|

0.20 |

|

| Tax effect of above adjustments & other

[7] |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,524 |

|

|

|

0.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted |

|

$ |

113,066 |

|

|

$ |

(42,295 |

) |

|

$ |

(63,834 |

) |

|

$ |

6,937 |

|

|

$ |

2,572 |

|

|

$ |

0.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| [1] |

Restructuring activities to better position the organization and the expenses incurred were primarily related

to employee termination benefits and professional fees. |

| [2] |

Acquisition, integration, divestiture and related expenses for the three months ended December 31, 2024

include the write-off of software costs incurred prior to the separation that were determined in the fourth quarter of 2024 to be unusable for ZimVie’s current enterprise resource planning software system

plans ($4.9 million), as well as professional services fees ($0.6 million) and stranded costs ($0.4 million) related to the sale of the spine segment. Acquisition, integration, divestiture and related expenses for the three months ended

December 31, 2023 include professional services fees ($10.0 million) related to the sale of the spine segment and rebranding costs ($0.4 million) related to the separation from our former parent. |

| [3] |

Expenses incurred for initial compliance with the European Union (“EU”) Medical Device Regulation

(“MDR”) for previously-approved products. |

9

| [4] |

Inventory write-offs resulting from restructuring activities and property, plant, and equipment step-up amortization from prior acquisitions. |

| [5] |

Legal expenses associated with the defense of claims that are outside the ordinary course of business.

|

| [6] |

Net impact to share-based compensation expense of converting outstanding restricted stock units

(“RSUs”) with performance-based metrics based on the consolidated results of the spine and dental segments into time-based RSUs following the sale of the spine segment. |

| [7] |

Reflects the tax effect of the adjustments from reported to adjusted, as well as an adjustment for

management’s expectation of ZimVie’s statutory tax rate based on current tax law and adjusted pre-tax income. |

| [8] |

Spin-related share-based compensation expense from grants provided due to the successful separation from Zimmer

Biomet. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Year Ended December 31, 2024 |

|

| |

|

Net Sales |

|

|

Cost of

products sold,

excluding

intangible

asset

amortization |

|

|

Operating

expenses,

excluding

cost of

products

sold |

|

|

Operating

(Loss)

Income |

|

|

Net (Loss)

Income |

|

|

Diluted EPS |

|

| Reported |

|

$ |

449,749 |

|

|

$ |

(162,303 |

) |

|

$ |

(308,110 |

) |

|

$ |

(20,664 |

) |

|

$ |

(33,830 |

) |

|

$ |

(1.23 |

) |

| Restructuring and other cost reduction initiatives

[1] |

|

|

— |

|

|

|

— |

|

|

|

5,681 |

|

|

|

5,681 |

|

|

|

5,681 |

|

|

|

0.21 |

|

| Acquisition, integration, divestiture and related

[2] |

|

|

— |

|

|

|

— |

|

|

|

12,882 |

|

|

|

12,882 |

|

|

|

12,882 |

|

|

|

0.47 |

|

| Intangible asset amortization |

|

|

— |

|

|

|

— |

|

|

|

24,053 |

|

|

|

24,053 |

|

|

|

24,053 |

|

|

|

0.88 |

|

| European union medical device regulation

[3] |

|

|

— |

|

|

|

— |

|

|

|

1,884 |

|

|

|

1,884 |

|

|

|

1,884 |

|

|

|

0.07 |

|

| Other charges [4] |

|

|

— |

|

|

|

1,144 |

|

|

|

— |

|

|

|

1,144 |

|

|

|

1,144 |

|

|

|

0.04 |

|

| Litigation settlement [5] |

|

|

— |

|

|

|

— |

|

|

|

1,095 |

|

|

|

1,095 |

|

|

|

1,095 |

|

|

|

0.04 |

|

| Share-based compensation modification

[6] |

|

|

— |

|

|

|

— |

|

|

|

(238 |

) |

|

|

(238 |

) |

|

|

(238 |

) |

|

|

(0.01 |

) |

| Tax effect of above adjustments & other

[7] |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,281 |

|

|

|

0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted |

|

$ |

449,749 |

|

|

$ |

(161,159 |

) |

|

$ |

(262,753 |

) |

|

$ |

25,837 |

|

|

$ |

16,952 |

|

|

$ |

0.62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Year Ended December 31, 2023 |

|

| |

|

Net Sales |

|

|

Cost of

products sold,

excluding

intangible

asset

amortization |

|

|

Operating

expenses,

excluding

cost of

products

sold |

|

|

Operating

(Loss)

Income |

|

|

Net (Loss)

Income |

|

|

Diluted EPS |

|

| Reported |

|

$ |

457,433 |

|

|

$ |

(167,050 |

) |

|

$ |

(321,322 |

) |

|

$ |

(30,939 |

) |

|

$ |

(56,049 |

) |

|

$ |

(2.12 |

) |

| Restructuring and other cost reduction initiatives

[1] |

|

|

— |

|

|

|

— |

|

|

|

4,489 |

|

|

|

4,489 |

|

|

|

4,489 |

|

|

|

0.17 |

|

| Acquisition, integration, divestiture and related

[2] |

|

|

— |

|

|

|

— |

|

|

|

15,195 |

|

|

|

15,195 |

|

|

|

15,195 |

|

|

|

0.57 |

|

| Intangible asset amortization |

|

|

— |

|

|

|

— |

|

|

|

26,512 |

|

|

|

26,512 |

|

|

|

26,512 |

|

|

|

1.00 |

|

| Related party |

|

|

(236 |

) |

|

|

231 |

|

|

|

— |

|

|

|

(5 |

) |

|

|

(5 |

) |

|

|

— |

|

| European union medical device regulation

[3] |

|

|

— |

|

|

|

— |

|

|

|

2,574 |

|

|

|

2,574 |

|

|

|

2,574 |

|

|

|

0.10 |

|

| Other charges [4] |

|

|

— |

|

|

|

1,143 |

|

|

|

1,145 |

|

|

|

2,288 |

|

|

|

2,288 |

|

|

|

0.09 |

|

| Spin-related share-based compensation expense

[8] |

|

|

— |

|

|

|

— |

|

|

|

7,679 |

|

|

|

7,679 |

|

|

|

7,679 |

|

|

|

0.29 |

|

| Tax effect of above adjustments & other

[7] |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,152 |

|

|

|

0.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted |

|

$ |

457,197 |

|

|

$ |

(165,676 |

) |

|

$ |

(263,728 |

) |

|

$ |

27,793 |

|

|

$ |

5,835 |

|

|

$ |

0.22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| [1] |

Restructuring activities to better position the organization and the expenses incurred were primarily related

to employee termination benefits and professional fees. |

10

| [2] |

Acquisition, integration, divestiture and related expenses for the year ended December 31, 2024 include

the write-off of software costs incurred prior to the separation that were determined in the fourth quarter of 2024 to be unusable for ZimVie’s current enterprise resource planning software system plans

($4.9 million) and professional services fees ($2.4 million) related to the evaluation of strategic alternatives for our portfolio, as well as professional services fees ($3.9 million) and stranded costs ($1.5 million) related to the sale of the

spine segment. Acquisition, integration, divestiture and related expenses for the year ended December 31, 2023 include professional services fees ($11.6 million) related to the sale of our spine segment, as well as professional services fees

($1.8 million), rebranding costs ($0.9 million) and information technology costs ($0.7 million) related to the separation from our former parent. |

| [3] |

Expenses incurred for initial compliance with the EU MDR for previously-approved products.

|

| [4] |

Inventory write-offs resulting from restructuring activities and property, plant, and equipment step-up amortization from prior acquisitions. |

| [5] |

Legal expenses associated with the defense of claims that are outside the ordinary course of business.

|

| [6] |

Net impact to share-based compensation expense of converting outstanding RSUs with performance-based metrics

based on the consolidated results of the spine and dental segments into time-based RSUs following the sale of the spine segment. |

| [7] |

Reflects the tax effect of the adjustments from reported to adjusted, as well as an adjustment for

management’s expectation of ZimVie’s statutory tax rate based on current tax law and adjusted pre-tax income. |

| [8] |

Spin-related share-based compensation expense from grants provided due to the successful separation from Zimmer

Biomet. |

RECONCILIATION OF ADJUSTED EBITDA:

Continuing Operations ($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months

Ended December 31, |

|

|

For the Years

Ended December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Third Party Sales |

|

$ |

111,521 |

|

|

$ |

113,066 |

|

|

$ |

449,749 |

|

|

$ |

457,197 |

|

| Related Party Sales |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

236 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Net Sales |

|

$ |

111,521 |

|

|

$ |

113,066 |

|

|

$ |

449,749 |

|

|

$ |

457,433 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(9,668 |

) |

|

$ |

(22,163 |

) |

|

$ |

(33,830 |

) |

|

$ |

(56,049 |

) |

| Interest expense, net |

|

|

2,009 |

|

|

|

4,976 |

|

|

|

11,837 |

|

|

|

20,234 |

|

| Income tax provision |

|

|

4,077 |

|

|

|

3,428 |

|

|

|

10,237 |

|

|

|

5,202 |

|

| Depreciation and amortization |

|

|

8,358 |

|

|

|

7,908 |

|

|

|

33,168 |

|

|

|

34,507 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

|

4,776 |

|

|

|

(5,851 |

) |

|

|

21,412 |

|

|

|

3,894 |

|

| Share-based compensation |

|

|

4,118 |

|

|

|

9,316 |

|

|

|

15,879 |

|

|

|

23,476 |

|

| Restructuring and other cost reduction initiatives

[1] |

|

|

2,017 |

|

|

|

(717 |

) |

|

|

5,681 |

|

|

|

4,489 |

|

| Acquisition, integration, divestiture and related

[2] |

|

|

5,948 |

|

|

|

10,548 |

|

|

|

12,882 |

|

|

|

15,195 |

|

| Related party gain |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5 |

) |

| European Union medical device regulation

[3] |

|

|

766 |

|

|

|

347 |

|

|

|

1,884 |

|

|

|

2,574 |

|

| Litigation settlement [4] |

|

|

1,095 |

|

|

|

— |

|

|

|

1,095 |

|

|

|

— |

|

| Other charges [5] |

|

|

(289 |

) |

|

|

278 |

|

|

|

1,144 |

|

|

|

1,143 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

18,431 |

|

|

$ |

13,921 |

|

|

$ |

59,977 |

|

|

$ |

50,766 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss Margin [6] |

|

|

(8.7 |

%) |

|

|

(19.6 |

%) |

|

|

(7.5 |

%) |

|

|

(12.3 |

%) |

| Adjusted EBITDA Margin [7] |

|

|

16.5 |

% |

|

|

12.3 |

% |

|

|

13.3 |

% |

|

|

11.1 |

% |

| [1] |

Restructuring activities to better position our organization for future success based on the current business

environment and sale of the spine business, primarily related to employee termination benefits and professional fees. |

| [2] |

Acquisition, integration, divestiture and related expenses for the three months and year ended

December 31, 2024 include the write-off of software costs incurred prior to the separation that were determined in the fourth quarter of 2024 to be unusable for ZimVie’s current enterprise resource

planning software system plans ($4.9 million and $4.9 million, respectively) and professional services fees ($0 and $2.4 million, respectively) related to the evaluation of strategic alternatives for our portfolio, as well as

professional services fees ($0.6 million and $3.9 million, respectively) and stranded costs ($0.4 million and $1.5 million, respectively) related to the sale of the spine segment. Acquisition, integration, divestiture and related

expenses for the three months and year ended December 31, 2023 include professional services fees ($10.0 million and $11.6 million, respectively) related to the sale of our spine segment, as well as professional services fees ($0 and

$1.8 million, respectively), rebranding costs ($0.4 million and $0.9 million, respectively) and information technology costs ($0 and $0.7 million, respectively) related to the separation from our former parent.

|

| [3] |

Expenses incurred for initial compliance with the EU MDR for previously-approved products.

|

| [4] |

Legal expenses associated with the defense of claims that are outside the ordinary course of business.

|

| [5] |

Inventory write-offs resulting from restructuring activities and property, plant, and equipment step-up amortization from prior acquisitions. |

| [6] |

Net Loss Margin is calculated as Net Loss divided by third party net sales for the applicable period.

|

| [7] |

Adjusted EBITDA Margin is Adjusted EBITDA divided by third party net sales for the applicable period.

|

11

RECONCILIATION OF ADJUSTED COST OF PRODUCTS SOLD (excluding intangible asset amortization), R&D and

SG&A:

Continuing Operations ($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

December 31, |

|

|

Percentage of Third

Party Net Sales |

|

|

Years Ended

December 31, |

|

|

Percentage of Third

Party Net Sales |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Cost of products sold, excluding intangible asset amortization |

|

$ |

(38,707 |

) |

|

$ |

(42,573 |

) |

|

|

(34.7 |

%) |

|

|

(37.7 |

%) |

|

$ |

(162,303 |

) |

|

$ |

(166,819 |

) |

|

|

(36.1 |

%) |

|

|

(36.5 |

%) |

| Other charges [1] |

|

|

(289 |

) |

|

|

278 |

|

|

|

(0.3 |

%) |

|

|

0.3 |

% |

|

|

1,144 |

|

|

|

1,143 |

|

|

|

0.3 |

% |

|

|

0.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted cost of products sold, excluding intangible asset amortization |

|

$ |

(38,996 |

) |

|

$ |

(42,295 |

) |

|

|

(35.0 |

%) |

|

|

(37.4 |

%) |

|

$ |

(161,159 |

) |

|

$ |

(165,676 |

) |

|

|

(35.8 |

%) |

|

|

(36.2 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Research and development |

|

$ |

(6,621 |

) |

|

$ |

(6,893 |

) |

|

|

(5.9 |

%) |

|

|

(6.1 |

%) |

|

$ |

(26,905 |

) |

|

$ |

(26,162 |

) |

|

|

(6.0 |

%) |

|

|

(5.7 |

%) |

| European union medical device regulation

[2] |

|

|

766 |

|

|

|

347 |

|

|

|

0.7 |

% |

|

|

0.3 |

% |

|

|

1,884 |

|

|

|

2,574 |

|

|

|

0.4 |

% |

|

|

0.5 |

% |

| Share-based compensation modification

[3] |

|

|

21 |

|

|

|

— |

|

|

|

0.0 |

% |

|

|

0.0 |

% |

|

|

(25 |

) |

|

|

— |

|

|

|

0.0 |

% |

|

|

0.0 |

% |

| Spin-related share-based compensation expense

[4] |

|

|

— |

|

|

|

80 |

|

|

|

0.0 |

% |

|

|

0.1 |

% |

|

|

— |

|

|

|

320 |

|