Current Report Filing (8-k)

April 13 2020 - 12:25PM

Edgar (US Regulatory)

false0000880266AGCO CORP /DE

0000880266

2020-04-09

2020-04-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

April 9, 2020

Date of Report

(Date of earliest event reported)

AGCO CORPORATION

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-12930

|

|

58-1960019

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

4205 River Green Parkway

Duluth, Georgia 30096

(Address of principal executive offices, including Zip Code)

770 813-9200

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act

|

|

Title of Class

|

Trading Symbol

|

Name of exchange on which registered

|

|

Common stock

|

AGCO

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

|

|

|

|

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On April 9, 2020, AGCO Corporation (the “Company”) entered into an amendment to its $800.0 million multi-currency revolving credit facility to include incremental term loans (“incremental term loans”) that allow the Company to borrow an aggregate principal amount of €235.0 million and $267.5 million, respectively (or an aggregate of approximately $524.4 million as of April 9, 2020). Amounts can be drawn on the incremental term loans at any time prior to maturity, but must be drawn down proportionately. Amounts drawn must be in a minimum principal amount of $100.0 million and integral multiples of $50.0 million in excess thereof. Once amounts have been repaid, those amounts are not permitted to be re-drawn. The maturity date of the incremental term loans is April 8, 2022. Interest accrues on amounts outstanding under the incremental term loans, at the Company's option, at either (1) LIBOR plus a margin based on the Company's credit rating ranging from 1.125% to 2.125% until April 8, 2021 and ranging from 1.375% to 2.375% thereafter, or (2) the base rate, which is equal to the higher of (i) the administrative agent’s base lending rate for the applicable currency, (ii) the federal funds rate plus 0.5%, and (iii) one-month LIBOR for loans denominated in U.S. dollars plus 1.0%, plus a margin based on the Company’s credit rating ranging from 0.125% to 1.375% until April 8, 2021 and ranging from 0.375% to 1.375% thereafter. The incremental term loans contain covenants restricting, among other things, the incurrence of indebtedness and the making of certain payments, including dividends. The Company also has to fulfill financial covenants with respect to a total debt to EBITDA ratio and an interest coverage ratio. In the event that LIBOR is no longer published, interest will be calculated upon a base rate. The incremental term loans also provide for an expedited amendment process once a replacement for LIBOR is established.

|

|

|

|

|

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information contained in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 2.03.

|

|

|

|

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File - the cover page from this Current Report on Form 8-K is formatted in Inline XBRL.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

AGCO Corporation

|

|

|

|

|

By:

|

/s/ Andrew H. Beck

|

|

|

Andrew H. Beck

Senior Vice President and

Chief Financial Officer

|

Dated: April 13, 2020

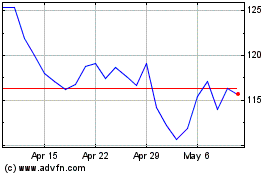

AGCO (NYSE:AGCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

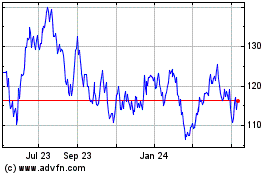

AGCO (NYSE:AGCO)

Historical Stock Chart

From Apr 2023 to Apr 2024