UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-31909

ASPEN INSURANCE HOLDINGS LIMITED

(Translation of registrant’s name into English)

141 Front Street

Hamilton HM 19

Bermuda

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F ¨

On November 14, 2024, Aspen Insurance Holdings Limited (the "Company”) issued a press release announcing its financial results for the three and nine months ended September 30, 2024.

The press release, furnished as Exhibit 99.1, is incorporated by reference as part of this Form 6-K.

The information included in this Form 6-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

EXHIBIT INDEX

Exhibit

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | ASPEN INSURANCE HOLDINGS LIMITED

|

| | | |

| Dated: November 14, 2024 | | | | By: | | /s/ Mark Pickering |

| | | | Name: | | Mark Pickering |

| | | | Title: | | Chief Financial Officer |

Aspen Reports Results Three and Nine Months Ended September 30, 2024

Net Income Available to Ordinary Shareholders of $43 million and Operating Income of $87 million for the Three Months Ended September 30, 2024

Net Income Available to Ordinary Shareholders of $196 million and Operating Income of $288 million for the Nine Months Ended September 30, 2024

Operating Return on Average Equity of 15.8% and Adjusted Combined Ratio of 91.5% for the Three Months Ended September 30, 2024

Operating Return on Average Equity of 17.6% and Adjusted Combined Ratio of 88.2% for the Nine Months Ended September 30, 2024

Hamilton, Bermuda, November 14, 2024 - Aspen Insurance Holdings Limited (“Aspen”) today reported results for the three and nine months ended September 30, 2024.

Mark Cloutier, Executive Chairman and Group Chief Executive Officer, commented: “Aspen has once again delivered strong performance across our underwriting and investment portfolios, and from Aspen Capital Markets.”

“For the nine months ended September 30, we saw gross written premium grow by 15.8% to $3.6 billion (2023: $3.1 billion), demonstrating the attractiveness of our platform and the relevance of our business to clients and trading partners for both insurance and reinsurance. Aspen Capital Markets generated fee income of $112 million*, an increase of 22%, while net investment income grew 15.2% to $239 million. The resulting operating income of $288 million** represents an increase of 6.5% over the prior year.”

“In a year challenged by a number of industry-wide major loss events, these results are driven by Aspen’s expert and disciplined underwriting, consistent investment performance and a growing contribution from Aspen Capital Markets, resulting in an annualized return on average equity of 17.6%** and an adjusted combined operating ratio of 88.2%**. Looking forward, we believe we have the earnings engines , culture, market standing, and risk management that positions us very well to continue to deliver much needed solutions to our customers and trading partners, while also achieving sustainable growth and consistent returns for our shareholders across a broad spectrum of industry loss event sets and cycles.”

“In the aftermath of Hurricanes Helene and Milton, our thoughts are with the communities affected, and we remain committed to playing our part in the recovery and rebuild. As a result of our careful and balanced approach to managing our risk portfolio, Aspen’s exposure to Hurricanes Helene and Milton are limited and fall within expectations. Hurricane Milton, net of reinsurance and reinstatement premiums, is expected to generate claims in the range of $40 - $60 million, based on our modelled loss projections and exposure analysis, at an industry loss estimate of $30 billion, and will be included in the Company’s fourth quarter results.”

* Reflected in our underwriting result as a reduction to acquisition costs.

** Non-GAAP financial measures are used throughout this release, such as operating income, operating return on average equity, adjusted underwriting income and adjusted combined ratio. These are non-GAAP financial measures as defined in SEC Regulation G. For additional information and reconciliation of non-GAAP financial measures, refer to the end of this press release. Refer to "Cautionary Statement Regarding Forward-Looking Statements" at the end of this press release.

Consolidated Highlights for the Three and Nine Months Ended September 30, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| | (in $ millions, except percentages) | | (in $ millions, except percentages) |

| Gross written premiums | | $ | 1,116.8 | | | $ | 982.7 | | | 13.6 | % | | $ | 3,598.6 | | | $ | 3,107.9 | | | 15.8 | % |

| Net written premiums | | $ | 673.6 | | | $ | 628.6 | | | 7.2 | % | | $ | 2,225.6 | | | $ | 1,979.1 | | | 12.5 | % |

| Net earned premiums | | $ | 698.3 | | | $ | 660.0 | | | 5.8 | % | | $ | 2,069.4 | | | $ | 1,947.4 | | | 6.3 | % |

Underwriting income (1) | | $ | 33.0 | | | $ | 47.9 | | | (31.1) | % | | $ | 202.8 | | | $ | 256.3 | | | (20.9) | % |

Adjusted underwriting income (1) | | $ | 59.7 | | | $ | 54.5 | | | 9.5 | % | | $ | 244.5 | | | $ | 250.5 | | | (2.4) | % |

| | | | | | | | | | | | |

| Net investment income | | $ | 79.6 | | | $ | 77.9 | | | | | $ | 238.9 | | | $ | 207.3 | | | |

| Net realized and unrealized investment gains/(losses) | | 6.1 | | | (1.8) | | | | | (21.0) | | | 16.2 | | | |

| Interest (expense)/income | | (20.9) | | | 1.8 | | | | | (51.0) | | | (41.1) | | | |

| Corporate and other expenses | | (18.6) | | | (32.6) | | | | | (83.3) | | | (85.7) | | | |

| Non-operating expenses | | (7.6) | | | (0.2) | | | | | (19.3) | | | (10.8) | | | |

| Net realized and unrealized foreign exchange (losses)/gains | | (8.5) | | | (1.5) | | | | | 2.5 | | | 4.4 | | | |

| Income tax (expense) | | (6.4) | | | (5.2) | | | | | (32.1) | | | (41.4) | | | |

| Net income | | $ | 56.7 | | | $ | 86.3 | | | | | $ | 237.5 | | | $ | 305.2 | | | |

| Net income available to ordinary shareholders | | $ | 42.9 | | | $ | 72.5 | | | | | $ | 196.4 | | | $ | 269.2 | | | |

| | | | | | | | | | | | |

| Loss ratio | | 67.9 | % | | 65.2 | % | | | | 61.8 | % | | 58.9 | % | | |

| Expense ratio | | 27.3 | % | | 27.5 | % | | | | 28.4 | % | | 27.9 | % | | |

| Combined ratio | | 95.2 | % | | 92.7 | % | | | | 90.2 | % | | 86.8 | % | | |

Adjusted combined ratio (1) | | 91.5 | % | | 91.7 | % | | | | 88.2 | % | | 87.1 | % | | |

| | | | | | | | | | | | |

Operating income (1) | | $ | 86.5 | | | $ | 78.9 | | | | | $ | 287.5 | | | $ | 270.0 | | | |

| | | | | | | | | | | | |

Annualized operating return on average equity (1) | | 15.8 | % | | 17.6 | % | | | | 17.6 | % | | 20.8 | % | | |

Annualized total investment return (1) | | 10.9 | % | | 17.6 | % | | | | 5.7 | % | | 3.5 | % | | |

(1) Underwriting income, adjusted underwriting income, adjusted combined ratio, operating income, annualized operating return on average equity and annualized total investment return are non-GAAP financial measures as defined in SEC Regulation G. The reconciliations to the most comparable U.S. GAAP financial measures and a discussion of the rationale for the presentation of these items is provided later in this press release.

Aspen Group Consolidated Results

Aspen is a specialty (re)insurer focused on generating consistent returns for our shareholders. Our ‘One Aspen’ approach is designed to provide bespoke solutions to complex issues by bringing together our expertise spanning different lines of business, segments and platforms, enabling us to develop enhanced and differentiated offerings to our distribution partners and customers. We are organized across two segments: Insurance and Reinsurance. We adopt a dynamic capital allocation approach, utilizing our platforms across the U.S., U.K., Lloyd’s and Bermuda to match risk with the most appropriate source of capital. In addition, through our Aspen Capital Markets team, Aspen generates fee income, which benefits our underwriting results, by offering investors access to Aspen’s specialty insurance and reinsurance portfolios.

Continued targeted growth in premium and a consistent improvement in operating and investment income.

Consolidated Highlights for the Three Months Ended September 30, 2024

•The Group continued its robust performance with a net combined ratio of 95.2% and underwriting income of $33 million despite the impact of significant industry loss activity in the quarter, notably Hurricane Helene. On an adjusted basis, underwriting income was $60 million, with an adjusted combined ratio of 91.5%.

•Operating income of $87 million in the quarter, resulting in an annualized operating return on average equity of 15.8%.

•Gross written premiums increased by $134 million with growth across both Segments. This is predominantly driven by significant growth in the Insurance Segment, as a result of growth in partnership arrangements and maximizing on opportunities within Casualty, FinPro and Specialty lines. Reinsurance has also seen growth across Casualty Re and Property Re driven by strong market conditions.

•Corporate and other expenses decreased by $14 million due to expense alignment in our functions which support corporate activities.

Consolidated Highlights for the Nine Months Ended September 30, 2024

•Net income available to ordinary shareholders was $196 million with operating income of $288 million. Aspen achieved an annualized operating return on average equity of 17.6%.

•Adjusted underwriting income of $245 million was driven by favorable earnings from premium growth, partially offset by increased catastrophe losses, which included Hurricane Helene, Baltimore bridge, Dubai flood events and various events in Canada, and increased operating expenses due to investment in operational excellence enhancements and the strengthening of the British Pound sterling.

•Gross written premiums increased by $491 million driven by growth across both Segments. Insurance has seen opportunities within Specialty and Casualty due to market conditions and has seen growth in new partnership arrangements. Reinsurance has seen growth across all subsegments by taking advantage of favorable market conditions, achieving significant rate growth on policy renewals, particularly in Casualty and Specialty lines.

•Continued growth by Aspen Capital Markets saw sourced capital grow to $2.0 billion, which resulted in a 22% increase in fee income to $112 million.

•Active repositioning of our investments to take advantage of higher interest rates has resulted in an increase in net investment income by $32 million to $239 million. Net realized and unrealized investment (losses)/gains recognized in net income was a loss of $21 million, largely due to realized losses arising from our privately held investments as well as the active rotations of the portfolio, partially offset by unrealized gains due to market movements.

•As of September 30, 2024, we had $336 million (December 31, 2023: $420 million) of remaining limit available on our LPT contract, representing 24% of our 2019 and prior accident year outstanding reserves. This contract provides protection against deterioration on these accident years, significantly limiting Aspen’s exposure to the risk of unfavorable development and strengthening our balance sheet.

Insurance Segment

Operating highlights for the Three and Nine Months Ended September 30, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| | | ($ in millions, except for percentages) | | ($ in millions, except for percentages) |

| Underwriting Revenues | | | | | | | | | | | | |

| Gross written premiums | | $ | 700.6 | | | $ | 615.2 | | | 13.9 | % | | $ | 2,001.8 | | | $ | 1,864.7 | | | 7.4 | % |

| Net written premiums | | $ | 409.9 | | | $ | 367.4 | | | 11.6 | % | | $ | 1,173.6 | | | $ | 1,112.9 | | | 5.5 | % |

| Net earned premiums | | $ | 404.8 | | | $ | 368.2 | | | 9.9 | % | | $ | 1,144.1 | | | $ | 1,083.6 | | | 5.6 | % |

| Underwriting Expenses | | | | | | | | | | | | |

| Current accident year net losses and loss expenses | | $ | 229.7 | | | $ | 213.5 | | | | | $ | 681.4 | | | $ | 624.0 | | | |

| Catastrophe losses | | 9.7 | | | 15.0 | | | | | 26.3 | | | 32.9 | | | |

| Prior year reserve development, post LPT years | | 4.1 | | | 10.4 | | | | | 0.6 | | | 15.1 | | | |

Adjusted losses and loss adjustment expenses (1) | | 243.5 | | | 238.9 | | | | | 708.3 | | | 672.0 | | | |

Impact of the LPT (2) | | 22.1 | | | 36.9 | | | | | 17.6 | | | 23.7 | | | |

| Total net losses and loss expenses | | 265.6 | | | 275.8 | | | | | 725.9 | | | 695.7 | | | |

| Acquisition costs | | 47.8 | | | 39.4 | | | | | 131.7 | | | 126.6 | | | |

| General and administrative expenses | | 58.2 | | | 57.6 | | | | | 183.8 | | | 168.2 | | | |

Underwriting income/(loss) (1) | | $ | 33.2 | | | $ | (4.6) | | | $ | 37.8 | | | $ | 102.7 | | | $ | 93.1 | | | $ | 9.6 | |

Adjusted underwriting income (1) | | $ | 55.3 | | | $ | 32.3 | | | | | $ | 120.3 | | | $ | 116.8 | | | |

| | | | | | | | | | | | |

| Ratios | | | | | | | | | | | | |

| Current accident year loss ratio, excluding catastrophe losses | | 56.7 | % | | 58.0 | % | | | | 59.5 | % | | 57.6 | % | | |

| Catastrophe losses | | 2.4 | | | 4.1 | | | | | 2.3 | | | 3.0 | | | |

| Current accident year loss ratio | | 59.1 | | | 62.1 | | | | | 61.8 | | | 60.6 | | | |

| Prior year reserve development ratio, post LPT years | | 1.0 | | | 2.8 | | | | | 0.1 | | | 1.4 | | | |

Adjusted loss ratio (1) | | 60.1 | | | 64.9 | | | | | 61.9 | | | 62.0 | | | |

Impact of the LPT (2) | | 5.5 | | | 10.0 | | | | | 1.5 | | | 2.2 | | | |

| Loss ratio | | 65.6 | | | 74.9 | | | | | 63.4 | | | 64.2 | | | |

| Acquisition cost ratio | | 11.8 | | | 10.7 | | | | | 11.5 | | | 11.7 | | | |

| General and administrative expense ratio | | 14.4 | | | 15.6 | | | | | 16.1 | | | 15.5 | | | |

| Combined ratio | | 91.8 | % | | 101.2 | % | | | | 91.0 | % | | 91.4 | % | | |

Adjusted combined ratio (1) | | 86.3 | % | | 91.2 | % | | | | 89.5 | % | | 89.2 | % | | |

(1) Adjusted losses and loss adjustment expenses, underwriting income, adjusted underwriting income, adjusted loss ratio and adjusted combined ratio are non-GAAP financial measures as defined in SEC Regulation G. The reconciliations to the most comparable U.S. GAAP financial measures are shown above and a discussion of the rationale for the presentation of these items is provided later in this press release. (2) Impact of the LPT includes the impact of prior year development on 2019 and prior accident years, net of the change in the deferred gain recognized in relation to retroactive reinsurance contracts as per accounting requirements for retroactive reinsurance under U.S. GAAP.

Insurance Segment Results

Aspen Insurance operates on a global and regional product basis, delivers service excellence from underwriting through to claims, thereby transforming risk for our customers into opportunities. Aspen Insurance focuses on market segments with high barriers to entry that require bespoke underwriting expertise and customized solutions to address client needs. Aspen Insurance has long-standing partnerships with brokers and other distribution partners, and our responsiveness and innovative mindset make us an ideal partner to deliver effective risk management solutions. Aspen Insurance is organized into four portfolios of business: Financial and Professional Lines, Casualty and Liability Lines, First Party Lines and Specialty Lines.

During 2024, Aspen Insurance’s continued focus on disciplined underwriting and operational efficiency has helped it deliver another set of good results.

Insurance Segment Highlights for the Three Months Ended September 30, 2024

•Underwriting income was $33 million with a combined ratio of 91.8%, a 9.4 percentage point improvement from prior year. Adjusted underwriting income was $55 million with an adjusted combined ratio of 86.3%.

•Improvement in the underwriting result was driven by favorable growth in premiums within Specialty and Casualty, alongside growth in cross class binders and new partnerships in the year.

•The improvement in the loss ratio benefited from more benign catastrophe experience in the quarter despite catastrophe events such as Hurricane Helene, which resulted in a 1.7 percentage point improvement, along with limited prior year reserve development post LPT years.

Insurance Segment Highlights for the Nine Months Ended September 30, 2024

•Underwriting income was $103 million with a combined ratio of 91.0%, a 0.4 percentage point improvement from prior year. Adjusted underwriting income was $120 million with an adjusted combined ratio of 89.5%.

•The strong underwriting result was driven by growth in premiums, mainly due to our new partnerships and opportunities within Specialty and Casualty lines due to favorable market conditions.

•The loss ratio has improved due to benign catastrophe experience in the year to date, despite significant industry loss events, as well as limited adverse prior year reserve development on post LPT years, partially offset by an expected increase in the frequency and severity of losses in financial and professional lines.

Reinsurance Segment

Operating highlights for the Three and Nine Months Ended September 30, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| | | ($ in millions, except for percentages) | | ($ in millions, except for percentages) |

| Underwriting Revenues | | | | | | | | | | | | |

| Gross written premiums | | $ | 416.2 | | | $ | 367.5 | | | 13.3 | % | | $ | 1,596.8 | | | $ | 1,243.2 | | | 28.4 | % |

| Net written premiums | | $ | 263.7 | | | $ | 261.2 | | | 1.0 | % | | $ | 1,052.0 | | | $ | 866.2 | | | 21.5 | % |

| Net earned premiums | | $ | 293.5 | | | $ | 291.8 | | | 0.6 | % | | $ | 925.3 | | | $ | 863.8 | | | 7.1 | % |

| Underwriting Expenses | | | | | | | | | | | | |

| Current accident year net losses and loss expenses | | $ | 157.8 | | | $ | 144.5 | | | | | $ | 422.4 | | | $ | 404.1 | | | |

| Catastrophe losses | | 45.1 | | | 40.6 | | | | | 109.1 | | | 76.1 | | | |

| Prior year reserve development, post LPT years | | 1.1 | | | (0.1) | | | | | (2.6) | | | 1.2 | | | |

Adjusted losses and loss adjustment expenses (1) | | 204.0 | | | 185.0 | | | | | 528.9 | | | 481.4 | | | |

Impact of the LPT (2) | | 4.6 | | | (30.3) | | | | | 24.1 | | | (29.5) | | | |

| Total net losses and loss expenses | | 208.6 | | | 154.7 | | | | | 553.0 | | | 451.9 | | | |

| Acquisition costs | | 43.9 | | | 54.9 | | | | | 158.5 | | | 160.6 | | | |

| General and administrative expenses | | 41.2 | | | 29.7 | | | | | 113.7 | | | 88.1 | | | |

Underwriting (loss)/income (1) | | $ | (0.2) | | | $ | 52.5 | | | $ | (52.7) | | | $ | 100.1 | | | $ | 163.2 | | | $ | (63.1) | |

Adjusted underwriting income (1) | | $ | 4.4 | | | $ | 22.2 | | | | | $ | 124.2 | | | $ | 133.7 | | | |

| | | | | | | | | | | | |

| Ratios | | | | | | | | | | | | |

| Current accident year loss ratio, excluding catastrophe losses | | 53.8 | % | | 49.5 | % | | | | 45.7 | % | | 46.8 | % | | |

| Catastrophe losses | | 15.4 | | | 13.9 | | | | | 11.8 | | | 8.8 | | | |

| Current accident year loss ratio | | 69.2 | | | 63.4 | | | | | 57.5 | | | 55.6 | | | |

| Prior year reserve development ratio, post LPT years | | 0.3 | | | — | | | | | (0.3) | | | 0.1 | | | |

Adjusted loss ratio (1) | | 69.5 | | | 63.4 | | | | | 57.2 | | | 55.7 | | | |

Impact of the LPT (2) | | 1.6 | | | (10.4) | | | | | 2.6 | | | (3.4) | | | |

| Loss ratio | | 71.1 | | | 53.0 | | | | | 59.8 | | | 52.3 | | | |

| Acquisition cost ratio | | 15.0 | | | 18.8 | | | | | 17.1 | | | 18.6 | | | |

| General and administrative expense ratio | | 14.0 | | | 10.2 | | | | | 12.3 | | | 10.2 | | | |

| Combined ratio | | 100.1 | % | | 82.0 | % | | | | 89.2 | % | | 81.1 | % | | |

Adjusted combined ratio (1) | | 98.5 | % | | 92.4 | % | | | | 86.6 | % | | 84.5 | % | | |

(1) Adjusted losses and loss adjustment expenses, underwriting income, adjusted underwriting income, adjusted loss ratio and adjusted combined ratio are non-GAAP financial measures as defined in SEC Regulation G. The reconciliations to the most comparable U.S. GAAP financial measures are shown above and a discussion of the rationale for the presentation of these items is provided later in this press release. (2) Impact of the LPT includes the impact of prior year development on 2019 and prior accident years, net of the change in the deferred gain recognized in relation to retroactive reinsurance contracts as per accounting requirements for retroactive reinsurance under U.S. GAAP.

Reinsurance Segment Results

Aspen Reinsurance offers a full suite of products organized around core products in Property, Catastrophe, Other Property Reinsurance, Casualty and Specialty. Through our highly experienced underwriting teams which are supported by claims, modelling and actuarial functions, we have developed longstanding relationships with our clients and brokers. We also provide innovative solutions to risk including utilizing Aspen Capital Markets to access additional third-party capital.

During 2024, Aspen Reinsurance has continued to take advantage of market opportunities while also seeing the benefit of repositioning of property catastrophe exposures.

Reinsurance Segment Highlights for the Three Months Ended September 30, 2024

•Underwriting loss of $0.2 million with a combined ratio of 100.1%. Adjusted underwriting income decreased by $18 million to $4 million driven by significant losses incurred in the period. The adjusted combined ratio of 98.5% is 6.1 percentage points higher than prior year.

•The underwriting result was significantly impacted by catastrophe events, such as Hurricane Helene, various events in Canada and other weather related events, as well as a large loss event in relation to New Caledonia riots experienced in Property and Specialty lines. On an adjusted basis, the loss ratio was 69.5%, an increase of 6.1 percentage points.

•Gross written premiums were $49 million higher than the prior year with growth across all lines.

•The expense ratio, which includes the acquisition ratio and general and administrative expense ratio, remained flat. Increased cessions to Aspen Capital Markets structures and the newly formed vehicles resulted in higher ceding commissions in Catastrophe, Property and Casualty lines contributing to a 3.8 percentage point improvement in our acquisition cost ratio, that was offset by an increase in operating expenses due to investment in operational excellence enhancements.

Reinsurance Segment Highlights for the Nine Months Ended September 30, 2024

•Underwriting income was $100 million with a combined ratio of 89.2%. Adjusted underwriting income was $124 million with an adjusted combined ratio of 86.6%.

•Gross written premiums increased by $354 million with growth achieved across all lines, but was most prominent in Casualty and Specialty lines driven by opportunities for targeted growth through new business, growth with existing clients and favorable renewals pricing.

•Adjusted loss ratio of 57.2% deteriorated by 1.5 percentage points. The main drivers of this were catastrophe losses relating to flood events in Dubai, Baltimore bridge, Hurricane Helene and various events in Canada, partially offset by a 1.1 percentage point improvement in the current accident year ex-catastrophe loss ratio.

Investment Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (in $ millions, except percentages) | | (in $ millions, except percentages) |

| Net investment income | | $ | 79.6 | | | $ | 77.9 | | | $ | 238.9 | | | $ | 207.3 | |

Net realized and unrealized investment gains/(losses) recognized in net income (1) | | 6.1 | | | (1.8) | | | (21.0) | | | 16.2 | |

Change in unrealized gains/(losses) on available for sale investments (gross of tax) (2) | | 120.7 | | | (45.0) | | | 103.6 | | | (32.7) | |

| Total return on investments | | $ | 206.4 | | | $ | 31.1 | | | $ | 321.5 | | | $ | 190.8 | |

| | | | | | | | |

| Average cash and investments | | $ | 7,544.8 | | | $ | 7,312.9 | | | $ | 7,586.3 | | | $ | 7,168.5 | |

| | | | | | | | |

| | | | | | | | | | | | | | |

| Fixed Income Portfolio Characteristics | | As at September 30, 2024 | | As at December 31, 2023 |

| | | | |

| Book yield | | 4.1 | % | | 3.8 | % |

| Average duration | | 2.5 years | | 2.6 years |

| | | | |

(1) Includes net unrealized gains of $29.4 million and $36.2 million for the three and nine months ended September 30, 2024, respectively (three and nine months ended September 30, 2023 — $6.8 million and $28.6 million gains).

(2) The tax impact of the change in unrealized gains/(losses) on available for sale investments was an expense of $15.1 million and $13.1 million for the three and nine months ended September 30, 2024, respectively (three and nine months ended September 30, 2023 — expense of $0.2 million and $1.8 million).

•Net investment income of $80 million in the quarter and $239 million for the nine months ended September 30, 2024 increased as a result of active repositioning of our investments to take advantage of higher interest rates.

•Net realized and unrealized investment gains/(losses) recognized in net income was a gain of $6 million for the three months ended September 30, 2024. This was largely due to net unrealized gains due to market movements, partially offset by net realized losses in the quarter arising from our privately held investments as well as the active rotations of the portfolio.

•Net realized and unrealized investment gains/(losses) recognized in net income was a loss of $21 million for the nine months ended September 30, 2024. This was largely due to net realized losses arising from our privately held investments as well as the active rotations of the portfolio, partially offset by unrealized gains due to market movements.

•The positive changes in unrealized gains/(losses) on available for sale investments of $121 million in the quarter and $104 million for the nine months ended September 30, 2024 was attributable to reductions in US Treasury yields.

Shareholders’ equity

•Total shareholders’ equity was $3,023 million as of September 30, 2024, compared with $2,909 million as of December 31, 2023. We continued to generate shareholder value in the period, with net income of $238 million. Distributions to shareholders were $236 million, with ordinary share dividends of $195 million and preference share dividends of $41 million. Other comprehensive losses totaled $113 million for the period, primarily due to valuation changes related to investments classified as available for sale.

| | | | | | | | |

| | Nine Months Ended September 30, 2024 |

| | ($ in millions) |

| Shareholders’ equity at the start of the period | | $ | 2,908.5 | |

| Net income for the period | | 237.5 | |

| Dividends on ordinary shares | | (195.0) | |

| Dividends on preference shares | | (41.1) | |

| Other comprehensive income | | 113.3 | |

| Shareholders’ equity at the end of the period | | $ | 3,023.2 | |

Earnings materials

The earnings press release for the three and nine months ended September 30, 2024 will be published on Aspen’s website at www.aspen.co.

For further information please contact

Mark Pickering, Group Chief Financial Officer & Treasurer

Mark.Pickering@Aspen.co

+1 441 297 9235

Marc MacGillivray, Chief Accounting Officer

Marc.MacGillivray@Aspen.co

+44 20 7184 8455

Aspen Insurance Holdings Limited

Summary condensed consolidated balance sheet (unaudited)

$ in millions

| | | | | | | | | | | | | | |

| As at September 30, 2024 | | As at December 31, 2023 |

| | | |

| ASSETS | | | |

| Total investments | $ | 6,487.1 | | | $ | 6,412.4 | |

| Cash and cash equivalents | 1,244.9 | | | 1,028.1 | |

| Reinsurance recoverables | 5,432.3 | | | 5,311.3 | |

| Premiums receivable | 1,819.1 | | | 1,435.3 | |

| Other assets | 1,120.9 | | | 1,037.7 | |

| Total assets | | $ | 16,104.3 | | | $ | 15,224.8 | |

| | | |

| LIABILITIES | | | |

| Losses and loss adjustment expenses reserves | $ | 8,201.3 | | | $ | 7,810.6 | |

| Unearned premiums | 2,849.8 | | | 2,426.3 | |

| Other payables | 1,730.0 | | | 1,779.4 | |

| Long-term debt | 300.0 | | | 300.0 | |

| Total liabilities | $ | 13,081.1 | | | $ | 12,316.3 | |

| | | |

| SHAREHOLDERS’ EQUITY | | | |

| Ordinary shares | $ | 0.6 | | | $ | 0.6 | |

| Preference shares | 753.5 | | | 753.5 | |

| Additional paid-in capital | 761.2 | | | 761.2 | |

| Retained earnings | 1,794.9 | | | 1,793.5 | |

| Accumulated other comprehensive loss, net of tax | (287.0) | | | (400.3) | |

| Total shareholders’ equity | 3,023.2 | | | 2,908.5 | |

| Total liabilities and shareholders’ equity | $ | 16,104.3 | | | $ | 15,224.8 | |

Aspen Insurance Holdings Limited

Summary consolidated statement of income (unaudited)

$ in millions, except ratios | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| UNDERWRITING REVENUES | | | | | | | |

| Gross written premiums | $ | 1,116.8 | | | $ | 982.7 | | | $ | 3,598.6 | | | $ | 3,107.9 | |

| Premiums ceded | (443.2) | | | (354.1) | | | (1,373.0) | | | (1,128.8) | |

| Net written premiums | 673.6 | | | 628.6 | | | 2,225.6 | | | 1,979.1 | |

| Change in unearned premiums | 24.7 | | | 31.4 | | | (156.2) | | | (31.7) | |

| Net earned premiums | 698.3 | | | 660.0 | | | 2,069.4 | | | 1,947.4 | |

| UNDERWRITING EXPENSES | | | | | | | |

| Losses and loss adjustment expenses | 474.2 | | | 430.5 | | | 1,278.9 | | | 1,147.6 | |

| Acquisition costs | 91.7 | | | 94.3 | | | 290.2 | | | 287.2 | |

| General and administrative expenses | 99.4 | | | 87.3 | | | 297.5 | | | 256.3 | |

| Total underwriting expenses | 665.3 | | | 612.1 | | | 1,866.6 | | | 1,691.1 | |

| | | | | | | |

| Underwriting income | 33.0 | | | 47.9 | | | 202.8 | | | 256.3 | |

| | | | | | | |

| Net investment income | 79.6 | | | 77.9 | | | 238.9 | | | 207.3 | |

Interest (expense)/income (1) | (20.9) | | | 1.8 | | | (51.0) | | | (41.1) | |

Corporate and other expenses (2) | (18.6) | | | (32.6) | | | (83.3) | | | (85.7) | |

| | | | | | | |

| | | | | | | | |

Non-operating expenses (3) | (7.6) | | | (0.2) | | | (19.3) | | | (10.8) | |

Net realized and unrealized foreign exchange (losses)/gains (4) | (8.5) | | | (1.5) | | | 2.5 | | | 4.4 | |

| Net realized and unrealized investment gains/(losses) | 6.1 | | | (1.8) | | | (21.0) | | | 16.2 | |

| INCOME BEFORE TAX | 63.1 | | | 91.5 | | | 269.6 | | | 346.6 | |

| Income tax (expense) | (6.4) | | | (5.2) | | | (32.1) | | | (41.4) | |

| NET INCOME | 56.7 | | | 86.3 | | | 237.5 | | | 305.2 | |

| Dividends paid on preference shares | (13.8) | | | (13.8) | | | (41.1) | | | (36.0) | |

| Net income available to Aspen Insurance Holdings Limited’s ordinary shareholders | $ | 42.9 | | | $ | 72.5 | | | $ | 196.4 | | | $ | 269.2 | |

| | | | | | | |

| Loss ratio | 67.9 | % | | 65.2 | % | | 61.8 | % | | 58.9 | % |

| Acquisition cost ratio | 13.1 | % | | 14.3 | % | | 14.0 | % | | 14.7 | % |

| General and administrative expense ratio | 14.2 | % | | 13.2 | % | | 14.4 | % | | 13.2 | % |

| Expense ratio | 27.3 | % | | 27.5 | % | | 28.4 | % | | 27.9 | % |

| Combined ratio | 95.2 | % | | 92.7 | % | | 90.2 | % | | 86.8 | % |

Adjusted combined ratio (5) | 91.5 | % | | 91.7 | % | | 88.2 | % | | 87.1 | % |

(1) Interest expense includes interest on funds withheld balances related to the LPT contract.

(2) Corporate and other expenses includes other income/(expenses), which were previously presented separately.

(3) Non-operating expenses in the three and nine months ended September 30, 2024 and September 30, 2023 includes expenses in relation to consulting fees, transformation activities, and other non-recurring costs.

(4) Includes the net realized and unrealized gains/(losses) from foreign exchange contracts.

(5) Adjusted combined ratio removes the impact of the change in deferred gain on retroactive reinsurance contracts in order to match the loss recoveries under the LPT contract. Adjusted combined ratio represents the performance of our business for accident years 2020 onwards, which we believe better reflects the underlying underwriting performance of the ongoing portfolio.

Aspen Insurance Holdings Limited

Summary consolidated segment information (unaudited)

$ in millions, except ratios

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 | | Three Months Ended September 30, 2023 | | |

| Reinsurance | | Insurance | | Total | | Reinsurance | | Insurance | | Total | | | | |

| | | | | | | | | | | | | | | |

Gross written premiums | $ | 416.2 | | | $ | 700.6 | | | $ | 1,116.8 | | | $ | 367.5 | | | $ | 615.2 | | | $ | 982.7 | | | | | |

Net written premiums | 263.7 | | | 409.9 | | | 673.6 | | | 261.2 | | | 367.4 | | | 628.6 | | | | | |

Gross earned premiums | 449.7 | | | 652.5 | | | 1,102.2 | | | 403.1 | | | 618.1 | | | 1,021.2 | | | | | |

Net earned premiums | 293.5 | | | 404.8 | | | 698.3 | | | 291.8 | | | 368.2 | | | 660.0 | | | | | |

Losses and loss adjustment expenses | 208.6 | | | 265.6 | | | 474.2 | | | 154.7 | | | 275.8 | | | 430.5 | | | | | |

Acquisition costs | 43.9 | | | 47.8 | | | 91.7 | | | 54.9 | | | 39.4 | | | 94.3 | | | | | |

General and administrative expenses | 41.2 | | | 58.2 | | | 99.4 | | | 29.7 | | | 57.6 | | | 87.3 | | | | | |

Underwriting (loss)/income | $ | (0.2) | | | $ | 33.2 | | | $ | 33.0 | | | $ | 52.5 | | | $ | (4.6) | | | $ | 47.9 | | | | | |

| | | | | | | | | | | | | | | |

| Net investment income | | | | | 79.6 | | | | | | | 77.9 | | | | | |

| Net realized and unrealized investment gains/(losses) | | 6.1 | | | | | | | (1.8) | | | | | |

Corporate and other expenses (1) | | | | | (18.6) | | | | | | | (32.6) | | | | | |

Non-operating expenses (2) | | | | (7.6) | | | | | | | (0.2) | | | | | |

Interest (expense)/income (3) | | | | | (20.9) | | | | | | | 1.8 | | | | | |

Net realized and unrealized foreign exchange losses (4) | | (8.5) | | | | | | | (1.5) | | | | | |

Income before tax | | | | | 63.1 | | | | | | | 91.5 | | | | | |

| Income tax (expense) | | | | | (6.4) | | | | | | | (5.2) | | | | | |

Net income | | | | | $ | 56.7 | | | | | | | $ | 86.3 | | | | | |

| | | | | | | | | | | | | | | | |

Ratios | | | | | | | | | | | | | | | |

Loss ratio | 71.1 | % | | 65.6 | % | | 67.9 | % | | 53.0 | % | | 74.9 | % | | 65.2 | % | | | | |

| Acquisition cost ratio | 15.0 | % | | 11.8 | % | | 13.1 | % | | 18.8 | % | | 10.7 | % | | 14.3 | % | | | | |

| General and administrative expense ratio | 14.0 | % | | 14.4 | % | | 14.2 | % | | 10.2 | % | | 15.6 | % | | 13.2 | % | | | | |

Expense ratio | 29.0 | % | | 26.2 | % | | 27.3 | % | | 29.0 | % | | 26.3 | % | | 27.5 | % | | | | |

Combined ratio | 100.1 | % | | 91.8 | % | | 95.2 | % | | 82.0 | % | | 101.2 | % | | 92.7 | % | | | | |

Adjusted combined ratio (5) | 98.5 | % | | 86.3 | % | | 91.5 | % | | 92.4 | % | | 91.2 | % | | 91.7 | % | | | | |

(1) Corporate and other expenses includes other income/(expenses), which were previously presented separately.

(2) Non-operating expenses in the three months ended September 30, 2024 and September 30, 2023 includes expenses in relation to consulting fees, transformation activities, and other non-recurring costs.

(3) Interest expense includes interest on funds withheld balances related to the LPT contract.

(4) Includes the net realized and unrealized gains/(losses) from foreign exchange contracts.

(5) Adjusted combined ratio removes the impact of the change in deferred gain on retroactive reinsurance contracts in order to match the loss recoveries under the LPT contracts. Adjusted combined ratio represents the performance of our business for accident years 2020 onwards, which we believe better reflects the underlying underwriting performance of the ongoing portfolio.

Aspen Insurance Holdings Limited

Summary consolidated segment information (unaudited)

$ in millions, except ratios

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2024 | | Nine Months Ended September 30, 2023 | | |

| Reinsurance | | Insurance | | Total | | Reinsurance | | Insurance | | Total | | | | |

| | | | | | | | | | | | | | | |

Gross written premiums | $ | 1,596.8 | | | $ | 2,001.8 | | | $ | 3,598.6 | | | $ | 1,243.2 | | | $ | 1,864.7 | | | $ | 3,107.9 | | | | | |

Net written premiums | 1,052.0 | | | 1,173.6 | | | 2,225.6 | | | 866.2 | | | 1,112.9 | | | 1,979.1 | | | | | |

Gross earned premiums | 1,298.2 | | | 1,876.2 | | | 3,174.4 | | | 1,158.8 | | | 1,821.7 | | | 2,980.5 | | | | | |

Net earned premiums | 925.3 | | | 1,144.1 | | | 2,069.4 | | | 863.8 | | | 1,083.6 | | | 1,947.4 | | | | | |

Losses and loss adjustment expenses | 553.0 | | | 725.9 | | | 1,278.9 | | | 451.9 | | | 695.7 | | | 1,147.6 | | | | | |

Acquisition costs | 158.5 | | | 131.7 | | | 290.2 | | | 160.6 | | | 126.6 | | | 287.2 | | | | | |

General and administrative expenses | 113.7 | | | 183.8 | | | 297.5 | | | 88.1 | | | 168.2 | | | 256.3 | | | | | |

Underwriting income | $ | 100.1 | | | $ | 102.7 | | | $ | 202.8 | | | $ | 163.2 | | | $ | 93.1 | | | $ | 256.3 | | | | | |

| | | | | | | | | | | | | | | |

| Net investment income | | | | | 238.9 | | | | | | | 207.3 | | | | | |

| Net realized and unrealized investment (losses)/gains | | (21.0) | | | | | | | 16.2 | | | | | |

Corporate and other expenses (1) | | | | | (83.3) | | | | | | | (85.7) | | | | | |

Non-operating expenses (2) | | | | (19.3) | | | | | | | (10.8) | | | | | |

Interest expense (3) | | | | | (51.0) | | | | | | | (41.1) | | | | | |

Net realized and unrealized foreign exchange gains (4) | | 2.5 | | | | | | | 4.4 | | | | | |

Income before tax | | | | | 269.6 | | | | | | | 346.6 | | | | | |

| Income tax (expense) | | | | | (32.1) | | | | | | | (41.4) | | | | | |

Net income | | | | | $ | 237.5 | | | | | | | $ | 305.2 | | | | | |

| | | | | | | | | | | | | | | | |

Ratios | | | | | | | | | | | | | | | |

Loss ratio | 59.8 | % | | 63.4 | % | | 61.8 | % | | 52.3 | % | | 64.2 | % | | 58.9 | % | | | | |

| Acquisition cost ratio | 17.1 | % | | 11.5 | % | | 14.0 | % | | 18.6 | % | | 11.7 | % | | 14.7 | % | | | | |

| General and administrative expense ratio | 12.3 | % | | 16.1 | % | | 14.4 | % | | 10.2 | % | | 15.5 | % | | 13.2 | % | | | | |

Expense ratio | 29.4 | % | | 27.6 | % | | 28.4 | % | | 28.8 | % | | 27.2 | % | | 27.9 | % | | | | |

Combined ratio | 89.2 | % | | 91.0 | % | | 90.2 | % | | 81.1 | % | | 91.4 | % | | 86.8 | % | | | | |

Adjusted combined ratio (5) | 86.6 | % | | 89.5 | % | | 88.2 | % | | 84.5 | % | | 89.2 | % | | 87.1 | % | | | | |

(1) Corporate and other expenses includes other income/expenses, which were previously presented separately.

(2) Non-operating expenses in the nine months ended September 30, 2024 and September 30, 2023 includes expenses in relation to consulting fees, transformation activities, and other non-recurring costs.

(3) Interest expense includes interest on funds withheld balances related to the LPT contract.

(4) Includes the net realized and unrealized gains from foreign exchange contracts.

(5) Adjusted combined ratio removes the impact of the change in deferred gain on retroactive reinsurance contracts in order to match the loss recoveries under the LPT contracts. Adjusted combined ratio represents the performance of our business for accident years 2020 onwards, which we believe better reflects the underlying underwriting performance of the ongoing portfolio.

About Aspen Insurance Holdings Limited (“Aspen” or the “Company”)

Aspen provides insurance and reinsurance coverage to clients in various domestic and global markets through wholly-owned operating subsidiaries in Bermuda, the United States and the United Kingdom, as well as its branch operations in Canada, Singapore and Switzerland. For the year ended December 31, 2023, Aspen reported $15.2 billion in total assets, $7.8 billion in gross loss reserves, $2.9 billion in total shareholders’ equity and $4.0 billion in gross written premiums. Aspen's operating subsidiaries have been assigned a rating of “A-” by Standard & Poor’s Financial Services LLC and an “A” (“Excellent”) by A.M. Best Company Inc. For more information about Aspen, please visit www.aspen.co.

Please refer to the “Financials – Annual Reports” section of Aspen’s investor website for a copy of our Annual Report on Form 20-F.

(1) Cautionary Statement Regarding Forward-Looking Statements

This press release or any other written or oral statements made by or on behalf of the Company may contain written “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are made pursuant to the “safe harbor” provisions of The Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts. In particular, statements using the words such as “expect,” “intend,” “plan,” “believe,” “aim,” “project,” “anticipate,” “seek,” “will,” “likely,” “assume,” “estimate,” “may,” “continue,” “guidance,” “objective,” “outlook,” “trends,” “future,” “could,” “would,” “should,” “target,” “predict,” “potential,” “on track” or their negatives or variations and similar terminology and words of similar import generally involve forward-looking statements.

All forward-looking statements rely on a number of assumptions, estimates and data concerning future results and events and that are subject to a number of uncertainties, assumptions and other factors, many of which are outside Aspen’s control that could cause actual results to differ materially from such forward-looking statements. Accordingly, there are important factors that could cause our actual results to differ materially from those anticipated in the forward-looking statements, including, but not limited to, our exposure to weather-related natural disasters and other catastrophes, the direct and indirect impact of global climate change, our relationship with, and reliance upon, a limited number of brokers for both our insurance and reinsurance business, the impact of inflation, our exposure to credit, currency, interest and others risks within our investment portfolio, the cyclical nature of the insurance and reinsurance industry, the occurrence, timing and results of, and market reaction to, our proposed initial public offering and proposed listing of our ordinary shares on the New York Stock Exchange and many other factors. For a detailed description of these uncertainties and other factors that could impact the forward-looking statements in this press release and other communications issued by or on behalf of Aspen, please see the “Risk Factors” section in Aspen’s Annual Report on Form 20-F for the twelve months ended December 31, 2023, as filed with the SEC, which should be deemed incorporated herein.

The inclusion of forward-looking statements in this press release or any other communication should not be considered as a representation by Aspen that current plans or expectations will be achieved. Aspen undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Basis of Preparation

Aspen has prepared the financial information contained within this financial results press release in accordance with the principles of U.S. Generally Accepted Accounting Principles (“GAAP”).

Non-GAAP Financial Measures

In presenting Aspen’s results, management has included and discussed certain measurements that are considered “non-GAAP financial measures” under SEC rules and regulations. Management believes that these non-GAAP financial measures, which may be defined differently by other companies, help explain and enhance the understanding of Aspen’s results of operations. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP.

Operating income is a non-GAAP financial measure. Operating income is an internal performance measure used by Aspen in the management of its operations and represents after-tax operating results. Operating income includes an adjustment for the change in deferred gain on retroactive reinsurance contracts in order to economically match the loss recoveries under the loss portfolio transfer (“LPT”) contract with the underlying loss development of the assumed net loss reserves for the subject business of 2019 and prior accident years. Operating income also excludes certain costs related to the LPT contract with a subsidiary of Enstar Group Limited, net foreign exchange gains or losses, net realized and unrealized gains and losses from foreign exchange contracts, net realized and unrealized gains or losses on investments and non-operating expenses and income.

Aspen excludes these items above from its calculation of operating income because management believes they are not reflective of underlying performance or the amount of these gains or losses is heavily influenced by, and fluctuates according to, prevailing investment market and interest rate movements. Aspen believes these amounts are either largely independent of its business and underwriting process, not aligned with the economics of transactions undertaken, or including them would distort the analysis of trends in its operations. In addition to presenting net income determined in accordance with GAAP, Aspen believes that showing operating income enables users of its financial information to analyze Aspen's results of operations in a manner consistent with how management analyzes Aspen's underlying business performance. Operating income should not be viewed as a substitute for GAAP net income.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended, | | Nine Months Ended, |

| (in $ millions) | | September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net income available to Aspen Insurance Holdings Limited’s ordinary shareholders | | $ | 42.9 | | | $ | 72.5 | | | $ | 196.4 | | | $ | 269.2 | |

| Add/(deduct) items before tax | | | | | | | | |

| Net foreign exchange losses/(gains) | | 8.5 | | | 1.5 | | | (2.5) | | | (4.4) | |

| Net realized and unrealized investment (gains)/losses | | (6.1) | | | 1.8 | | | 21.0 | | | (16.2) | |

| | | | | | | | | |

| Non-operating expenses | | 7.6 | | | 0.2 | | | 19.3 | | | 10.8 | |

| Impact of the LPT, net of certain costs related to the LPT contract with Enstar | | 39.5 | | | 3.9 | | | 66.0 | | | 10.7 | |

| Non-operating income tax (benefit) | | (5.9) | | | (1.0) | | | (12.7) | | | (0.1) | |

| Operating income | | $ | 86.5 | | | $ | 78.9 | | | $ | 287.5 | | | $ | 270.0 | |

Underwriting result or income/loss is a non-GAAP financial measure. Income or loss for each of the business segments is measured by underwriting income or loss. Underwriting income or loss is the excess of net earned premiums over the underwriting expenses. Underwriting expenses are the sum of losses and loss adjustment expenses, acquisition costs and general and administrative expenses. Underwriting income or loss provides a basis for management to evaluate the segment’s underwriting performance.

Adjusted underwriting income or loss is a non-GAAP financial measure. It is the underwriting profit or loss adjusted for the change in deferred gain on retroactive reinsurance contracts in order to economically match the loss recoveries under the LPT with the underlying loss development of the assumed net loss reserves for the subject business of 2019 and prior accident years. Adjusted underwriting income or loss represents the performance of our business for accident years 2020 onwards, which management believe reflects the underlying underwriting performance of the ongoing portfolio.

Book yield is a non-GAAP financial measure. Book yield is the yield of the security after adjusting for accretion/amortization of the difference between par value and purchase price.

Combined ratio is the sum of the loss ratio and the expense ratio. The loss ratio is calculated by dividing losses and loss adjustment expenses by net earned premiums. The expense ratio is calculated by dividing the sum of acquisition costs and general and administrative expenses, by net earned premiums.

Adjusted combined ratio is a non-GAAP financial measure. It is the sum of the adjusted loss ratio and the expense ratio. The adjusted loss ratio is calculated by dividing the adjusted losses and loss adjustment expenses by net earned premiums. The expense ratio is calculated by dividing the sum of acquisition costs and general and administrative expenses, by net earned premium.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Underwriting Income, Adjusted Underwriting Income and Adjusted Combined Ratio | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in $ millions except where stated) | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Net earned premium | | $ | 698.3 | | | $ | 660.0 | | | $ | 2,069.4 | | | $ | 1,947.4 | |

| | | | | | | | |

| Current accident year net losses and loss expenses | | 387.5 | | | 358.0 | | | 1,103.8 | | | 1,028.1 | |

| Catastrophe losses | | 54.8 | | | 55.6 | | | 135.4 | | | 109.0 | |

| Prior year reserve development, post LPT years | | 5.2 | | | 10.3 | | | (2.0) | | | 16.3 | |

| Adjusted losses and loss adjustment expenses | | 447.5 | | | 423.9 | | | 1,237.2 | | | 1,153.4 | |

Impact of the LPT1 | | 26.7 | | | 6.6 | | | 41.7 | | | (5.8) | |

| Losses and loss adjustment expenses | | 474.2 | | | 430.5 | | | 1,278.9 | | | 1,147.6 | |

| Acquisition costs | | 91.7 | | | 94.3 | | | 290.2 | | | 287.2 | |

| General and administrative expenses | | 99.4 | | | 87.3 | | | 297.5 | | | 256.3 | |

| Underwriting expenses | | $ | 665.3 | | | $ | 612.1 | | | $ | 1,866.6 | | | $ | 1,691.1 | |

| | | | | | | | |

| Underwriting income | | $ | 33.0 | | | $ | 47.9 | | | $ | 202.8 | | | $ | 256.3 | |

| | | | | | | | |

| Combined ratio | | 95.2 | % | | 92.7 | % | | 90.2 | % | | 86.8 | % |

| | | | | | | | |

| Adjusted underwriting income | | $ | 59.7 | | | $ | 54.5 | | | $ | 244.5 | | | $ | 250.5 | |

| Adjusted combined ratio | | 91.5 | % | | 91.7 | % | | 88.2 | % | | 87.1 | % |

(1) Impact of the LPT represents the deferral of a portion of loss recoveries on 2019 and prior accident year loss development as per accounting requirements for retroactive reinsurance under U.S. GAAP.

Operating return on average equity is calculated by taking the operating income/(loss) after tax, less dividends paid on preference shares and divided by average equity attributable to ordinary shareholders.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| | | ($ in millions) | | ($ in millions) |

| Total shareholders’ equity | | $ | 3,023.2 | | | $ | 2,535.1 | | | $ | 3,023.2 | | | $ | 2,535.1 | |

| Preference shares less issue expenses | | (753.5) | | | (753.5) | | | (753.5) | | | (753.5) | |

| Average adjustment | | (76.5) | | | 6.8 | | | (85.7) | | | (46.9) | |

| Average ordinary shareholder’s equity | | $ | 2,193.2 | | | $ | 1,788.4 | | | $ | 2,184.0 | | | $ | 1,734.7 | |

| | | | | | | | |

| Operating Income | | $ | 86.5 | | | $ | 78.9 | | | $ | 287.5 | | | $ | 270.0 | |

| | | | | | | | |

| Annualized operating return on average equity | | 15.8 | % | | 17.6 | % | | 17.6 | % | | 20.8 | % |

| Annualized net income available to ordinary shareholders on average equity | | 7.8 | % | | 16.4 | % | | 12.0 | % | | 20.7 | % |

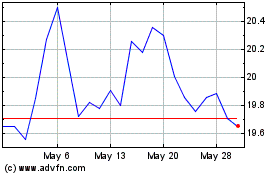

Aspen Insurance (NYSE:AHL-D)

Historical Stock Chart

From Oct 2024 to Nov 2024

Aspen Insurance (NYSE:AHL-D)

Historical Stock Chart

From Nov 2023 to Nov 2024