Company Delivers on 2024 Financial

Outlook Board Approves New $500 Million Share Repurchase

Program in Early November

FISCAL 2024 YEAR-OVER-YEAR SUMMARY

- Revenue +8%; Organic Revenue +10%

- Represented highest annual revenue in Global FSS history

- Driven by base business volume, pricing, and net new

business

- Operating Income +13%1; Adjusted Operating Income (AOI)

+20%2

- Record AOI in both FSS U.S. and International segments for any

fiscal year

- Operating Income Margin +20 bps; AOI margin +50 bps2

- GAAP EPS (42)%1 to $0.99; Adjusted EPS +35%2 to $1.55

- Results reflected execution on profitable growth strategies

across organization

- GAAP EPS in the prior year included a gain from the sale of

noncontrolling interest in AIM Services

- Strong Cash Flow Contributed to +50 bps Improvement in

Leverage Ratio

- Net cash from operations +42%1; Free Cash Flow +121%; Over $2.6

billion of cash availability

- Sold remaining portion of ownership stake in San Antonio Spurs

NBA franchise

Q4 YEAR-OVER-YEAR SUMMARY

- Revenue +5%; Organic Revenue +7%

- Record revenue in a fourth quarter for both FSS U.S. and

International segments

- Operating Income +2%1; Adjusted Operating Income (AOI)

+8%2

- Increased profitability from revenue growth, cost discipline,

and supply chain efficiencies

- GAAP EPS +12%1 to $0.46; Adjusted EPS +14%2 to

$0.54

FOLLOWING FISCAL 2024 YEAR-END

- Authorized $500 Million Share Repurchase Program; Raised

Quarterly Dividend by 11%

- Demonstrates strong confidence in the business and the

significant growth opportunities ahead

Aramark (NYSE: ARMK) today reported results for the full year of

fiscal 2024.

“We reached new highs in our financial performance every quarter

during fiscal 2024, ultimately achieving record revenue and AOI

profitability for any year in Global FSS history,” said John

Zillmer, Aramark’s Chief Executive Officer. “Aramark’s results are

a testament to what our teams are capable of—continuously raising

the bar and challenging ourselves across the organization to

deliver for our stakeholders.”

“As part of this commitment, our Board has approved a new $500

million share repurchase program, reflecting our strong capital

structure capabilities, which include 1) strategically investing to

drive growth; 2) ongoing debt repayment; 3) issuing quarterly

dividends; and 4) now utilizing excess cash generation to

repurchase Aramark shares. I’m proud of what we’ve accomplished

this past year at the Company and believe we have tremendous runway

in the business.”

1

Operating Income, Operating

Income Margin, GAAP EPS, and Net cash provided by operating

activities reported on a continuing operations basis

2

On a constant-currency basis;

Adjusted EPS excludes the interest expense, net of tax, recorded

during fiscal 2023 on the $1.5 billion Senior Notes due 2025 that

were repaid in the current year

FISCAL 2024 SUMMARY

Consolidated revenue was $17.4 billion, an increase of 8%

year-over-year, as a result of record base business volume,

pricing, and net new business growth. The effect of currency

translation reduced revenue by $275 million.

Organic revenue grew 10% compared to the prior year period.

Revenue

FY24

FY23

Change (%)

Organic Revenue

Change (%)

FSS United States

$12,577M

$11,721M

7%

7%

FSS International

$4,824M

$4,362M

11%

17%

Total Company

$17,401M

$16,083M

8%

10%

Difference between Change (%) and

Organic Revenue Change (%) reflects the effect of currency

translation

May not total due to rounding

Operating income increased 13% year-over-year to $707 million

and AOI grew 20%2 to $882 million, which represented an operating

margin increase of 20 basis points and AOI margin expansion of 50

basis points2 year-over-year. Profitability growth was from higher

base business volume and net new business, operational cost

discipline across the portfolio, supply chain optimization, and

favorable inflation trends. The effect of currency translation

reduced operating income by $11 million.

Operating Income

Adjusted Operating Income

(AOI)

FY24

FY23

Change (%)

FY24

FY23

Change (%)

Constant

Currency

Change (%)

FSS United States

$660M

$650M

2%

$774M

$682M

13%

14%

FSS International

$187M

$114M

64%

$219M

$176M

24%

30%

Corporate

($141M)

($139M)

(1)%

($111M)

($115M)

4%

4%

Total Company

$707M

$625M

13%

$882M

$743M

19%

20%

May not total due to rounding

The Company's earnings per share in fiscal 2024 was $0.99,

compared to $1.71 in fiscal 2023. Prior year earnings per share

included a gain from the sale of Aramark's noncontrolling interest

in AIM Services. Adjusted earnings per share increased 35%2 to

$1.55, led by the ongoing focus and execution of the Company's

profitable growth strategies across the organization.

FOURTH QUARTER RESULTS

Consolidated revenue was $4.4 billion in the fourth quarter, a 5%

increase year-over-year, largely driven by strong base business

from volume across both segments with pricing normalizing from

favorable inflation trends, particularly in Education. The effect

of currency translation reduced revenue by $72 million.

Organic revenue grew 7% year-over-year.

Revenue

Q4 '24

Q4 '23

Change (%)

Organic Revenue

Change (%)

FSS United States

$3,176M

$3,067M

4%

4%

FSS International

$1,241M

$1,134M

9%

16%

Total Company

$4,417M

$4,200M

5%

7%

Difference between Change (%) and

Organic Revenue Change (%) reflects the effect of currency

translation

May not total due to rounding

- FSS United States revenue growth was led by 1) Sports &

Entertainment from higher per capita spending and strong fan

attendance levels in stadiums; 2) Business & Industry as a

result of increased participation rates and new client wins; and 3)

retail expansion in Corrections, including micro-markets—which more

than offset the exit of some lower margin accounts within

Facilities.

- FSS International revenue growth was broad-based across

geographies, particularly in the U.K., Germany, Canada, and South

America. Top performing industries included Business &

Industry, Sports & Entertainment, and Extractive Services.

Revenue on a GAAP basis reflected the effect of currency

translation as referenced above.

In the fourth quarter, operating income increased 2%

year-over-year to $219 million, and AOI grew 8%2 to $271 million.

Increased profitability was primarily due to higher revenue levels,

cost discipline, and supply chain efficiencies. The prior year

quarter included $17 million of income from proceeds associated

with possessory interest at a Destinations site. The effect of

currency translation reduced operating income by $3 million.

Operating Income

Adjusted Operating Income

(AOI)

Q4 '24

Q4 '23

Change (%)

Q4 '24

Q4 '23

Change (%)

Constant

Currency

Change (%)

FSS United States

$201M

$217M

(7)%

$241M

$229M

5%

5%

FSS International

$46M

$41M

12%

$58M

$52M

10%

16%

Corporate

($28M)

($43M)

34%

($27M)

($28M)

4%

4%

Total Company

$219M

$215M

2%

$271M

$253M

7%

8%

May not total due to rounding

Year-over-year profitability resulted from the following segment

performance:

- FSS United States was driven by higher base business volume,

operational cost management, and supply chain productivity

initiatives across the sectors, which more than offset prior year

income at a Destinations site referenced above. Excluding this

item, FSS United States would have experienced double-digit AOI

growth. Operating income in the current year also reflected a

non-cash inventory adjustment based on expected usage for certain

products within the Corrections business.

- FSS International benefited from increased revenue, disciplined

management of operating costs, and supply chain efficiencies,

partially offset from higher incentive-based compensation.

- Corporate expenses were lower from tight control of above-unit

overhead costs.

CASH FLOW AND CAPITAL

STRUCTURE Net cash provided by operating activities

increased 42% to $727 million in fiscal 2024, and Free Cash Flow

was higher by 121% to $323 million. The year-over-year improvement

was led by higher cash from operations and favorable working

capital.

In the fourth quarter, the Company had a significant source of

cash driven by the Collegiate Hospitality business, consistent with

Aramark's historical seasonality.

Net cash from investing activities in the current year included

proceeds from the sale of the Company's remaining portion of its

ownership stake in the San Antonio Spurs NBA franchise.

As a result of the cash flow performance, higher earnings, and

over $1.6 billion of net debt reduction versus prior year-end,

Aramark's leverage ratio improved 50 basis points year-over-year to

3.4x at the end of September 2024.

At fiscal year-end, the Company had over $2.6 billion in cash

availability.

DIVIDEND DECLARATION

Aramark's Board of Directors approved an 11% increase to the

quarterly dividend. The dividend of $0.105 cents per share of

common stock will be payable on December 12, 2024, to stockholders

of record at the close of business on December 2, 2024.

BUSINESS UPDATE AND SHARE REPURCHASE

PROGRAM During fiscal 2024, the Company drove strong

financial performance through double-digit organic revenue growth,

higher profitability, and margin expansion, as well as a

strengthened balance sheet with considerable financial

flexibility.

Aramark experienced significant annualized gross new business

wins totaling more than $1.4 billion, representing 9% of prior year

revenue—the best year ever for Global FSS. Facilities recently

exited some lower margin accounts within FSS United States, which

contributed to an overall retention level of 93.2%. Aramark's core

Foodservice business in both the United States and International

achieved retention of 95.2% in the fiscal year.

The Company's new business pipeline across the organization

remains substantial, including in first-time outsourcing. Aramark

remains confident in the ability to achieve its Net New target of

4% to 5% of prior year revenue—with retention levels above 95%—in

fiscal 2025 and beyond.

Share Repurchase Program As a result of Aramark’s

growing, predictable cash flow and enhanced financial flexibility,

including significant progress in reducing the Company's leverage

ratio, Aramark's Board of Directors approved a newly created share

repurchase program. The Company is authorized to repurchase up to

$500 million of its outstanding common stock—demonstrating strong

confidence in the business and the significant growth opportunities

ahead. The share repurchase program does not have a fixed

expiration date, providing Aramark with the flexibility to

repurchase shares at opportune times.

Under the share repurchase program, repurchases can be made from

time to time using a variety of methods, including open market

purchases, privately negotiated transactions, accelerated share

repurchases and Rule 10b5-1 trading plans. The size and timing of

any repurchases will depend on a number of factors, including share

price, general business and market conditions and other

factors.

OUTLOOK The Company provides

its expectations for organic revenue growth, Adjusted Operating

Income growth (constant currency), Adjusted Earnings per Share

growth (constant currency) and Net Debt to Covenant Adjusted EBITDA

("Leverage Ratio") on a non-GAAP basis, and does not provide a

reconciliation of such forward-looking non-GAAP measures to GAAP

due to the inherent difficulty in forecasting and quantifying

certain amounts that are necessary for such reconciliations,

including adjustments that could be made for the effect of currency

translation. The fiscal 2025 outlook reflects management's current

assumptions regarding numerous evolving factors that are difficult

to accurately predict, including those discussed in the Risk

Factors set forth in the Company's filings with the United States

Securities and Exchange Commission.

Aramark currently anticipates its full-year financial

performance for fiscal 2025 as follows:

($ in millions, except EPS)

FY24

FY25* Outlook

Reference Point

Year-over-year

Growth1

Organic Revenue

$17,401

+7.5%

—

+9.5%

Adjusted Operating

Income

$882

+15%

—

+18%

Adjusted EPS

$1.55

+23%

—

+28%

Leverage Ratio

3.4x

~3.0x

Adjusted EPS Outlook does not

include benefit from potential share repurchases

* 53 week year

1Constant Currency, except

Leverage Ratio

“As we enter fiscal 2025, we continue to take the steps

necessary to reach and surpass new levels of financial

performance,” Zillmer added. “Our teams have laid the groundwork to

create significant new business and value-creating opportunities,

and we are confident in our ability to deliver on them.”

CONFERENCE CALL SCHEDULED

The Company has scheduled a conference call at 8:30 a.m. ET today

to discuss its earnings and outlook. This call and related

materials can be heard and reviewed, either live or on a delayed

basis, on the Company's website, www.aramark.com, on the investor

relations page.

About Aramark Aramark (NYSE:

ARMK) proudly serves the world’s leading educational institutions,

Fortune 500 companies, world champion sports teams, prominent

healthcare providers, iconic destinations and cultural attractions,

and numerous municipalities in 16 countries around the world with

food and facilities management. Because of our hospitality culture,

our employees strive to do great things for each other, our

partners, our communities, and the planet. Aramark has been

recognized on FORTUNE’s list of “World’s Most Admired Companies,”

The Civic 50 by Points of Light 2024, Fair360’s “Top 50 Companies

for Diversity” and “Top Companies for Black Executives,” Newsweek’s

list of “America’s Most Responsible Companies 2024,” the HRC’s

“Best Places to Work for LGBTQ Equality,” and earned a score of 100

on the Disability Equality Index. Learn more at www.aramark.com and

connect with us on LinkedIn, Facebook, X, and Instagram.

Selected Operational

and Financial Metrics

Adjusted Revenue (Organic)

Adjusted Revenue (Organic) represents revenue, adjusted to

eliminate the impact of currency translation.

Adjusted Operating Income

Adjusted Operating Income represents operating income adjusted to

eliminate the change in amortization of acquisition-related

intangible assets; severance and other charges; spin-off related

charges and other items impacting comparability.

Adjusted Operating Income (Constant

Currency) Adjusted Operating Income (Constant Currency)

represents Adjusted Operating Income adjusted to eliminate the

impact of currency translation.

Adjusted Net Income Adjusted

Net Income represents net income from continuing operations

attributable to Aramark stockholders adjusted to eliminate the

change in amortization of acquisition-related intangible assets;

severance and other charges; spin-off related charges; gain on sale

of equity investments, net; the effect of debt repayments,

repricings and other on interest expense, net, and other items

impacting comparability, less the tax impact of these adjustments.

The tax effect for Adjusted Net Income for our United States

earnings is calculated using a blended United States federal and

state tax rate. The tax effect for Adjusted Net Income in

jurisdictions outside the United States is calculated at the local

country tax rate.

Adjusted Net Income (Constant

Currency), Net of Interest Adjustment Adjusted Net

Income (Constant Currency), Net of Interest Adjustment represents

Adjusted Net Income adjusted to eliminate the impact of currency

translation and interest expense, net of tax, recorded during

fiscal 2023 on the $1.5 billion Senior Notes due 2025 that were

repaid in the current year.

Adjusted EPS Adjusted EPS

represents Adjusted Net Income divided by diluted weighted average

shares outstanding.

Adjusted EPS (Constant

Currency) Adjusted EPS (Constant Currency) represents

Adjusted EPS adjusted to eliminate the impact of currency

translation and interest expense, net of tax, recorded during

fiscal 2023 on the $1.5 billion Senior Notes due 2025 that were

repaid in the current year.

Covenant Adjusted EBITDA

Covenant Adjusted EBITDA represents net income attributable to

Aramark stockholders adjusted for interest expense, net; provision

for income taxes; depreciation and amortization and certain other

items as defined in our debt agreements required in calculating

covenant ratios and debt compliance. We also use Net Debt for our

ratio to Covenant Adjusted EBITDA, which is calculated as total

long-term borrowings less cash and cash equivalents and short-term

marketable securities.

Free Cash Flow Free Cash

Flow represents net cash provided by (used in) operating activities

of continuing operations less net purchases of property and

equipment and other. Management believes that the presentation of

free cash flow provides useful information to investors because it

represents a measure of cash flow available for distribution among

all the security holders of the Company.

We use Adjusted Revenue (Organic), Adjusted Operating Income

(including on a constant currency basis), Adjusted Net Income

(including on a constant currency basis, net of interest

adjustment), Adjusted EPS (including on a constant currency basis),

Covenant Adjusted EBITDA and Free Cash Flow as supplemental

measures of our operating profitability and to control our cash

operating costs. We believe these financial measures are useful to

investors because they enable better comparisons of our historical

results and allow our investors to evaluate our performance based

on the same metrics that we use to evaluate our performance and

trends in our results. These financial metrics are not measurements

of financial performance under generally accepted accounting

principles, or GAAP. Our presentation of these metrics has

limitations as an analytical tool and should not be considered in

isolation or as a substitute for analysis of our results as

reported under GAAP. You should not consider these measures as

alternatives to revenue, operating income, net income, earnings per

share or net cash provided by (used in) operating activities of

continuing operations, determined in accordance with GAAP. Adjusted

Revenue (Organic), Adjusted Operating Income, Adjusted Net Income,

Adjusted EPS, Covenant Adjusted EBITDA and Free Cash Flow as

presented by us may not be comparable to other similarly titled

measures of other companies because not all companies use identical

calculations.

Explanatory Notes to the Non-GAAP

Schedules

Spin-off of Uniform Services

- as previously announced, the Company completed the spin-off of

the Uniform segment into an independent publicly traded company,

Vestis Corporation, on September 30, 2023. As a result, the Uniform

segment historical results and assets and liabilities included in

the spin-off are reported as discontinued operations in the

Company's consolidated financial statements for all periods prior

to the separation and distribution as reflected below.

Amortization of Acquisition-Related

Intangible Assets - adjustments to eliminate the change

in amortization expense recognized on acquisition-related

intangible assets.

Severance and Other Charges

- adjustments to eliminate severance expenses in the applicable

period ($6.8 million for the fourth quarter of 2024, $13.0 million

for fiscal 2024, $3.8 million for the fourth quarter of 2023 and

$32.8 million for fiscal 2023).

Spin-off Related Charges -

adjustments to eliminate charges related to the Company's spin-off

of the Uniform segment, including accounting and legal related

expenses, third party advisory costs and other costs. Adjustment

also eliminates charitable contribution expense for the

contribution of Vestis shares to a donor advised fund in order to

fund charitable contributions ($8.8 million for fiscal 2024).

Gains, Losses and Settlements impacting

comparability - adjustments to eliminate certain

transactions that are not indicative of the Company's ongoing

operational performance, primarily for non-cash adjustments to

inventory based on expected usage ($18.2 million for both the

fourth quarter and fiscal 2024), the reversal of contingent

consideration liabilities related to acquisition earn outs, net of

expense ($8.7 million for the fourth quarter of 2024, $8.2 million

for fiscal 2024, $13.4 million for the fourth quarter of 2023 and

$85.7 million for fiscal 2023), charges related to a ruling on a

foreign tax matter ($6.8 million for both the fourth quarter and

fiscal 2024), charges related to hyperinflation in Argentina ($0.2

million for the fourth quarter of 2024, $5.4 million for fiscal

2024, $3.7 million for the fourth quarter of 2023 and $10.4 million

for fiscal 2023), non-cash charges related to the impairment of

trade names ($3.3 million for fiscal 2024 and $2.3 million for both

the fourth quarter and fiscal 2023), legal fees ($1.1 million for

both the fourth quarter and fiscal 2024), non-cash charges for the

impairment of operating lease right-of-use assets and property and

equipment ($21.7 million for fiscal 2023), non-cash charges related

to information technology assets ($2.1 million for the fourth

quarter of 2023 and $8.2 million for fiscal 2023), pension

withdrawal charges ($2.0 million for the fourth quarter of 2023 and

$6.7 million for fiscal 2023), non-cash charges for the impairment

of certain assets related to a business that was sold ($5.2 million

for fiscal 2023), charges related to the retirement of the

Company's former Executive Vice President of Human Resources ($2.6

million for fiscal 2023), cash termination fees and moving costs

related to exiting a real estate property ($1.3 million for fiscal

2023) and other miscellaneous charges.

Gain on Sale of Equity Investments,

net - adjustments to eliminate the impact from the sale

of the Company's equity investment in the San Antonio Spurs NBA

franchise ($25.1 million gain for both the fourth quarter and

fiscal 2024 and $1.1 million loss for fiscal 2023) and the gain

from the sale of the Company's equity method investment in AIM

Services, Co., Ltd. ($377.1 million for fiscal 2023).

Effect of Debt Repayments, Repricings

and Other on Interest Expense, net - adjustments to

eliminate expenses associated with the repayment of borrowings,

including the Senior Notes due 2025, and refinancings by the

Company in the applicable period such as charges related to the

payment of a call premium ($23.9 million for fiscal 2024), non-cash

charges for the write-off of unamortized debt issuance costs ($1.1

million for the fourth quarter of 2024, $9.0 million for fiscal

2024 and $2.5 million for fiscal 2023) and the payment of third

party costs ($0.2 million for both the fourth quarter and fiscal

2024). Adjustment also eliminates expenses associated with the

repricing of the United States Term B-5 Loans due 2028 and United

States Term B-6 Loans due 2030 such as non-cash charges for the

write-off of unamortized debt issuance costs and discount ($1.2

million for fiscal 2024) and the payment of third party costs ($0.4

million for fiscal 2024). Additionally, the adjustment eliminates

the impact on interest related to a ruling on a foreign tax matter

($3.9 million for both the fourth quarter and fiscal 2024).

Tax Impact of Adjustments to Adjusted

Net Income - adjustments to eliminate the net tax impact

of the adjustments to Adjusted Net Income calculated based on a

blended United States federal and state tax rate for United States

adjustments and the local country tax rate for adjustments in

jurisdictions outside the United States. Adjustment also eliminates

the tax related impact of the Company's spin-off of the Uniform

segment, including a valuation allowance recorded based on the

Company's ability to utilize foreign tax credits ($1.3 million

benefit for the fourth quarter of 2024 and $5.8 million charge for

fiscal 2024), disallowed transaction costs ($1.5 million benefit

for the fourth quarter of 2024 and $1.1 million charge for fiscal

2024) and the restatement of the Company's deferred tax position

($2.1 million charge for the fourth quarter of 2024 and $0.2

million charge for fiscal 2024). Additionally, the adjustment

reverses valuation allowances recorded against deferred tax assets

in a foreign subsidiary that were previously deemed to be not

realizable ($3.8 million for both the fourth quarter and fiscal

2024 and $3.8 million for fiscal 2023) and eliminates the impact

related to international tax restructuring initiatives ($29.1

million for both the fourth quarter and fiscal 2023), including the

utilization of capital losses to offset the tax gain related to the

Company's sale of AIM Services, Co., Ltd. and from the reversal of

valuation allowances based on the Company's ability to utilize

deferred tax assets based on future taxable income.

Effect of Currency

Translation - adjustments to eliminate the impact that

fluctuations in currency translation rates had on the comparative

results by presenting the periods on a constant currency basis.

Assumes constant foreign currency exchange rates based on the rates

in effect for the prior year period being used in translation for

the comparable current year period.

Effect of Repayment of the Senior Notes

due 2025, net - adjustments to eliminate the interest

expense, net of tax, recorded during 2023 on the $1.5 billion

Senior Notes due 2025 that were repaid in 2024.

Forward-Looking Statements

This press release contains "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements reflect our current expectations as to

future events based on certain assumptions and include any

statement that does not directly relate to any historical or

current fact. These statements include, but are not limited to,

statements under the heading "Outlook" and those related to our

expectations regarding the performance of our business, our

financial results, our operations, our liquidity and capital

resources, the conditions in our industry and our growth strategy.

In some cases, forward-looking statements can be identified by

words such as "outlook," "aim," "anticipate," "have confidence,"

"estimate," "expect," "will be," "will continue," "will likely

result," "project," "intend," "plan," "believe," "see," "look to"

and other words and terms of similar meaning or the negative

versions of such words. These forward-looking statements are

subject to risks and uncertainties that may change at any time, and

actual results or outcomes may differ materially from those that we

expected.

Some of the factors that we believe could affect or continue to

affect our results include without limitation: unfavorable economic

conditions; natural disasters, global calamities, climate change,

pandemics, energy shortages, sports strikes and other adverse

incidents; geopolitical events including, but not limited to, the

ongoing conflict between Russia and Ukraine and the ongoing

conflict in the Middle East, global supply chain disruptions,

inflation, volatility and disruption of global financial markets;

the failure to retain current clients, renew existing client

contracts and obtain new client contracts; a determination by

clients to reduce their outsourcing or use of preferred vendors;

competition in our industries; increased operating costs and

obstacles to cost recovery due to the pricing and cancellation

terms of our food and support services contracts; currency risks

and other risks associated with international operations, including

compliance with a broad range of laws and regulations, including

the United States Foreign Corrupt Practices Act; risks associated

with suppliers from whom our products are sourced; disruptions to

our relationship with our distribution partners; the contract

intensive nature of our business, which may lead to client

disputes; the inability to hire and retain key or sufficient

qualified personnel or increases in labor costs; our expansion

strategy and our ability to successfully integrate the businesses

we acquire and costs and timing related thereto; risks associated

with the completed spin-off of Aramark Uniform and Career Apparel

("Uniform") as an independent publicly traded company to our

stockholders; continued or further unionization of our workforce;

liability resulting from our participation in multiemployer defined

benefit pension plans; laws and governmental regulations including

those relating to food and beverages, the environment, wage and

hour and government contracting; liability associated with

noncompliance with applicable law or other governmental

regulations; new interpretations of or changes in the enforcement

of the government regulatory framework; increases or changes in

income tax rates or tax-related laws; potential liabilities,

increased costs, reputational harm, and other adverse effects based

on our commitments and stakeholder expectations relating to

environmental, social and governance considerations; the failure to

maintain food safety throughout our supply chain, food-borne

illness concerns and claims of illness or injury; a cybersecurity

incident or other disruptions in the availability of our computer

systems or privacy breaches; our leverage; variable rate

indebtedness that subjects us to interest rate risk; the inability

to generate sufficient cash to service all of our indebtedness;

debt agreements that limit our flexibility in operating our

business; and other factors set forth under the headings "Part I,

Item 1A Risk Factors," "Part I, Item 3 Legal Proceedings" and "Part

II, Item 7 Management's Discussion and Analysis of Financial

Condition and Results of Operations" and other sections of our

Annual Report on Form 10-K, filed with the Securities and Exchange

Commission (the "SEC") on November 21, 2023 as such factors may be

updated from time to time in our other periodic filings with the

SEC, which are accessible on the SEC's website at www.sec.gov and

which may be obtained by contacting Aramark's investor relations

department via its website at www.aramark.com. These factors should

not be construed as exhaustive and should be read in conjunction

with the other cautionary statements that are included herein and

in our other filings with the SEC. As a result of these risks and

uncertainties, readers are cautioned not to place undue reliance on

any forward-looking statements included herein or that may be made

elsewhere from time to time by, or on behalf of, us.

Forward-looking statements speak only as of the date made. We

undertake no obligation to publicly update or review any

forward-looking statement, whether as a result of new information,

future developments, changes in our expectations, or otherwise,

except as required by law.

ARAMARK AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(Unaudited)

(In Thousands, Except Per Share

Amounts)

Fiscal Year Ended

September 27, 2024

September 29, 2023

Revenue

$

17,400,701

$

16,083,212

Costs and Expenses:

Cost of services provided (exclusive of

depreciation and amortization)

15,975,017

14,774,664

Depreciation and amortization

435,547

409,857

Selling and general corporate expenses

283,627

273,663

16,694,191

15,458,184

Operating income

706,510

625,028

Gain on Sale of Equity Investments,

net

(25,071

)

(375,972

)

Interest Expense, net

366,716

437,476

Income from Continuing Operations Before

Income Taxes

364,865

563,524

Provision for Income Taxes from Continuing

Operations

102,972

116,426

Net income from Continuing Operations

261,893

447,098

Less: Net loss attributable to

noncontrolling interests

(629

)

(578

)

Net income from Continuing Operations

attributable to Aramark stockholders

262,522

447,676

Income from Discontinued Operations, net

of tax

—

226,432

Net income attributable to Aramark

stockholders

$

262,522

$

674,108

Basic earnings per share attributable to

Aramark stockholders:

Income from Continuing Operations

$

1.00

$

1.72

Income from Discontinued Operations

$

—

$

0.87

Basic earnings per share attributable to

Aramark stockholders

$

1.00

$

2.59

Diluted earnings per share attributable to

Aramark stockholders:

Income from Continuing Operations

$

0.99

$

1.71

Income from Discontinued Operations

$

—

$

0.86

Diluted earnings per share attributable to

Aramark stockholders

$

0.99

$

2.57

Weighted Average Shares Outstanding:

Basic

263,045

260,592

Diluted

266,200

262,594

ARAMARK AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(Unaudited)

(In Thousands, Except Per Share

Amounts)

Three Months Ended

September 27, 2024

September 29, 2023

Revenue

$

4,416,947

$

4,200,286

Costs and Expenses:

Cost of services provided (exclusive of

depreciation and amortization)

4,019,921

3,806,909

Depreciation and amortization

112,753

102,774

Selling and general corporate expenses

65,478

75,129

4,198,152

3,984,812

Operating income

218,795

215,474

Gain on Sale of Equity Investments,

net

(25,071

)

—

Interest Expense, net

84,299

110,686

Income from Continuing Operations Before

Income Taxes

159,567

104,788

Provision (Benefit) for Income Taxes from

Continuing Operations

37,314

(3,545

)

Net income from Continuing Operations

122,253

108,333

Less: Net (loss) income attributable to

noncontrolling interests

(158

)

10

Net income from Continuing Operations

attributable to Aramark stockholders

122,411

108,323

Income from Discontinued Operations, net

of tax

—

97,109

Net income attributable to Aramark

stockholders

$

122,411

$

205,432

Basic earnings per share attributable to

Aramark stockholders:

Income from Continuing Operations

$

0.46

$

0.42

Income from Discontinued Operations

$

—

$

0.37

Basic earnings per share attributable to

Aramark stockholders

$

0.46

$

0.79

Diluted earnings per share attributable to

Aramark stockholders:

Income from Continuing Operations

$

0.46

$

0.41

Income from Discontinued Operations

$

—

$

0.37

Diluted earnings per share attributable to

Aramark stockholders

$

0.46

$

0.78

Weighted Average Shares Outstanding:

Basic

263,894

261,319

Diluted

267,912

263,454

ARAMARK AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In Thousands)

September 27, 2024

September 29, 2023

Assets

Current Assets:

Cash and cash equivalents

$

672,483

$

1,927,088

Receivables

2,096,928

1,970,782

Inventories

387,601

403,707

Prepayments and other current assets

249,550

297,519

Current assets of discontinued

operations

—

620,931

Total current assets

3,406,562

5,220,027

Property and Equipment, net

1,573,193

1,425,973

Goodwill

4,677,201

4,615,986

Other Intangible Assets

1,804,602

1,804,473

Operating Lease Right-of-use Assets

638,659

572,268

Other Assets

574,154

728,678

Noncurrent Assets of Discontinued

Operations

—

2,503,836

$

12,674,371

$

16,871,241

Liabilities and Stockholders'

Equity

Current Liabilities:

Current maturities of long-term

borrowings

$

964,286

$

1,543,032

Current operating lease liabilities

54,163

51,271

Accounts payable

1,394,007

1,271,859

Accrued expenses and other current

liabilities

1,801,754

1,768,281

Current liabilities of discontinued

operations

—

395,524

Total current liabilities

4,214,210

5,029,967

Long-Term Borrowings

4,307,171

5,098,662

Noncurrent Operating Lease Liabilities

241,012

245,871

Deferred Income Taxes and Other Noncurrent

Liabilities

865,510

914,064

Noncurrent Liabilities of Discontinued

Operations

—

1,861,735

Commitments and Contingencies

Redeemable Noncontrolling Interest

7,494

8,224

Total Stockholders' Equity

3,038,974

3,712,718

$

12,674,371

$

16,871,241

ARAMARK AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

(In Thousands)

Fiscal Year Ended

September 27, 2024

September 29, 2023

Cash flows from operating activities of

Continuing Operations:

Net income from Continuing Operations

$

261,893

$

447,098

Adjustments to reconcile Net income from

Continuing Operations to Net cash provided by operating activities

of Continuing Operations:

Depreciation and amortization

435,547

409,857

Asset write-downs

18,186

29,865

Reduction of contingent consideration

liability

(8,710

)

(97,336

)

Gain on sale of equity investments,

net

(25,071

)

(375,972

)

Deferred income taxes

(7,323

)

100,158

Share-based compensation expense

62,552

76,337

Changes in operating assets and

liabilities

14,014

(19,915

)

Payments made to clients on contracts

(139,003

)

(119,217

)

Other operating activities

114,429

60,772

Net cash provided by operating activities

of Continuing Operations

726,514

511,647

Cash flows from investing activities of

Continuing Operations:

Net purchases of property and equipment

and other

(403,480

)

(365,476

)

Proceeds from sale of equity

investments

101,198

633,179

Acquisitions, divestitures and other

investing activities

(113,580

)

(44,045

)

Net cash (used in) provided by investing

activities of Continuing Operations

(415,862

)

223,658

Cash flows from financing activities of

Continuing Operations:

Net proceeds/payments of long-term

borrowings

(1,432,278

)

(615,719

)

Net change in funding under the

Receivables Facility

—

(104,935

)

Payments of dividends

(99,901

)

(114,614

)

Distribution from Vestis

—

1,456,701

Proceeds from issuance of common stock

36,573

45,602

Other financing activities

(65,590

)

(7,408

)

Net cash (used in) provided by financing

activities of Continuing Operations

(1,561,196

)

659,627

Discontinued Operations:

Net cash provided by operating

activities

—

254,782

Net cash used in investing activities

—

(14,746

)

Net cash provided by financing

activities

—

3,322

Net cash provided by Discontinued

Operations

—

243,358

Effect of foreign exchange rates on cash

and cash equivalents and restricted cash

10,790

4,697

(Decrease) increase in cash and cash

equivalents and restricted cash

(1,239,754

)

1,642,987

Cash and cash equivalents and restricted

cash, beginning of period

1,972,367

365,431

Cash and cash equivalents and restricted

cash, end of period

$

732,613

$

2,008,418

Balance Sheet classification

(in thousands)

September 27, 2024

September 29, 2023

Cash and cash equivalents

$

672,483

$

1,927,088

Restricted cash in Prepayments and other

current assets

60,130

45,279

Cash and cash equivalents in Current

assets of discontinued operations

—

36,051

Total cash and cash equivalents and

restricted cash

$

732,613

$

2,008,418

ARAMARK AND

SUBSIDIARIES

RECONCILIATION OF NON-GAAP

MEASURES

ADJUSTED CONSOLIDATED

OPERATING INCOME MARGIN

(Unaudited)

(In thousands)

Fiscal Year Ended

September 27, 2024

FSS United States

FSS International

Corporate

Aramark and

Subsidiaries

Revenue (as reported)

$

12,576,737

$

4,823,964

$

17,400,701

Operating Income (as reported)

$

659,907

$

187,341

$

(140,738

)

$

706,510

Operating Income Margin (as reported)

5.2

%

3.9

%

4.1

%

Revenue (as reported)

$

12,576,737

$

4,823,964

$

17,400,701

Effect of Currency Translation

1,189

274,017

275,206

Adjusted Revenue (Organic)

$

12,577,926

$

5,097,981

$

17,675,907

Revenue Growth (as reported)

7.3

%

10.6

%

8.2

%

Adjusted Revenue Growth (Organic)

7.3

%

16.9

%

9.9

%

Operating Income (as reported)

$

659,907

$

187,341

$

(140,738

)

$

706,510

Amortization of Acquisition-Related

Intangible Assets

91,358

15,706

—

107,064

Severance and Other Charges

12,868

—

92

12,960

Spin-off Related Charges

—

—

29,037

29,037

Gains, Losses and Settlements impacting

comparability

10,044

15,528

1,075

26,647

Adjusted Operating Income

$

774,177

$

218,575

$

(110,534

)

$

882,218

Effect of Currency Translation

436

10,342

—

10,778

Adjusted Operating Income (Constant

Currency)

$

774,613

$

228,917

$

(110,534

)

$

892,996

Operating Income Growth (as reported)

1.5

%

63.6

%

(0.9

)%

13.0

%

Adjusted Operating Income Growth

13.5

%

24.2

%

4.2

%

18.8

%

Adjusted Operating Income Growth (Constant

Currency)

13.5

%

30.1

%

4.2

%

20.2

%

Adjusted Operating Income Margin

6.2

%

4.5

%

5.1

%

Adjusted Operating Income Margin (Constant

Currency)

6.2

%

4.5

%

5.1

%

Fiscal Year Ended

September 29, 2023

FSS United States

FSS International

Corporate

Aramark and

Subsidiaries

Revenue (as reported)

$

11,721,368

$

4,361,844

$

16,083,212

Operating Income (as reported)

$

649,982

$

114,480

$

(139,434

)

$

625,028

Amortization of Acquisition-Related

Intangible Assets

76,798

12,664

—

89,462

Severance and Other Charges

2,310

29,951

552

32,813

Spin-off Related Charges

—

—

19,922

19,922

Gains, Losses and Settlements impacting

comparability

(46,869

)

18,915

3,633

(24,321

)

Adjusted Operating Income

$

682,221

$

176,010

$

(115,327

)

$

742,904

Operating Income Margin (as reported)

5.5

%

2.6

%

3.9

%

Adjusted Operating Income Margin

5.8

%

4.0

%

4.6

%

ARAMARK AND

SUBSIDIARIES

RECONCILIATION OF NON-GAAP

MEASURES

ADJUSTED CONSOLIDATED

OPERATING INCOME MARGIN

(Unaudited)

(In thousands)

Three Months Ended

September 27, 2024

FSS United States

FSS International

Corporate

Aramark and

Subsidiaries

Revenue (as reported)

$

3,176,066

$

1,240,881

$

4,416,947

Operating Income (as reported)

$

200,715

$

46,214

$

(28,134

)

$

218,795

Operating Income Margin (as reported)

6.3

%

3.7

%

5.0

%

Revenue (as reported)

$

3,176,066

$

1,240,881

$

4,416,947

Effect of Currency Translation

515

71,863

72,378

Adjusted Revenue (Organic)

$

3,176,581

$

1,312,744

$

4,489,325

Revenue Growth (as reported)

3.6

%

9.4

%

5.2

%

Adjusted Revenue Growth (Organic)

3.6

%

15.8

%

6.9

%

Operating Income (as reported)

$

200,715

$

46,214

$

(28,134

)

$

218,795

Amortization of Acquisition-Related

Intangible Assets

23,724

4,527

—

28,251

Severance and Other Charges

6,719

—

—

6,719

Gains, Losses and Settlements impacting

comparability

9,476

7,055

1,075

17,606

Adjusted Operating Income

$

240,634

$

57,796

$

(27,059

)

$

271,371

Effect of Currency Translation

170

2,713

—

2,883

Adjusted Operating Income (Constant

Currency)

$

240,804

$

60,509

$

(27,059

)

$

274,254

Operating Income Growth (as reported)

(7.4

)%

12.1

%

33.9

%

1.5

%

Adjusted Operating Income Growth

5.1

%

10.3

%

4.5

%

7.2

%

Adjusted Operating Income Growth (Constant

Currency)

5.1

%

15.5

%

4.5

%

8.4

%

Adjusted Operating Income Margin

7.6

%

4.7

%

6.1

%

Adjusted Operating Income Margin (Constant

Currency)

7.6

%

4.6

%

6.1

%

Three Months Ended

September 29, 2023

FSS United States

FSS International

Corporate

Aramark and

Subsidiaries

Revenue (as reported)

$

3,066,543

$

1,133,743

$

4,200,286

Operating Income (as reported)

$

216,778

$

41,227

$

(42,531

)

$

215,474

Amortization of Acquisition-Related

Intangible Assets

19,268

3,540

—

22,808

Severance and Other Charges

—

3,861

—

3,861

Spin-off Related Charges

—

—

12,962

12,962

Gains, Losses and Settlements impacting

comparability

(6,990

)

3,758

1,245

(1,987

)

Adjusted Operating Income

$

229,056

$

52,386

$

(28,324

)

$

253,118

Operating Income Margin (as reported)

7.1

%

3.6

%

5.1

%

Adjusted Operating Income Margin

7.5

%

4.6

%

6.0

%

ARAMARK AND

SUBSIDIARIES

RECONCILIATION OF NON-GAAP

MEASURES

ADJUSTED NET INCOME &

ADJUSTED EARNINGS PER SHARE

(Unaudited)

(In thousands, except per share

amounts)

Three Months Ended

Fiscal Year Ended

September 27,

2024

September 29,

2023

September 27,

2024

September 29,

2023

Net Income from Continuing Operations

Attributable to Aramark Stockholders (as reported)

$

122,411

$

108,323

$

262,522

$

447,676

Adjustment:

Amortization of Acquisition-Related

Intangible Assets

28,251

22,808

107,064

89,462

Severance and Other Charges

6,719

3,861

12,960

32,813

Spin-off Related Charges

—

12,962

29,037

19,922

Gains, Losses and Settlements impacting

comparability

17,606

(1,987

)

26,647

(24,321

)

Gain on Sale of Equity Investments,

net

(25,071

)

—

(25,071

)

(375,972

)

Effect of Debt Repayments, Repricings and

Other on Interest Expense, net

5,282

—

38,634

2,522

Tax Impact of Adjustments to Adjusted Net

Income

(11,663

)

(40,169

)

(39,956

)

37,809

Adjusted Net Income

$

143,535

$

105,798

$

411,837

$

229,911

Effect of Currency Translation, net of

Tax

161

—

4,295

—

Effect of Repayment of the Senior Notes

due 2025, net

—

18,556

—

74,137

Adjusted Net Income (Constant

Currency), Net of Interest Adjustment

$

143,696

$

124,354

$

416,132

$

304,048

Earnings Per Share (as

reported)

Net Income from Continuing Operations

Attributable to Aramark Stockholders (as reported)

$

122,411

$

108,323

$

262,522

$

447,676

Diluted Weighted Average Shares

Outstanding

267,912

263,454

266,200

262,594

$

0.46

$

0.41

$

0.99

$

1.71

Earnings Per Share Growth (as reported)

%

12.2

%

(42.1

)%

Adjusted Earnings Per Share

Adjusted Net Income

$

143,535

$

105,798

$

411,837

$

229,911

Diluted Weighted Average Shares

Outstanding

267,912

263,454

266,200

262,594

$

0.54

$

0.40

$

1.55

$

0.88

Adjusted Earnings Per Share Growth %

32.5

%

76.1

%

Adjusted Earnings Per Share (Constant

Currency)

Adjusted Net Income (Constant Currency),

Net of Interest Adjustment

$

143,696

$

124,354

$

416,132

$

304,048

Diluted Weighted Average Shares

Outstanding

267,912

263,454

266,200

262,594

$

0.54

$

0.47

$

1.56

$

1.16

Adjusted Earnings Per Share Growth

(Constant Currency) %

13.6

%

35.0

%

ARAMARK AND

SUBSIDIARIES

RECONCILIATION OF NON-GAAP

MEASURES

NET DEBT TO COVENANT ADJUSTED

EBITDA

(Unaudited)

(In thousands)

Twelve Months Ended

September 27, 2024

September 29, 2023

Net income Attributable to Aramark

Stockholders (as reported)

$

262,522

$

674,108

Interest Expense, net

366,716

439,585

Provision for Income Taxes

102,972

177,614

Depreciation and Amortization

435,547

546,362

Share-based compensation expense(1)

62,552

86,938

Unusual or non-recurring (gains) and

losses(2)

(22,752

)

(422,596

)

Pro forma EBITDA for certain

transactions(3)

840

4,033

Other(4)(5)

126,581

100,681

Covenant Adjusted EBITDA

$

1,334,978

$

1,606,725

Net Debt to Covenant Adjusted

EBITDA

Total Long-Term Borrowings(6)

$

5,271,457

$

6,763,514

Less: Cash and cash equivalents and

short-term marketable securities(6)(7)

714,825

573,853

Net Debt

$

4,556,632

$

6,189,661

Covenant Adjusted EBITDA

$

1,334,978

$

1,606,725

Net Debt/Covenant Adjusted EBITDA(8)

3.4

3.9

(1) Represents share-based

compensation expense resulting from the application of accounting

for stock options, restricted stock units, performance stock units,

deferred stock unit awards and employee stock purchases.

(2) The twelve months ended

September 27, 2024 represents the fiscal 2024 gain from the sale of

the Company's remaining equity investment in the San Antonio Spurs

NBA franchise ($25.1 million) and the fiscal 2024 non-cash charge

for the impairment of certain assets related to a business that was

sold ($2.3 million). The twelve months ended September 29, 2023

represents the fiscal 2023 gain from the sale of the Company's

equity method investment in AIM Services, Co., Ltd. ($377.1

million), the fiscal 2023 gain from the sale of the Company's

equity investment in a foreign company ($51.8 million), the fiscal

2023 non-cash charge for the impairment of certain assets related

to a business that was sold ($5.2 million) and the fiscal 2023 loss

from the sale of a portion of the Company's equity investment in

the San Antonio Spurs NBA franchise ($1.1 million).

(3) Represents the annualizing of

net EBITDA from certain acquisitions and divestitures made during

the period.

(4) "Other" for the twelve months

ended September 27, 2024 includes adjustments to remove the impact

attributable to the adoption of certain accounting standards that

are made to the calculation in accordance with the Credit Agreement

and indentures ($52.2 million), charges related to the Company's

spin-off of the Uniform segment ($29.0 million), non-cash

adjustments to inventory based on expected usage ($21.7 million),

severance charges ($13.0 million), the reversal of contingent

consideration liabilities related to acquisition earn outs, net of

expense ($8.1 million), charges related to a ruling on a foreign

tax matter ($6.8 million), the impact of hyperinflation in

Argentina ($5.4 million), non-cash charges related to the

impairment of a trade name ($3.3 million), income related to

non-United States governmental wage subsidies ($1.1 million) and

other miscellaneous expenses.

(5) "Other" for the twelve months

ended September 29, 2023 includes the reversal of contingent

consideration liabilities related to acquisition earn outs, net of

expense ($85.7 million), charges related to the Company's spin-off

of the Uniform segment ($51.1 million), adjustments to remove the

impact attributable to the adoption of certain accounting standards

that are made to the calculation in accordance with the Credit

Agreement and indentures ($47.5 million), net severance charges

($37.5 million), non-cash charges for the impairment of operating

lease right-of-use assets and property and equipment related to

certain real estate properties ($29.3 million), income related to

non-United States governmental wage subsidies ($12.5 million), the

impact of hyperinflation in Argentina ($10.4 million), non-cash

charges related to information technology assets ($8.2 million),

the gain from the sale of land ($6.8 million), net multiemployer

pension plan withdrawal charges ($5.9 million), labor charges and

other expenses associated with closed or partially closed locations

from adverse weather ($5.4 million), legal settlement charges ($2.7

million), non-cash charges for inventory write-downs ($2.6

million), the gain from the change in fair value related to certain

gasoline and diesel agreements ($1.9 million) and other

miscellaneous expenses.

(6) "Total Long-Term Borrowings"

and "Cash and cash equivalents and short term marketable

securities" for the twelve months ended September 29, 2023 excludes

both the outstanding liability and the related cash proceeds

resulting from the $1.5 billion of new term loans borrowed by the

Uniform Services business in anticipation of the spin-off which

occurred on September 30, 2023.

(7) Short-term marketable

securities represent held-to-maturity debt securities with original

maturities greater than three months, which are maturing within one

year and will convert back to cash. Short-term marketable

securities are included in "Prepayments and other current assets"

on the Consolidated Balance Sheets.

(8) The twelve months ended

September 29, 2023 reflects reported net debt to covenant adjusted

EBITDA, which includes the reported results of the Uniform segment

prior to the spin-off. The twelve months ended September 27, 2024

excludes the results of the Uniform segment for the entire

period.

ARAMARK AND

SUBSIDIARIES

RECONCILIATION OF NON-GAAP

MEASURES

FREE CASH FLOW

(Unaudited)

(In thousands)

Fiscal Year Ended

Nine Months Ended

Three Months Ended

September 27, 2024

June 28, 2024

September 27, 2024

Net cash provided by (used in)

operating activities of Continuing Operations

$

726,514

$

(295,101

)

$

1,021,615

Net purchases of property and

equipment and other

(403,480

)

(270,912

)

(132,568

)

Free Cash Flow

$

323,034

$

(566,013

)

$

889,047

Fiscal Year Ended

Nine Months Ended

Three Months Ended

September 29, 2023

June 30, 2023

September 29, 2023

Net cash provided by (used in)

operating activities of Continuing Operations

$

511,647

$

(415,007

)

$

926,654

Net purchases of property and

equipment and other

(365,476

)

(245,629

)

(119,847

)

Free Cash Flow

$

146,171

$

(660,636

)

$

806,807

Fiscal Year Ended

Nine Months Ended

Three Months Ended

Change

Change

Change

Net cash provided by operating

activities of Continuing Operations

$

214,867

$

119,906

$

94,961

Net purchases of property and

equipment and other

(38,004

)

(25,283

)

(12,721

)

Free Cash Flow

$

176,863

$

94,623

$

82,240

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241110221756/en/

Inquiries: Felise Glantz Kissell (215) 409-7287

Kissell-Felise@aramark.com

Gene Cleary (215) 409-7945 Cleary-Gene@aramark.com

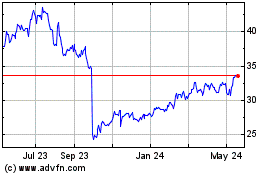

Aramark (NYSE:ARMK)

Historical Stock Chart

From Oct 2024 to Nov 2024

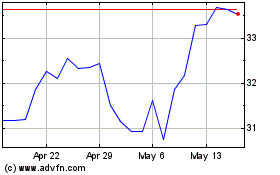

Aramark (NYSE:ARMK)

Historical Stock Chart

From Nov 2023 to Nov 2024