American Express More Than Doubles Annual Profit

January 17 2019 - 4:06PM

Dow Jones News

By Maria Armental

American Express Co. on Thursday reported solid financial

results for the most recent period, capping a record year.

The results -- and a strong forecast for 2019 -- mark a notable

recovery for the financial-services company, which a year earlier

was driven to the first quarterly loss in more than a

quarter-century as it absorbed a hit from the U.S. tax

overhaul.

On Thursday, Amex reported a fourth-quarter profit of $2.01

billion, or $2.32 a share, ending the year at a $6.92 billion

profit, more than double the $2.75 billion profit for 2017.

Revenue, net of interest expense, rose 8% to $10.47 billion for

the quarter and ended the year at $40.34 billion.

It was the highest annual profit and revenue, according to

securities filings.

Analysts surveyed by FactSet had projected a profit of $1.80 a

share on $10.58 billion in revenue for the quarter and $7.38 a

share with $40.44 billion in revenue for the year.

This year, the New York company expects profit to reach $7.85 a

share to $8.35 a share and revenue to increase 8% to 10%, compared

with analysts' projected $8.15 a share and a 7.5% revenue

increase.

Discount revenue, which reflects the fees charged to merchants

for accepting AmEx cards, brought in $6.46 billion for the quarter

and $24.72 billion for the year, an 8% increase from a year

ago.

The company last year scored a major legal victory when the U.S.

highest court ruled that AmEx's policy of preventing retailers from

offering customers incentives to pay with cheaper cards wasn't

anticompetitive.

The credit-card company historically charged retailers higher

so-called swipe fees, which typically include a flat fee and a

percentage of the dollar amount of a purchase, than many of its

competitors' cards.

Card-members rewards, the company's largest single expense that

includes such things as points redeemed for hotels and airfare,

reached $2.52 billion in the fourth quarter and $9.7 billion for

the year, an 11% and 12% increase respectively.

Overall, expenses rose 9% for the quarter and 8% for the

year.

AmEx, which has been building its reserves for possible losses,

ended the year with a $3.35 billion loss provision, a 21% increase

from the previous year, as card-member loans increased.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

January 17, 2019 16:51 ET (21:51 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

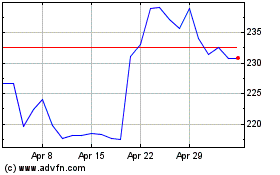

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

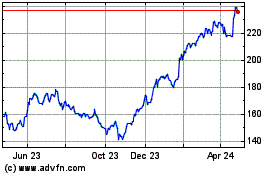

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024