AmEx Results Cap a Record Year -- WSJ

January 18 2019 - 2:02AM

Dow Jones News

By Maria Armental

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 18, 2019).

American Express Co. on Thursday reported solid financial

results for the most recent period, capping a record year.

The results -- and a strong forecast for 2019 -- mark a notable

recovery for the financial-services company, which a year earlier

was driven to the first quarterly loss in more than a

quarter-century as it absorbed a hit from the U.S. tax

overhaul.

On Thursday, Amex reported a fourth-quarter profit of $2.01

billion, or $2.32 a share, ending the year at a $6.92 billion

profit, more than double the $2.75 billion profit for 2017.

Revenue, net of interest expense, rose 8% to $10.47 billion for

the quarter and ended the year at $40.34 billion.

It was the highest annual profit and revenue, according to

securities filings.

Analysts surveyed by FactSet had projected a profit of $1.80 a

share on $10.58 billion in revenue for the quarter and $7.38 a

share with $40.44 billion in revenue for the year.

This year, the New York company expects profit to reach $7.85 a

share to $8.35 a share and revenue to increase 8% to 10%, compared

with analysts' projected $8.15 a share and a 7.5% revenue

increase.

Discount revenue, which reflects the fees charged to merchants

for accepting AmEx cards, brought in $6.46 billion for the quarter

and $24.72 billion for the year, an 8% increase from a year

ago.

The company last year scored a major legal victory when the U.S.

highest court ruled that AmEx's policy of preventing retailers from

offering customers incentives to pay with cheaper cards wasn't

anticompetitive.

The credit-card company historically charged retailers higher

so-called swipe fees, which typically include a flat fee and a

percentage of the dollar amount of a purchase, than many of its

competitors' cards.

Card-members rewards, the company's largest single expense that

includes such things as points redeemed for hotels and airfare,

reached $2.52 billion in the fourth quarter and $9.7 billion for

the year, an 11% and 12% increase respectively.

Overall, expenses rose 9% for the quarter and 8% for the

year.

AmEx, which has been building its reserves for possible losses,

ended the year with a $3.35 billion loss provision, a 21% increase

from the previous year, as card-member loans increased.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

January 18, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

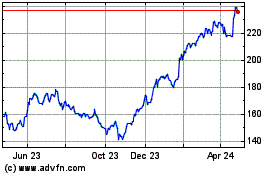

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

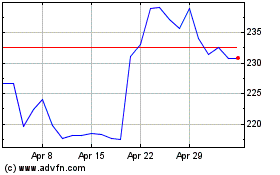

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024