Marriott Gets $920 Million in Amended Pacts With JPMorgan, American Express

May 05 2020 - 7:26AM

Dow Jones News

By Colin Kellaher

Marriott International Inc. Tuesday said it will receive a $920

million cash infusion under amended co-brand credit- card

agreements with JPMorgan Chase & Co. and American Express

Co.

The Bethesda, Md., hotel operator said it will receive $570

million from JPMorgan Chase, including $500 million of prepayment

of certain future revenue and $70 million from the early payment of

a signing bonus under the co-brand agreement.

Marriott said it will receive $350 million from American Express

for the pre-purchase of Marriott Bonvoy points and other

consideration.

Marriott said the cash, which it will record as deferred

revenue, bolsters its liquidity position and will be available for

general corporate purposes.

The world's largest hotel company has been beset by plunging

occupancy rates amid the worldwide coronavirus pandemic.

Marriott also said it terminated the $1.5 billion 364-day

revolving credit facility commitment it announced last month after

the facility's capacity was substantially reduced due to a

subsequent $1.6 billion senior notes offering.

Shares of Marriott, which closed Monday at $82.58, rose 3.4% in

light premarket trading Tuesday.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

May 05, 2020 08:11 ET (12:11 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

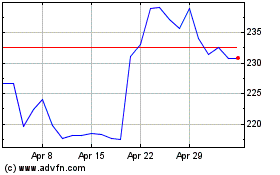

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

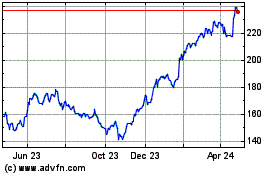

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024