Carlyle, GIC Back Away from AmEx Global Business Travel Deal

May 09 2020 - 9:11AM

Dow Jones News

By AnnaMaria Andriotis and Miriam Gottfried

Private-equity firm Carlyle Group Inc. and Singapore

sovereign-wealth fund GIC Pte. Ltd. are backing away from a deal to

take a 20% stake in American Express Global Business Travel, whose

revenue has plummeted as a result of the coronavirus pandemic,

according to people familiar with the matter.

The deal, announced in December, values the company at $5

billion including debt. It was scheduled to close Thursday but

representatives for Carlyle and GIC informed AmEx Global Business

Travel on Wednesday they wouldn't participate in the closing, the

people said.

AmEx Global Business Travel, which is 50%-owned by American

Express Co., offers airfare and hotel-booking services mostly to

large and midsize businesses. In 2014 the credit-card giant sold

the other half to a group led by investment firm Certares. Carlyle

and GIC, along with a group of others, agreed to purchase a portion

of that stake last year.

An entity acting on behalf of the sellers filed a motion this

past week in Delaware Chancery Court against Carlyle and GIC,

calling for it to compel the duo to proceed with the purchase.

If the deal is scuttled, it would be the latest high-profile

transaction to fall apart as a result of the pandemic. On May 4, L

Brands Inc. and private-equity firm Sycamore Partners said they

were scrapping plans to take Victoria's Secret private, a decision

that came after Sycamore filed a lawsuit to try to cancel the

deal.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and

Miriam Gottfried at Miriam.Gottfried@wsj.com

(END) Dow Jones Newswires

May 09, 2020 09:56 ET (13:56 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

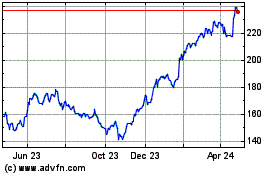

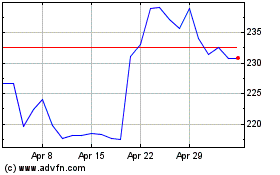

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024