American Express Posts 1Q Revenue. Growth Driven by Card Member Spending

April 22 2022 - 6:30AM

Dow Jones News

By Will Feuer

American Express Co. posted higher revenue in the first quarter

as the company said spending among card members reached record

volumes in March.

The New York City-based credit-card company logged first-quarter

net income of $2.10 billion, down from $2.24 billion a year

earlier. Earnings were $2.73 a share, compared with $2.74 a share.

Analysts polled by FactSet had forecast earnings of $2.40 a

share.

Revenue at the company, net of interest expense, rose 29% to

$11.74 billion. Analysts surveyed by FactSet had been expecting

$11.62 billion.

The jump in revenue was driven by global card member spending

growth of 35%, with volumes reaching a monthly record high in

March, Chief Executive Stephen Squeri said.

"We added 3 million new proprietary cards in the quarter, as

acquisitions of U.S. Consumer Platinum and Gold Cards and U.S.

Business Platinum Cards reached all-time highs for the quarter.

With travel activity continuing to pick up, we also had record

monthly acquisitions for our Delta Cards in March," he said.

Spending on travel and entertainment jumped 121% from a year

earlier and "essentially reached pre-pandemic levels globally for

the first time in March, driven by continued strength in consumer

travel," he added.

The company's provisions for credit losses was a benefit of $33

million, compared with a benefit of $675 million a year ago,

reflecting lower net reserve release in the current quarter.

Consolidated expenses for the quarter rose 34% to $9.1 billion,

the company said, reflecting higher customer engagement costs

primarily driven by a 30% increase in network volumes.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

April 22, 2022 07:15 ET (11:15 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

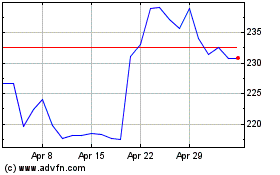

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

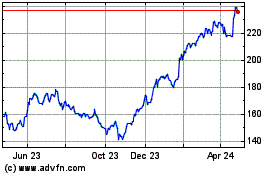

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024