Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

October 31 2022 - 3:51PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed pursuant

to Rule 433

Registration No. 333-253057

AMERICAN EXPRESS COMPANY

$1,500,000,000 5.850% Notes due November 5,

2027 (the “Notes”)

Terms and Conditions

| Issuer: |

American Express Company |

| |

|

| Expected Ratings(1): |

A2 / BBB+ / A (Stable/Stable/Stable) (Moody’s / S&P / Fitch) |

| |

|

| Ranking: |

Senior unsecured |

| |

|

| Trade Date: |

October 31, 2022 |

| |

|

| Settlement Date: |

November 7, 2022 (T+5). Pursuant to Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes on any date prior to two business days before delivery will be required, because the Notes initially will settle in T+5, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. |

| |

|

| Maturity Date: |

November 5, 2027 |

| |

|

| Par Amount: |

$1,500,000,000 |

| |

|

| Benchmark Treasury: |

UST 4.125% due October 31, 2027 |

| |

|

| Benchmark Treasury Price and Yield: |

99-113/4; 4.267% |

| |

|

| Re-offer Spread to Benchmark: |

+160 bps |

| |

|

| Re-offer Yield: |

5.867% |

| |

|

| Coupon: |

5.850% |

| |

|

| Public Offering Price: |

99.928% |

| |

|

| Underwriters’ Discount: |

0.350% |

| |

|

| Net Proceeds to American Express: |

$1,493,670,000 (before expenses) |

| |

|

| Interest Payment Dates: |

May 5 and November 5 of each year, beginning May 5, 2023 (short first interest period) |

| Day Count: |

30 / 360 |

| |

|

| Optional Redemption: |

In whole or in part, on or after the date that is 31 days prior to the Maturity Date at a redemption price equal to the principal amount of the Notes being redeemed, together with any accrued and unpaid interest thereon to, but excluding, the date fixed for redemption. |

| |

|

| Listing: |

The Notes will not be listed on any exchange. |

| |

|

| Minimum Denominations/Multiples: |

Minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

| |

|

| CUSIP: |

025816DB2 |

| |

|

| ISIN: |

US025816DB21 |

| |

|

| Joint Book-Running Managers: |

Citigroup Global Markets Inc.

Goldman Sachs & Co. LLC

Mizuho Securities USA LLC |

| |

|

| Co-Managers: |

R. Seelaus & Co., LLC

MUFG Securities Americas Inc.

SMBC Nikko Securities America, Inc. |

| |

|

|

Junior Co-Managers: |

Mischler Financial Group, Inc.

Siebert Williams Shank & Co., LLC |

(1) An explanation of the significance of ratings

may be obtained from the rating agencies. Generally, rating agencies base their ratings on such material and information, and such of

their own investigations, studies and assumptions, as they deem appropriate. The rating of the Notes should be evaluated independently

from similar ratings of other securities. A credit rating of a security is not a recommendation to buy, sell or hold securities and may

be subject to review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency.

The issuer has filed a registration statement (including a base prospectus

dated February 12, 2021) and a preliminary prospectus supplement, dated October 31, 2022 (the “preliminary prospectus

supplement”), with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus

in that registration statement, the preliminary prospectus supplement and other documents the issuer has filed with the SEC for more complete

information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov.

Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you

request it by calling Citigroup Global Markets Inc. at 1-800-831-9146, Goldman Sachs & Co. LLC at 1-866-471-2526 and Mizuho Securities

USA LLC at 1-866-271-7403.

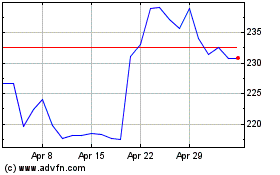

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

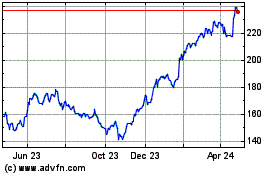

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024